Uddrag fra Zerohedge:

Shitty housing data to start the day and chaos around The Fed’s statement (25bps cut), Powell’s comments, and the apparent contradictions to finish it:

The Fed is cutting rates, and projecting more rate cuts, at the same time as upgrading its growth forecast and nudging up its inflation outlook too.

UBS noticed too that during the press conference, Fed Chair Powell got a hard time from reporters who have spotted inconsistencies in the decision and rationale compared to the forecasts.

Here, the Fed has cut rates and has signaled that in all probability will cut twice more this year.

Yet against that it has economic growth speeding up, the jobless rate coming down and inflation back to (just above) target at the very end of the forecast horizon. In particular, he is being pushed on why the Fed has switched over to the jobs part of the mandate.

Indeed even in Powell’s own comments, it doesn’t really come across:

“Right now, the situation we’re in is that we see, we see inflation, we continue to expect it to move up maybe not as high as we would have expected it to move up a few months ago. “

It’s been nine months since the last cut…

Perhaps most notably Powell described his action as a “risk management” cut.

Powell says the revised jobs numbers mean the “labor market is ‘no longer solid” and the move to a “more neutral” position will “presumably” be helpful to the labor market.

Powell says “there wasn’t widespread support at all” for a 50 basis-point cut today.

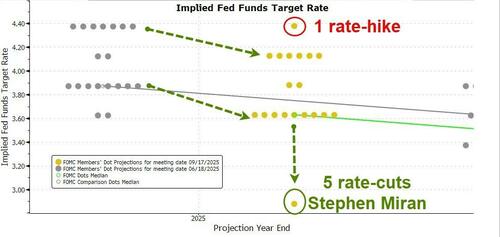

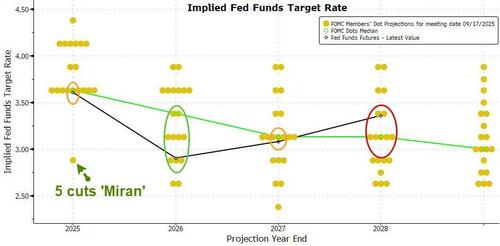

7 of the 19 members see no more rate-cuts this year, which means 12 of 19 see at least one more cut (9 for 2 cuts, 2 for 1 cut and 1 for 5 cuts)

Powell didn’t specifically mention ‘tariffs’ but did note that “we have begun to see” higher goods prices feed through to inflation, but he then tamped any inflation fears down by noting that the risks since April (i.e., Liberation Day) of higher and more persistent inflation have eased.

“No one really knows where the economy will be in three years,” Powell concluded, highlighting that “we’re in a meeting-by-meeting situation.”

The uncertainty is not without merit as, looking through the Statement, there is acknowledgement of:

1) Labor market weakness – the highly anticipated Dovish nod – as ‘job gains have slowed’ and ‘downside risks’ there stay elevated; but also that

2) ‘Inflation has moved up and remains somewhat elevated’.

Goldman’s Head of G10 FX Rsrch/Strategy, Mike Cahill first take is as follows:

Powell’s press conference clearly more balanced than the statement changes. I think this is down to two things.

- First, Powell suggested this meeting as a bit of a pivot point for the Committee compared to the last few years when inflation was driving the rate decisions. Today’s was about the employment side of the mandate, and the statement changes make that clear. It’s not new for the market, but new to the Committee and explains some of the emphasis in the statement edits.

- Second, there was some muddy communication around Powell’s initial explanation for the rate cut, describing it as providing some insurance for the economy and helping ensure better activity outcomes. It was in the context of explaining the changes in the SEP, which is important. He later described this as the first step on the path and noted mkt pricing and the process of getting back to neutral.

Overall, the message is that the risks are new but not so severe that they need to consider outsized policy steps that they only do when policy is clearly in the wrong place.

The FOMC intended today’s message to be that the labor market has become the primary motivation now.

The market had already moved to that spot, at least by the July employment report, so instead takes the news today that it would take more than just “rising risks” to warrant faster or deeper moves.

Against expectation for a more hawkish statement & SEP followed by a more dovish offset from Powell in the press conference, we actually saw a more dovish statement & SEP with Powell then sounding more hawkish – firmly downplaying the likelihood of a -50bps increment and giving more balanced jobs vs. prices mandate comments.

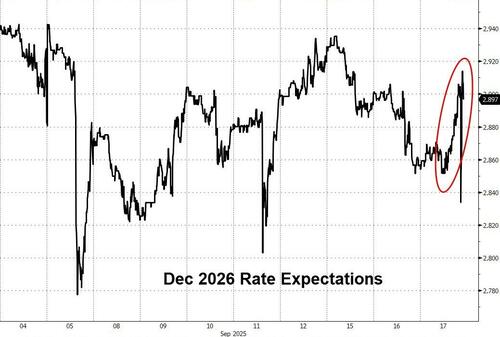

Interestingly, 2026 rate-expectations rose (hawkishly) on the day…

Source: Bloomberg

So what was the result of all this data, chatter, and nuance on just how bad the jobs market is?

The market reaction was dovish (25bps cut and significant drop in DOTS)… to hawkish (Powell: 50bps wasn’t even discussed)… to unch (Powell: back to balanced warning that both inflation and labor are in play).

In a word: Chaos!

Stocks, bonds, the dollar, crypto, and gold all whipsawed wildly from 1400ET until the US day session close.

