Uddrag fra Bloomberg, Gundlach og Zerohedg

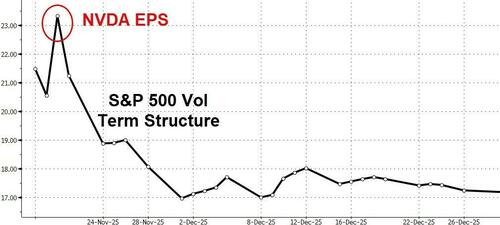

Markets chopped around early before breaking down as Europe closed ahead of a catalyst-heavy week where we will learn more on the AI story (NVDA), the consumer (WMT, TGT, HD, etc), and policy (FOMC mins, Fed speak, and NFP).

Small Caps were the worst performers with the rest of the majors down around the same 1.5% before some late-day buying (profit-taking o-DTEs) lifted stocks off their lows…

S&P 6725 – the key short-term CTA threshold – was very much the level to watch today…

…and all the majors broke key technical supports (S&P, Dow, and Nasdaq <50DMA; RTY <100DMA)

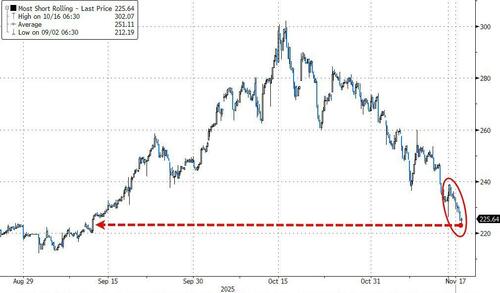

After spending most of the pre-open oscillating around zero, US stocks ended distinctly lower as no short squeeze was ignited (Most Shorted stocks are back at two month lows)…

Source: Bloomberg

Communication Services, Utilities, and Healthcare are the best performing sectors in the S&P 500 today, but are not enough to offset Tech weakness. 5 of the Magnificent 7 stocks are lagging today, including NVDA and AAPL. Hardware and crypto-exposed names — including DELL, HPE, COIN, SMCI, HOOD, HPQ – are among the worst performing names today.

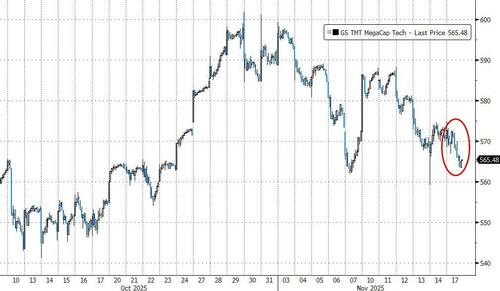

Mega-Cap tech lowest close in almost a month…

Source: Bloomberg

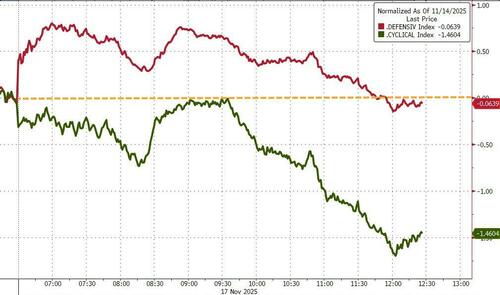

A Defensive bid was probably the biggest standout as Cyclicals lagged…

Source: Bloomberg

The weakness comes on the heels of relatively constructive data points from CSCO and HOOD last week, but ahead of results for NVDA (reports after the close on Nov-19…

Source: Bloomberg

We actually got some macro data today. Better than expected survey data for the New York Manufacturing sector along with a jump in construction spending (handily beating the expectations of a small decline), both prompted a further decline in rate-cut odds for December (down to less than 40%)…

Source: Bloomberg

Notably, late in the session, ultra-dovish future Fed chief Waller took the mic:

- *WALLER: DON’T SEE ANY FACTORS THAT WOULD ACCELERATE INFLATION

- *WALLER: LABOR MARKET STILL WEAK AND NEAR STALL SPEED

- *WALLER: UNDERLYING INFLATION EX-TARIFFS CLOSE TO 2% TARGET

It had no effect on STIRs or stocks.

