Uddrag fra Morgan Stanley, Goldman og andre analytikere via Zerohedge

The Federal Reserve is widely expected to cut by 25bps at Wednesday, Setp 17 meeting to 4.00-4.25%, with a very small probability priced for a larger 50bps rate cut, while only two analysts, out of 107, surveyed by Reuters expect a 50bps move.

Within the statement, focus will be on its guidance to see whether this is a “one-time” event in the eyes of the Fed Chair, or if it is adjusted to signal more easing ahead, or whether the FOMC maintains a data-dependent stance. As Newsquawk notes, the vote split will also be watched to see if there are any dissenters, and also to see how aggressively the brand new Fed governor Stephen Miran pushes for lower rates, while also seeing if any of the hawks prefer to maintain rates (and whether Lisa Cook will vindictively seek to hike rates before the Supreme Court ends her tenure at the Fed). The dot plot will be viewed to see the median rate cut path view on the Fed, particularly through year-end and through 2026, to shape rate cut expectations amid a slowing labor market while inflation remains above target in the face of Trump’s tariffs.

EXPECTATIONS: The FOMC is widely expected to cut its target for the Federal Funds Rate by 25bps, taking it to 4.00-4.25%. 105 out of 107 surveyed expect this to be the case, but the remaining two expect a 50bps rate cut. There will also be attention on the vote split, to see if the doves (Waller, Bowman, Miran) vote for a larger than 25bps rate cut. There is also the possibility of some opting to keep rates unchanged before the blackout period. Musalem, Schmid and Goolsbee were reluctant to outright call for a reduction of rates in September as they were waiting for the data. Within the statement, JPMorgan expects the Fed to leave out a clear commitment to lower rates further, and instead maintain its data-dependent approach. Its descriptions of the economy may change, particularly on the labor market, given the July and August NFP reports, and also the large downward revisions to the preliminary benchmark payroll revisions. Note, JPM see a 25bps cut but with 2-3 potential dovish dissenters who would be looking for at least 50bps of cuts. There is also the possibility of a 3-way dissent if some of the staunch nevertrumpers on the FOMC vote for unchanged, or even for a hike (that would be an unprecedented 4-way dissent). Looking ahead, the desk expects three consecutive cuts from Oct 2025 – Jan 2026, while Goldman is flipped and expects 3 rate cuts in 2025 and 2 in 2026.

FED SPEAK COMMENTARY: Fed Chair Powell opened the door to a September rate cut at his Jackson Hole speech, following the weak July jobs report that was met with huge downward two-month net revisions of -258k. Since then, the August jobs report was also soft and cemented expectations for a cut in September. Meanwhile, the preliminary BLS benchmark revisions were revised down drastically, painting an even weaker picture of the labor market. WSJʼs Timiraos highlighted that weak hiring makes it easier for policymakers to agree on a 25bps rate cut at their upcoming meeting, but further muddies the debate over the pace of cuts thereafter. Waller, who has been advocating for rate cuts due to the weakness in the labor market, has suggested that the pace of future rate cuts will be dictated by incoming data. However, Goolsbee (2025 voter) said he had not yet made up his mind, noting he wants to ensure that the services inflation pickup is just a blip. The doves had been arguing before July that the tariff impact would lead to a one-time price increase, and by September, it appears more are taking this approach to the estimated tariff impact, albeit some are still showing concerns. Musalem and Schmid have been on the hawkish side of voters, albeit Musalem said before the blackout he had marked down his inflation risk, and marked up his labor market risk, with the Fed largely looking to dictate monetary policy based on the distances away from its mandate.

