Uddrag fra Zerohedge

Update 1:10pm ET. Late on Friday, we were amazed to learn that apparently nobody has learned anything from the past 6 months of TACOing, and said that Trump would post something late on Sunday to calm markets…

Well…. we were off by a few hours, in what has been the fastest TACO reversal yet.

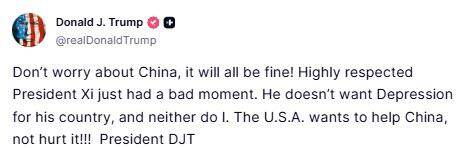

Moments ago, confirming the rapid shift in sentiment that gripped markets on Sunday morning following JD Vance’s far more palatable comments, Trump crushed any hopes the bears may have had of a limit down open when he took down the trade DefCon tension with China from 10 back to 2, stating on Truth Social “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!”

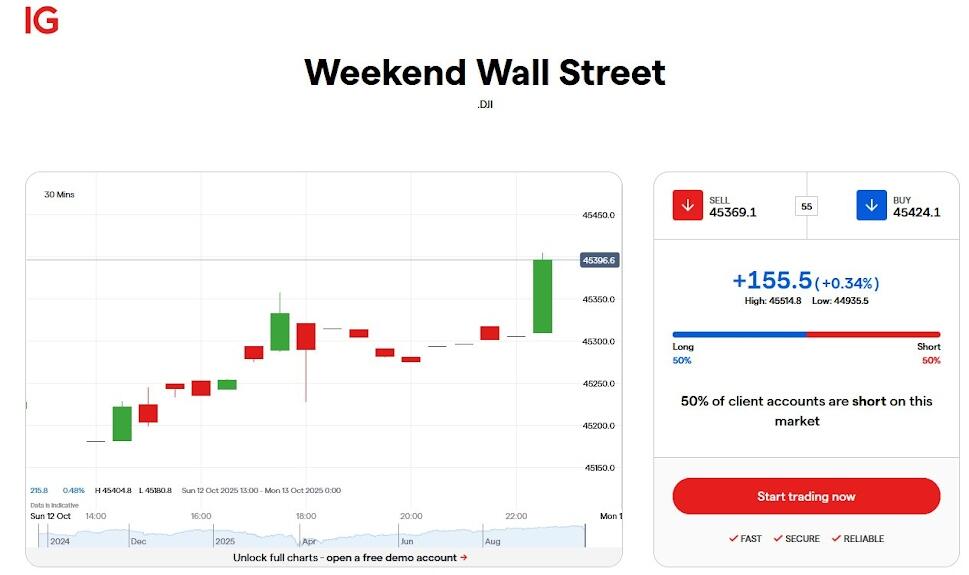

There is still a few hours before futures reopen for trading, but while we wait for Polymarket to launch a weekend market, IG is showing a surge in weekend pricing…

