Resume af teksten:

Kinas økonomiske vækst i 3. kvartal 2025 var bedre end forventet med en stigning på 4,8 % sammenlignet med samme periode året før. Mens Kinas vækstmål på “omkring 5%” for året stadig er inden for rækkevidde, er der bekymring over svag forbruger- og investeringsaktivitet samt den forværrende boligsituation. Industriproduktionen steg stærkt, delvist takket være robust ekstern efterspørgsel, især inden for biler og elektronik. Dog er ejendomspriserne faldet markant, hvilket har påvirket tilliden negativt og forstærket den deflationære tendens. Forbrugsdata viser tegn på opbremsning, da tidligere stimuleringspolitikker mister deres effekt. Investeringer falder fortsat, og virksomheder forholder sig tilbageholdende under usikkerhederne i handelsmiljøet. Kinas indsats for at opnå en mere indenlandsk drevet vækstmodel står over for udfordringer, som muligvis kræver yderligere politisk støtte.

Fra ING:

Chinese GDP slowed by less than expected in the third quarter amid the boost from external demand. With China on track to hit this year’s growth target, we could see less policy urgency. But weak confidence translating to soft consumption, investment, and a worsening property price downturn still need to be addressed

China’s 3Q25 GDP growth

GDP growth slowed by less than expected in 3Q25

China’s GDP grew by 4.8% year-on-year in the third quarter, slowing for a second consecutive quarter from the 5.2% growth in the second quarter. Still, the economy managed to beat expectations for a steeper decline. Through the first three quarters of the year, China’s economy has grown by 5.2% YoY.

By industry, China’s tertiary industry drove growth in 3Q25 with a 5.4% YoY growth, comfortably outpacing growth in the secondary (4.2%) and primary (4.0%) industries.

The better-than-expected GDP data was likely thanks in part to a strong bounce-back in industrial production to 6.5% YoY in September, which is benefiting from resilient external demand. Yet, soft monthly activity data throughout the quarter suggests that a favourable boost from the GDP deflator may have contributed to this performance.

Looking at the other activity indicators, though, weak confidence continues to be a major factor dragging on domestic economic activity. Consumption has continued to slow to 3.0% YoY in September as the peak of the trade-in policy boost appears to be past us. Fixed asset investment growth continued its rapid decline, falling to -0.5% YoY year-to-date. The property market continues to represent a major drag on China’s economy with a -13.9% YoY ytd decline in property investment. Prices saw the steepest monthly decline of the year in September.

The third quarter GDP data keeps China solidly on pace to reach this year’s “around 5%” growth target, and it may reduce the urgency for more immediate action. This could prove to be a mistake, as the underlying trend makes a strong case for more policy support.

3Q25 GDP beat keeps China’s ytd growth comfortably above 5%

Value added of industry benefiting from solid external demand

China’s value added of industry rebounded to 6.5% YoY in September, up from 5.2% in August, marking a three-month high. This beat market forecasts, expecting a slight slowdown in the month. Through the first three quarters of the year, industrial production has grown 6.2% YoY ytd and has been a solid driver of growth.

The data benefited from continued outperformance of manufacturing (7.3%), and in particular, hi-tech manufacturing (10.3%). By industry, the sectors seeing the strongest growth included auto (16.0%), computer, communications and other electronic equipment manufacturing (11.3%) and rail, ships, and aeroplanes (10.3%), which is in line with China’s fastest growing export categories as well. This suggests that industrial activity is supported by resilient external demand.

In contrast, we saw weakness in areas impacted by the property slump, such as cement (-8.6%), flat glass (-9.7%) and crude steel (-4.6%), as well as the tariff-impacted sectors, such as textiles (2.2%).

Industrial activity remains a bright spot in China’s economy

Worsening property slump may require further policy support

China’s 70-city property price data showed the downturn in prices worsened in September. New home prices were down -0.41% month-on-month, while used home prices fell -0.64% MoM. Both marked the steepest MoM declines of the year. New home prices are back to 2019 levels, while used home prices have fallen back to 2016 levels. They’re down -11.4% and -19.8% from their respective peaks.

Unsurprisingly, this weakness was reflected in the city-level data. In the primary market, two cities saw prices unchanged, while five cities saw prices increase in September, the worst reading since October 2024. None of the 70 cities saw an uptick or stabilisation of prices in the secondary market. Such a broad-based decline hasn’t been seen since September 2024.

The worsening downturn of the property market should ring some alarm bells. Falling prices remain a major factor behind weak confidence, given the heavy weight of property in household balance sheets. It contributes to overall deflationary pressure on the economy. If the downturn is not reversed, this will likely restrain China’s efforts to pivot toward a more domestic demand-driven growth model. There remains room to support the property market through further easing of purchase restrictions, rate cuts, and by ramping up purchases of unsold homes where appropriate for conversion into social housing or other uses.

