Resume af teksten:

Sydkoreas forbrugertillidsindeks steg for fjerde måned i træk, hvilket er det højeste niveau siden juni 2021. Tilliden er især stærk for nuværende levevilkår og den indenlandske økonomiske situation. Forventningerne til fremtidige levevilkår og økonomien forblev stort set uændrede. Stramninger på boligmarkedet og stigende leveomkostninger kan påvirke forbrugernes fremtidige adfærd. Boligprisudsigten faldt betydeligt med 11 point i juli, hvilket indikerer en mulig moderation af boligpriserne. Bank of Korea ser dette som positivt, men det er usikkert, om det fører til rentesænkning i august. Inflation forventes at forblive omkring 2%, men kan påvirkes midlertidigt af naturkatastrofer. BoK forventes at sænke renten i oktober afhængigt af fremtidige data, herunder boligpriser og handelspolitik med USA.

Fra ING:

South Korea’s consumer sentiment index improved for the fourth straight month. It also suggests a moderation of housing prices, which should offer relief to the government and the Bank of Korea

Source: Shutterstock

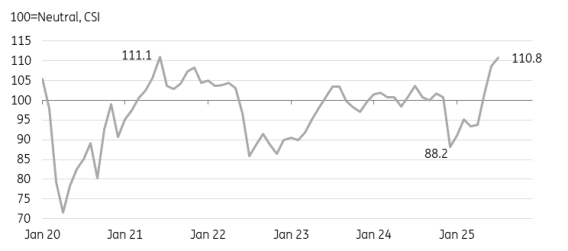

Consumer sentiment index

The highest level since June 2021

Consumer sentiment improves in July as fiscal support kicks in

The Bank of Korea’s July consumer sentiment index increased to 110.8, as expected, for the highest reading since June 2021 and the fourth consecutive monthly gain. Confidence was particularly strong for both current living standards (+2) and the domestic economic situation (+12). However, expectations of living standards (0) and the domestic economic situation (-1) remained largely unchanged.

The supplementary budget and other support measures have begun to have an impact on consumers. Yet ongoing tightening measures in housing markets and increasing living costs may lead consumers to take a cautious approach regarding the future.

Consumer sentiment rose the highest since June 2021

Source: CEIC

The outlook of housing prices dropped notably

The most significant finding in the report was a notable decline in the housing price outlook, which dropped by 11 points in July after four consecutive months of rapid gains. We believe this serves as a powerful forward-looking indicator for assessing actual housing prices. It suggests that recent stringent mortgage regulations have been effective in moderating the rise in housing prices.

The outlook for housing prices dropped, suggesting the moderation of housing prices in near future

Source: CEIC, ING estimate

BoK watch

The BoK may view this moderation positively. It remains uncertain, though, whether it’s sufficient for the BoK to implement a rate cut in August. In its previous meeting, the BoK cited financial instability for its decision not to lower policy rates. This may influence its decision regarding the timing of a future rate cut. In terms of inflation, expectations edged up to 2.5%, but still remain on a downward trend. Recent natural disasters may push up fresh food prices temporarily. But we still expect inflation to remain anchored around 2% level.

We expect the BoK to cut rates by 25 bp in October rather than in August. Going forward, we believe that any signs of continuation of moderation of housing prices, a US-Korea trade deal, and USDKRW moves will be watched closely by the BoK, making the timing of rate cuts highly data dependent.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.