Få fri adgang til alle lukkede artikler på ugebrev.dk hele sommerferien:

Tilmeld dig tre udgaver gratis af aktieanalysepublikationen ØU Formue, der udkommer igen til august

Uddrag fra Goldman Sachs / tekst bearbejdet til dansk under originaltekst

One of the dirty secrets of the first half is that while everyone was either panicking as stocks puked and sold at the lows, and then panicking and chasing momentum higher as stocks proceeded to melt up, is that for all the rollercoaster turbulence which saw the S&P suffer the biggest 2-day drop since Black Monday after Trump’s Liberation Day only to then see the biggest recovery on record over the next two months, sending the S&P to all time highs, and close the quarter at all time highs, there was one strategy that was rock solid and made gains even when everyone else was crashing and burning.

We are talking, of course, about the Momentum factor, or put simply in the parlance of trading desks, Momentum (or momo).

The chart below shows the indexed YTD performance of the S&P and Nasdaq in all their crash-then-meltup glory, which have returned barely 5% YTD, superimposed with what may be the two most important momentum indexes: the Goldman US Momentum Pair (bbg ticker GSPUMFMO, which represents an equal notional pair trade of going long GSXUMFML, or GS US Momentum Long, and short GSXUMFMS, or GS US Momentum Short) and its supercharged cousin, the Goldman US High Beta Momo Pair (bbg ticker GSPRHIMO, which represents an equal notional pair trade of going long GSXUHMOM, or High Beta Momentum Long and short GSXULMOM, High Beta Momentum Short).

What is notable about the red and green lines above, which are Goldman’s momentum and momentum plus (high beta) pair trades, is that since they inherently provide an internal hedge (by being a pair trade), they tend to eliminate much of the daily volatility. And, indeed, one can see that when stocks were plunging, the short leg of the pair would dominate and push the overall index higher. Then, when conditions normalized, it was the long leg’s turn to take over which it did.

Long story short, in a year when the S&P and Nasdaq are up a modest 5% (after being down double digits at one point), various Momentum baskets are up double digits, and in the case of the Goldman Momentum Pair basket and Goldman High Beta Momo Pair, they closed the first half up 20%!

It’s not just 2025: go back another year, and the divergence becomes even more remarkable: the GSPRHIMO is up 80% in the past 18 months, vs only 30% for the S&P500.

Furthermore, since many of the long momo names are simply solid balance sheet/large cap/growthy tech names (i.e., whatever has worked so far will continue working), the record divergence we pointed out last night between the AI winners and AI losers may just as well apply to the unprecedented gains in pure momentum observed in the first half (which ultimately boils down to a hedged but levered AI trade).

AI is priced beyond perfection. The gap between AI winners and AI losers has never been greater pic.twitter.com/aQNAYlo5MR

— zerohedge (@zerohedge) July 1, 2025

And then, after two quarters of remarkable, high-Sharpe outperformance, Momentum finally blew up today.

What happened? Well, despite both UBS…

UBS: “Seeing big momentum unwind with the UBS basket {UBPTMOMO} -5.7%, which is the biggest move since January with the long leg selling off (-3.8%) and short leg squeezing (+1.9%). No clear catalyst, though profit taking ahead of nonfarm payrolls likely fueling the rotation”

— zerohedge (@zerohedge) July 1, 2025

… and Goldman highlighting the momo blow by blow during the day…

Someone cracked: “Violent moves under the surface with our Momentum pair (GSPRHIMO) -780bps / 5 sigma move having its worst day since Deepseek” – GS https://t.co/QBoD4s9GG7

— zerohedge (@zerohedge) July 1, 2025

… there was no clear catalyst for the violent momentum unwind observed today.

As Goldman trader Mike Washington writes in his EOD note titled “Momententum Unwind the abovementioned GSPRHIMO momo pair traded down -7% and had its worst day since Deepseek (5 sigma move).

