Uddrag fra Goldman, FT, Bloomberg og andre finanshuse

Trump Tweets ≠ European Macro

Tariff headlines tied to Greenland make good copy, but the numbers barely matter. Growth has stopped contracting, earnings downgrades have paused, flows are turning, and Europe is still underowned. It’s not good, but after years of bad, getting less bad is how turns begin. Brace for short-term headline volatility, but do not get shaken out of the trade.

GS says very small effects of the 10% tariff

“While implementation is highly uncertain, we estimate that a 10% tariff would lower real GDP in the affected European countries by 0.1-0.2% via lower exports. The inflation effects would likely be very small and a Taylor rule would point to modestly lower policy rates, all else equal.”

Source: Goldman

Counterstrike

The EU is reportedly readying to ruin Davos with tariffs for the United States over Greenland. Not huge numbers yet though…

Source: FT

Past the worst?

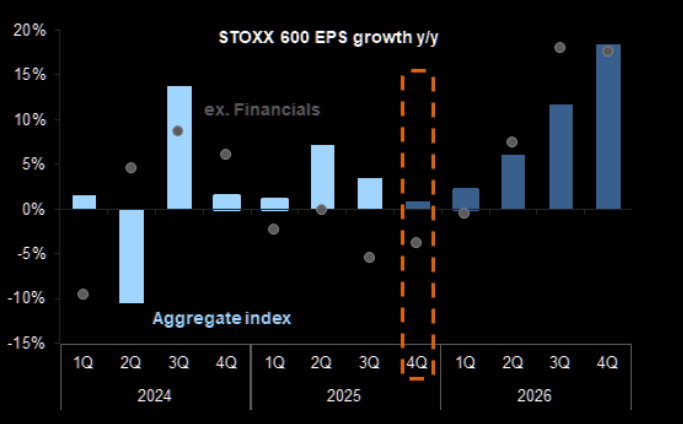

Consensus expects STOXX 600 EPS growth of a pathetic 1% year/year in 4Q 2025, which decreases to -5% when excluding the financial sector. Truly awful. But it looks like we are past the worst.

Source: FactSet

Germany got “growth”

Germany recorded its 1st year of growth since 2022. GDP rose by 0.2% in 2025 after 2 consecutive years of contraction. Modest expansion was driven by household consumption & government spending, while investment declined and foreign trade weighed on growth.

Source: Bloomberg

Recovery signs emerge

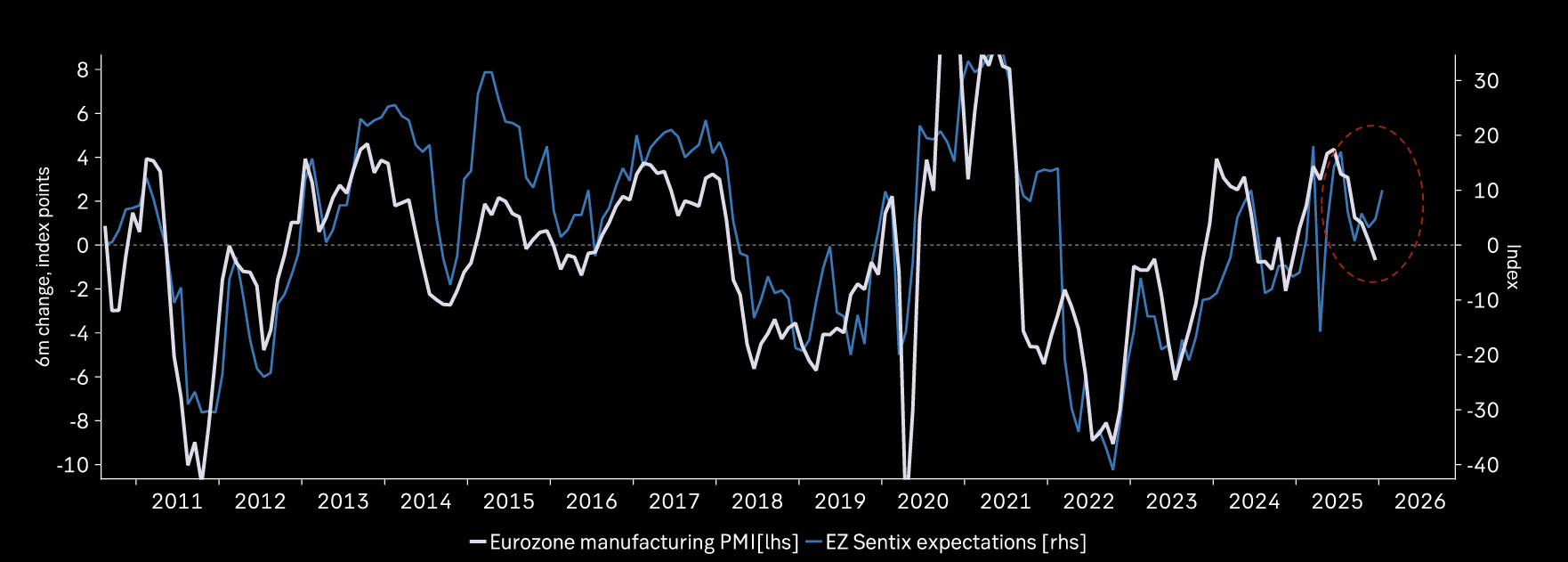

Eurozone Sentix index suggests PMI will start rising again in early 2026 – encouraging sign.

