Uddrag fra Zerohedge:

The latest Federal Reserve rate decision will be announced on Wednesday 7th May at 19:00BST/14:00EDT, with Chair Powellʼs press conference starting 30 minutes later. We will not get an updated Summary of Economic Projections (SEPs) at this confab and will have to wait until the June meeting for updated forecasts.

The central bank is widely expected to keep rates unchanged at 4.25- 4.50% after the stronger-than-expected April jobs report. In other words, the Fed will do exactly nothing even as the PBOC finally cuts rates and unleashes the liquidity floodgates to give Beijing ammo for the trade war negotiations with the US starting later this week.

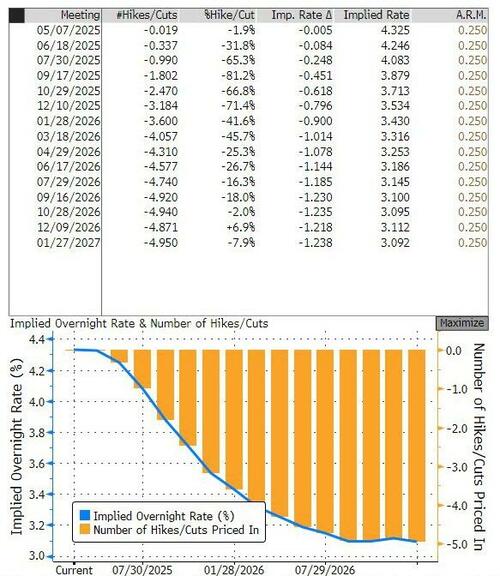

But back to the Fed doing nothing: money markets currently assign just a 2% probability of a 25bps reduction at the meeting, with 72bps of easing priced through year-end.

At the meeting, and Powell’s presser, the focus will continue to reside on commentary of the tariff impacts and the guidance the central bank has to offer. Nonetheless, the Fed is very likely to reiterate its wait-and-see approach to see Trumpʼs tariffs filter through into the hard data and help the Fed decide what to do next. In the wake of the solid US jobs report on Friday, May 2nd, both Goldman and Barclays pushed back their next rate cut calls to July from June. Note, Citi initially expected a 25bps cut, although it pushed back its rate cut forecast to June but still sees 125bps of cuts this year.

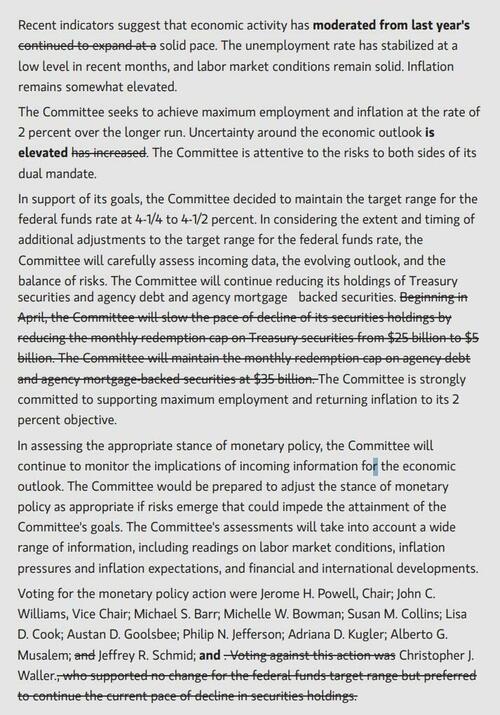

STATEMENT/PRESSER: JPMorgan expects no change in policy and no substantive change to the post-meeting statement. The bank states the reason for no change in policy is clear from Fed communications, and even after Liberation Day, Fed speakers have pointed to the virtues of waiting to act. JPM expects no dissents to this decision, and while Governor Waller has become more dovish, they argue his recent remarks havenʼt made the case for pre-emptive policy easing. In the accompanying statement, JPMorgan says there is no need to change the description of labour market conditions as “solid”, and likewise the last statementʼs characterization of inflation as “somewhat elevated” remains appropriate. However, Morgan Stanley expects the Fed to downgrade their assessment of economic activity—indicating it has “moderated from” vs “continued to expand at” a solid pace. MS also expect the statement to highlight the “elevated” risks to the Fed’s dual mandate. In the prior meeting, the Committee judged that “uncertainty around the economic outlook has increased.” Liberation Day didnʼt reduce economic uncertainty, and JPM details that itʼs a close call as to whether the Committee wants to pile on with “has increased further” or goes with something like “remains highly uncertain.” On forward guidance, the statement is expected to leave the existing commentary unchanged. Regarding the press conference, the main message is likely to repeat that the Committee is well-positioned to wait for greater clarity before making any changes to policy.