Stress in credit markets is really starting to become more understood among the mainstream media (something we have been discussing for a few months)…

Source: Bloomberg

Both IG and HY spreads are starting to accelerate higher (outpacing VIX)…

Source: Bloomberg

…as AMZN’s big bond offering drew a lot of attention but despite the reported marge demand, the bonds went out significantly cheap (wider spread to the current curve…

Source: Bloomberg

…as the spread of the hyperscalers credit continued to widen out…

Source: Bloomberg

… with CRWV the worst…

Source: Bloomberg

…but ORCL’s divergence the most ominous…

Source: Bloomberg

AI/Hyperscalers CDS Run: back to buyers (buyers of CDS, implicit equity sellers) into the close

- GOOGL 5yr 36/44 10×10 +2

- MSFT 5yr 33/40 10×10 +1

- META 5yr 47/57 10×10 +2

- ORCL 5yr 105/110 10×10 +8

- AMZN 5yr 38/42 10×10 +1

- NVDA 5yr 37/47 10×10 +3

- CRWV CDS even wider now, 660-710 2×2 +65

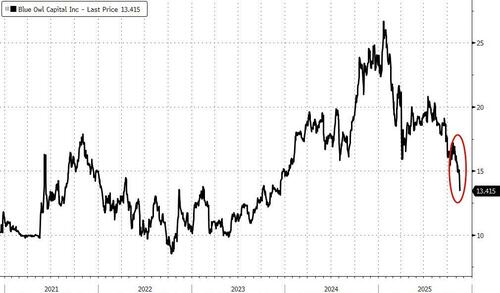

It’s not just AI/hyperscalers that are seeing problems from the credit market, Blue Owl was monkeyhammered today as private credit concerns (remember all those cockroaches) come back to haunt more Alts after the firm reportedly gated redemptions.

“Recent BDC sector volatility reflects technical market pressures, not portfolio fundamentals, which remain strong,” Blue Owl added in the filing.

Redemption requests in the non-traded fund surged last month, exceeding Blue Owl’s pre-set limit. The firm chose to honor about $60 million in redemptions, or 6% of the vehicle, according to regulatory filings.

Source: Bloomberg

Additionally, Jeffrey Gundlach commented that he is especially worried about the rapid growth of private credit, a $1.7 trillion market that lends directly to companies.

He said lenders are making “garbage loans” similar to what happened before the 2008 mortgage crisis, pointing to recent failures like auto lender Tricolor and car parts supplier First Brands Group as early warning signs.

“The next big crisis in the financial markets is going to be private credit,” he said.

“It has the same trappings as subprime mortgage repackaging had back in 2006.”

Gundlach also criticized the push to sell private credit funds to retail investors, calling it a “perfect mismatch” where there’s a promise for easy withdrawals despite the fact those assets can’t typically be sold quickly. If investors pull money out, funds may be forced to sell at steep losses, he said.

Treasuries were broadly bid (though the short-end underperformed as rate-cut odds remained more hawkish)…

Source: Bloomberg

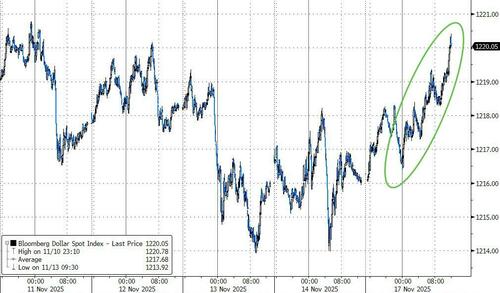

The dollar rallied strongly, extending recent rebound gains and still well above pre-Powell hawkish comments…

Source: Bloomberg

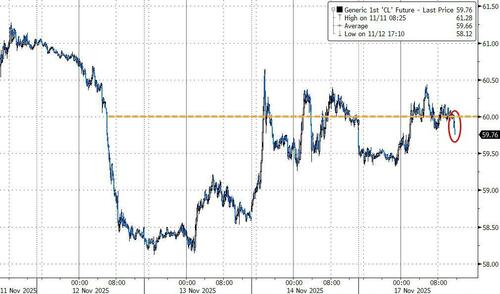

Crude prices chopped around, ending slightly lower unable to hold $60 (WTI)…

Source: Bloomberg

Gold was dumped back near the $4000 Maginot Line (breaking down as stocks broke key support)…

Source: Bloomberg

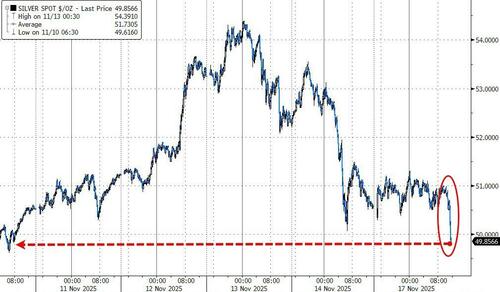

Silver was also slammed, breaking back below the key $50 level

Source: Bloomberg

Bitcoin crashed into the red for 2025, trading down to a $92k handle… triggering an ominous-sounding death cross (50DMA crossing below the 200DMA). NOTE that in April when BTC triggered a death cross, it marked the lows…

