Uddrag fra Zerohedge:

Two months ago, when nobody was thinking about the massive debt that would be required to fund the trillions in data center capex spending, and when absolutely nobody was paying attention to Oracle’s CDS, we published “The Stunning Math Behind The AI Vendor Financing “Circle Jerk“, in which we laid out all the weakest links in the global AI revolution thesis, including the dismal return on equity (which was hardly a new topic), the ridiculous circle-jerk vendor financing schemes concocted by the handful of top players to pretend their revenue is growth at a torrid pace (and pushing the market cap to the stratosphere), but more importantly, we highlighted the growing bifurcation within the hyperscaler space between companies that do have the cash from operations to fund their growth and massive capex budgets, and those that don’t… with Oracle the clear standout in this group. This is what we said:

Oracle crashed the AI bubble party on Sept 10 with all the grace of a bull in a China shop, when it unveiled one of the biggest circle jerk vendor financing deals of all time (more below), announcing a massive $300 billion, five-year cloud computing deal with OpenAI.

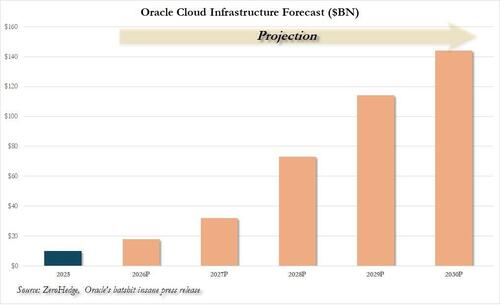

In retrospect, Oracle – which has since erased all of its gains from its deal announcement and almost all gains from its “batshit insane” hockeystick revenue projections which revealed the company added a mindblowing $317 billion in future contract revenue with just three different customers…

… could have been less painful had Oracle also not reminded everyone that it, drumroll, doesn’t actually have the money to pay for this spending orgy which is now projected to last well into the 2030s (without any recession on the horizon, of course, because nobody ever forecasts a recession).

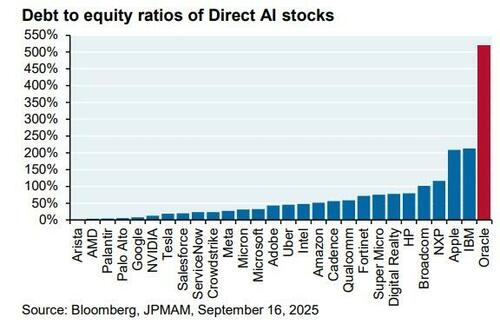

We also quoted from a recent note by JPM’s Michael Cembalest who framed the problem as follows

Oracle’s stock jumped by 25% after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt to equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google. In other words, the tech capital cycle may be about to change.

Cembalest also showed this stunning chart of debt to equity ratios for AI stocks…

… and quoted the following from Doug O’Laughlin’s Fabricated Knowledge substack:

Capital Cycles and Debt: There is no way for Oracle to pay for this with cash flow. They must raise equity or debt to fund their ambitions. Until now, the AI infrastructure boom has been almost entirely self-funded by the cash flows of a select few hyperscalers. Oracle has broken the pattern. It is willing to leverage up to hundreds of billions to seize a share. The stable oligopoly is cracking…The implications are profound. Amazon, Microsoft and Google can no longer treat AI infrastructure as a discretionary investment. They must defend their turf. What had been a disciplined, cash-flow-funded race may now turn into a debt-fueled arms race.

What happened since then is familiar to regular readers: Oracle CDS exploded as traders realized the company has emerged as the weakest AI link …

… and while its stock has now fully filled the gap from its idiotic September gap up…

… it has a long way to go if its CDS is a leading indicator…

… especially as others start looking at the fundamentals… and are shocked at what they find.

And now, with its usual 2 month lag, Wall Street has woken up.