RECENT FED SPEAK: Heading into the meeting, many, including Chair Powell, have continued to toe the line that the Fed is wellpositioned to wait for greater clarity on Trumpʼs policies before considering altering its policy stance, with Powell sticking to his ‘wait-and-see approach.ʼ However, other influential officials, such as Governor Waller, have leant dovish while there is also significant pressure from US President Trump for the Fed to lower rates, as he continues to stress the Fed is moving too slowly. Many also suggest that policy is in a good place to address risks to the economic outlook. However, Governor Waller has warned if the Fed waits until the new policies are seen in the hard data, it may be too late. Waller has also said he would be willing to look through price increases from tariffs, as he sees them as transitory while noting that rate cuts could come from rising unemployment. The general view of the Fed is that tariffs will result in higher inflation and slower growth while warning inflationary effects of tariffs could be more persistent. The Fed has also been stressing that they are highly attentive to long-term inflation expectations, but so far, they remain anchored – which is a sign of encouragement for the Fed. Many have also been describing the current policy stance as “modestly restrictive”, although Waller suggests it is “meaningfully restrictive”, others have also used “clearly restrictive”.

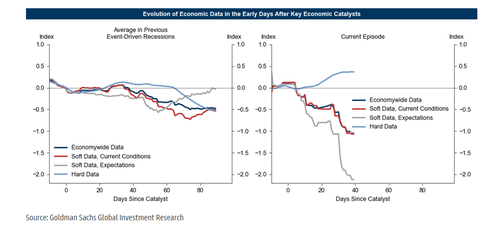

ECONOMY: A lot of the focus currently resides around the impact of Trumpʼs tariffs, and how much of the impact has filtered through yet into the economy, if any. The soft and hard data are currently showing differences, although Q1 US GDP slipped into contractionary territory, but labor data has been solid with no marked weakness, yet. All in all, hard data has continued to be resilient, and while soft data paints a different picture, the Fed does not appear worried unless it were to filter through into the hard data. On the other side of the mandate, inflation remains “somewhat elevated”. However, the last CPI/PCE prints were consistent with Morgan Stanleyʼs expectation of disinflation through April.

FOMC POLICY STATEMENT: Morgan Stanley expects the following changes to the March FOMC statement that will appear in May. Strikethrough text is language that we expect will be removed from the March statement, and boldface text represents new additions that may appear in the May statement

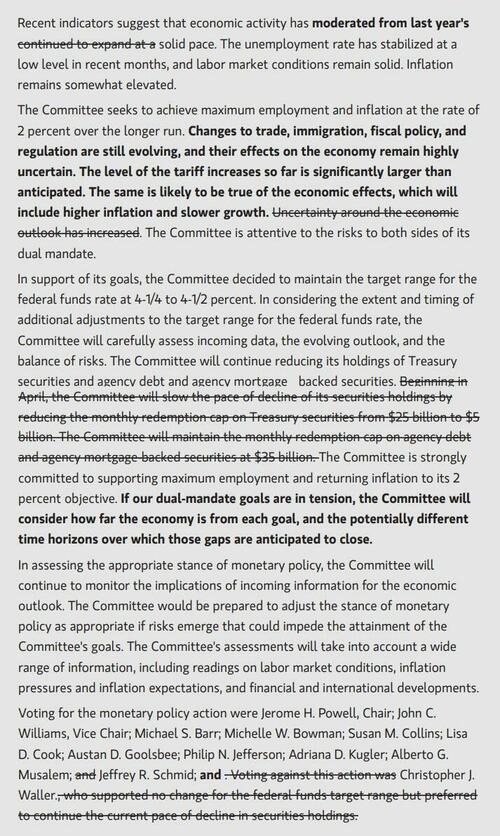

FOMC STATEMENT ALTERNATIVE 1: Should the committee want to be more explicit in highlighting the size and timing implications of recent policy decisions, it could choose to make more substantive changes to the statement. Here is one alternative.

SELLSIDE VIEWS: In their preview of the FOMC, Goldman’s economists make 2 key points:

- Soft vs Hard Data: The data have followed an exaggerated version of the sequencing usually seen in event-driven slowdowns: the survey or “soft” data have deteriorated quickly and sharply, especially expectations about the outlook, while the hard data, which in the past have taken about three months on average to deteriorate convincingly in real time, have not yet weakened overall. While the survey data are already very weak, Fed officials, like investors, surely remember that the survey data sent a “false positive” about recession risk in recent years and will want to see evidence from labor market and other hard data too before delivering rate cuts.