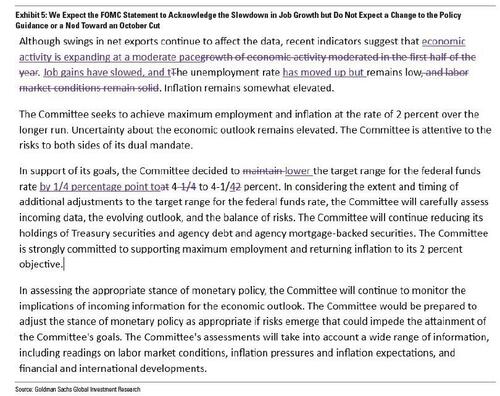

KEY QUESTION: The key question for the September FOMC meeting is whether the Committee will signal that this is likely to be the first in a series of consecutive cuts or leave the future path a more open question. In its preview (available to pro subscribers), Goldman expects the statement to acknowledge the softening in the labor market, perhaps by using language similar to that used in September 2024, but do not expect a change to the policy guidance, which was designed to be durable, or a nod to an October cut. However, Powell might hint softly in that direction in his press conference. Even just indicating that the reason that the FOMC cut was to support the labor market might be taken by investors as signaling that another cut is likely in October because “insurance cuts” have come as a consecutive series in the past and it would be unnatural to space out cuts that are meant to address an immediate problem. The FOMC will likely end balance sheet reduction at its October meeting and as a result do not expect any changes to the sentence about it in the September statement. Powell might acknowledge that the Committee discussed it, and the minutes might eventually provide more information. In terms of the votte, at least one participant is likely to dissent in favor of a 50bp cut, and as many as three (Miran, Waller, Bowman).

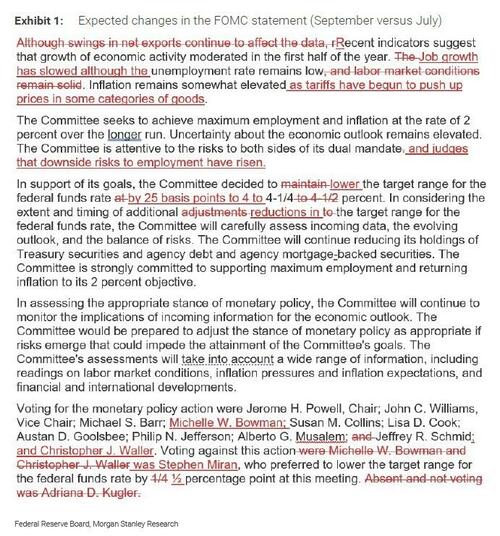

FOMC STATEMENT: The FOMC statement will probably repeat that growth “moderated in the first half of the year.” The Fed’s labor market assessment probably softens. In July, the Fed amusingly characterized labor market conditions as solid and the unemployment rate as low: and then the bottom fell out when first jobs were revised to negative in June, and then the BLS released its annual benchmark eliminating some 911K payrolls from the last year of Biden’s admin. Oops. In the September statement, Morgan Stanley expects that the FOMC instead writes that “job growth has slowed” while still acknowledging low unemployment. On inflation, the FOMC probably again says that inflation “remains somewhat elevated” and elaborates in some way on the temporary upward pressures from tariffs. On the economic outlook, the statement will repeat that the Committee sees risks to both sides of its mandate and that uncertainty remains elevated. But after the last two weak employment reports, expect new language that “downside risks to employment have risen”. The new labor market concern justifies the rate cut, so expect policy guidance to suggest a new easing bias as the FOMC considers “the extent and timing of additional reductions” to the policy rate. The prior statement had not shown a policy bias, instead referring to “adjustments” to the funds rate. Separately. while Governor Cook will be at the FOMC meeting thanks to the Appeals Court, Stephen Miran will also be there, and Morgan Stanley expects him to dissent in favor of a faster start to easing with a 50bp cut to the funds rate.

Here is a proposed statement redline from Morgan Stanley…

… and here is Goldman’s redline proposal:

