Uddrag fra Goldman Sachs

Her er de afgørende spørgsmål, finanshusets trading kunder stiller lige nu:

- hat will stocks do if the Fed sits on their hands?

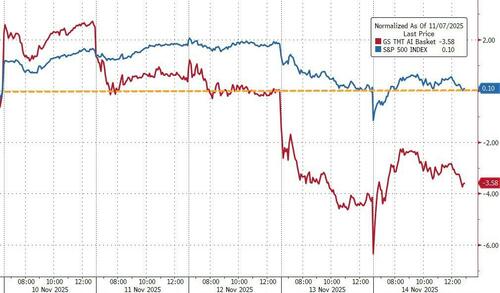

- is there any gas left in the AI trade?

- how much does one need to worry about the newfound credit component?

- as hiring stops, is the US retail investor over their skis?

- will the damage in BTC protract into the equity market?

To an extent, there’s a tell here: the trading community – who carried decent skin in the equity game for the past six months – is alert and disciplined in their risk-taking right now.

In turn, the hedge fund honcho says that the Goldman franchise saw a few pockets of risk transfer late last week.

While GS PB data doesn’t reflect a comprehensive sale of US equities, client activity on both sides of the ledger was very, very high.

Consider this: “single stocks saw the largest increase in gross trading activity in over 4 years as all 11 sectors saw an increase in gross trading flow”.

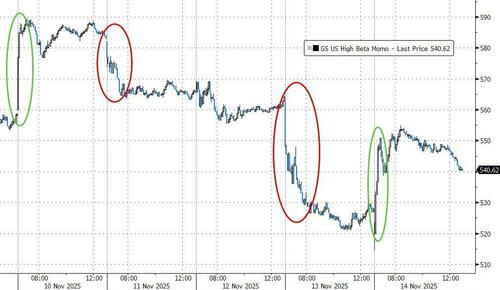

Attendant to this, the higher velocity parts of the market were intermittently taken to the woodshed, and the momentum factor was shaky…

…such that S&P and NDX (both notably FLAT in the end) understate the difficulty of managing money over recent weeks.

I’m not dismissive of these challenges.

Looking forward, I suspect the market will keep asking hard questions on the quantum and funding of AI capex (in this regard, a big card turns over on Wednesday).

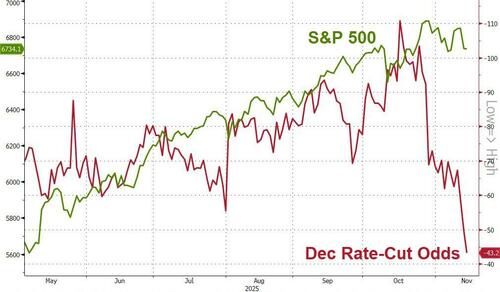

In addition, right as we’re working through a point of heavy tariff drag AND the effects of the shutdown, an increasing number of Fed members are coming out against a December cut.

Again, this tension is a photographic negative of the very tidy balance of AI expenditure / US GDP acceleration / Fed insurance cuts that had recently powered the market.

At the very least, the local trading environment has become more complicated when compared to the harvest of October, with a palpable increase in day-to-day realized volatility (at both the index level and the factor level).

This is more of an instinct than anything more formal, but it feels to me like the tails are getting a bit fatter, particularly if the Fed keeps the trading community on edge.

Here I’d register my recent emphasis on being “responsible” in your risk taking.

With ALL of this said, my baseline view is still net positive, and I’m not convinced this is the start of something rotten.

The core of my argument:

- financial conditions are easy

- US growth is set to accelerate

- and the flow of capital is supportive of stock prices (e.g. fund flows +$18bn last week).

So, while I’m again not in love with risk / reward, I reckon most of the big market dynamics are still favorable from here to year-end.

Next week is a big one in the US:

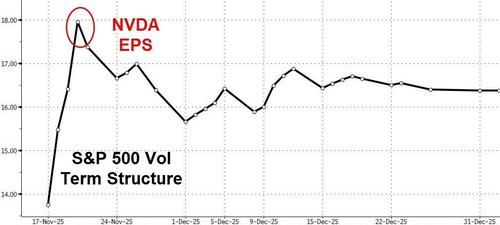

- NVDA of course (have we moved into a new chapter in the infrastructure game or not,

- a slug of retail earnings that should be closely watched (e.g. HD, WMT,

- another chop of Fedspeak (and the FOMC minutes,

- and the quirkiest payrolls report that I can remember in a long time (aka the missing September data).

Alongside financials, healthcare is the clear beneficiary from whatever rotation is surely taking place within the market (seemingly out of tech); after a blistering run, now the real question is whether earnings growth will inflect.

The CTA S&P short-term level is ~6725.

If breached to the downside, it would be the first time since one day in October, and before that, the first time since February in our work.

The signal is effectively closer to neutral currently vs. more positive before.

The SPX medium-term area for reference is around 6440 currently.

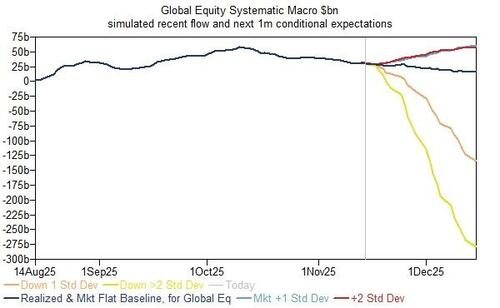

In conjunction with the vol-based investors, we expect $165bn of global equity selling over the month if the market continued lower and was down 1x std deviation or 4.4% during that time.

While easier said than done, when the options market gives you the opportunity to own short-dated gamma (say < 1-month expiry), I’d grab it.

On the index front, leading up to Friday we’ve seen client demand for downside hedges in mega-cap tech (pre-NVDA next week).

This has caused the NDX – SPX 3m 25dp implied vol spread to sit at the highest levels in the last year.

If you want to own vol, Goldman likes owning it well out the curve as longer dated vol should perform better on a rally vs. the front end.