Overbought giant

NVDA is getting into very overbought zone here, and the stock has decoupled from the 200 day moving average. It is impossible to not love this magnificent company, but we are not trading the stock right now in this “danger zone”. Let’ have a look at the latest for this giant.

Source: LSEG Workspace

Superlatives

“Nvidia market cap is now larger than the entire US energy sector; its larger than all US-listed REITs equity; larger than the market cap of US consumer staples companies; and its 80% of the value of all US industrials … Maybe this one will come as less of a shock, but its also now larger than the equity value of UK FTSE-All Share …” (Wilson, GS)

Magnificent without the magnificent one

25E EPS Revisions: Nvidia, Mag 7, 493, Stoxx 600. Not a lot of positive earnings revisions for the Mag6…

Source: FactSet

Wide dispersion

Wide dispersion among the Mag 7 so far this year. Big shift from the previous few years when they all moved in tandem.

Source: Bilello

The top ten institutional holders of NVDA

The top ten institutional holders of NVDA now control over 40% of shares outstanding, with ~10M additional shares bought each month via 401(k) contributions alone.

Source: Tier 1 Alpha

Tech positioning crawls back to flat

Mega-cap growth & Tech positioning.

Source: Deutsche Bank

Well positioned

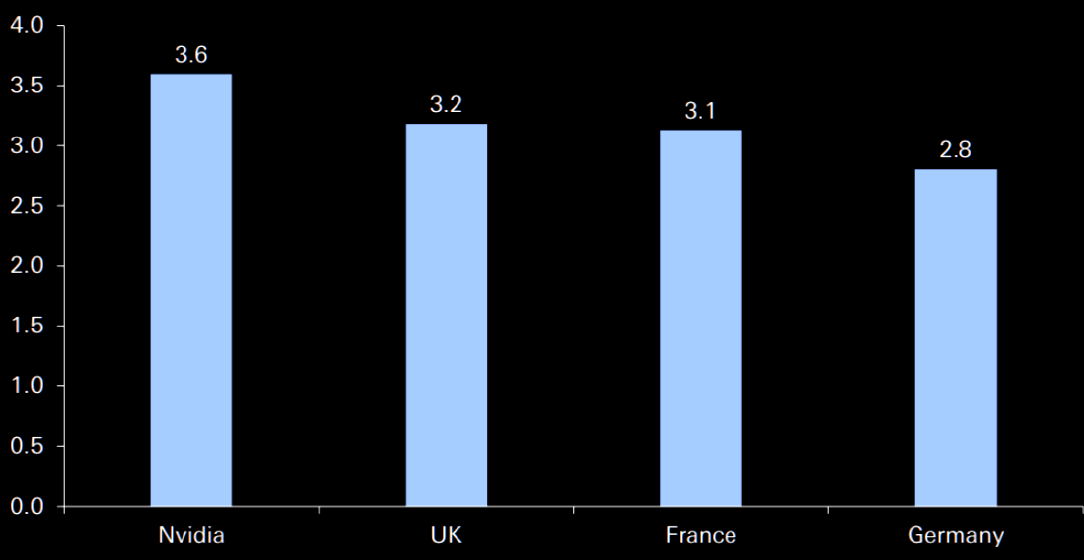

NVDA very much holding that pole position.

Source: GS

Gotta spend…

…to earn. NVDA continues to outspend competition from an R&D perspective.

Source: GS

Doubt the AI uptake?

Doubt no more…