Source: Bloomberg

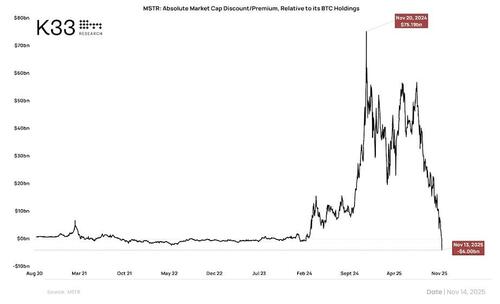

…as it appears Michael Saylor’s Strategy is under attack (mNAV now negative – the company’s market cap is less than its BTC holdings)…

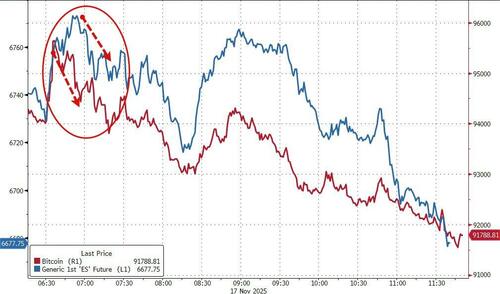

Arguably, bitcoin started today’s weakness in stonks – look at the turn around 0945ET. Bitcoin was the first to rollover (the fulcrum leverage security) which then dragged down stocks…

Source: Bloomberg

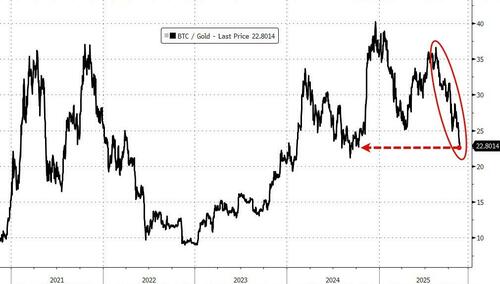

BTC continues to notably underperform Gold, now at its weakest in 13 months…

Source: Bloomberg

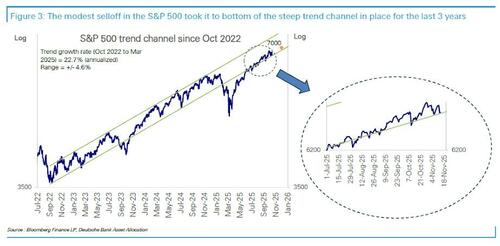

Finally, Deutsche Bank’s Jim Reid notes that the recent weakness in the S&P has taken it to the low end of the steep up-trend channel of the past three years…

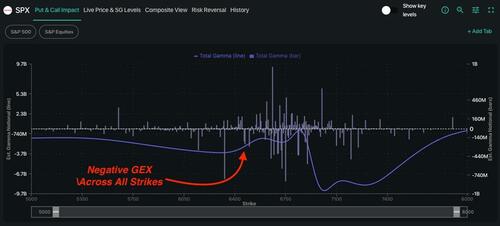

As we noted above, 6725 – the key short-term CTA threshold – remains very much the pivot point to watch (along with the 50DMA at 6709 and the medium-term CTA threshold at 6440 if you’re really looking for a target).

Bloomberg’s Michael Ball highlights the broader tactical range for the SPX is now 6,650 to 6,800, where longer-dated positioning acts as support and resistance, though that likely starts to shift with monthly and VIX option expirations due this week.

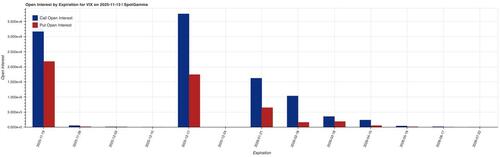

The VIX OPEX hits Wednesday morning and about half of VIX open interest expires then, so the time decay is heavy.

The rolling of these calls should suppress implied vols, which could give equities a lift, according to a recent note out of SpotGamma.

Further, they want on to point out that with the “big move” window clustered around Wednesday night’s Nvidia earnings and into monthly OPEX due on Friday, 0DTE flow is expected to add local positive gamma near 6,700 and 6,800 until the catalyst hits.

After that, the SPX is likely to resume trading in a wider range until market participants get clarity on what the Fed will do in December. And if policymakers are turning more hawkish on inflation worries, it would make sense for traders to hedge tighter future financial conditions. That makes the path for equities choppier until next month’s gathering.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her