Washington further notes that Asset Manager and the hedge fund community are both in aggressive “question and watch” mode; meanwhile there is no overarching fundamental driver for the clear value tilt (RTY/SPW> NDX/SPX). The Goldman trader thinks the following three may have been catalysts for today’s move:

- Start of a new quarter (new ideas, reversions play, reluctance to sell YTD winners until after Q2)

- Powell remarks at the ECB’s Forum in Sintra ( “wouldn’t take any meeting off the table” when asked if it was too soon for the Fed to start cutting in July)

- Unease into NFP Thurs (GS +85k, cons +113k, last +139k). Mixed data today (JOLTS job openings up / ISM manufacturing increased but composition weak).

Some of Goldman’s specialists also chimed in. Below are the views of the bank’s TMT, Healthcare, Consumer and Financials heads:

- TMT (Pete Callahan): seems to be primarily driven by a sharp reversal in YTD winners. SE, SPOT, RBLX, NVDA, AVGO, AMD, NFLX, META all stand out // not seeing a ton of flow on our desk TODAY specifically to substantiate this, our sense is most of these moves are related to the calendar flipping to Q3 // we saw a ton of LO movement into quarter-end last week across Sectors, and wonder if there was a reluctance to sell/trim some of the big YTD/thematic Winners until after Q2 ended // Notably, AAPL (-18% ytd) stands out as one of the best assets today in TMT

- HealthCare (Jon Chan): after exiting 2Q with the XLV/SPY pair at relative lows (levels not seen since ‘01) – the group is extra springy today – with Managed Care (+2-3%), Pharma (+1-3%), Tools (+2%) all leading the way – while more well-owned Medtech lagging marginally – suggestive of positioning driven rotations/momentum unwind with the turn of the quarter // No overarching fundamental driver from what we see – though can frame a couple headlines as being favorable for group – (i) with Senate progressing towards voting on final amendments for BBB (read: clarity on Medicaid/gov’t exposed), (ii) headlines over AZN discussing moving listing to US (read: could this be part of drug price negotiations?), (iii) incremental M&A headlines (more neg EV deals with IGMS, MRK GY says looking at more Life Sciences deals).

- Consumer (Scott Feiler): Tons of inbounds as to “why is consumer working so well today?” // Think it could be as simple as Consumer Discretionary is the most net sold sector YTD on our PB book and is in the low-single digit percent in terms of exposure vs other sectors on a 1, 3 and 5-yr basis. Feels like a catch-up trade to the market on day 1 of 3Q // JOLTS job openings up, oil is at steady levels and positioning (according to PB data) in the space is light // The names moving are largely the shorted ones (see AEO/ANF/VSCO/KSS etc) vs some of the more owned names underperforming like RL, AS, TPR etc.

- Fins (Alex Mitola): Performance seemingly driven by Powell’s comments regarding the possibility of a July rate cut “can’t say whether July is too soon to consider a cut” sparking a rotation toward cyclicals/value/small caps. Within Fins, seeing this in retail broker weakness (HOOD IBKR, LPLA, SCHW), regionals > large caps, and weakness in defensives (exchanges, pockets of insurance) most notably. Our Fins Pairs say it all – Long MoMo, High Growth and and Low Value baskets all underperform

Perhaps, at the end of the day it was as simple as sector rotation: outperformance of the past Losers (bbg ticker GSXULMOM) combined with a selloff in past Winners (e.g. AI complex).

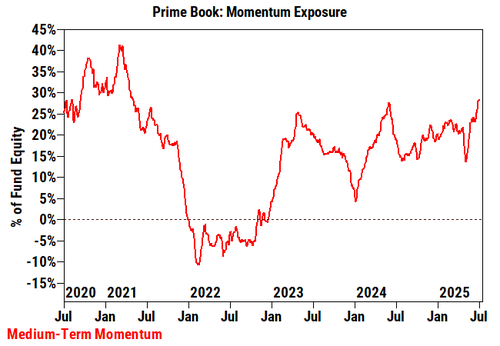

So what is the best strategy? For the answer we go to Goldman’s thematic trading desk which published a note by trader Guillaume Soria (full note available to pro subscribers), in which he writes that while the risk backdrop coming into today has been friendly (oil is well below $80, the dollar is weaker, rate cuts are in the picture) today’s price action “could have been exacerbated by the high gross positioning exposure in our Prime Book (99th percentile 1-year), high net leverage (93rd percentile in the last year) and elevated momentum exposure across Prime (87th percentile in last 5y).”

