Få fri adgang til alle lukkede artikler på ugebrev.dk hele sommerferien:

Tilmeld dig tre udgaver gratis af aktieanalysepublikationen ØU Formue, der udkommer igen til august

Uddrag fra Bank of America

Last weekend, when Trump himself made it abundantly clear that DOGE is dead and buried and any pretense of government cost-cutting had been just for show, we said that with the budget deficit about to really explode, the president was “all about boosting revenue (and debt) now.” And if not revenue – because everyone always claims in the beginning they can somehow push revenue growth into overdrive until a recession or a crisis hits in a few years and then all the promises are quietly forgotten – then certainly debt.

At roughly the same time, One River’s Eric Peter echoed the same sentiment, writing in his weekly note that “Trump Has Decided To Go For Broke, And Pump This Economy Into A Boom To Grow Our Way Out Of Debt.”

“He tried to cut spending through peace,” barked Biggie Too. “But the war in Ukraine is raging on. And now he got this new taste for B2s and bunker busters,” bellowed Biggie, Chief Global Strategist for one of Wall Street’s too-big-to-fail affairs.

“And he tried to DOGE discretionary spending, but that was a bust too.” Indeed. “So, looks like he’s going to go for broke and pump this economy into a boom to grow our way out of debt,” he said. “He’s saying, ‘gimme everything now,’ and if there’s inflation next year, the Fed can always hike.” And Biggie broke into one of his devious little smiles, a lover of booms, bubbles, busts. “If we couldn’t get the 30yr yield to hold above 5% with all this crap going on, then why can’t the stock market trade at 30x earnings?”

Fast forward to today, when in a holiday-shortened Flow Show note (available to pro subs here), Bank of America’s Michael Hartnett makes the final logical observation that since Trump “can’t cut spending, can’t cut defense, can’t cut debt, go big with tariffs, so only way they can pay for One Big Beautiful Bill is with One Big Beautiful Bubble.”

Translation: not just more of the same, but much more of the same.

How much more? Well, as first noted here (when we noted that the Senate version of the bill will actually raise debt by $5 trillion, more than the $4 trillion in the House version), Hartnett also reminds us that the Big Beautiful Bill is set to raise US debt ceiling $5tn to $41tn…

… which – as we first explained over a month ago in ‘“Hell To Pay”: This Is What America’s Debt Doomsday Looks Like” – means that US debt is set to rise to $43 trillion by the next US election in ’28, and to exceed $50tn by 2032. And, most likely, the actual number will be even greater since the US will have at least one deficit-busting recession/crisis/pandemic/shock before than which will add an “unexpected” $10 trillion in incremental debt.

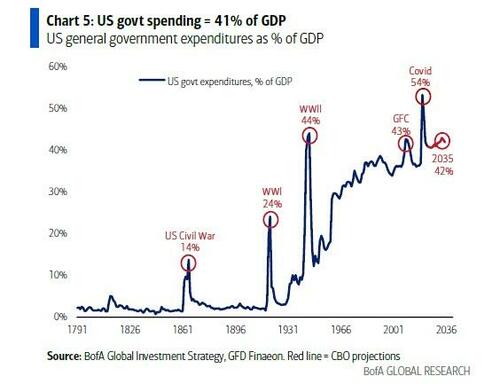

This brings us to the latest Tale of the Tap , in which Hartnett writes that the recent political U-turns on German fiscal, UK benefit spending, US DOGE, shows electorates/politicians are never voting for lower debt/deficits (govt spend as a percentage of GDP is 44% in the UK, and 41% in the US)…

… and it’s why asset allocators are so averse to long bonds (not just in the US but everywhere), and are slashing US dollar exposure, raising allocation to international markets, hard assets, digital assets in ‘25.

Which also explains the monumental shifts in returns for some of the world’s key assets: in the first half the US dollar crashed a massive -11%, the biggest drop since ‘73…

…. while gold was up a staggering 26% (its best first half since ‘79) and global stocks ex-US (16%) had their best first half since ‘93. And while being long the “long bond” whiffed (TLT 2.9%), the S&P 500 managed to reverse a huge $10 trillion market cap loss with a $11 trillion gain (Mag7 up $5tn), and the 7k vs 5k “bubble or bust” summer risk is firmly skewed to the former.

The rest of Hartnett’s note deals with the latest fund flows (which pro subs can read all about), but there were two notable highlights having to do with tipping points.

First, according to the BofA Global Flow Trading Rule, when flows to global equity and high yield bonds exceed 1.0% of AUM in 4 weeks, sell, and when outflows >1.0% of AUM – buy. Well, in the past 4 weeks inflows to global equities & HY bonds were 0.9% of AUM, while backs off slightly from last week’s near “sell signal” (0.99%) due to small outflow from stocks this week, but is just shy of triggering a sell signal.

Second, according to the BofA Global Breadth Rule, the market is rapidly approaching a sell trigger. As Hartnett explains, when >88% of MSCI ACWI country stock indices are trading above 50-& 200-day moving averages, it’s time to sell, and when >88% trading below…buy; well currently 82% of MSCI ACWI country stock indices trading above 50- and 200-day moving averages. And while the upcoming July move in the S&P above 6300 will likely trigger a “sell signal”; the BofA CIO warns that “overbought markets can stay overbought as greed is harder to conquer than fear.