Uddrag fra Zerohedge/ Nomura

Just as the U.S. Equities story “right-side” of the distribution was getting interesting again (and we were on the cusp of rallying up into Options Dealers’ “Short (OTM Call) Strikes” above 6000 and beyond in the SPX), Nomura Managing Director and macro strategist Charlie McElligott warns macro-dysfunction strikes back…

After a decade + of “U.S. Exceptionalism” and “QE Largesse” helped to facilitate over-ownership which is now leaking-out…

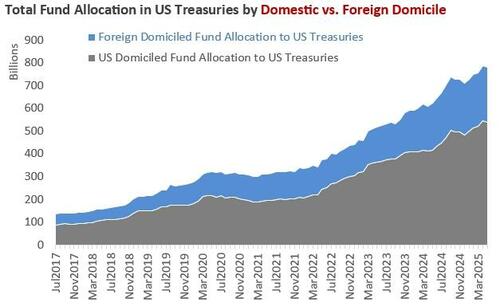

PLENTY OF LEGACY UST POSITIONING FOR R.O.W. TO SLOWLY REBALANCE / LEAK OUT OF:

Source: Nomura Vol, EPFR

…he tied-at-the-hip bleed in the USD and the UST Long-End exposes further downside susceptibility in each…

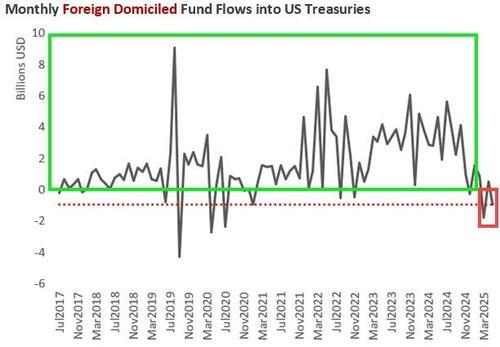

Source: Nomura Vol, EPFR

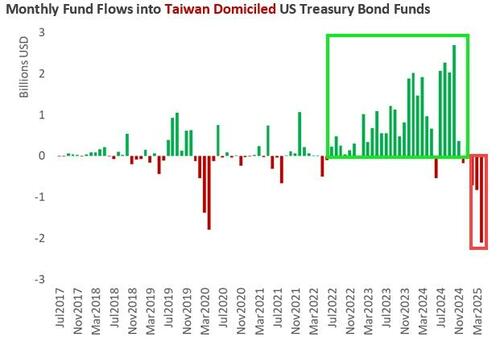

Source: Nomura Vol, EPFR

I think the current dynamic with the Dollar and “Exceptionalism Unwind” is not just about the shrinking growth premium and interest rate differentials to R.O.W. …

…but now too about the abrupt “Plan B” shift in Trump Trade policy, where Tariffs are increasingly “out” and FX is “in,” with bilateral agreements on exchange rates being sought – as per what’s now become weekly sources stories out of Asia (overnight we got this: S. KOREA SAYS FX TALKS WITH US ARE ONGOING, NO DECISION MADE), and thus the enormous demand for Dollar Downside Puts against Euro, Yen, Swiss Franc, Sterling

Source: Bloomberg, Nomura Vol

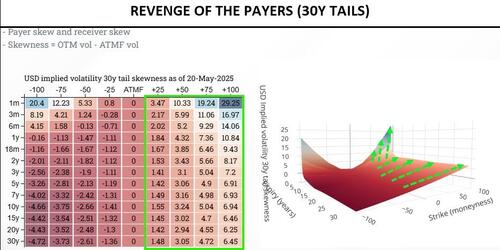

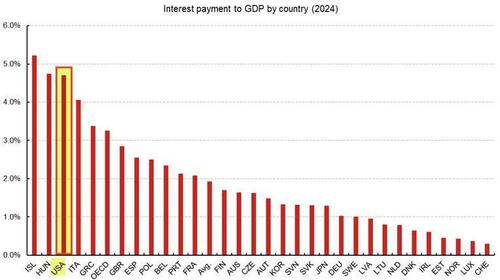

The U.S. Yield Curve remains too flat for the current state of the “Fiscal Profligacy” devouring us and forcing significant term-premium rebuild, hence this grinding and persistent state of Steepening which we are experiencing, and driving the ongoing demand for Curve Caps / Long-End Vol (30Y Payers), as the Global Long-End is feeling wildly precarious right now