Another potential explanation of today’s selloff according to Soria could be attributed to the start of the quarter and perhaps, for window dressing reasons, there was an incentive to hold onto winners even though they were overbought.

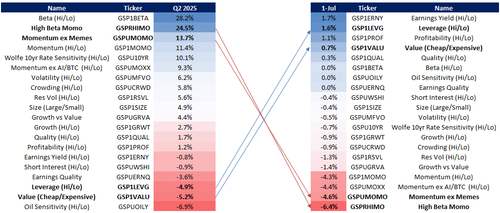

Visually, today’s action boils down to aggressive factor rotation…

… and just as aggressive thematic rotation.

So what are the key risks to watch in the all-important momentum factor? According to Goldman, these are several trades where positioning is excessive and could lead to continued rollover (i.e., these are extremely consensus trades, at least for those who have made money in H1):

- Long Software vs Short Semis (GSPUSOSE)

- Long Nat Gas vs Short Oil (GSPUNATO)

- AI Exposure (GSPUARTI)

- Long Larger cap (GSP1SIZE), Growth vs Value (GSPUGRVA) and Short Leverage (GSP1LEVG)

Said otherwise, momentum is long larger cap and higher quality while short leverage and value:

For those seeking to protect against continued pain in the space, these are Goldman’s recommended targeted Momentum hedges:

- Indexified Barra Momentum (GSP1MOMO)

- Momentum excluding AI / Power / BTC (GSPUMOXX)

- High Beta Momentum (GSPRHIMO)

Soria then urges Goldman clients to manage momo exposure with or without sector or AI biases, and specifically underscores the importance of pursuing momentum ex AI if the current drawdown extends:

We’ve noticed our Momentum ex AI Pair (GSPUMOXX) underperforming our pure momentum pair (GSPUMOMO) as well as our less sector constrained High Beta Momo pair (GSPRHIMO). Given how crowded the AI trade has become and the potential further pain, we see room to move between momentum implementations in order to express a view on these dynamics or to avoid them.

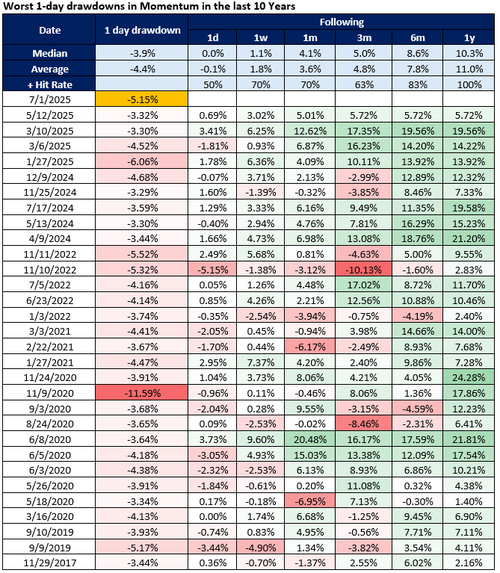

The next question of course, is whether the drawdown will extend. Nobody knows but here is a historical snapshot of what happened after the biggest 1-day Momentum drawdowns in the past decade.

Which brings us to the final question: for those who don’t have Goldman as a Prime Broker and are unable to trade the bank’s synthetic baskets, what are the components?

