Uddrag fra JP Morgan og Zerohedge

Ahead of Nvidia’s earnings after the close on Wednesday – arguably the most important report of Q2 season and perhaps even more so than Powell’s “shocking” Jackson Hole pivot- Goldman writes that positioning is a hefty 9/10 with expectations for a clean beat/raise. For context, NVDA has been beating Revs by ~$1bn the last few quarters (consensus is $46bn and guidance is $45bn) and investors are also looking for a very solid Oct quarter guide (consensus is $53bn) as the Blackwell product cycle takes off; upside here could be impacted by some moving parts on China/H20s (how much is included in guide, if any) and then what the “mid-70s” gross margin framework really translates to (73% or more like 75%). Goldman’s Bottom-line is that with Nvidia now accounting for 8% of the S&P 500, its Q2 earnings release is viewed as one of the most important events, which is likely to set the tone for the AI trade and broader Tech sector.

In its preview, JPMorgan’s trading desk writes that it too sees bullish positioning near extreme levels, and views near-term AI fundamentals as strong, driven by strong hyperscale capex spending. This trend is evident in the upward revision in capex during the Q2 2025 earnings season by the cloud/hyperscale companies, and the strong results/guidance telegraphed by other AI beneficiaries (e.g., MTSI, ALAB, AMD). In the cyclical segments, such as telecom/service provider and enterprise, conditions have continued to gradually improve.

Focusing on NVDA, the largest US bank expects a July quarter revenue beat (print of $46-$47B) and Oct quarter guidance of $53-$54B+ modestly better than Street, led by GB200 ramp and start of GB300 program.

As noted above, Nvidia is set to report July quarter earnings on Wednesday, with revenue likely landing in the range of $46-47B (ahead of $45B guidance), driven almost exclusively by a strong ramp in GB200 rack shipments. In fact, stripping out ~$4.5B of H20 revenue from Apr-Quarter revs ($44B – $4.5B = $39.5B) implies an incremental $6.5-7.5B of revenue in the Jul-Quarter on a like-for-like basis (compared to headline +$2-3BN revenue growth), driven almost entirely by the GB200 ramp.

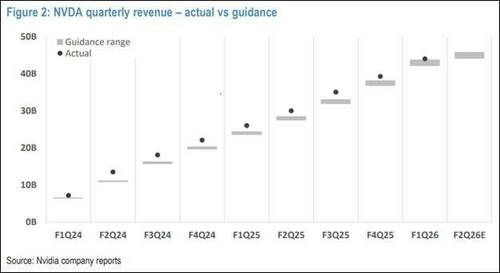

For the October quarter, JPM sees NVDA guiding revenue to $53-54B+, modestly better than Street, consistent with how the company has generally guided in recent quarters…

… but ahead of JPM’s own $51BN est, with GB200 shipment volumes continuing to escalate (in the range of 8-9k racks). JPM’s traders see total Blackwell rack volumes approaching 12k in FQ4, taking full-year shipments to ~28-30k.

In line with what has been seen from AMD, JPM does not expect NVDA to include H20 (or B20/30) revenue in its Oct-Quarter guidance, due to a combination of:

- protracted and uncertain timelines for US govt license approvals

- NVDA having to scrub its China customer order book

- Chinese govt discouraging local entities (cloud providers, hyperscalers, government institutions, etc.) from deploying NVDA GPUs due to “back door” concerns.

That said, thinking through potential upside from H20 revenue, JPM estimates NVDA’s existing $1.9B of inventory will translate into $5-6B of revenue, with every additional 100k units driving at least $1B of incremental revenue, which could amount to ~$3-4B/quarter (in aggregate) over 2-3 quarters. Finally, the bank expects gross margin to be guided incrementally higher for Oct-Quarter (JPM est. 73%) on improved supply chain cost optimization – on track for mid-70s% by year-end.

Echoing Goldman’s take, JPMorgan tech specialist Josh Meyers writes that positioning in NVDA remains relatively high “both from what we see on our book/trading and from investor conversations.”