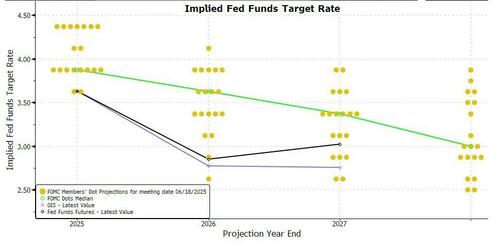

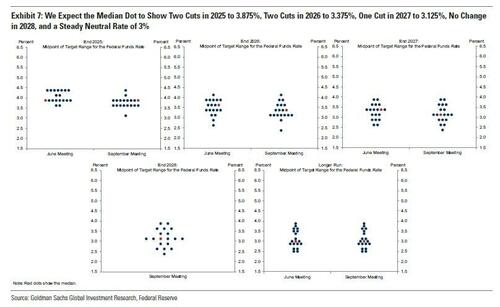

DOT PLOTS: The updated Summary of Economic Projections will be used to help shape Fed rate cut expectations through year-end and into 2026, as well as how far away rates are from neutral. It will also be used to see how the Fed thinks its distance to its goals has evolved since June. Inflation has been ticking up, but many on the Fed expect this to be transitory with upside primarily as a response to tariffs. The health of the labour market has deteriorated drastically since June, and even since the last FOMC meeting in July. The unemployment rate has ticked up slightly, but the main focus has been on the pace of payrolls. When accounting for revisions to NFP, the last four months of data have been very weak, with jobs added each month ranging from -13k to +79k. Ahead of the August NFP, Fed expectations of the breakeven employment rate ranged from 30-80k, and three of the last reports have been below the breakeven rate amid a drop in both labour supply and labour demand. Below are the SEP expectations compiled by the Bloomberg survey of 36 economists, with priors from the June SEP report.

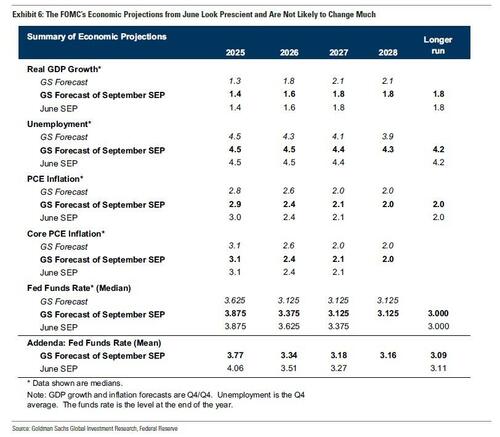

SUMMARY OF ECONOMIC PROJECTIONS AND FUTURE RATE GUIDANCE: The FOMC’s economic projections from June now look prescient and are not likely to change much. For 2025, Goldman expects the median to continue to show 1.4% GDP growth, a 4.5% unemployment rate, and 3.1% core PCE inflation. While the Atlanta Fed’s GDPNow estimate for Q3 GDP growth is currently 3.1%, which would suggest upside to the 2025 Q4/Q4 forecast if taken on board, the GDPNow model is likely having trouble dealing with distortions created by frontloading ahead of tariffs and that the forecast provided to participants by the Fed staff will be lower. The projections for 2026-2028 are also likely to remain largely unchanged

The most obvious way that the FOMC could indicate that another cut is likely in October is by showing a median dot with three cuts in 2025. But Goldman thinks the median dot is most likely to instead show just two cuts in total in 2025 to 3.875%, though by a narrow 10-9 margin. While the Fed leadership now most likely anticipates and will project three consecutive cuts this year, it will probably not see it as necessary to try to nudge the median participant to show three cuts. Goldman – which expects three rate cuts in 2025 – expects the median dot to show two more cuts in 2026 to 3.375%, one cut in 2027 to 3.125%, no change in 2028, and an unchanged longer-run or neutral rate of 3%.

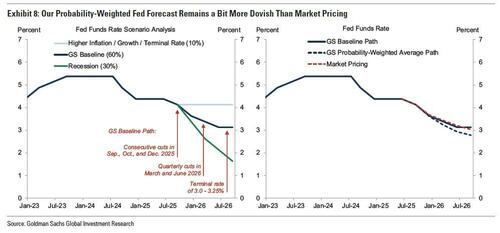

As noted above, Goldman forecasts three consecutive 25bp cuts at the September, October, and December meetings followed by two more cuts in 2026 to a terminal rate of 3-3.25%. A 50bp cut is also possible in October or December if the labor market deteriorates more quickly than we the bank assumed in its forecast. The chart below shows that on a probability-weighted basis, our Fed forecast remains a bit more dovish than market pricing.

PRESS CONFERENCE: Chair Powell’s tone shifted between the July FOMC and Jackson Hole. The July employment report raised concern: “while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly…”. The employment report since then will not have lessened his concerns. Expect similar language about employment risks in the press conference. He is also likely to recognize tension in the Fed’s inflation goal: that inflation remains above target and that tariffs threaten a one-time shift upward in the price level. More persistent price pressures could follow, but at Jackson Hole he downplayed the possibility: “Given that the labor market is not particularly tight and faces increasing downside risks, that outcome does not seem likely.” At Jackson Hole, he explained that “with policy in restrictive territory, the baseline outlook and the shifting balance of risks” could justify a rate cut. With the conflict between inflation risks on the upside and employment risks on the downside, Morgan Stanley expect Chair Powell repeats that policy is not on a preset course and is data dependent. But we also expect he will point to a new course, of gradual, cautious, data-dependent policy easing.

