Uddrag fra Zerohedge:

While US government shutdowns have become so common in recent decades that every federal agency has a playbook for how to implement them, the Trump administration is rewriting those plans in advance of the end of the fiscal year this Tuesday, making a potential shutdown on Oct 1 even more unpredictable, and potentially disruptive, than any other in memory.

Government shutdowns all have the same cause: Congress fails to approve new spending when previous spending bills expire. But their impact can vary based on timing, duration and quirks of the budget process that can make money available to some agencies but not others.

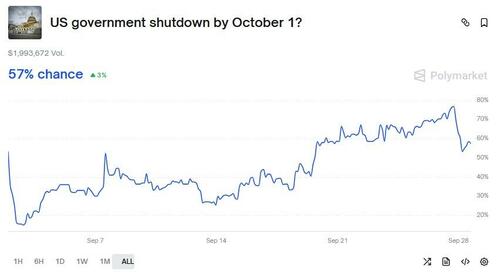

According to Goldman’s chief political economist, Alec Phillips, a government shutdown beginning next week, on October 1st, looks increasingly likely. It would likely be more severe than most. It would be the first since the Obama administration to begin on a fiscal year, quarter or month, and congress hasn’t passed any of the 12 appropriations bills that fund specific agencies.

Prediction markets are reflecting this sentiment, with Polymarket indicating a greater than 70% chance of a shutdown occurring as of Saturday, although odds dipped in recent hours amid speculation of further meetings between Trump and Democrats.

There is one final opportunity for a resolution early next week, when the Senate returns on September 29th. At that point, if Democrats were to change their stance, they could potentially pass the extension approved by the House, though this scenario is considered unlikely.

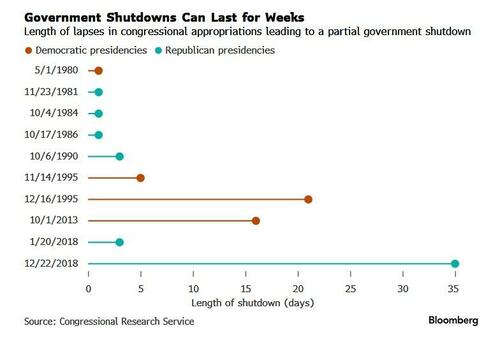

Should a shutdown occur, its duration is a key concern. Here, Goldman’s economists have some templates to use. While the 2013 shutdown, which lasted three weeks in October, serves as a potential template, it’s important to note that it overlapped with a debt limit debate, which is not a factor in the current situation.

With the debt limit already addressed, the primary economic impact of this potential shutdown would stem from federal employees being furloughed and the collateral effects on data releases. This would be aggravated by Trump decision to ratchet up the pressure by threatening to permanently fire – instead of temporarily furlough – non-essential federal workers whose positions are unfunded.

Goldman estimates suggest a hit of 15 basis points to GDP growth per week of shutdown within the affected quarter, with a subsequent recovery in the following quarter (for instance, a three-week shutdown could result in a 45 basis point cut to GDP growth, followed by a boost in the subsequent quarter).

A significant consequence of a shutdown would be the disruption of federal data releases. Both NFP & CPI are likely to be delayed for the duration of the shutdown, and there might be a delay in the release the month following the shutdown too. The best guide is 2013, when NFP was delayed for the length of the shutdown (ultimately released Oct 22 after Govt reopened Oct 17) and the following release was delayed by around a week, because it affected the data collection the prior month and set everything back.

A worst case scenario could see the shutdown stretch for more than a month, as was the case in December 2018 when under a Trump 1.0 presidency, the govt shut down for 35 days.

Adding to the uncertainty, last Wednesday the White House Office of Management and Budget directed agencies to revise their shutdown contingency plans to specify which workers will be dismissed during a shutdown. Agencies say they can’t publish those plans until OMB signs off on them, and as of Saturday morning details were scant.

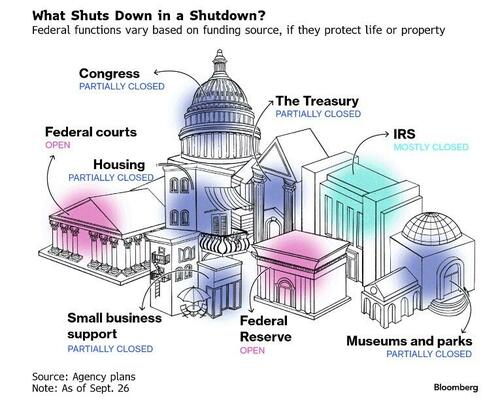

Who Remains Open and Who Closes

In case of a shutdown, law mandates that activities essential to protecting life and property continue. Those include military operations, law enforcement and food inspections.

The president must continue to carry out his constitutional responsibilities. So much of the White House, the Office of the Pardon Attorney and the US Trade Representative remain open. High-ranking federal officials confirmed by the Senate are always exempt from furlough, but could be left without staff. Members of Congress must also be paid under the 27th Amendment to the Constitution.

And a number of entities – including the Federal Reserve and the Consumer Financial Protection Bureau – aren’t funded by annual appropriations from Congress and can continue running off their own funding sources.