Investors – including re-positioned long only investors – sound optimistic:

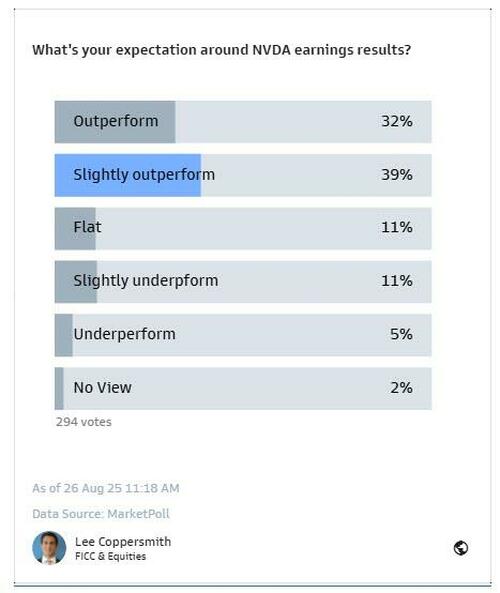

- JPM survey results mirror the high expectations heard from investors: for another quarter of ~60%YoY revenue growth, and a guide for another ~55%YoY growth.

- Survey respondents are ~3.5% ahead of consensus for both July revenues and for the October guide (Predictably, investors are again ~$2b ahead of the current guide).

- Survey respondents also expect over $6.5 for C26 EPS (though $7 is frequently heard in client conversations, a number which the JPM research analyst believes is easily achievable).

Between GB200 finally shipping smoothly and the GB300 ramp in C2H, there are reasons for optimism, though there remains uncertainty around:

- 1) order lumpiness (indicated by suggestions from Quanta and others that buyers may be pulling in GB300 systems),

- 2) the guide on H20 shipments (China corporate demand versus politics) and

- 3) networking (component shortages).

Bulls point to server strength at Hon Hai to justify optimism on the first point (JPM sees at least 6k servers in C3Q), the second two points at least seem well-socialized, so surprises should be easy to justify. Importantly, the JPM survey showed little dispersion in margin expectations. Curiously, JPM’s Asia Tech Spec Duncan Wagner cautioned that Asia investors seem less bullish than these survey results. The other thing that hasn’t gone unnoticed among folks is NVDA’s recent pattern of strong equity performance in the first half (i.e. 1H23, 1H24, 1H25) followed by sideways trading in the back half (2H23 and 2H24).

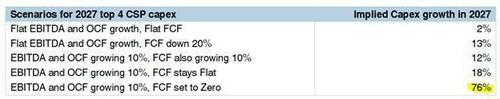

In summarizing comments from JPM’s Ashwin Panjabi, he writes that “Nvidia could be the accelerant to animal spirits this week”, and “the set-up is just perfect” – Altman’s comments and the M.I.T. report last week led to the six-monthly concern on AI capex sustainability. In response JPM put together an excellent table to highlight the gargantuan ability for the US CSPs to spend through 2027.

If EBITDA and OCF grow 10% and all of that money is spent on capex in 2027, 2027 capex can grow 76% (this is not the JPM base case but you get the idea).

What about the willingness to spend? Equally gargantuan. The Big 4 are already monetizing on AI looking at current-year FCF. None of this really includes the expected success around reasoning models (where token usage is 10-30x that of chatbots).

Video-related GenAI followed by Agentic AI are the next drivers of hope and growth. The willingness to spend has broadened out to startups, sovereigns and enterprises, which lends confidence right out to 2028. This demand is latent as the industry is woefully supply-constrained, which has led to price hikes popping up everywhere from advanced packaging and ABF substrates to Power ICs and MLCCs, and right down to commodity DRAM. Winners are going to keep winning: Hon Hai, ASE, TSMC, Delta, Elite Materials, SK Hynix, GDS and Unimicron.