FED INDEPENDENCE: US President Trump has been calling for lower rates from the Fed, and he has called for Fed Chair Powell to lower rates, “bigger than he had in mind”. The administration has been trying to shake up the Federal Reserve. Once Kugler resigned, also reportedly due to alleged mortgage fraud, Trump announced CEA Chair Miran as a replacement, who has since been confirmed, allowing him to partake in the vote this week. Miran shares the same views as Trump on interest rates, but it will be interesting to see the ultimate rate cut size he votes for. Miran is only set to be at the Fed until the end of January, when Trump will put in a permanent replacement. Perhaps NEC Director Hassett, or former Fed Governor Warsh, both seen as favorites for Fed Chair, alongside Fed Governor Waller. If Powell steps down once his term as Chair ends in May, Trump will be able to appoint another ally to the Fed board. He has also been attempting to fire Fed Governor Cook over alleged mortgage fraud, but the appeals court has blocked Trump from firing her for now, also allowing her to vote at this meeting. Powell will likely get quizzed on Fed independence and his future at the Fed, but he tends to push away these questions, noting he focuses on the Fed’s mandate. Nonetheless, it is clear that Trump is trying to get a Republican majority on the board of governors.

MARKET COMMENTARY:

According to JPMorgan’s Market Intel desk (full note available here to pro subscribers), a Dovish Cut as the most likely outcome, producing a positive gain on the day. However, as we look toward month-end, the Fed Day may act as a “sell-the-news” event as investors take time to consider the macro environment, the Fed future reaction function, potentially stretched positioning, a temporarily weaker corporate buyback bid, waning Retail investor participation, and quarter-end rebalancing.

If this comes to fruition, look for a 3-5% pullback with some key catalysts to support the bull case:

- (i) PCE on Sep 26 which is already de-risked with today’s CPI print;

- (ii) NFP on Oct 3 where a higher MoM print will continue to support an increasingly optimistic macro outlook;

- (iii) CPI on Oct 15 which will guide expectations for the Oct 29 Fed similar to the set-up into Sept Fed.

Based upon information already available, JPM likes the bull case and would use any pullback to add to risk.

- WHAT WOULD JPM BUY AFTER A PULLBACK? While the bank likes the market broadening theme it also likes being OW TMT / MegaCap Tech / AI-Theme. Defensives are unlikely to outperformbut things like (i) Utilities will benefit from a decline in the 10Y yield esp. if it falls to / thru 3.50% and (ii) Healthcare on the combination of strong EPS generation and low positioning plus Biotech should benefit from the anticipated wave of M&A. In international space, the bank likes EM over DM if USD continues to weaken but if US macro data continues to inflect higher there could be squeeze that strengthens the USD, likely benefitting the US, generally, and TMT, specifically.

- WHAT IF A PULLBACK DOES NOT MATERIALIZE? Given a dovish cut, it is possible that this phase of the Bull Rally continues without a pullback despite the aforementioned reasons. If so, it is likely a continuation of the short-covering led rally that we saw on CPI Day, potentially at the expense of TMT; where TMT is positive but underperforms both SPX and RTY.

- MONETIZATION MENU (Sep 8) – The bank’s views are unchanged, but Equity investors may consider adding / increasing gold exposure as the rate cut expectations drive the USD lower.

