Resume af teksten:

Sydkoreas økonomi voksede hurtigere end forventet i tredje kvartal takket være stærk indenlandsk efterspørgsel, der blev understøttet af kontanthjælp og stærke aktivmarkeder. BNP steg med 1,2% kvartal over kvartal, drevet af en stigning på 1,3% i privatforbruget. Investeringer, især i IT, oplevede en bemærkelsesværdig opsving med en stigning på 2,4%, mens anlægsaktiviteten forsatte med at trække sig sammen, men med en reduceret hastighed. Eksporten voksede med 1,5%, hjulpet af stærk eksport af halvledere og transportudstyr. Forventningen til BNP væksten i det nuværende kvartal falder til 0,6%, mens forbrugertilliden forblev optimsitisk, selv med en lille nedgang i oktober. Forventningerne om stigende boligpriser forbliver høj trods stramme reguleringer, hvilket gør det usandsynligt med rentenedsættelser i november. Centralbanken afventer forbedret stabilisering af boligmarkedet før yderligere beslutninger.

Fra ING:

South Korean growth beat expectations amid robust domestic demand, boosted by cash handouts and strong asset markets. Yet a slowdown is expected in the fourth quarter as government support wanes and export challenges abound

GDP

1.7% YoY

Real GDP grew 1.2% QoQ sa in 3Q25 (vs 0.7% in2Q25, 1.0% market consensus)

South Korean private consumption increased by 1.3% quarter-on-quarter, providing the primary driver of growth. Both goods and service consumption rose thanks to government support, strong stock market performance, and the normalisation of the political situation. However, we believe that the effects of government aid are likely to diminish. Also, recent housing market regulations may negatively affect consumption in the short term. Thus, this would weigh on overall growth in the current quarter.

Regarding investment, facility investment demonstrated a notable recovery, rising 2.4%, mainly due to increased IT investment. Construction activity contracted for the sixth consecutive quarter, but the rate of contraction showed signs of easing. We expect solid facility investment to continue as capital goods imports rose recently, while construction finally bottomed out. Thus, investment is likely to contribute positively to the current quarter.

Exports grew modestly by 1.5% thanks to strong exports of semiconductors and transportation equipment. We continue to believe robust semiconductor and vessel exports in coming quarters. But tariff headwinds and expected slowdown of US consumption should challenge overall exports going forward.

Looking ahead, GDP growth is expected to slow in the current quarter from 1.2% to 0.6%. We keep our 2025 annual GDP growth at 1.2%.

Korean GDP is expected to slow down in coming quarters

Source: CEIC

Consumer sentiment edged down in October but remained above neutral level

The composite consumer sentiment index edged down slightly to 109.8 from 110.1, but remains above 100, indicating continued optimism. Of the six subcomponents, expectations for the domestic economy declined; the rest were unchanged.

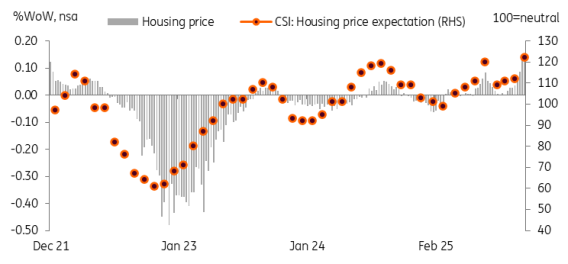

Also significant: a 10-point increase in consumer expectations on housing prices. Despite the implementation of recent, more stringent, measures prior to the survey, consumers continue to anticipate an upward trend in housing prices. This is expected to decrease in the coming months, while the Bank of Korea and the government are anticipated to exercise caution in policy decision-making.

That’s why we believe a November rate cut is unlikely. Sentiment is a leading indicator of the actual housing market. Thus, the BoK should take a wait-and-see approach until it sees a clearer sign of stabilisation. In addition, President Lee publicly supported the BoK’s on-hold decision thanks to housing market trends. So clearly, the prerequisite of a rate cut should be stabilisation of the housing market. We currently have a 25bp cut pencilled in for January, but we may push it to February or even April, depending on the housing market trend.

Housing prices are key to watch

Source: CEIC

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.