While most views on Nvidia’s earnings are almost uniformly bullish, one can still find the occasional growling permabear:

* * *

On a separate note, JPM surveyed 300 institutional clients on their sentiment regarding the upcoming earnings – overall sentiment is very bullish, with over 70% expecting NVDA to outperform yet retail speculation has faded compared to the past.

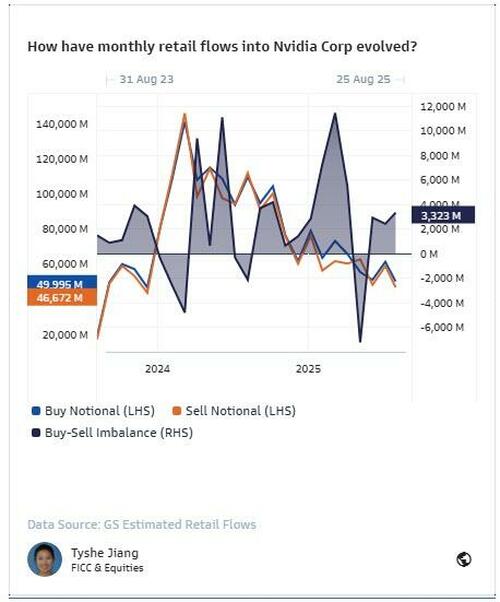

Retail traders have stepped back. In 2024, monthly notional flows from retail peaked near $140 billion, but by March 2025 Buy-sell imbalance have dropped sharply.

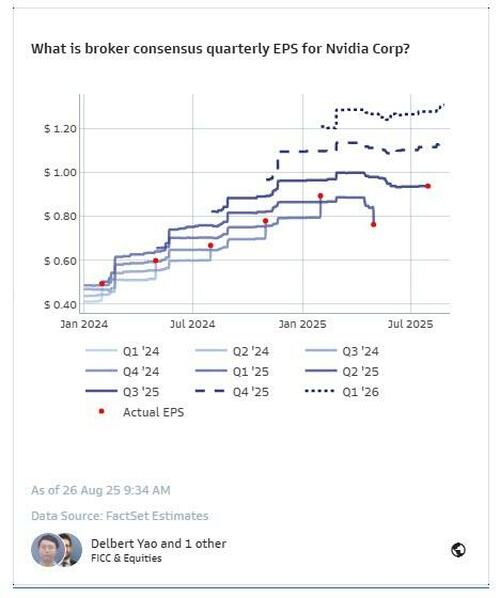

In terms of street conviction, EPS forecasts continue to climb, with average broker consensus over $1.00 per share for Q4 2025 and over $1.20 per share for Q1 2026, but consensus revisions have flattened since the middle of this year. In 2024, all prints were higher than consensus, but the last two quarters reversed the trend.

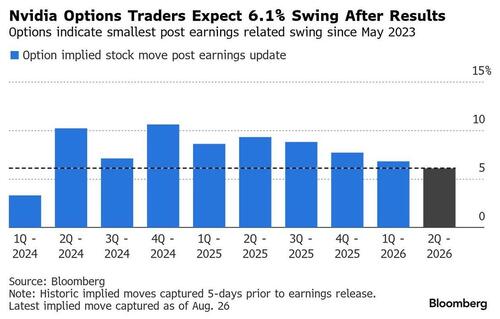

Finally, in terms of market reaction, options straddles imply a 6.1% swing in the stock, which would represent a move of roughly $270 billion in either direction in market value, which while larger than about 95% of the S&P 500 companies is the lowest anticipated post-earnings swing for Nvidia since the company’s earnings for the first quarter of 2024 published in May 2023. It’s worth noting that over the last eight quarters, realized earnings day moves in Nvidia have been lower than what option markets were implying, with a realized absolute post earnings day swing averaging 5.9% versus an average implied move of 8.6%.

Key Takeaway: If Nvidia beats and raises, revisions might restart, and high valuation could sustain. However, if the results are just in line or even lower, as what happened in the last two quarters, the market may assume margins have peaked, and the story will become less about hypergrowth and more about stabilization.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her