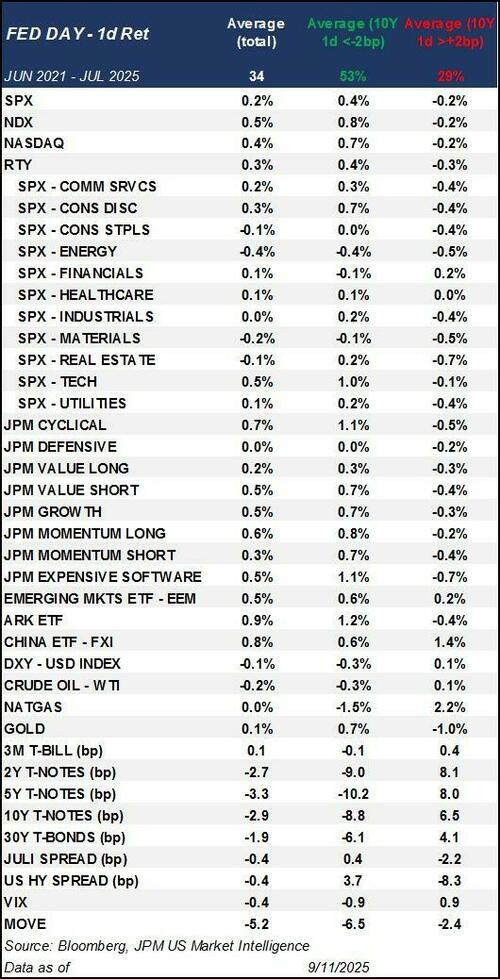

ADDITIONAL OBSERVATIONS: When analyzing Fed meeting from June 2021 to present (see chart below), JPM finds the average 1-day return for the SPX is +0.2% with up-days averaging 0.4% and down-days falling 0.2%. Some other observations: (i) Tech and Momentum Longs tend to outperform in all scenarios; (ii) Energy, Materials, and Value Longs underperform in all scenarios; (iii) EM Equities do well, also outperforming in all scenario led by China (FXI); (iv) while MOVE declines after the print, VIX may not.

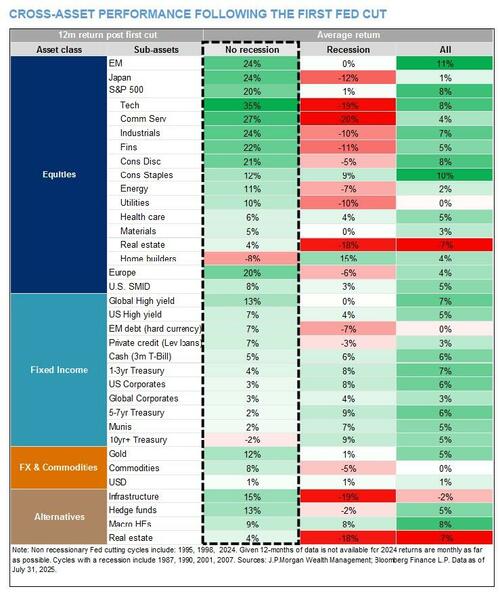

Separately, JPM Wealth Management has provided a chart on 12-month returns following the first Fed cut (see chart below).

This being JPMorgan, there is of course a market reaction matrix:

- [1.0%] FED HIKES – SPX falls 2% – 4%. The first tail risk with the probability closer to zero than 1%. Given that Core CPI MoM has increased 3 consecutive months, this will given the Fed pause but the CPI print was not hot enough to make this a credible threat. For reference, the 3-month average for Core CPI MoM is .30% or 3.64% annualized which is hot but not enough to hike given tariff policy that may inflect dovishly.

- [4.0%] FED REMAINS PAUSED – SPX falls 1% – 2%. Another tail-risk and we think that this outcome would have required both a stronger NFP print as well as a hotter CPI print. We effectively received neither and given Powell’s comments at Jackson Hole, this scenario likely does more harm than good.

- [40%] HAWKISH 25BP CUT – SPX is flat to down 50bp. The primary argument now is whether the statement / press conference skewed hawkishly or dovishly. We are in the camp that with inflation increasing at a decreasing rate, plus YoY levels that in a 2% – 3% range are fine for the Fed to cut rates and resume its data-driven approach. Fedspeak points to the labor market being the bigger concern than inflation and with data pointing to hiring inflecting higher (Small Biz survey, Indeed listing, etc.) this could lead to a more hawkish Powell than expected, nullifying some of the stock market appreciation into Fed Day.

- [47.5%] DOVISH 25BP CUT – SPX gains 50bp – 1%. Continuing with the above argument, it is possible that with a transitory view on inflation that the Fed sees the labor market as being far away from having an inflationary impact on the economy and thus has some room to cut, preferring a gradual series of 25bp cuts, as long as inflation remains contained and NFP remains weak.