Scott Ladner of Horizon Investments weighs in on the market reaction:

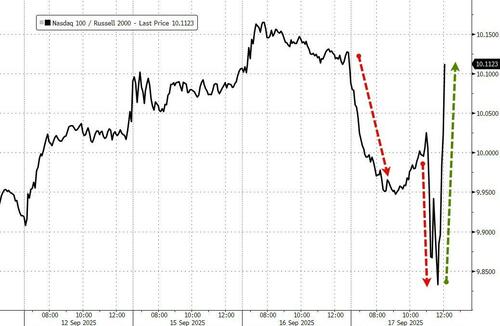

“The initial reaction in stocks was a clear ‘run it hot’ reaction with smalls and cyclicals screaming vs Nasdaq selling off, but this reaction did not reach across to other markets. You would have expected a steeper yield curve with longer rates going higher + commodities / coins rallying – and you saw the opposite of this in the rates & commodity space.

“This cross asset divergence gives some credence to the idea that the equity market reaction right now has more to do with positioning than reading much into the ‘macro implications’ of the Fed result.”

For a sense of the havoc, we note that ahead of The Fed, there was a major divergence between Nasdaq (down) and Small Caps (higher), that extended on the statement but as soon as Powell started speaking, Small Caps dumped relative to Mega-Cap tech…

Source: Bloomberg

The S&P and Nasdaq were the laggards on the day (but as we noted, it was Small Caps that suffered the wildest swings from very strong gains right after the FOMC statement to only modest gains by the close). The Dow managed to close green and outperformed on the day…

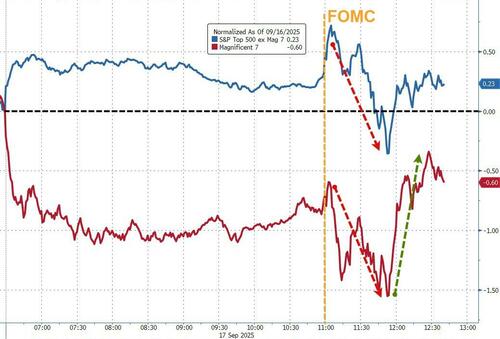

Mag7 stocks underperformed the S&P 493 on the day (but we note that Mag7 was bid after Powell stopped speaking)…

Source: Bloomberg

Treasury yields were just as wild with the initial reaction to the dovish Fed statement and Dots sending yields lower, but Powell’s comments sparked selling and yields soared (especially in the belly

Source: Bloomberg

The 10Y yield dropped back below 4.00% briefly but bounced back up to the highs of the day by the close…

Source: Bloomberg

The dollar actually ended flat on the day after puking on the initial statement and then bouncing back aggressively…

Source: Bloomberg

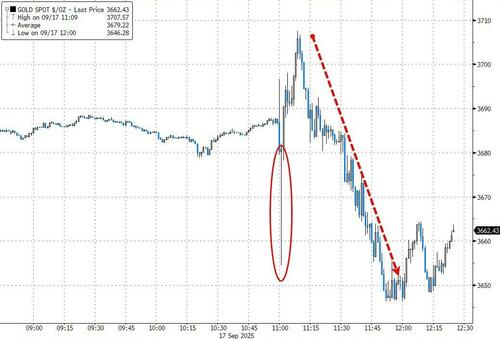

Gold traded wildly to start after the FOMC statement, recovered from its puke, but then started to leak back lower as the dollar strengthened…

Source: Bloomberg

Bitcoin was lower on the day but recovered from its initial puke following the FOMC statement…

Source: Bloomberg

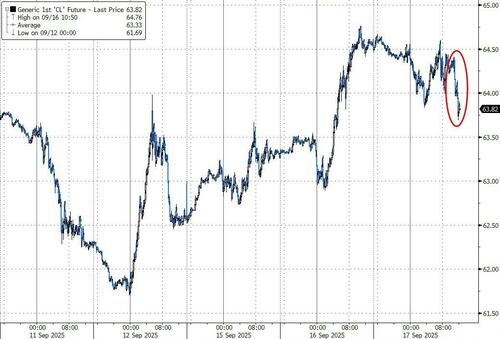

Oil prices leaked lower after The Fed (despite early gains following a large crude inventory draw)…

Source: Bloomberg

Finally, we note that 2025 dots were adjusted to ‘meet’ the market, but the market is now significantly more dovish than The Fed for next year…

Source: Bloomberg

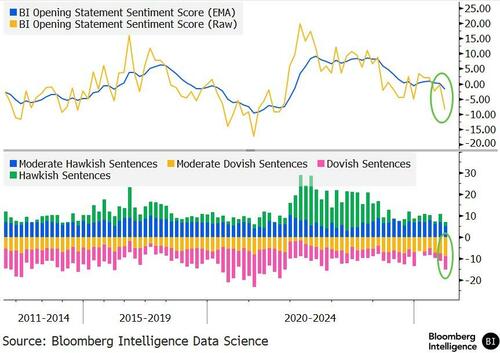

The Bloomberg Intelligence US Rates Strategy natural language processing model shows that Powell’s opening remarks were even more dovish than last year, when the Fed cut by 50 bps.

“Our model showed the last few meetings’ press conferences were quite neutral,” notes BI’s Jersey.

“Today’s very dovish move matched our ear test and suggests to us this will be at least one other rate cut.”

That’s quite a dovish tilt!! Did Powell fully ‘bend the knee’ after all?