- Higher Bar for Rate Cuts: GS does not expect a change in the target range (4.25% – 4.50%) for the funds rate, further changes to balance sheet policy after the decision to slow the pace of Treasury runoff in March, or significant changes to the statement. The FOMC appears to be setting a higher bar for rate cuts than during the 2019 trade war, when the committee cut -25bps in three consecutive meetings. With inflation and survey-based inflation expectations now much higher (if only due to Democrat responses), participants will want to see more compelling evidence that the economy is slowing and rate cuts are needed before they act.

TRADER TAKES:

Rates:

- Powell in “Wait and See” mode; Like Payer Side Distribution Trades : Risk assets and equities in particular have recovered from the moves post-Liberation Day on the back of a more mild tone in terms of tariffs from the administration and better than expected economic data. From here, it seems like the administration is in de-escalation mode and there is a stalemate as they negotiate deals with other nations and potentially start talks with China. The two big events left for this month are FOMC (tomorrow) and CPI (13May). I don’t expect anything new from Powell and would expect the messaging to be consistent with his previous “wait and see” stance especially after the stronger hard data last week.

Vols have repriced lower led by shorter dated gamma points as systematic sellers came back to supply the street with 1m expiries, steepening the vol surface. With the beat in last week’s data and ISM Services, I would expect vols to grind lower over the next few weeks before the next payrolls as I don’t see a clear direction for rates to break through ranges. Upper left side vols also look expensive here with a lot of pessimism priced into economic growth despite hard data coming out better than expected. In terms of skew, receivers were bid into the initial risk off event but now with duration risks more symmetric, payers richen back across the surface in both gamma and vega points (market is weighing US growth concerns vs. decreased interest in owning US assets from foreign accounts). Locally, we like payer side distribution trades on 5y and 10y tails in gamma to sell some vol and fade the richer payer skew. (Goldman’s Ada Situ – USD Rate Vol Trading)

- Rec June vs Long Risk Assets: While Friday’s in-line print ameliorates the need for any action at the FOMC meeting, and accordingly shifts the burden of proof for action at the June meeting from a coin flip to an on-hold base case, the market’s structural concern of slowing growth and labor market deterioration on a forward basis remain intact. We continue to think that June FOMC pricing is under-estimating the probability of a 50bp cut relative to the probability weight assigned to the >150bp cuts by z5 in options markets; we prefer expressing this distributional view via rec June vs long risk assets or covered call structures on sfrz5. An equally interesting expression is rec z5z6, which terminally should continue to grind lower as 2025 cuts are repriced into 1h 2026 – with May/June 2026 pictured around -6bps, the bar for a protracted move lower in 2026 pricing is fairly low. (Goldman’s Brian Bingham– STIR Macro Trading)

- Hard Data Continues to Hold Up: The market has found a way of processing narrative volatility with great speed. As we enter the month of May, much of the shockwaves from trade policy continue to feel more distant. Consider that, in the time since 4/7, 10s are 35bps cheaper, stocks are about 630 points higher, and 5s30s is 14bps steeper. The market has largely taken out the deeply negative growth shock pricing and climbed a wall of worry since those days.

On Wednesday, I expect the message from Chair Powell to reflect the data path which the market has observed. The reality is, the hard data continues hold up quite well while the softness of the survey data has troughed and continues to move up modestly from the low levels seen in the prior months data cycle. With respect to inflation, last month’s lower core PCE taken alongside the prior month’s firm PCE offers little by way of trend inflation progress. June meeting can probably take out another basis point on this messaging while July prices more cut premium for the end of the 90 day tariff pause. The market will have to digest a meaningful amount of long end supply shortly after the FOMC, but from there we think the curve can bull flatten in the absence of vol-inducing data. (Goldman trader Kyle Peterson – UST Trading)

FX:

- USD is a Tactical Buy: We don’t see the FOMC impacting FX too much, especially after the recent data flow. Relevant for broader price action this week is what is happening in TWD (and broader Asia FX), where we have seen a significant appreciation in the ccy vs USD (+6%). While I think the USD is a tactical buy here, the cross winds from potential lifer proxy hedging or recycling flows to temper USD/Asia may in fact add pressure to the USD. It is hard to ascertain if this is a USD asset dumping exercise but it is weighing in on the ccy. If we see USD/Asia temper, we could see a mini rally in the USD – you can see that USD weakness yesterday and Friday morning is heavily concentrated in JPY and EUR. (Goldman’s Mark Salib – G10 FX One-Delta Trading)