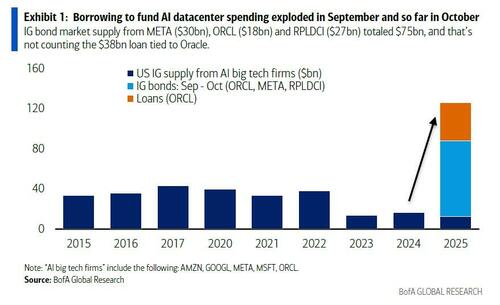

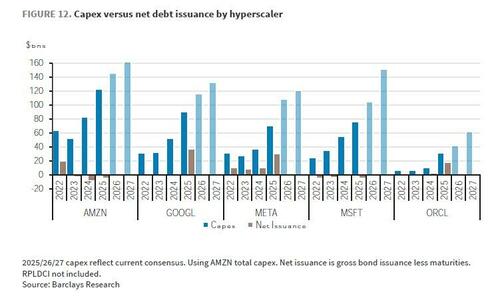

In a note published by Barclays fixed income research (authored by Andrew Keches) the bank writes that “hyperscaler [debt] issuance has overwhelmed the market and the growth of private/off balance sheet financing is also adding pressure. Issuance is likely to slow from here, but the direction of supply is higher for longer as cash flow is no longer the sole funding mechanism.”

How does Barclays trade this dramatic shift in sentiment? Simple: “We lower ORCL to UW”

Below, we go through Barclays’ key considerations one by one, starting with what we first noted in “AI Is Now A Debt Bubble Too, Quietly Surpassing All Banks To Become The Largest Sector In The Market“, namely that …

Hyperscaler supply has overwhelmed the market

While Hyperscaler capex has hardly been a secret, the key companies in the sector have remained infrequent issuers and have largely funded the spending out of cash flow. This, Barclays writes, changed recently with three of the hyperscalers coming to the unsecured market alongside two private “adjacent” transactions in the past two months. The size of the transactions is notable, averaging $25bn. Inclusive of two offerings earlier this year, hyperscaler supply across public/private markets is tracking to $160bn in 2025, $140bn of which just in the past few months.

New issue concessions have expanded meaningfully, which is notable considering the credit ratings of this cohort (META/GOOGL are both AA rated). This is just the IG universe of issuance associated with the IG hyperscalers. Funding from utilities and high yield (XAI, CRWV, WULF, NBIS) is also rising.

Ominously, Barclays writes that the pace of supply has overwhelmed the IG Tech sector and has had ripple effects across the market. More ominously, Barclays does not view this as a one-off dynamic and expect capex estimates and fundingneeds to continue to grow. That being said, the bank expects the pace of future supply to be more moderate than the recent flurry of activity. META, GOOGL, and ORCL each have deteriorating excess cash flow outlooks which is behind the coincident timing of their funding activity. And while MSFT/AMZN have much stronger excess cash positions; and while one should not rule out these two coming to market as well, they don’t have an obvious need and have the ability to be patient, especially in the context of wider spreads and higher new issue concession. As a result, Barclays view these recent dynamics as somewhat of a wake-up call to the fact that hyperscaler capex is no longer going to be funded entirely by FCF and that issuance will be higher for longer. However outside of ORCL, Barclays do not see significant credit red flags across the hyperscalers and expect IG Technology sector spreads—which quickly reached multi-year wides in the past two weeks—to march tighter as the recent supply is digested,

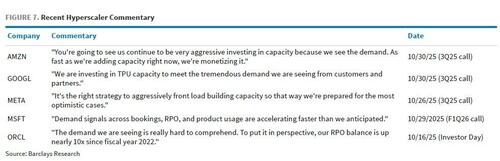

Barclays then turns to another topic we have covered extensively, namely the massive data center capex needs, or as the bank puts it “We’re gonna need a bigger boat”

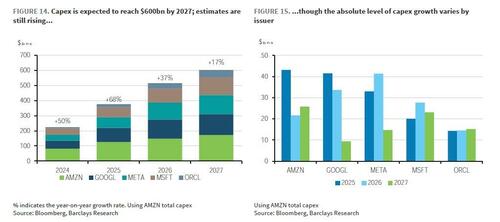

Here, the bank observes that forward capex estimates tend to be revised higher every time hyperscalers report. While there have been questions about the extent to which this pace of capex growth can persist, it is clear that the direction will remain upward over the coming years. Capex estimates have steadily increased throughout 2025, driven by new capacity announcements, strategic partnerships, and the rising costs associated with leading-edge data centers, collectively pushing spending projections higher for the coming years.