- [7.5%] 50BP CUT – SPX loses 1.5% to SPX gains 1.5%. The final tail risk and we are aware that this range of outcomes is pretty wide. The negative outcome would be tied to a market expressing a view that the Fed is more concerned about the labor market than it is letting on and that new uncertainty triggers a selling event. The positive outcome is tied to a view that the Fed sees itself as needing to catch up to the economic realities of a labor market on the precipice of rolling over and printing negative NFP.

What are options pricing: These are indicative only, call the desk for live pricing.

- Equities: S&P options are pricing in 88bp move for options that expire on September 17, based upon data as of Sep 12.

- FX: EUR / USD is a 10 vol equating to a 42bp breakeven. USD / JPY is a 15 vol equating to a 63bp breakeven; pricing is as of Sep 11.

- RATES: The 10Y breakeven is 4.625bp; pricing is as of Sep 12. Tomorrow, the team will update the full list of major Treasuries.

Finally, we turn to Goldman’s trading desk which can be summarized as follows:

TLDR: 25bps cut tomorrow; 2 dot SEP base case for 2025; Powell dovish at Presser trying to keep Oct live; concern on can Powell meet market’s expectation; risk lighter overall ; small flatteners; long Z5; steepeners in red/greens Z6/Z7

Turning to individual FICC traders, we start with:

MITCH CORNELL (USD VOL TRADING)

2025 Dot is Less Important than October Guidance: Ahead of this week’s Fed, activity has come in waves as the market has continued to process marginally weaker labor data and inflation that is holding steady for the time being. Since the last Fed, as the market first twist steepened then bull steepened, left side has re richened vs right side modestly. Last Fed, 1y1y went in very close to flat to 1y10y. Here, 1y1y is about 6 normal vols higher than 1y10y. Rather than wider left side distributions, this mostly reflects constrained right side distributions as the belly/back end has been more well sponsored and forward curves have flattened considerably. Since this months NFP, z6 is about 5bps richer while the bond is nearly 25 richer. Flows have turned to better selling of 30y tails in shorter dated expiry as ratio to 10s has approached 1. Gamma selling has also abated from the summer highs even as DoD Delivered vol remains very poor. Nevertheless, the surface remains quite steep with shorter dated expiries having led the grind lower in implieds. Any material shakeup this week from the fed can flatten the surface somewhat, but we will need to see an uptick in delivered vol for it to stick. Looking to tomorrow, we think a 25 dot that shows 2 or 3 cuts is less important than the guidance that Powell gives for Oct. There will be signal value if he leaves it open as a possibility or not. In our mind, it is not likely to be a vol inducing event, but rather we are going to have to see what the data brings to understand how distributions should shift.

MARK SALIB (G10 FX ONE-DELTA TRADING)

Consensus for USD Lower: While consensus continues to be for the USD to move lower, positioning does not reflect that. New risk in USD downside trades has been limited in absence of any catalysts. The Fed on Wednesday could provide said catalyst, with clients suggesting the market is still underpricing Fed into YE. Should we see a dovish cut (25 or 50bps alongside dots / Powell commentary) and a move in the DXY through 96.80 (50bps from current spot), we think we would unlock the catalyst for a further move lower in the USD. 96.80 in the DXY signifies the lower trend channel for the 11y trend, and from a technical perspective, a break of this level opens up 8.5% to the downside (2021 levels). We like expressing this view in options via mid-curve expressions given the relative levels of the DXY and Z6 levels that Wednesday could trigger hedging flows from RM – namely EU RM which could overshoot G10. Nevertheless, it is clear the market has under owned the position outside of some decent gamma buyers of late in EUR and JPY. Level-wise, mid 1.20s seems like a reasonable target into YE. Going into this week, I own 1y 1.25 binaries with windows for December and look to be additive via to USD shorts via USD/EM downside considering the levels of put vol – BRL looks like the cleanest expression for now.