- Uneventful Fed Meeting Locally: We don’t have a strong bias for the USD heading into this week’s FOMC. It seems likely to be a pretty uneventful Fed meeting. Once we get more evidence of how the tariffs are affecting inflation and growth, the Fed’s reaction function will be a lot more meaningful for USD price action. On the USD more broadly, we view last week’s strong employment report mostly as a reflection of what might have been, rather than a sign of what will be. Recession watch begins now, and that will mostly dictate the Dollar’s direction over the next few weeks. Our economists expect that data over the coming months will feature slower spending and higher inflation. Our rates strategists have noted that this mix will undermine the relative hedge benefit of Treasuries. Partly for that reason, it paints a bleak picture for the currency. Realizing this outcome should weigh on the Dollar’s lofty valuation over time. That said, as we have previously discussed, it is important to recognize that there have been fundamental drivers to the Dollar’s stabilization in recent weeks; it has not just been a technical or positioning-led move. In particular, there are signs of some policy recalibration that could alleviate some of the most currency-negative implications. In addition, data so far have generally reaffirmed that the US economy entered this period with solid momentum, as underlying measures of Q1 domestic demand help demonstrate, and the surprisingly resilient ISM report and company capex spending plans suggest that sentiment did not weaken materially over the course of April. Our baseline forecasts reflect our view that this balance should shift over the next few months, which should weigh on the Dollar. And while the valuation case vis-à-vis the Euro is not quite as compelling as it was a month ago, the potential for other catalysts is just as strong, in our view. In this context, we also note that—especially in G10—measures of valuation tend to be more of an average than an anchor. (Goldman’s Isabella Rosenberg – FX Research)

Equities:

- Long Vol Implementations in SPX and NDX: Heading into Wednesday’s FOMC, we’ve seen a dramatic reracking of the vol surface over the course of the last month. On a persistent bounce from the lows of the market at the beginning of April, we have seen implied vols hit dramatically. The desk thinks that the retrace in vol is overdone and likes long vol implementations in SPX and NDX, particularly on the topside. Even with no major headlines expected out of the FOMC, we think marginal hawkishness could help vol carry well and we think that there is limited downside to topside vol on any further rallies in spot. (Goldman’s Joe Clyne – Index Deriv Trading)

- View Relaxation as an Opportunity to Add Downside Protection: We expect the Fed to keep the policy rate unchanged this week, but this FOMC meeting is likely to provide less information for markets than at times in the past, because the path forward for both the Fed and for markets now depends on the evolution of the data. The tariff shock that we’ve seen creates two issues for the Fed: 1) a challenge to both sides of its dual mandate, and in opposite directions—lower growth, higher inflation and 2) significant uncertainty around the economic impact—the survey data has weakened sharply, but the hard data has yet to. In practice, we think that means the Fed will wait to see clearer evidence that the economy is weakening before cutting (our US economists now expect three consecutive cuts beginning in late July), and that the Fed will cut if the labor market begins to deteriorate. That means that the data will need to speak. Our growth pricing work suggests that the market is fully pricing our baseline growth forecast but leaves little buffer for recession, which our US team still puts at a 45% probability. In the absence of fresh news and with the potential for positive near-term news on trade talks, we see some scope for equities and yields to continue to drift higher and for vol to compress further. Beyond that, we think the risks are tilted to the downside in both equities and yields, and so we view further relaxation as an opportunity to add downside protection, particularly in equities, where the risks from higher inflation and lower growth both push towards lower equities. (Goldman’s Dom Wilson & Vickie Chang – GS Research)

Credit:

- Come on (back) in, the Water’s Warm: It’s been a journey out to the wides then straight back to nearly unchanged since March FOMC. With several record setting days of intraday realized volatility not seen since the GFC, it seems almost unfathomable that we’ve since seen only a continued grind in risk back for the last 10 basis points with back to back rallies across macro products. Cash has lagged synthetics in this move with decent supply/profit taking to slog through in bonds vs large short cover demand and risk addition on RV vs other asset classes that have moved even further. Interestingly, 2nd order indicators in credit (vol + curves) suggest that we could tighten even further in the medium term; 1mo IG iVol is at 70 percentile on a 1y lookback and IG44 5x10s spread is at 64th percentile since inception (higher = risk on), all while spot IG 5yr index is still at 86th percentile on a 1y lookback (we hadn’t properly broken 60 bps for over a year pre-April ’25, lest we forget). In the absence of any significant policy shift from what has been well telegraphed and supported by data, we don’t expect tomorrow’s FOMC to meaningfully change this narrative in credit. (Goldman’s Eric Wu– Macro Credit Index Trading)