The problem here is that the cost of an AI data center can be as high as $50-60bn/GW and is set to rise even more with new generations of chips; it depends on the type of chips involved based on commentary from NVDA and ORCL and as much as 3x the cost of conventional non-AI data centers. More than half of that cost can be attributed to the compute infrastructure that fills out the DCs, such as NVDA GPUs, racks, networking, cooling, etc. Meanwhile, commentary from hyperscalers in recent public appearances suggests that a sharp supply-demand imbalance persists across the AI infrastructure market, spurring the companies to accelerate investments to take as much remaining share as they can.

Barclays cautions that the recent commentary comes despite hyperscaler capex forecasts through the end of the decade nearly doubling since the start of 2025, including an increase of 20% since early September (prior to ORCL’s latest earnings), indicating that spending could exceed already elevated expectations.

Which brings us to the punchline we first framed more than two months ago:

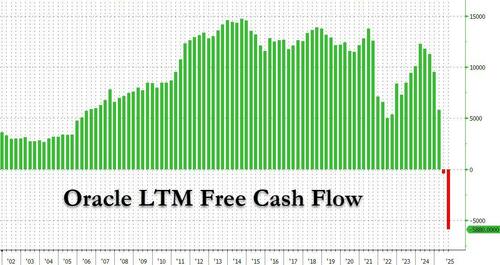

Free cash flow is no longer the sole funding source

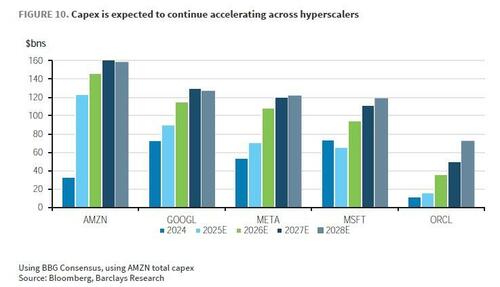

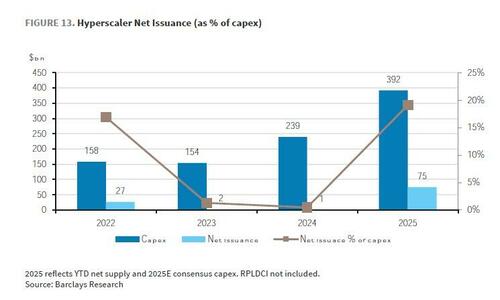

Barclays echoes what we have been discussing for weeks, and writes that despite the significant acceleration of capex, the spending has largely been funded out of cash flow while debt issuance from the hyperscalers has been modest up to this point. Each of the hyperscalers generates significant FCF with the exception of ORCL and, as a result, net debt issuance as a % of capex have been remarkably light in recent years. However, free cash flow alone is somewhat misleading, as all of the hyperscalers with the exception of Amazon send a significant amount of capital to shareholders in the form of dividends and buybacks.

As we also discussed before, shareholder returns are an increasingly important factor in hyperscaler funding, as they directly reduce the cash available to support ongoing capital investments. While Barclays projects that FCF (excluding ORCL) appears set to remain comfortably positive for hyperscalers, substantial dividend and share repurchase programs at GOOGL, META, and MSFT significantly reduce cash availability, painting a different picture when paired with accelerating capex outlooks.

This net FCF perspective is useful and explains the motivation around the recent jumbo issuances from ORCL ($18bn) GOOGL (~$25bn across USD and EUR) and META ($30bn) in recent weeks.