Additionally, government-owned or -sponsored enterprises like Amtrak, the US Postal Service, Fannie Mae and Freddie Mac have funding streams that don’t rely on annual appropriations from Congress and will continue to operate.

Federal Employees

In past shutdowns, Bloomberg calculates that about four in 10 federal employees were furloughed and barred from doing any work under a law that prohibits agencies from accepting volunteer labor. The remaining six in 10 must continue to work as essential employees.

Regardless, federal employees won’t get paid – at least not during the shutdown. The Government Employee Fair Treatment Act of 2019 codified a longstanding practice of paying federal employees retroactively after the shutdown ends – whether they worked or not.

Travel and Transportation

The Federal Aviation Administration and Transportation Security Administration provide essential safety functions and would continue. But travelers could still face delays: Air traffic controllers and TSA officers would be without pay, which has led to higher rates of no-shows during past shutdowns. US consulates and passport offices can operate as long as they are relying on income from fees.

Social Security, Health Care

Medicare benefits would continue, as would new and continuing Social Security checks. But some administrative actions – things like benefit verifications, corrections to earnings records and replacement cards – have been delayed in past shutdowns.

And the Bureau of Labor Statistics says any delay of its October inflation report would impact the calculation of annual cost-of-living increases for Social Security beneficiaries.

The National Institutes of Health’s hospital in Bethesda, Maryland, would remain open to care for current patients, and research activities would continue where shutting them down would disrupt ongoing clinical trials. Safety-net food assistance programs have continued in past shutdowns, but could be a lower priority for the Trump administration.

Medical care at veterans hospitals and clinics would likely go on, as would suicide prevention programs, medical and prosthetic research and burial benefits. But other benefits for veterans could be delayed, including those for education, job training and loans.

Parks and Museums

Most national parks would likely be shuttered, turning away visitors and impacting businesses in the $1 trillion outdoor recreation economy. During some past shutdowns parks were closed off completely, but in 2018 the National Park Service left some easily accessible sites open, although with uncleaned toilets and increased litter. Museums including the Smithsonian and National Gallery of Art could close in a protracted shutdown.

Cemeteries, monuments and visitor centers worldwide housed under the American Battle Monuments Commission would also likely shutter.

National Defense

Uniformed personnel are exempt from furloughs and would continue to report for duty without pay. Most civilian Defense Department employees would be initially furloughed.

The Pentagon could continue many contracting activities to support service members under a Civil War-era law called the Feed and Forage Act. Burials and tours at Arlington National Cemetery would continue.

Spy agencies give scant details on how they would be impacted, but the Office of the Director of National Intelligence has previously provided guidance to employees that they’re not automatically exempt from the shutdown.

Labor and Economic Data

Among the Department of Labor agencies that would likely shutter completely is the Bureau of Labor Statistics, according to a March 2025 contingency plan released under the Freedom of Information Act. A shutdown would likely delay the release of the September jobs report, due next Friday, and, if it continues, the inflation report due mid-month. That could be present a major concern for the Fed and its October FOMC meeting set for Oct 28/29 as the central bank would not have key data on which to base its decision whether top cut again.

It’s not just the data releases. Data collection would also stop, impacting the quality of data for months to come – leaving the Federal Reserve without reliable data to help it plot the course of interest rates. Data-dependent policymakers and investors would have to look to third parties to fill in the blanks on the health of the economy.

The Labor Department’s health and safety-related functions, like workplace inspections by the Occupational Safety and Health Administration, would continue. Many benefits programs would also be uninterrupted because they have permanent appropriations, including black lung benefits.

Treasury Department

In past shutdowns, the Treasury Department continued government borrowing and debt servicing, policy work and other items required to fulfill the president’s constitutional authorities. Many research and regulatory agencies are funded through user fees and would continue. Those include the Office of Financial Research, the Office of Recovery Programs and the Financial Stability Oversight Council.

Processing of cases in front of the Committee on Foreign Investment in the United States would cease, potentially leaving pending merger decisions unresolved.

Internal Revenue Service

During a shutdown, the IRS stops answering the calls to the dozens of customer service lines it operates. Most tax administration would stop. A shutdown doesn’t postpone tax withholding or deadlines for any estimated tax payments due.

Regulatory Agencies

The Trump administration has tightened its hold on independent regulatory agencies, but past shutdown plans called for the Federal Trade Commission to stop most investigative activity.

- The Securities and Exchange Commission doesn’t review or approve registrations from investment advisers, broker-dealers, transfer agents, rating organizations, investment companies and municipal advisers.

- The Commodity Futures Trading Commission has relied on a 1995 legal opinion that its market-supervision functions are essential to prevent “massive dislocations of and losses to the private economy, as well as disruptions of many aspects of society and of private activity generally, producing incalculable amounts of suffering and loss.”

- The Consumer Product Safety Commission could still issue recalls where there is “an imminent threat to the safety of human life,” but more routine monitoring would cease.

- The Department of the Interior may issue some permits for offshore oil and gas drilling, but they could depend on factors like safety and the government’s property interest in the well.

- The Environmental Protection Agency can continue some programs and activities with other funding sources, like cleanup at Superfund sites.

