Goldman TMT specialist Peter Callahan, here are his top 10 takes and thoughts from the week at the bank’s GS Communacopia & Technology Conference.

1. Sentiment & Flows: It felt like many investors came into last week’s GS Communacopia and Tech Conference with a thesis / hunch that the GenAI ecosystem could be due for a breather (candidly, as did I) – either a fundamentally driven one (think: rate of change, China competition, ASICs vs Merchant, ROIC concerns, etc) or a sentiment driven breather (think NVDA down 4 weeks in a row into the conference) … yet, exiting a week where our GS AI basket was up ~5%+ (best week since May), it felt like price action and storylines made it too hard to fight that AI momentum (again). Datapoints for AI were nearly universally positive this past week at our Tech Conference (both on spending and on usage / monetization), only to be further underscored by ORCL’s historic earnings print & reaction (the big ‘deal’ from the print, imo, was the 4 years of revenues “visibility” that we got as TMT companies have been increasingly comfortable speaking to out-year(s) AI revenues (& expenditures)). This positive re-inflection in sentiment lines up with desk flows, where desk flows skewed better to Buy in Tech this week (led by Semis & Semi Equip and to a lesser extent Software), per GS PB data. Next up = this week makes for a busy week of Software analyst days (CRWD, WDAY, INTU, ZM, MDB, TTAN analyst days all next week), alongside the all-important FOMC meeting (and Pres. rump in the UK, where Tech is expected to be a focus, per reports)

2. Who caught my eye at the Conference last week (‘sounded good’ / best?): AVGO, TWLO, UBER, SNDK, CRWD, MDB, NET, APP, GOOGL, FOXA, SNOW, TKO, NFLX.

3. Where was there the most debate / biggest storylines at our conference: PINS (was that a ‘downtick’ on macro or not?); SAP (how to think about 2H/exit-rate?); ABNB (what does it take for growth to inflect?); SNPS (does the ‘cut’ make more sense or not?); AMZN (source-of-funds or something more?); RBRK (earnings reaction / feedback?) .. IBM (anything new?) .. Memory Mania (Kioxia +70% in Sept, SNDK +65%, MU +32%); TER (was there a genuine downtick = stock down 7% last week?)

4. Extra reading:

- Goldman on AI x GDP: interesting weekend note from GS Econ: A Primer on the Impact of AI on the GDP Statistics [how AI spending is—and is not—recorded in the US GDP statistics and estimate both its true and measured contributions to GDP growth] – 1-liner: GIR ests that AI has only boosted measured real GDP by $45bn (0.2%) since 2022, or around 0.1pp at an annualized rate. more here

5. Software: doesn’t feel like the week did all that much to thaw the investor cautions around Software (partially an output of AI going bid again and partially an output of ADBE’s px action – flat on a beat/raise) .. one nuance I continue to sense however is a “preference” for carving out: vertical software (think; SNPS/CDNS, PCOR, GWRE types), Security software (PANW, CRWD, OKTA types) and Data/Infra (NET, MDB, SNOW types) .. whereas broader “SaaS” still has something to prove in the coming weeks. Absent a downtick in AI sentiment, my best sense on “when” things could get better for SaaS / Apps could be into 2026 – should we see some revenue accelerations (on the point of AI driven revenues or not — this line from ADBE’s CEO resonated with me: “The North Star clearly for us is we want AI infused in every dollar of revenue that we’re providing, and I think we’re doing a great job against that.” .. “the value of AI is going to be delivered through software.”)

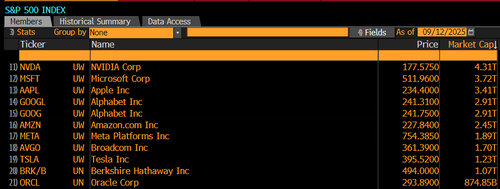

6. AI = Big Tech: after ORCL’s prolific run this past week (approached the $1TN mkt cap level), what continues to strike me is the overlap between “GenAI” (9 of the 10 largest S&P members are arguably “AI plays”) and “big tech” (top 10 names in S&P500 now >40% of market cap – for reference, the dotcom high for top 10 weighting was in the `25-30% range); just something to continue to think about re: the importance of AI to public markets.

7. Consumer updates (+) this past week: per UBER (no signs of consumer weakness – not seeing consumers trade-down (types of rides, restaurants they are ordering from, etc.) .. MA (August trends inlin with July QTD trends) .. Visa (August and July were pretty consistent and relatively even across the world) .. TKO (seeing significant advance demand for its premium hospitality offerings (e.g. Olympics, World Cup) and no signs of slowdown in sponsorship demand) … worth mentioning similarly (+) commentary at our Retail Conference last week (and our Consumer Specialist, S Feiler, has noted an uptick in inflows/buy tickets across Consumer Discretionary as of late)

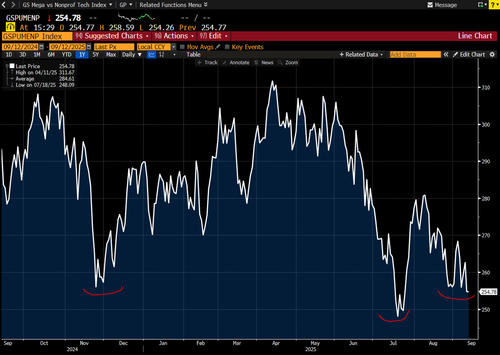

8. One to watch: this is our Megacap Tech (mag 7) charted against our Non-Profitable Tech basket … the former has sharply underperformed the latter on the back of rates-driven excitement and some “intra-Mag 7 rotations”… might be worth looking at this pair again..

9. Applying AI – soundbites where AI is starting to show up in products (not just in internal cost savings):

- Adyen talked about “Agentic commerce” as increasingly becoming top of mind for customers (with factors like authentication, fraud management, and payment method diversity all important areas here re: Payments considerations);

- IOT talked about being able to unlock the latent value in customers’ vast operational datasets by applying AI to surface actionable insights that were previously overlooked (e.g. pinpointing the most fuel-efficient drivers – and driving tangible business outcomes)

- UBER on AVs (a form of “Physical AI”), Uber noted the consumer’s willingness to pay a premium for the product (experience and safety)

- SNOW has seen 50% of new logo wins attributed to AI and mgmt further expects AI to be a powerful pull to drive more data into Snowflake, further expanding the company’s TAM in addition to the broader ongoing cloud migration

- BKNG is applying GenAI in areas such as customer service (where they are seeing tangible benefits).

10. Around the horn: Goldman Research hosting webinar: Takeaways from the 2025 Communacopia + Technology Conference @ 10am ET/Friday.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her