Uddrag fra JP Morgan:

this morning JPM’s Andrew Tyler warned that “given the rapid shift in geopolitics and looming deadline for the expiration of the trade deals, with Trump to set levels this week or next, it seems likely that markets are set for a near-term pullback.”

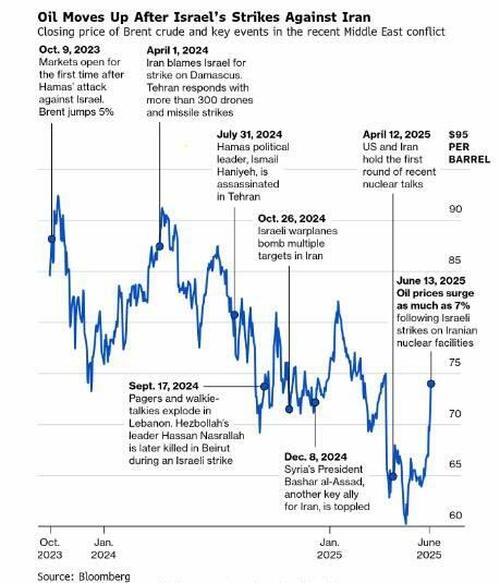

As a result, JPM’s Market Intel desk is shifting its view to “tactically cautious, with a pullback risk increasing following an assumed spike in volatility across multiple asset classes and positioning becoming increasingly stretched.” And while Tyler still thinks that much of the bull case remains in replace, “it feels prudent to be more conservative with risk until we gain more clarity on US involvement in the Middle East, the extent to which energy prices spike, the impact on bond yields/USD, and ultimately whether this latest conflict drives a further move away from dollar-denominated assets.”

The JPM trader then lists some of the key factors behind his tactical reversal:

- Escalation Potential: On Sunday, Trump indicated that the US may get involved while also indicating that he is open to having Russian mediate the conflict; Russia is a strategic ally of Iran having work against the US in recent wars in Iraq and Syria (BBG). Separately, Trump vetoed a plan to kill Iran’s Supreme Leader (RTRS). As JPM warns, “this conflict may spread from an operation to destroy nuclear and ballistic missile capabilities to one that looks more like regime change; if the latter, then should be considered multi-month/multi-quarter type of conflict. If we avoid escalation, the negative impact on markets may be 1-3 weeks.“

- Short-Term Inflation Spike: Last Last week, ZH readers learned that according to JPM’s commodity analyst, there is potential for crude prices to move to $120/bbl. This would exacerbate the current trend which has seen WTI +20% MTD with gasoline +9.3%; UK and European natgas are +13.7% and +12.7%, though returns are in USD.It would also more than double CPI from its current 2.4% print to 5.0%, ostensibly forcing the Fed to aggressively tighten financial conditions once more.

- Profit-Taking: JPM notes that while YTD US returns have not been impressive, “since the April 8 low we have seen some strong moves with the SPX +20%, NDX +26.6%, SPX Tech sector +33.35, SOX Index +42.7%, ARKK +53.5%, Retailers +21.3%, and WTI +22.5% (full chart is after the Monetization Menu section).” As a result, JPM warns that investors may take profits given the heightened uncertainty from geopolitics and trade. In some sub-sectors, seasonality is turning negative. E.g., SOX Index has averaged a -1.1% return in June, over the last 25 years, and then has increased that loss with an average return of -3.1% from July – September. The SOX has been seen more negative returns than positive June – Sept, with stats summarized below. Lastly, positioning in Semis appears to be stretched.

- Rotation Potential: When viewing performance from the April 8 bottom to Friday, SPX is +20% vs. global returns (MXWO) of 19.9%, EU (MXEU) +18.2%, APAC (MXAP) +19.1%, and Latam (MXLA) of 19.4%. YTD, SPX trails global returns by 350bp, APAC by 748bp, EU by 1818bp, and Latam by 2097bp. According to Tyler, given the recent performance of US Tech and global AI, it seems unlikely that we see a similar performance gap by the US as that witnessed in the first quarter of the year. The commodity price spike will create some distinct country-level winners the role of the consumer may be critical when viewing DM opportunities; the US consumer is relatively stronger than their counterparts so may be better able to withstand the energy price spike despite the tariff uncertainty. Further, the USD may return to being a safety haven, further pressuring ex-US trades.

In light of the above, JPMorgan’s Market Intel shifts from tactically bullish to cautious; the team’s new hypothesis looks to trade around the spike in geopolitical tensions while navigating pullback risk. That said, “any consolidation is likely to be shallow given the spike in energy prices may not derail the bull case, we think there is a buy-the-dip moment on any pullback. Positioning indicates that, irrespective of Israel/Iran, the market was setting up for a pullback.”

At the same time, “Friday’s price action felt muted, potentially as investors await to better understand the Israel/Iran situation. While there has been a strong buy-the-dip mentality with investors having been rewarded for fading negative news this year, we think it best to pull back on risk into this week.”

Finally, the combination of (i) Russia targeting Ukrainian refining sites and thus increasing the probability of Ukraine doing a similar activity and (ii) the escalating situation in the Middle East with energy infra being a key target means that we are likely to see a materially higher move in energy prices according to JPMorgan. This occurs at a time when consumer (and investor) sentiment is hitting local highs and muddles an already complicated inflation story.

Risks to JPM’s bearish call: here are the top three

- (i) a quick resolution of Israel/Iran without further escalation in Russia/Ukraine – futures are trading as though the conflict has been resolved without chance of further escalation;

- (ii) a series of trade deals is able to decrease inflation expectations despite the energy price spike;

- (iii) investors start pricing in a US fiscal stimulus from a higher/new budget allocation to military spending.

How to trade it? Here is the proposed “monetization menu” from JPM’s Market Intel desk:

Friday’s price action seemed abnormal, e.g., equities down less than expected, “so we may see some follow-up selling this week for the reasons listed above.” JPM thinks a market-neutral or slight bearish tilt makes sense. Still, with current information, the bank does not view Israel/Iran as an event that derails the bull run with the greater impact coming from trade deals.

- X-Asset/Country Level: JPM likes the commodity-focused countries/regions like Australia and Latam as relative sources of outperformance in the very near-term. Looks for Equities to underperform both Treasuries and Credit with Commodities the near-term winner.

- US: JPM likes (i) Mag7 but thinks people may want to reduce their exposure level; also (ii) a +Software vs. -Semis trade within Tech given the potential for profit-taking to catalyze investors to flip from bullish to a seasonally-driven short/bearish play; (iii) +Defensives vs. -Cyclicals; for those looking to ‘play offense’ you may consider (iv) bullish Energy plays for the obvious reasons; (v) bullish Healthcare, specifically Biotech as the sub-sector has seen a resurgence in interest with BTK outperforming SPX by 3.1% over the last month and associated ETFs having stronger performance. (vi) bullish Precious & Base Metals plays with gold/silver operating as safety havens, subject to USD dynamics, and energy intensive base metals likely catching a bid; (vii) bullish Aero/Def on the potential for escalation and the potential for escalation and the potential for RU/UKR to combine with Israel/Iran to turn into a significantly larger conflict or proxy war.

And so, one week after Goldman’s trading desk also called time on the meltup saying “troubling is brewing below the surface” and that it’s time to start selling “this junk rally”, JPMorgan agrees. Now the question is whether retail investors ganging up to incite another massive short squeeze, can singlehandedly defy not just hedge funds, but also the world’s two most important banks.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her