META that has been the most consistent issuer, bringing ~$10bn of net supply per year in 2022-2024 (in part to fund the company’s catastrophic expansion into the metasphere), while issuance from the other hyperscalers has been infrequent, with Microsoft and Amazon having negative net supply in recent years. Clearly, this dynamic is changing with META accelerating its pace of supply, issuing $30bn recently, and GOOGL coming to market twice this year to bring nearly $40bn across USD/EUR after being out of the market since 2020. ORCL has also brought sizable issuance, though the market anticipated this given the company’s already negative free cash flow and rising capex outlook. AMZN and MSFT have not come to market, but also carry much healthier net FCF outlooks than their peers. While this is not to say that AMZN and MSFT will not issue, they appear to have much less pressure to do so from a net FCF standpoint and have the ability to be opportunistic.

Taking a step back to quantify the bigger picture funding needs, we find some truly stunning numbers (if not shocking as we already laid them out back in July).

Framing the Funding Needs

Earlier this year, McKinsey estimated that AI data centers globally would add 124GW of power demand between 2025-2030, representing $7tn of spending. Barclays Thematic Research has already tracked over 45GW of announced projects targeted to come online in the US alone over the next few years, which would correspond to over $2tn of spending. The tracked pipeline, however, is understated as many data center projects are not publicly announced or lack details.

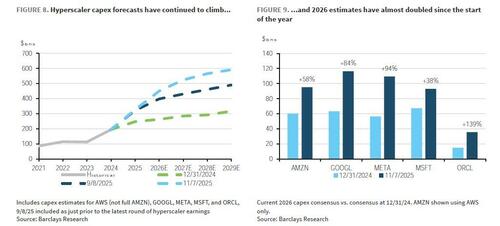

2026 will be another year of upward capex revisions. Currently, consensus is calling for aggregate hyperscaler capex to increase 37% to $515bn in 2026 (fiscal year basis) and 17% to $603bn in 2027. Though the rate of increase is slowing in percentage terms for the group (excl MSFT), absolute levels of capex growth are expected to increase for META, MSFT, and ORCL in 2026. In Barclays view, capex is inherently a lagging indicator and there is likely more upside to capex estimates.

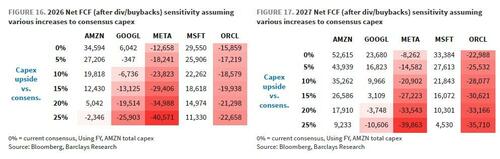

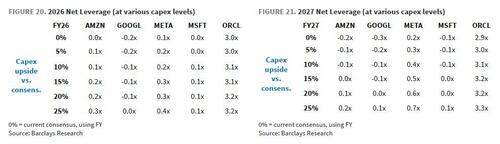

To frame the funding needs, Barclays examined net FCF after shareholder returns for each hyperscaler in 2026 and 2027 based on consensus estimates. It then sensitized this metric assuming various increases to capex estimates from here. For context, 2025 capex is tracking ~30% higher than where consensus estimates stood coming into the year.

These sensitivities show that ORCL and META are most susceptible to widening cash burns, followed by GOOGL, while AMZN and MSFT remain FCF positive on a net basis in most cases. To be fair, these sensitivities assume that share repurchases continue at levels near current, which could be a lever to pull back on, especially for META (ORCL and AMZN do not currently have meaningful buyback programs).

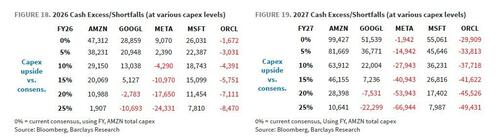

After accounting for maturities, Barclays arrives at fiscal year-end cash balances for each issuer under the these various capex scenarios. Assuming that each issuer aims to maintain a cash balance consistent with their LTM average, and then back into implied funding needs in each scenario.

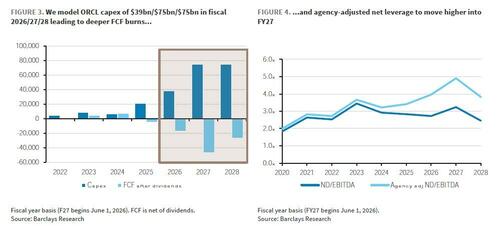

The key finding: ORCL is the largest outlier with meaningful funding needs in most scenarios across 2026/27. Even assuming no upward revision to capex, ORCL would run out of cash by the November 2026 quarter, implying substantial funding needs. These funding needs grow considerably in higher capex scenarios through fiscal 2027 (commencing June 1, 2026). It is worth noting that given ORCL’s low capex base versus peers, large upward revisions to estimates are not out of the question, especially given the pace of business wins recently. For context, Barclays’ own model has ORCL capex rising to $75bn in fiscal 2027, 50% higher than current consensus.

