Uddrag fra Bloomberg og Zerohedge

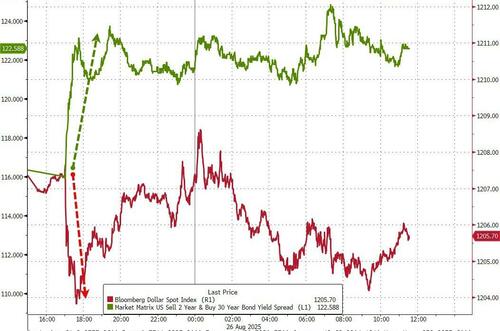

Overnight, news of Lisa Cook’s firing will raise new questions about Fed credibility and independence. She has pledged to stay on, so this likely moves to the courts. But the die has been cast… dollar lower, curve steeper.

Source: Bloomberg

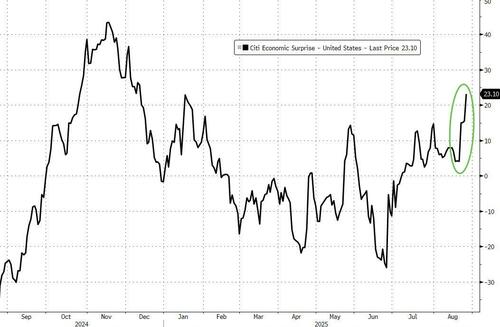

Solid macro today… The rally we have seen in stocks since Apr-9 is now coming alongside a rally in both Business and Consumer sentiment. Today’s Richmond Fed Manufacturing Index improved to -7 from -20 a month ago. And the Consumer Board’s Consumer Confidence Index also beat expectations coming in at 97.4 (albeit below last month’s revised higher index level of 98.7

Source: Bloomberg

In addition to the forward sentiment readings, we also got a backward (July) durable goods release, with core cap good orders up 1.1% (m-o-m), much better than the 0.6% decline we saw in orders in June. On the back of today’s releases, Goldman’s economists raised their 3Q GDP growth tracking estimate to +1.8%…

Source: Bloomberg

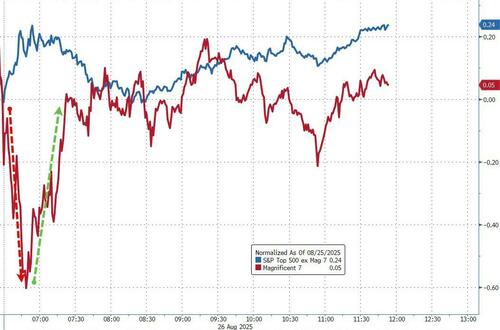

While most of the majors were tightly range-bound today, Small Caps outperformed amid another short-squeeze. Late in the day saw a bid put some lipstick on the otherwise quiet pig of a day as it seems the stock market couldn’t give a shit about Fed independence (as the market is already pricing in rate cuts)…

Mag7 stocks underperformed modestly today with the S&P 493 managing modest gains…

Source: Bloomberg

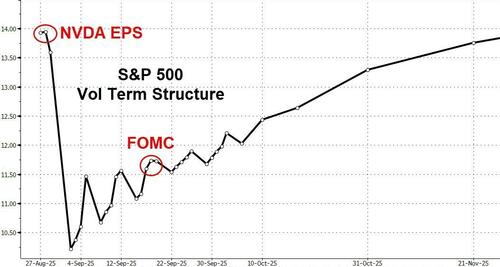

But realistically, the lull before the storm of tomorrow’s NVDA earnings after the close remains the week’s biggest focus (for now)…

Source: Bloomberg

A strong 2Y bond auction helped extend post-Cook-firing Treasury gains on the day but on the day the curve steepened notably with 30Y +2bps, 2Y -4bps…

Source: Bloomberg

That pushed the yield curve (2s30s) to its steepest since Jan 2022…

Source: Bloomberg

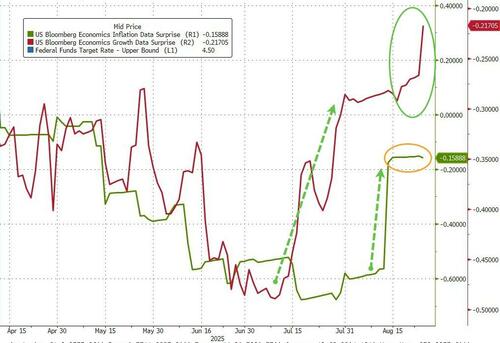

Rate-cut odds rose modestly today after Cook’s “firing”…

Source: Bloomberg

The dollar drifted lower amid worries over Fed independence as alleged mortgage cheat Fed Governor Cook refuses to quit (despite receipts)…

Source: Bloomberg

Gold was bid after the Cook firing (holding above its 50DMA)…

Source: Bloomberg

Oil prices tumbled after four days of gains as broad derisking (Cook chaos) weighed on overall sentiment and rising supply is also checking prices, with the Sept 1st end to the summer driving season likely to ease demand even as OPEC+ readies the final final 548,000 barrel per day tranche of its return of 2.2-million bpd of production cuts at the start of next month. Additionally, Russia’s major Volgograd refinery aims to resume operations at its drone-hit crude-processing units nearly a week earlier than initially planned amid a fuel crunch…

Source: Bloomberg

Bitcoin was slammed back to two month lows but found support at $109k and bounced back up towards testing its 100DMA at around $111k…

Source: Bloomberg

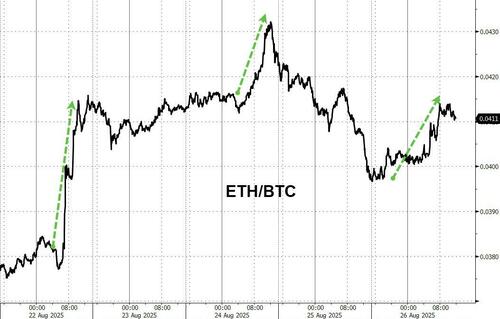

ETH outperformed BTC on the day as the whale rotation continues…

Source: Bloomberg

Still BTC seems cheap to global liquidity…

Source: Bloomberg

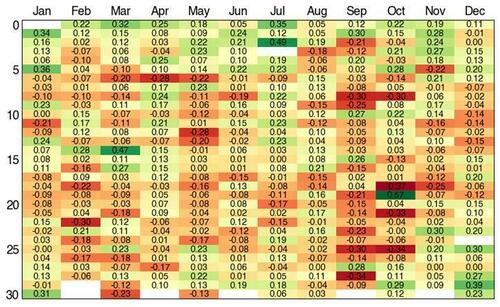

Finally, with NVDA out of the way after tomorrow’s close, don’t forget September seasonality is not your friend…

The AI trade has paused in the near term.

- First, the MIT paper arguing most AI projects aren’t yielding positive returns got unusual traction.

- Second, Meta’s hiring slowdown (a non-event, but it hit sentiment).

- Third, ChatGPT-5 was more sizzle than steak—overhyped.

- Fourth, Altman’s bubble comments didn’t help.

- Fifth, Apple’s paper reiterating that LLMs don’t actually “think” added to the mood.

NVDA is tomorrow.