Property prices saw the steepest MoM drop of the year in September

Consumption softened in September as trade-in policy effect continues to wane

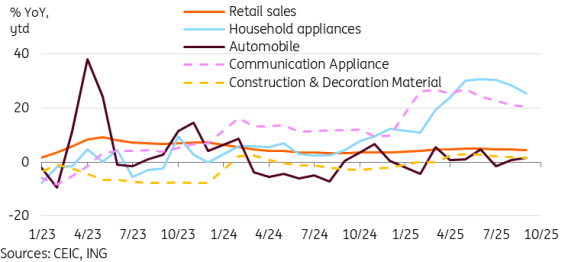

Retail sales slowed to 3.0% YoY in September, down from 3.4% in August. This marked the fourth straight month of deceleration and the weakest monthly growth of the year. Through the first three quarters, retail sales growth is still at a respectable 4.5% YoY ytd. But the trend has been negative in recent months. A major reason for this slowdown is that we’ve moved past the peak of the boost from China’s trade-in policy, which helped front-load consumption of categories such as household appliances and consumer electronics earlier in the year.

At the same time, households remain cautious as confidence remains soft. This can be seen in the disparity between real per capita disposable income and expenditure growth, where incomes have risen by 5.2% YoY, but expenditures rose just 4.7% through the first three quarters of the year, suggesting the difference is being saved.

Looking at the retail sales categories, household appliances slowed dramatically to just 3.3% YoY in September after contributing double-digit growth for the prior 12 months. This primarily reflects the base effect as trade-in policies for household appliances ramped up in September 2024. Communication appliances continued to outperform amid the trade-in policy boost, but also decelerated to 16.2% YoY. The boost from the trade-in policy will likely further weaken in 4Q.

Food and beverage-related categories also suggest a more cautious consumer, with catering (0.9%) and tobacco and alcohol (1.6%) both quite soft. Sales of basic grains and oils (6.3%) were well above headline growth.

Consumption softens as trade-in policy boost fades and sentiment remains downbeat

Fixed asset investment continued to decline as corporates stay sidelined

Fixed Asset Investment (FAI) growth turned negative at -0.5% YoY ytd for the first three quarters of the year. This growth represented the weakest level since July 2020.

The decline was broad-based on the month. While public-led FAI growth remained positive at 1% YoY ytd, private investment continued to contract sharply, down a sixth consecutive month to -3.1% YoY ytd. Foreign investments also saw a decline of -12.6% YoY ytd.

By sector, manufacturing remains the primary driver of FAI, but growth slowed from 5.1% YoY ytd last month to 4.0%, mainly supported by autos (19.2%) and rail, ship, and aircraft manufacturing (22.3%). Compared with last month, most categories that had previously shown growth saw a deceleration.

The overall weak sentiment has been exacerbated by elevated external uncertainty amid the trade war. Many corporates have chosen to stay sidelined in this environment, translating into soft FAI growth.

Investment continues to disappoint as corporates stay sidelined

Fourth Plenum, Xi-Trump summit, and PBOC are potential catalysts to watch

The stronger-than-expected third-quarter data mean that, barring a dramatic deceleration in 4Q, China will likely manage to reach its full-year target of “around 5%” growth.

Domestically, the Fourth Plenum meetings this week are likely to give some insights into China’s 15th Five-Year Plan. The full text will not be available until the plan is formally approved at the Two Sessions next year. This plan will offer some insight into how China plans to navigate an increasingly difficult external environment. Investors will likely watch closely for signs of concrete steps to boost consumption, as well as areas for tech development and focus.

The long-awaited and high-stakes Xi-Trump meeting next week in South Korea looks likely to take place despite the recent escalations in US-China friction. Language and signalling suggest that both sides would prefer to reach some sort of agreement to continue the current uneasy truce rather than see a re-escalation back to, or beyond, this year’s peak tensions in April-May. The odds of miscalculation remain, though, representing a potential downside risk to the outlook. While we see a diminishing marginal impact from further tariff hikes, the prospects of non-tariff escalations represent a notable uncertainty. Regardless of how talks go, China’s export resilience suggests that trade is about more than just US tariffs , and external demand should support growth for the rest of the year.

Monetary easing has been incremental over the past year. This is likely due to concerns over perceptions of limited policy ammunition, given the low nominal rates, the rally of equity markets, and China’s broader currency stability objective. Loan prime rates remained unchanged in October as expected, and the 3Q data beat may further reduce the immediate urgency for stimulus. However, soft inflation and loans data combined with the slowdown of activity indicators still suggest that the case remains solid for further monetary easing. An unfavourable outcome from the US-China talks could expedite monetary easing, while any upside surprises could further reduce the urgency for policy support. We still have one 10bp rate and 50bp reserve-requirement ratio (RRR) cut pencilled in for this year.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.