- The Energy Information Administration, already struggling with delayed reports because of staff cuts, would likely shut down.

- The Nuclear Regulatory Commission would stop licensing, certification and permitting and inspection activities, along with emergency preparedness exercises. The National Nuclear Security Administration would focus on maintaining and safeguarding nuclear weapons and deployed naval reactors.

Housing

Mortgage programs administered by the Federal Housing Administration and Ginnie Mae have continued in past shutdowns. Many Housing and Urban Development block grants have already been obligated to states and haven’t been disrupted.

Subsidized housing — including public housing and Section 8 housing choice vouchers — don’t rely on annual spending bills but are still at risk of running out of funds.

“Nearly all” fair housing work would stop, according to the most recent public contingency plan.

Housing

Mortgage programs administered by the Federal Housing Administration and Ginnie Mae have continued in past shutdowns. Many Housing and Urban Development block grants have already been obligated to states and haven’t been disrupted.

Subsidized housing — including public housing and Section 8 housing choice vouchers — don’t rely on annual spending bills but are still at risk of running out of funds.

“Nearly all” fair housing work would stop, according to the most recent public contingency plan.

Small Business

The availability of loans would depend on how they’re funded. Many disaster relief programs would continue, while more traditional loan applications would be delayed. Programs supporting veteran-owned businesses, exports and mentorship would also cease. Most emergency relief workers at the Federal Emergency Management Agency would stay on the job.

Federal Courts

The Supreme Court, which opens its new term on Oct. 6, would continue normal operations in the event of short-term lapse, said Supreme Court spokeswoman Patricia McCabe.

In the past, lower courts have dipped into other available funds that aren’t subject to the annual appropriations process, but those funds could run out.

Federal Reserve

Federal Reserve operations would be unaffected, meaning the central bank could still adjust interest rates, regulate banks and conduct economic research. The CFPB, which is funded by the Fed, could also remain open but has vastly curtailed its activities under Trump.

Congress

While Congress’s authority to fund itself would also run out, it also has to function to be able to end the shutdown. But other agencies that fall under Congress — like the Library of Congress and the US Botanic Garden — will likely close to visitors.

Markets

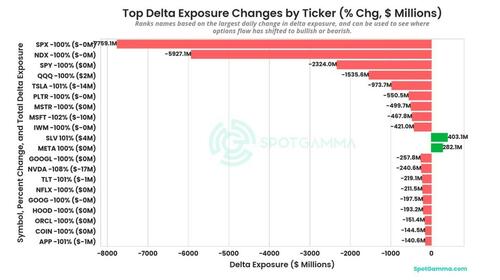

With the fate of the government likely to drag until the late hours of Sept 30, markets will be hit with a double whammy of potential volatility. As SpotGamma writes, all roads lead to the 9/30 quarterly expiration this Tuesday. That’s because the massive gamma concentration around the 6,505 JPM Collar strike has provided a floor for this market, but that exact support structure will soon disappear. Add to that the possible volatility from a shutdown and all the ingredients are there for a perfect market selloff storm.

Indeed, as SpotGamma adds, implied volatility for SPX rises markedly immediately following 9/30 when the JPM Collar, and similar positive gamma positioning, expires. This indicates traders are gearing up for at least some uptick in market movement.

One silver lining: there has been a lot of hedging ahead of the obvious event risk, as many traders have already factored in the threat of a shutdown. The options positioning data from SpotGamma’s Synthetic OI model reveals systematic and escalating downside hedging across virtually all major US equity benchmarks throughout the week, with institutions establishing both short-term tactical and long-term structural protection. The negative delta exposure across the major indices closely tracks with bearish options flow across all major US equity benchmarks.

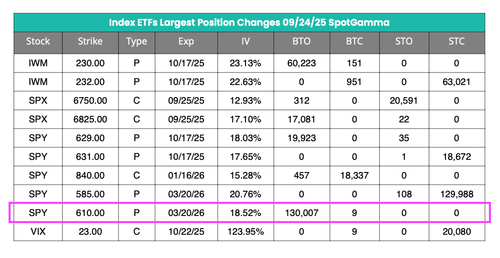

Additionally, the bought-to-open (BTO) index options positioning reveals aggressive new downside hedging across major ETFs, with institutions establishing fresh protective positions rather than closing existing ones. Of all names last week SPY shows the most significant new downside hedging activity with over 130k contracts bought at the 610 strike and nearly 20k contracts at the 629 strike.

In the tech sector, similarly large put positions were opened in QQQ (121k new puts added at the 555 strike) and IWM, with additional VIX call-buying.

The worst case scenario is that these new positions represent fresh hedges against, or speculative bets on, a Volmegeddon scenario that would only pay off in severe market stress. At the very least, it appears that large buy-side firms are preparing for a transition away from the zombie market we have observed this past summer.

So as we head into what could be a pivotal week, SpotGamma urges readers to keep an eye on both when and how the market structure could shift – and the specter of heightened volatility seems to be a strong possibility as we head into the fall. The post-government shutdown environment may require recalibrating risk frameworks and position sizing accordingly, at least until things are back to normal.