KAMAKSHYA TRIVDEI AND MICHAEL CAHILL (GS RESEARCH)

Dollar Downside: Impending Fed cuts should catalyze a fresh leg of Dollar downside. We believe this for three reasons – First, we think the motivation for the cuts is consistent with our central thesis for why the Dollar should fall: the US economy is not outperforming the way it was before, and no longer should command the same degree of Dollar overvaluation. Second, we think the changing cost of hedging should lead investors in Asia to adjust their investments like their counterparts in Europe did in the first half of the year, which we think was a significant factor behind relative FX performance in the first half. Third, we think the recent policy bias in the CNY fixing mechanism is an important “policy push” that can help support broader Dollar downside. All that said, we acknowledge that the recent front-end rally that has brought the Fed policy path close to our expectations has not yet reignited broad Dollar depreciation. We think that should change as cuts are actually delivered and labor market concerns remain front and center, but this is part of why we think those quality carry currencies should remain a key part of investors’ portfolios for now, with G10 Dollar down positions still better expressed in options.

RICHARD CHAMBERS (CO-HEAD OF US IRP SALES & TRADING)

Tomorrow’s meeting will be a difficult needle to thread for Chair Powell. I expect the median to be just about at two dots given the sheer numbers that would need to move lower to get a three dot outcome. However we believe that outcome will get masked with a very dovish press conference keeping the October meeting live. The unknown is the Miran effect on the dots if there is any and we also believe there will be two 50 cut votes. Risk wise we continue to like z6/z7 steepeners, have covered shorts in front end swap spreads and believe the logical step on UST funding is to cut the SRF to promote usage into more net supply into year-end. At these levels we think dec sofr/ff is cheap.

DOMINIC WILSON AND VICKIE CHANG (GS RESEARCH)

Risk of Hawkish Fed Worth Hedging (Equity Puts/Belly Payers): We expect the FOMC to cut 25bps this week in the first of a series of consecutive cuts. Our tools suggest that the main macro shift in recent weeks has been the market’s continued shift towards pricing a more dovish Fed while market growth pricing has stayed resilient. The labor market weakness so far has not shaken the market’s confidence that current softness will be temporary, and the market instead seems to be processing the weaker jobs news as something that allows the Fed to cut more easily. The macro pricing backdrop looks broadly in line with our own baseline forecasts, but now that this view is better reflected, there is more risk that the market worries that it’s priced too much Fed easing and reverses some of the dovish policy shock that we’ve seen. That could put upward pressure on rates in a way that weighs on equities. Our baseline forecast is still a friendly one for risk assets and our expectations for the FOMC meeting should be fairly neutral for the market, but we think the risk of a hawkish Fed shock may be worth hedging if it makes it easier to stick with long risk positions. For a hawkish Fed scenario, it is likely the later 2026 cuts that the market has priced and terminal rate pricing that are most vulnerable, so payers towards the belly of the curve look most attractive as a hedge. Equity puts screen well too and have the added advantage of being protective of a long risk position against a negative growth shock if the labor market data in the coming weeks shows sharper weakness

ALEXIS SLATTERY (INDEX DERIVS TRADING):

Like Owning Short-Dated SPX Gamma: Short dated SPX options look extremely cheap into this week’s Fed meeting – the Wednesday straddle is just 0.72%, which is unusually low given the event risk. Front end term structure is steep with notable vol roll down priced between October and November, likely driven by VIX ETN’s rolling Sep VIX futures into Oct. We like owning short-dated SPX gamma into the event and funding those longs with Nov to take advantage of the steep term structure. On a relative basis, we think short-dated RTY options screen as expensive vs SPX. The IWM Wednesday straddle is priced at 1.85% (more than 2.5x its SPX counterpart). While RTY is indeed the most rates sensitive out of the major indices, the past few FOMC meetings the relationship between the RTY straddle and SPX has been closer to 1.5-1.7x. We think this relative premium looks stretched and may offer opportunities for relative value positioning.

MANASI HARDIKAR (MACRO CREDIT INDEX TRADING)

Spreads Near the Tights Offer Tactical Hedge Opportunities: Credit has been grinding steadily tighter, with bullish decompression playing out over the summer into the vol crush, CDX roll seasonal, and HY CCC weakness. Some of the recent CDX outperformance vs stocks also felt exacerbated by short gamma positioning around these levels in spread. CDX IG is in its 8th percentile in spreads, DTCC non-dealer positioning is in its 99th percentile on a 10y lookback, and the credit/equity one delta ratio is compressed (~25c/1% SPX implied for HY:SPX). Credit, even on a one delta level, has a natural convexity, and we think it makes sense to spend premium on tactical credit hedges here — in particular, we think IG seagulls look attractive here to play for a small pullback, with the entry point looking attractive given recent steepening of IG skew.

