Uddrag fra Goldman:

Real economic headwind

Goldman sees tariffs as a real economic headwind—not just a headline risk. Higher prices may drag on real incomes, stalling consumption and growth. Add slowing hiring and trade data, and the stage is set for policy shifts and weaker GDP. But there is always a silver lining…

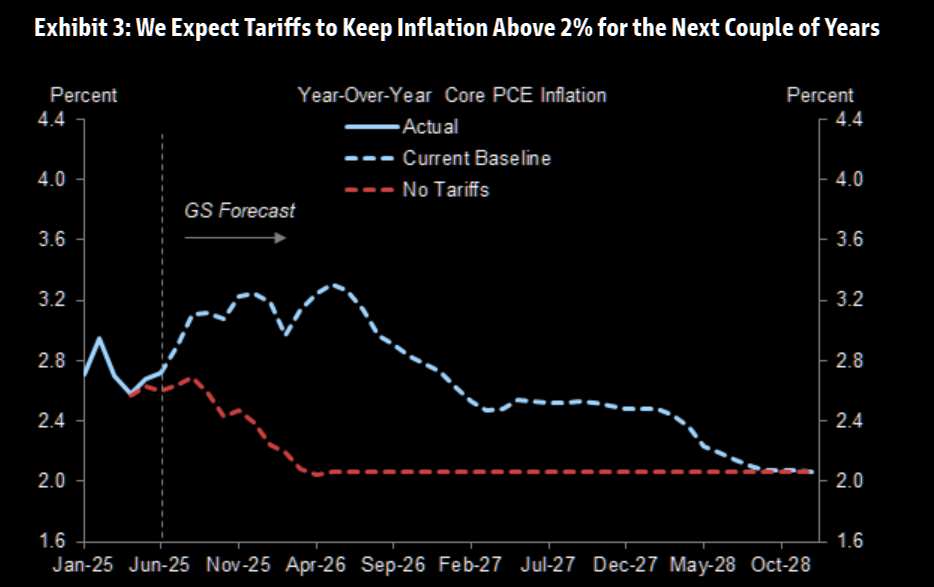

Tariffs boost inflation

GS: “…we expect our baseline tariff forecast to result in a roughly 1.7pp cumulative boost to core PCE prices between 2025 and 2027.”

Source: Goldman

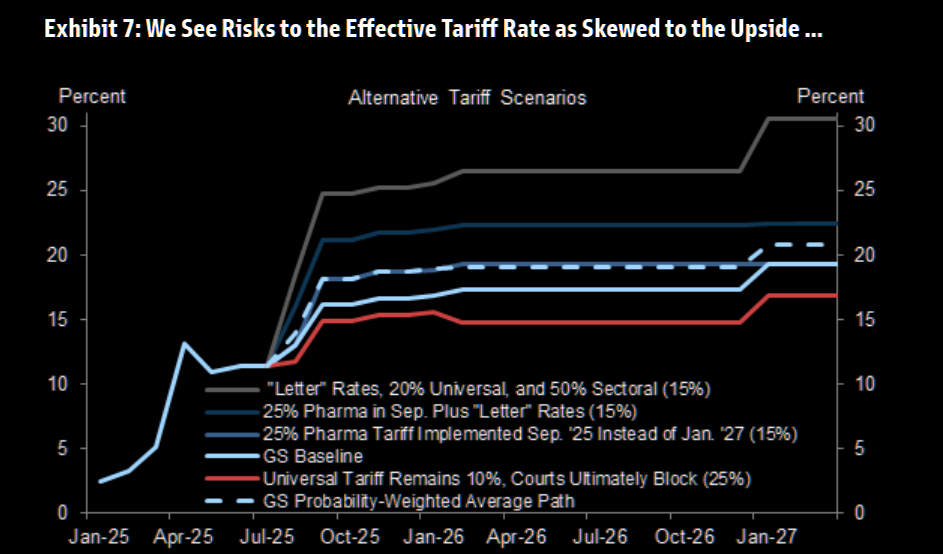

Tariff risk skewed to the upside

“Together with our subjective probabilities, our scenarios imply a weighted-average ETR that rises by 16pp in 2025 (vs. 14pp in our baseline), 0.4pp in 2026 (vs. 0.6pp), and 2.3pp in 2027 (vs. 2.3pp), meaning that the risks to our baseline tariff increase forecast are tilted slightly to the upside.”

