Uddrag fra Andreas Steno

Large parts of the Mar’o’Lago Accord are actually progressing according to plan, despite poor implementation and widespread global outrage. China is now buying U.S. Treasuries due to the weaker dollar

Many pundits have (rightfully) struggled to find a coherent logic behind the Trump administration’s trade policy. However, quietly—but increasingly noticeably—the administration is beginning to make progress on a few of the core objectives outlined in the so-called “Mar-a-Lago Accord.”

This accord seeks to leverage the U.S. defense umbrella to compel major trade partners to accept:

- a weaker USD, and

- increased purchases of U.S. Treasuries (USTs) in exchange for continued security guarantees— with tariffs serving as the primary tool in this negotiation strategy.

While this approach has clearly sparked outrage globally—and while one can certainly question the strategic coherence and execution—the first signs are emerging that suggest it might be achieving some of its intended effects.

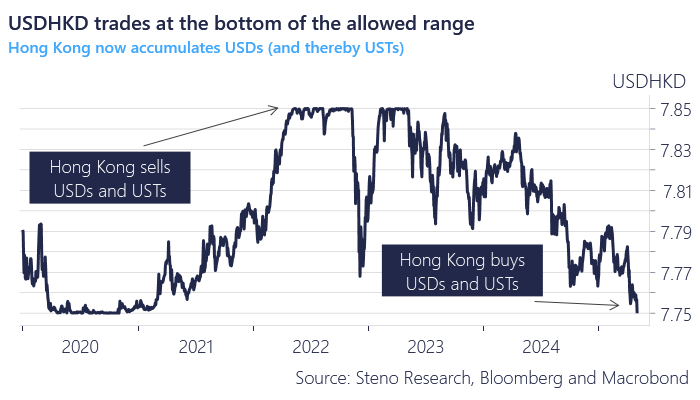

The USD weakened materially last week against several Asian currencies, including the HKD, TWD, and KRW. Most notably, the USD/HKD exchange rate hit the bottom of its trading band, prompting the Hong Kong Monetary Authority to intervene by purchasing USDs and, as a consequence, U.S. Treasuries.

In effect, China began accumulating USDs and USTs last week—no small feat, considering the global backlash the policy has provoked.

Here’s what’s likely to happen next.

Chart of the week: Intervention against a weak USD in Hong Kong