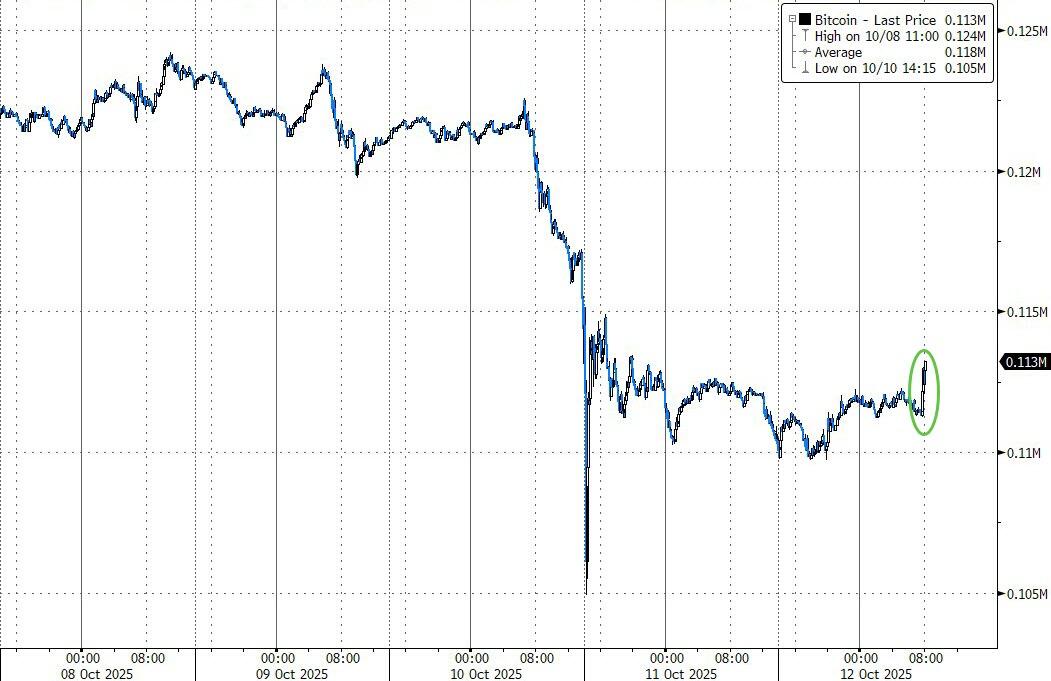

… and ETH has almost fully reversed the Friday flash crash.

* * *

Who could have seen this coming?

After President Trump (perhaps unexpectedly) caused a shitstorm in markets on Friday with his threats against China, it appears the scale of the carnage required ‘good cop’ VP Vance to calm the waters before futures open tonight.

The FT reports that Beijing has slammed President Trump’s plan to impose additional 100 per cent tariffs on Chinese exports and threatened new countermeasures as it blamed the US for escalating tensions between the world’s two biggest economies.

The commerce ministry said on Sunday that since the two countries held trade talks in Madrid last month, the US had “continuously introduced a series of new restrictions against China”, including putting Chinese companies on a trade blacklist.

“China’s position on tariff wars has been consistent: we do not want to fight, but we are not afraid to fight,” the ministry added.

So, VP Vance was rolled out to Sunday morning shows to walk-back the US rhetoric a little…

During an interview with Maria Bartiromo on Fox News, JD Vance called on Beijing to “choose the path of reason” in the latest spiraling trade fight between the US and China, claiming that President Donald Trump has more leverage, but is “willing to be a reasonable negotiator with China.”

“It’s going to be a delicate dance, and a lot of it is going to depend on how the Chinese respond,” Vance said on Fox News’s Sunday Morning Futures.

“If they respond in a highly aggressive manner, I guarantee you, the president of the United States has far more cards than the People’s Republic of China. If, however, they’re willing to be reasonable,” he said, then the US would, too.

Vance, who said he had spoken with Trump Saturday and Sunday, said the president “appreciates the friendship that he’s developed with Xi,” but added, “We have a lot of leverage. And my hope, and I know the president’s hope, is that we don’t have to use that leverage.”

He added that the good relationship is threatened “if the Chinese go down this pathway of cutting off the entire world from access to some of the goods that they produce.”

“We’re going to find out a lot in the weeks to come about whether China wants to start a trade war with us, or whether they actually want to be reasonable. I hope they choose the path of reason,” Vance said.

Watch the subtle shift in stance here…

Shortly after Vance spoke, US Trade Rep Greer spoke on Fox News, explicitly trying to calm markets:

- *GREER ON TARIFFS: THINK WE’LL SEE MARKETS CALM IN COMING WEEK

- *GREER: TRUMP CONTINUES TO HAVE GREAT RELATIONSHIP WITH CHINA XI

- *GREER ON CHINA: WE NEED TO FIND A WAY BACK TO STABLE SITUATION

- *GREER ON TARIFFS: I THINK CHINA REALIZED THEY OVERSTEPPED

Crypto markets are up significantly on the comments with Ethereum outperforming…

And IG shows The Dow trading up around 155pts at time of writing…

So, circling back to where we started, who could have seen this coming? Well, us for sure…

As we noted on Friday, Brace for the TACO Monday meltup as with one post, Trump pulled the Nasdaq from overbought…in fact, RSI is now below 50.

And just like that, the euphoria has reset.

Will the market ever learn?

* * * We have two new Reverse Osmosis water filters for you to check out…