META also faces cash shortfalls in most cases and should remain an issuer going forward, likely in large size. However, its important to remember that META is starting from a significant liquidity position (~$80bn following its recent bond offering), so the magnitude of funding needs may not be as pronounced as implied by the sensitivity. We do not expect META to be back in the market anytime soon but it will likely remain a periodic issuer.

In theory, GOOGL may also have funding needs, though it is not as clear as with ORCL/ META. While cash dips below GOOGL’s typical ~$95bn balance in some scenarios, even in more extreme capex cases, the company would still carry >$70bn of liquidity, suggesting it could avoid funding needs for quite some time.

Barclays does not see obvious funding needs for AMZN or MSFT. Each has the ability to maintain cash consistent with current levels even under the more lofty capex scenarios, while they would build cash if capex ends up closer to current estimates. The bank does not entirely rule out supply from these two as there is an argument for adding leverage when rates fall, but strictly speaking they are not likely to be “forced” issuers. Rather, supply from these two would be opportunistic and they have the ability to be patient.

The silver lining of all this is that leverage should not increase meaningfully for most of the hypersalers, largely due to their starting points of little to no net debt. However, ORCL is the exception, as it already operates with significantly more leverage than its peers. ORCL’s leverage could also be meaningfully higher than what is captured in the analysis above as it does not account for the $100bn+ of leases signed but not yet recognized on the balance sheet (we will discuss the topic of leases in a subsequent post).Accounting for these and the higher capex assumptions, there is the potential for much weaker FCF and higher rating agency leverage.

What is the trade

Simple: dump ORCL bonds, buy ORCL CDS. Or, as Barclays puts it, “we downgrade ORCL to Underweight and recommend buying 5y CDS while selling 2035/2055 bonds.”

While Keches says that he is typically hesitant to downgrade a credit when trading near the local wides, “ORCL is a unique case”, and we certainly agree, having pounded the table on its CDS for weeks now.

The reason for Barclays’ striking bearishness on ORCL is that “the company has significant funding needs beginning in fiscal 2027 (commencing June 2026) which could limit the ability for secondaries to perform, especially when AA rated hyperscalers were coming with 10bp+ of new issue concession recently. We also see upside risk to capex estimates (our 2027 estimate is 50% above consensus); although some of this could be smoothed out via vendor financing and off-balance sheet facilities, these also create overhangs for public IG debt and would be added back by the rating agencies in many cases.”

It get’s worse: According to Barclays, ORCL will likely end up a BBB- credit, and while it certainly wants to avoid being downgraded to high yield, the combination of BBB- ratings and significant FCF burns over the next few years will leave comfort levels low. In this context, spreads can continue to re-rate wider toward other large BBB- structures that trade with beta (CHTR, autos) and recommend selling the ORCL 5.20% 2035s and 5.95% 2055s as “metrics are objectively much worse and will remain that way for a few years.”

Where could Barclays be wrong? For one, ORCL (still) has a strong equity currency; if the company used that subsidize cash flow, spreads would react sharply. That being said, the bank views equity and equity-like funding as a last resort, especially with the stock having given back all of the September rally.

Not surprising at all, Barclays also recommend buying ORCL 5y CDS. While similarly at the wides, “vendor financing appears to be a significant focus of ORCL’s funding strategy” according to Keches who may have read our October report. As this drives counterparty exposure to ORCL higher, hedging demand will rise from corporates and financing partners, which are less sensitive to relative value than other market participants. Finally, Barclays views ORCL as a quasi proxy for OpenAI risk given its $300bn backlog associated with the model builder and spreads do not look overdone at these levels (~80bp for 5y).

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her