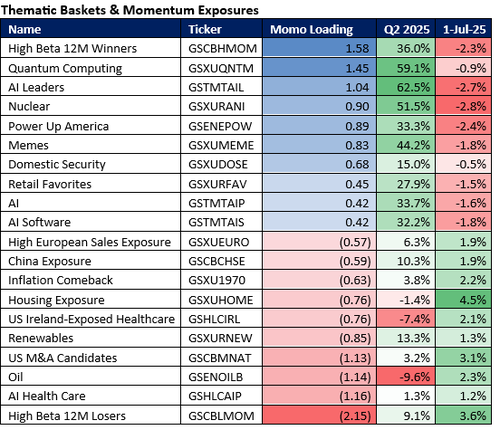

First, we answer the bigger picture question, namely what are the various momentum exposures inside the bank’s assorted thematic baskets:

Next, we narrow down the momentum universe down by drilling into sector and industry breakdown of high beta momentum:

Last, but certainly not least and quite possibly best, here are the most important momentum stocks right now: the constituents of Goldman’s market crushing GS US High Beta Momo (GSPRHIMO ) basket.

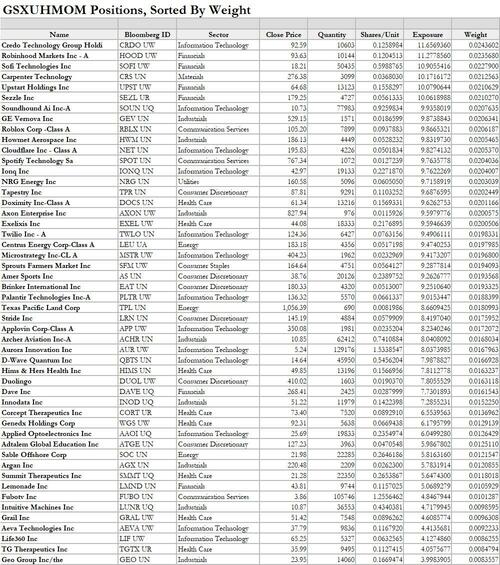

We start with the longs (BBG ticker GSXUHMOM) and show the first 50 (the rest are available to pro subscribers)…

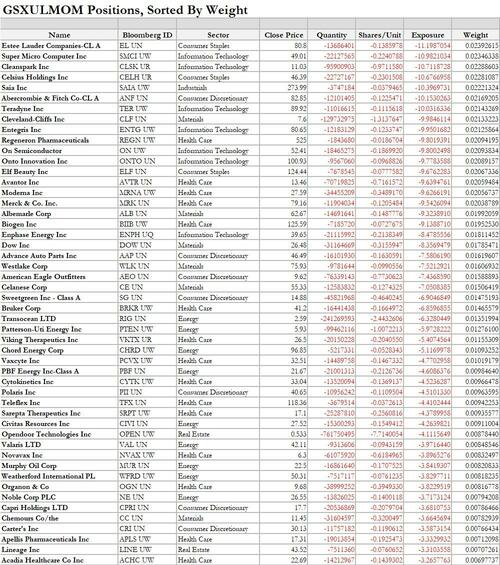

… and here are the 50 largest shorts (BBG ticker GSXULMOM) because it is, after all, a pair trade.

——————————-

tekst bearbejdet til dansk

Momentumstrategien: Første halvårs skjulte vinder – og dens dramatiske kollaps

En af de “beskidte hemmeligheder” i første halvår af 2025 var, at mens investorer først panikkede under markedsfald og solgte ud nær bunden, og siden panikkede igen i deres jagt på momentum opad, så var der én strategi, der stod klippefast gennem hele turbulensen og genererede markante afkast – også da andre brændte fingrene.

Vi taler naturligvis om Momentum-faktoren – eller som det ofte kaldes på trading-deske: “momo”.

Momentum slog bredt marked – massivt

S&P 500 og Nasdaq leverede begge beskedne afkast på ca. 5 % year-to-date (YTD), trods voldsomme udsving. Dette inkluderede det største 2-dages fald siden “Black Monday” efter Trumps “Liberation Day”, efterfulgt af den største rekyl nogensinde, der løftede S&P til rekordhøjder ved kvartalets slutning.

Men Momentum-strategier – især Goldmans egne syntetiske par-handler – leverede langt bedre. Både:

Goldman US Momentum Pair (ticker: GSPUMFMO)

Goldman US High Beta Momo Pair (ticker: GSPRHIMO)

– steg med over 20 % i første halvår alene. Over de seneste 18 måneder er High Beta Momo oppe med 80 %, mod blot 30 % for S&P 500.