Source: Goldman

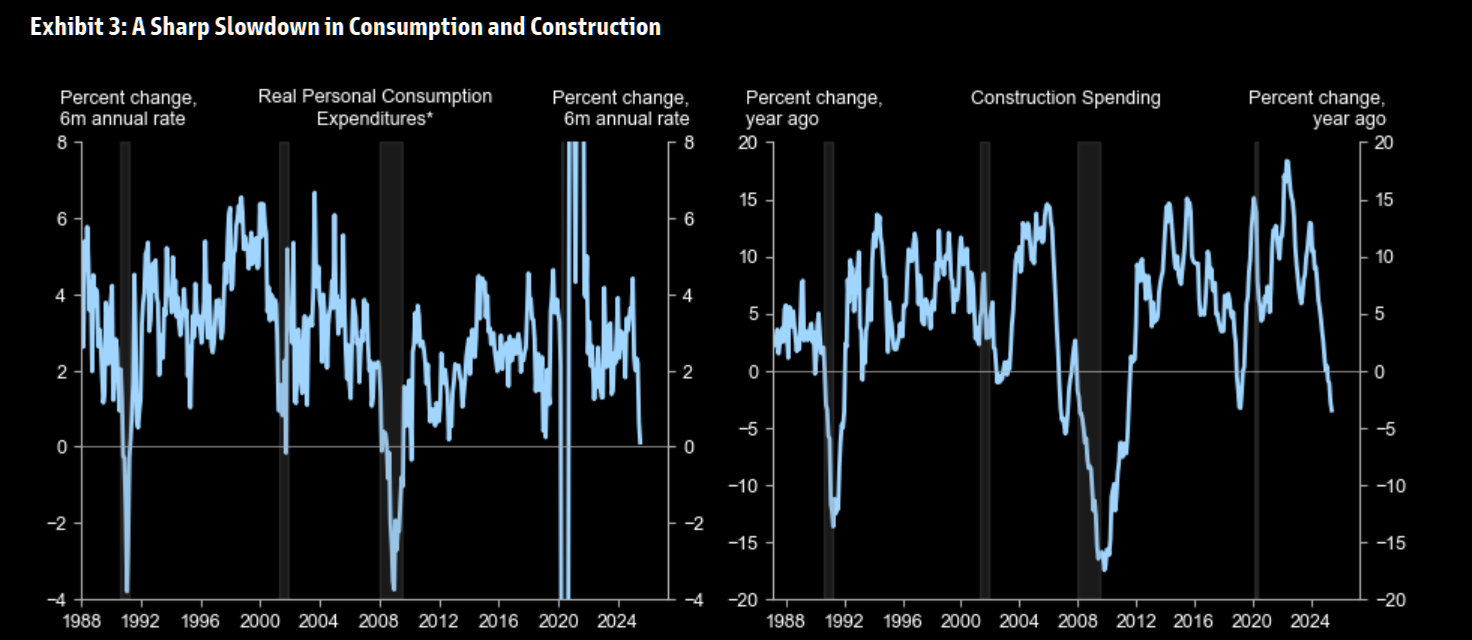

It will eat into the real economy

Goldman argues that even a one-time price increase will eat into real income, at a time when consumer spending trends already look shaky.

GS: “…we estimate that real personal consumption has now stagnated on net for six months, which rarely happens outside of recession.”

The weakness in consumption and housing has pushed down their tracking estimate for H1 real GDP growth to 1.1%, about a percentage point below potential.

GS continued: “We expect a similar pace in H2, as the growing real income drag from tariff-related price increases offsets the boost from easier financial conditions.”