ARVIND GIRIDHAR (HEAD OF VOL TRADING):

I think 2 vs 3 in SEP will be less relevant than if he gives a soft nod to October cut (retaining optionality in Dec rather than Oct), and I would expect Powell to do that. We are still long z5, lightened up on flatteners a little bit, short gamma over the event.

BRANDON BROWN (UST TRADING):

Small long Oct meeting and would likely add into a backup, little long back end. Just don’t think markets really wrong. Payrolls is really the next catalyst to move the market. On the weekly data front Continuing Claims matters, as it dipped back down last week, so that doesn’t just trend up, it’s probably a sign the labor market is fine.

MIKE MITCHELL (HEAD OF UST TRADING):

Quite light curve and duration risk at the moment. Think Powell unlikely to want to rock the boat tomorrow. The market will be focused on whether the SEP shows 2 or 3 cuts for 2025 (inclusive of Sept cut), and which of those camps Powell sounds like he is in. It might be a bit hard for Powell to out-dove 2025 market pricing, and so I worry that even if he tries to not send a new message to the market (I don’t think he’s trying to send a new message) that he might come off as not quite as dovish as the market hopes.

MARVIN WALLEZ (METALS TRADING):

Positioning Getting Heavy In Gold via ETFs: After the $300 rally in gold, we expect most of the outcome to be in the price and the meeting to not be very impactful unless tails realize. A consolidation around $3,600 is likely before we see another leg of the rally potentially into year-end. Positioning is getting heavier through ETFs but still has room especially for COMEX which is lower than the highs of Jan. Vols have failed to perform, and we think should be traded in the 13-18v range, meaning that they look rather cheap here to play a meeting outcome if needed. Preferred structures continue to be exotics to play an upside in gold so far, single binaries or KO, or dual coupled with crude. Silver is getting some traction as it’s managed to hold well and avoid sell-offs while listed positioning reduced on the way up due to physical buying. Lease rates are tight and we see more spec getting interested in the high convexity trade.

ILIR XHOLI (HEAD OF SWAPS TRADING):

We’re generally pretty light risk and are looking for ways to get short duration from here. Will likely have limited downside expressions in TY.

ANDREW LAVENBURG (HEAD OF INFLATION TRADING):

We see two sided risks to spot breakevens at the moment 1) recent data has shown importers are struggling to pass along tariff costs to consumers driving margin compressing which should soften breakevens and allow the curve to steepen offset with 2) continued concerns around the future of the feds independence. We continue to like owning backend breakevens outright and in forward basis expressing our view that the breakeven curve should steepen and normalize. On the Fed itself we don’t think it’ll be a big event for the inflation market unless there is a strong deviation on messaging which we expect to be more middle of the road but lean slightly dovish

BRIAN BINGHAM (SHORT MACRO TRADING):

GIR and the vast majority of forecasters are calling for a 3.875 median 2025 dot, but we are looking for a 3.625 dot and view the vote as tantamount to a binary on Powell’s submission. We expect the majority of the Board will follow the leader, whereas the regional presidents will presumably reiterate the hawkish bias we have heard on a consistent basis over the past 3mo. It remains to be seen the extent to which regional presidents update forecasts in light of new information, but given the voting contingent will likely pencil a clear 3.625 median we equally place lesser weight on hawkish regional communication

Watching for how the relationship between >= 3 cuts and > 4.5% UER transpires in the dot plot, currently 2 & 3 respectively. This would be the clearest signal of a proactively dovish reaction function and is likely the green light needed for Sep/Oct to materially flatten.

The sfru5 options expiry on Friday seems to have significantly reduced exposure to a rally, and positioning in Oct meeting feels quite clean at these levels. The gap risk is clearly to a rally, with -20bps asymmetric to the downside should the FOMC in fact show 3 cuts, but given exogenous/implicit long positioning (long eq, short usd, rate curve steepeners etc), capacity for long vol expressions is limited in this environment

Continue to favor reds/greens steepeners as a long delta proxy over the meeting, and have sympathy for GIR’s conditional bull steepener idea on the same thesis. Optionalized upside also screens attractive, and with terminal rates hovering around 3% we believe the line in the sand for a front-end rally is still approx. 50bps from strike

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her