From Rates Sales:

“In the past, we’ve continued to see support in the long end from across the regions anytime we faced 5% in the long bond, but we didn’t see much sponsorship last night – and it feels like we may need to test higher yields for investors to re-engage from the Asian region. TLT ETF flows yesterday were -1.1mm/01 and confirm the weakness in the long end. In swaps, the pain trade seems to be a continued leak lower in spreads for the time being – would look for a test of -60 in 10y headlines in the not so distant future.”

SKEWNESS IN 30Y TAILS SHOWS DEMAND FOR OTM PAYERS OVER OTM RECEIVERS

Source: Nomura Qstrat, Nomura Vol

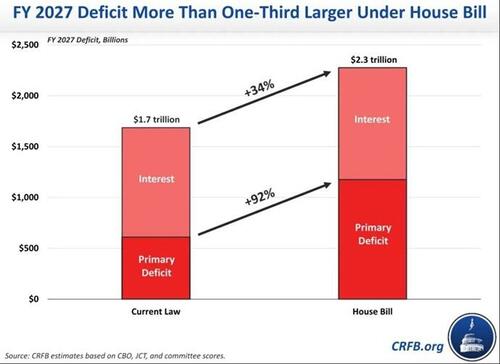

U.S. deficit spending trajectory is bending off the line, which then too embeds inflation risk, higher debt servicing costs and other growing “bad outcomes” probabilities…

…yet all while nominal GDP stays firm with what has been dual above-trend growth- and inflation- in the post COVID fiscal stimulus–response era, and keeps Fed policy “stuck” far from deep cuts…

…as the siren song of recession / sharp slowdown refuses to materialize, particularly as Corporates continue lugging scar-tissue of post COVID reopening and refuse to lay off workers (means wages and employment holding….which keeps the “U.S. Consumer Miracle” quasi-alive, but also in a zombie-state which could go wrong the minute we get steep Margin Compression which hits Corporate Earnings and Layoffs occur)….

Source: Nomura Rates Sales, OECD Global Debt Report

And hey, as it pertains to the “Will They, Won’t They” of the House GOP budget sign-off—just a bit ago, House Speaker Johnson said they came to $40,000 SALT deduction cap agreement…so the Street messaging has continued to be that the structuring will keep the +++ stimulus effect more front-loaded due to the tax cuts…although we would continue to note risks that with such a razor thin margin on this vote, you’re still in a place where the final budget could look “skinnier” and disappoint these “stimmy” expectations

Source: Nomura Rates Sales, OECD Global Debt Report

But it’s not just a U.S. thing…where the Global Long-End has many reasons to remain under pressure:

- Europe and their removal of its legacy “austerity” debt brake(s), which will of course mean heavy shift towards BIG SUPPLY as they course-correct decades of outsourced Defense / Security and its massive de-Industrialization / Energy -follies

- Japan, however, is receiving the MOST attention after the exponential JGB yields move and the ugly 20Y auction from two days ago…where generally-speaking, structural excess supply of super- long-term JGBs into domestic investors (e.g. Lifers) has seen them “overowning” Duration into 30 years of QE market interventionism and ZIRP / NIRP –policies from the BoJ, which in-turn have rendered the grossly illiquid market “unfit to trade” without a perpetual BoJ bid (especially as they’ve reduced outright purchases since July ’24)…but now have to normalize policy “tighter” in light of finally escaping their multi-decade “balance-sheet recession” deflationary spiral…and instead, landing in a place with above-trend growth and actual sticky inflation / higher wages

- And not-fer-nuthin, but in a world that’s been utterly focused on “Recession” –risks and “Downside Growth Shock” -potentials, how about those HOT CPI prints in UK today and Canada yday, at the same time that we’ve seen U.S. Corporates like Home Depot, Lowes and Amer Sports wax “bullish” on Consumer

So generally-speaking, you’re just not going to get huge demand for Duration against this type of backdrop, until you find a proper “clearing-price” i.e. add back more term-premium to compensate for various stated risks above…all conveniently into today’s UST 20Y auction!!!!