Source: Goldman

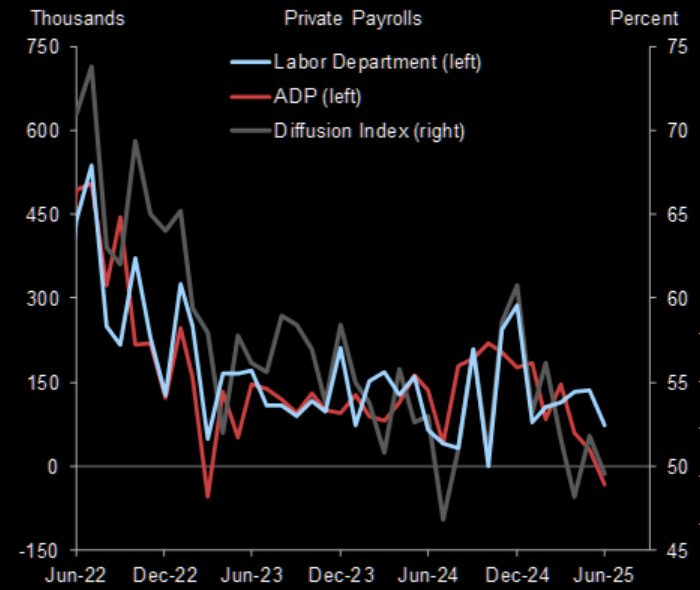

The pace of hiring is slowing

Private payrolls grew only 74k in June according to the Labor Department and contracted outright according to ADP. On a similar note, the payroll diffusion index has fallen to levels indicating that there are now just as many industries cutting as adding jobs.

GS: “… if GDP growth remains sluggish, the labor market might soon hit “stall speed”—a pace of job creation weak enough to trigger a self-reinforcing rise in unemployment. “

Source: US Bureau of Labor Statistics

Not a great day for the US economic outlook

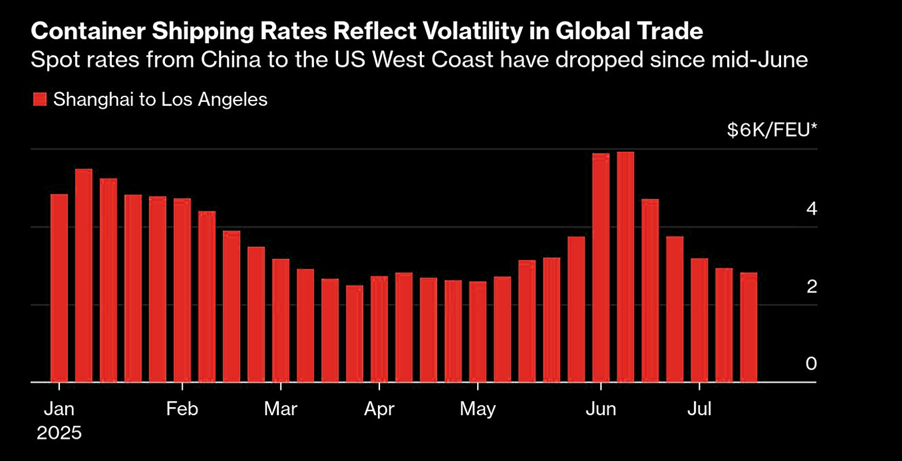

First there was new data showing the number of shipping containers carrying US imports fell for a second straight month, setting the stage for one of the sharpest year-on-year reversals on record thanks to President Donald Trump’s trade war.

Veteran industry analyst John McCown, writing in a monthly report based on the 10 largest US ports, said that inbound container volume fell 7.9% in June from a year before. Similar declines during the global financial crisis and the pandemic were short-term slumps. In this case, however, he estimated that a 25% reduction in US container volumes is “readily possible” and would translate “directly into a $510 billion reduction in annual commerce for the US.”

