Resume af teksten:

Den japanske regering har haft succes med at dæmpe inflationen, selvom pristrykket i Tokyo stadig er højt. Bank of Japan forventes ikke at ændre renten ved det kommende møde. Tokyo’s inflation aftog mere end forventet i juli, hovedsageligt på grund af vandafgiftsfritagelser og faldende råvarepriser, med en årlig stigning på 2,9% sammenlignet med 3,1% i juni. Kerneinflationen uden friske fødevarer og energi forblev på 3,1%. Det forventes, at inflationen forbliver volatil på grund af tidligere regeringssubsidier, men stadig forhøjet. Bank of Japan ser ud til at holde renten stabil, mens de overvåger økonomiske indikatorer som handelsaftalen med USA. Forventningen er, at kerneinflationens prognose justeres opad for de kommende år. En rentestigning kan blive aktuel i oktober, afhængigt af prisudviklingen inden for service og fremstillet fødevarer samt en moderat genopretning i eksport og produktion.

Fra ING:

Japanese government efforts to moderate inflation are working, though underlying Tokyo price pressures remain elevated. Even so, the Bank of Japan is expected to stand pat next week. Its quarterly outlook report will be closely watched

The Bank of Japan in Tokyo

Tokyo CPI (%YoY)

Core excluding fresh food and energy rose 3.1%

Tokyo headline CPI cooled more than expected

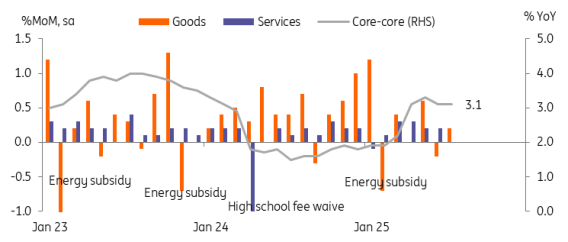

Tokyo inflation rose 2.9% year on year in July (vs 3.1% June, 3.0% market consensus). The moderation was mainly related to the Tokyo government’s water charge waiver for the summer and falling commodity prices. Core inflation, excluding fresh food and energy, stayed at 3.1% for a second month. The overall inflation trend peaked in May, and then moderated for the past couple of months largely thanks to government subsidies. Utilities fell 4.5% in July from a recent peak of 7.6% in April. Rice prices also came down to 81.8% from 90.6% in June as the government released public stockpiles.

We expect inflation to be a bit volatile over the next few months due to base effects related to the government’s energy subsidy programme last year. But, earlier gains in food prices will pass through to manufactured food prices and the costs of eating out. Thus , inflation should stay elevated throughout the year.

Core-core inflation (excluding fresh food and energy) stayed at 3.1% YoY in July

Source: Source: CEIC

BoJ watch

We believe that the BoJ will hold rates steady at next week’s 30-31 July meeting. This put the focus on the BoJ’s quarterly outlook report and its post-meeting communications on the recent US-Japan trade deal. We expect the BoJ to revise upward its core inflation, excluding energy, forecast from the current 2.3% to 2.5% for fiscal year 2025 and from 1.8% to 1.9% for FY26. Also, the recent trade deal between Japan and the US should still be negative for the economy. Yet, the BoJ might assess it positively as it removes uncertainty. It’s a close call, but we continue to believe October is a likely time for the rate hike. This assumes that services and manufactured food prices will rise and manufacturing and exports will recover modestly over the coming months.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.