Forklaringen er, at disse parhandler er konstrueret som hedgede long/short-positioner, hvilket neutraliserer markedsvolatilitet. Når markedet falder, gavner short-benene – når markedet stiger, fører long-benene an.

Momentum: En afledt AI-strategi?

En væsentlig del af momentumafkastene har været båret af stærke, store teknologivirksomheder med robuste balancer og høj vækst – præcis de aktier, der også udgør AI-vinderne. Det betyder, at Momentum i 2025 i praksis kan betragtes som en gearet AI-handel, men i parhandelsformat.

Divergensen mellem AI-vindere og -tabere har aldrig været større, og det samme gælder afkastene fra momentumstrategier.

“AI er prisfastsat ud over perfektion – forskellen mellem AI-vindere og -tabere har aldrig været mere ekstrem.”

…Indtil Momentum kollapsede

Den 1. juli oplevede momentum sin værste dag siden “Deepseek”. Flere af Goldmans og UBS’ baskets faldt dramatisk:

UBS Momentum Basket (UBPTMOMO) faldt -5,7 %

Goldmans High Beta Momo Pair (GSPRHIMO) faldt -7 %, et 5 sigma move

Der var ingen entydig udløsende faktor, men markedsaktører peger på:

Starten på Q3: Mange holdt fast i YTD-vindere frem til Q2’s afslutning – nu kommer realisation og rebalancering.

Powells kommentarer i ECB’s Forum: Han nægtede at afvise juli-renteændringer.

Uro op til NFP (Nonfarm Payrolls) torsdag, hvor markedet er splittet mellem GS-forventning (+85k) og konsensus (+113k).

Samtidig er positioneringen ekstrem:

Goldmans Prime Book er i 99. percentilen for bruttoeksponering det seneste år

87. percentilen for momentumeksponering over 5 år

Nettogearing i 93. percentilen

Sektorrotation og Momentum-eksplosion

Goldman-noter fra deres sektorteams viser bred omvæltning:

Tech: Tidligere vindere (NVDA, SPOT, META) blev hårdt ramt. AAPL – en YTD-tabende aktie – steg.

Healthcare: Stor rotation ind i Pharma, Tools og Managed Care – alt tidligere undervægtet.

Consumer: Shorts blev købt kraftigt (eks. AEO, KSS), mens tidligere stærke navne (RL, TPR) haltede.

Financials: Powell-kommentarer førte til vægtning mod cyclicals og small caps; retail brokerage svækkedes (HOOD, IBKR).

Overordnet set ser vi klassisk sektorrotation: Sælg vinderne, køb taberne.

Goldmans anbefalinger til investorer i Momentum

For dem med eksponering mod momentum (især AI-drevne baskets), anbefaler Goldman:

Taktiske hedges mod Momentum-kollaps:

GSP1MOMO – Barra Momentum

GSPUMOXX – Momentum ekskl. AI/Power/BTC

GSPRHIMO – High Beta Momentum

“Momentum ekskl. AI underperformer i forhold til bred momentum – vi anbefaler rotation mellem implementationer for at styre eksponeringen.”

Hvad nu? Historikken siger… måske mere smerte

Et historisk overblik over de største 1-dags fald i momentum viser, at drawdowns ofte kan forlænges over flere dage/uger, selv uden tydelige fundamentale katalysatorer.

Goldman peger også på specifikke, overfyldte handler, som er i farezonen:

Long software vs. short semis

Long natgas vs. short olie

Long AI-eksponering

Long large caps, growth vs. value, short leverage

De vigtigste aktier i momentumstrategier

For investorer uden adgang til Goldmans syntetiske baskets, men som vil følge udviklingen:

De 50 vigtigste longs i GSXUHMOM

De 50 vigtigste shorts i GSXULMOM

Disse udgør grundstammen i GSPRHIMO og viser, hvor markedets risici og muligheder pt. koncentreres.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her