Source: Bloomberg

Recession risk

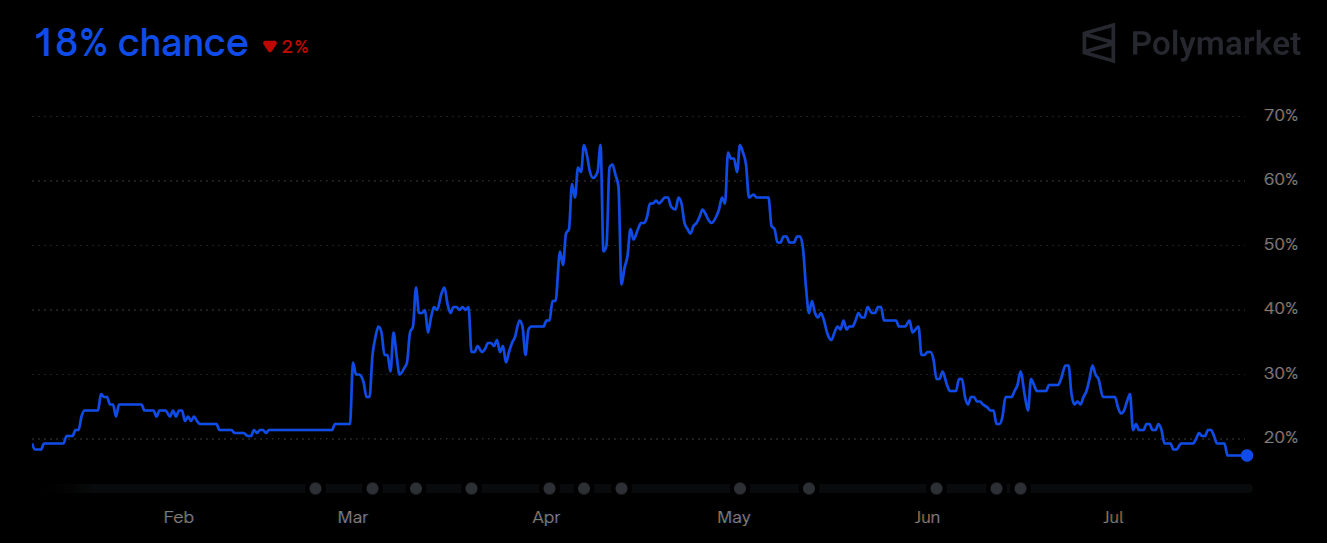

Polymarket has it at 18% which is a touch above “normal” but Goldman is more cautious:

“Our 12-month recession risk estimate remains at 30%, double the unconditional historical average.”

Source: Goldman

Here comes the cuts

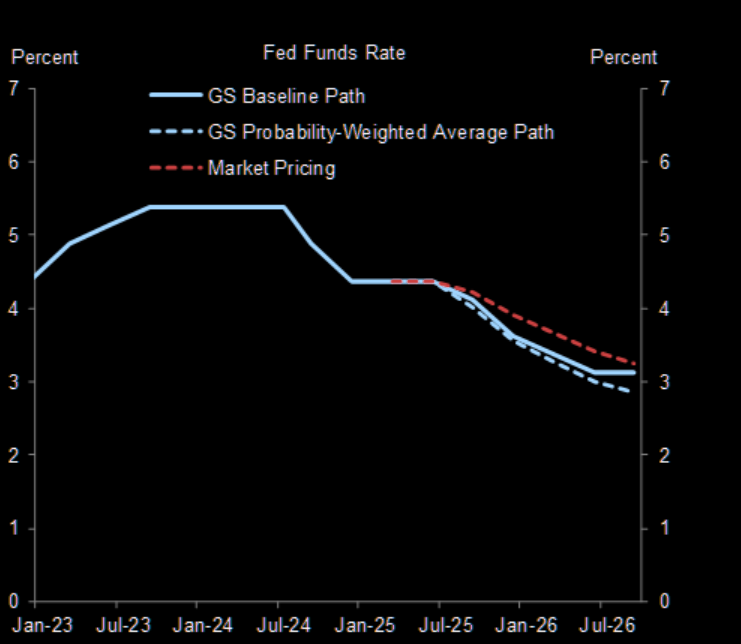

The slowdown has strengthened the case for earlier monetary policy easing,

GS: “Starting in September we expect three consecutive 25bp cuts that take the funds rate down to 3½-3¾% at yearend 2025, followed by two more 25bp cuts in the first half of 2026. Our forecast remains modestly below market pricing.”

Source: Goldman

The case against the cut

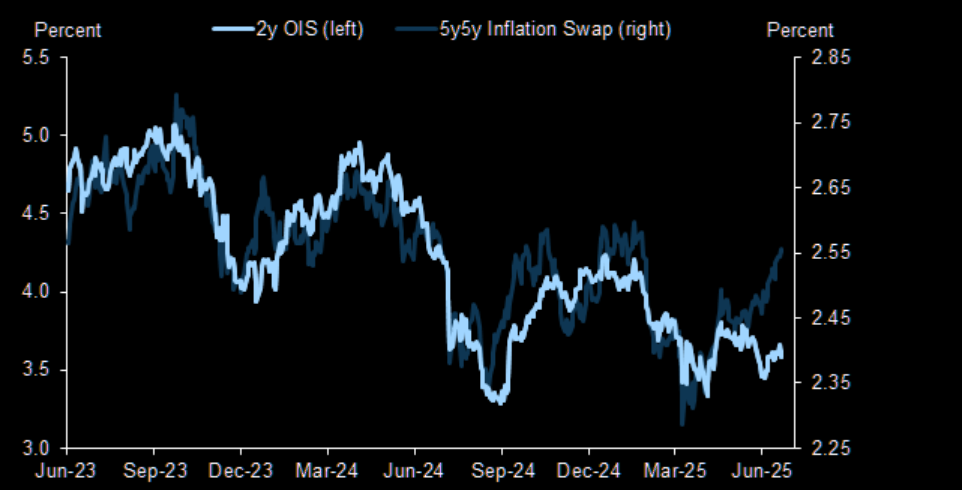

5-year 5-year forward inflation swaps have recently decoupled higher from their prior close relationship with the 2-year note yield. A further increase could make Fed officials more reluctant to cut.

Source: Goldman

How to trade it

Jan Hatzius sees the following continuation of major macro thematic trades:

“A return to Fed easing should push down US Treasury yields and the dollar while boosting global equities and gold. Among these trades, our preference lies with short dollar and long gold positions because they also hedge against greater concerns about Fed independence and/or another major tariff shock.”

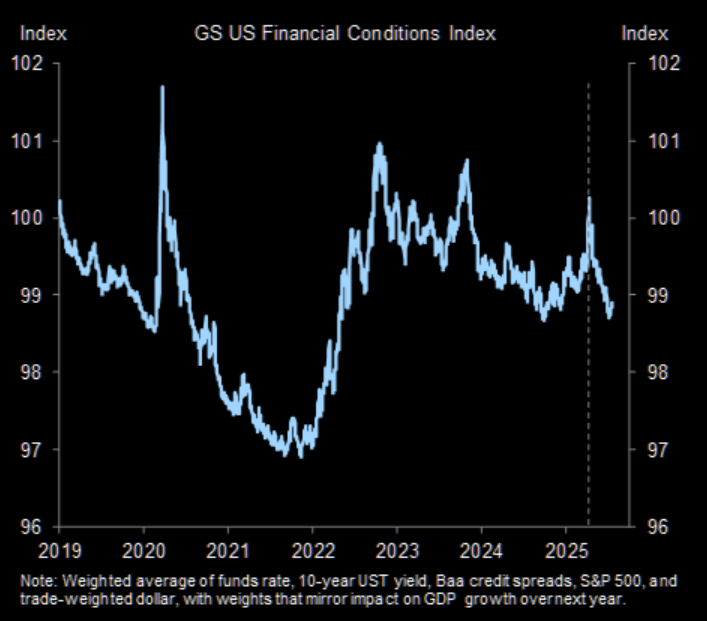

The good “get out of tariff jail” card

Financial conditions are easier than they were before the tariffs were implemented.

Source: Goldman

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her