Source: Macrobond

Siren signal says

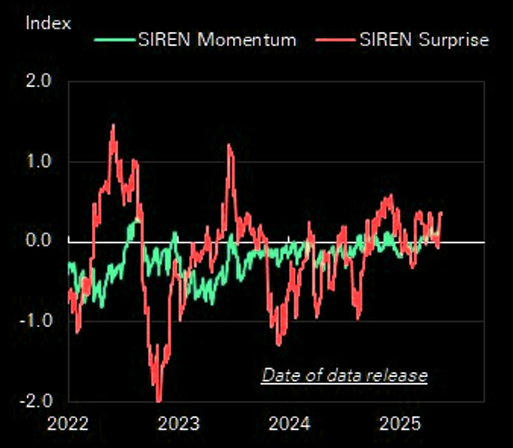

Both SIREN indices strengthened significantly, this week, also signalling a strong Q4.

Source: Deutsche Bank

At least the downgrades stopped

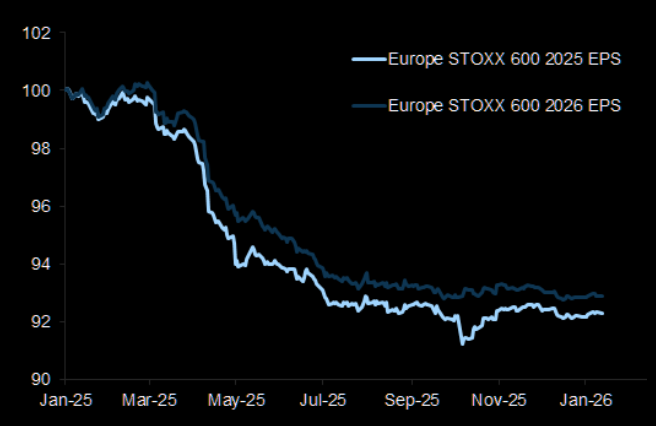

Analysts’ forecasts and companies’ guidance on 2026 earnings have been relatively constant in the last six months.

Source: FactSet

This is not how bull markets end

“Europe crossed a symbolic milestone this week as the STOXX 600 pushed through 600 for the first time – a move that’s drawn some questions about overbought conditions. The index RSI is stretched, yes, but the internals tell a more nuanced story. Only ~17% of European stocks are actually overbought, well below prior cycle peaks, and the Global Risk Demand Index sits comfortably above neutral without tipping into greed. This doesn’t look like a market that’s run out of fuel – it looks like one that’s just starting to attract attention. Positioning reinforces that view – Europe’s share of global gross and net exposure is still near the bottom of its historical range. So it seems, the rally has happened without the crowd. But of course, that’s not usually how bull markets end, it’s how they get started.” (Morgan Stanley)

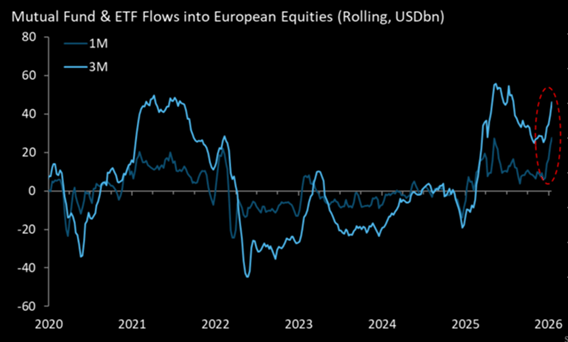

Buying

Flows into Europe going higher & stronger.

Source: MS

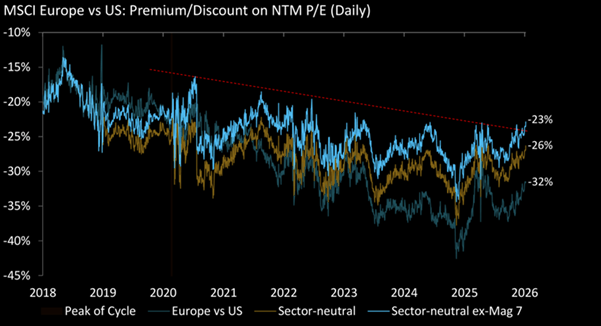

Valuation break-out

Europe trying to “break-out” from the downward trend of ever increasing discount valuation.

Source: MS

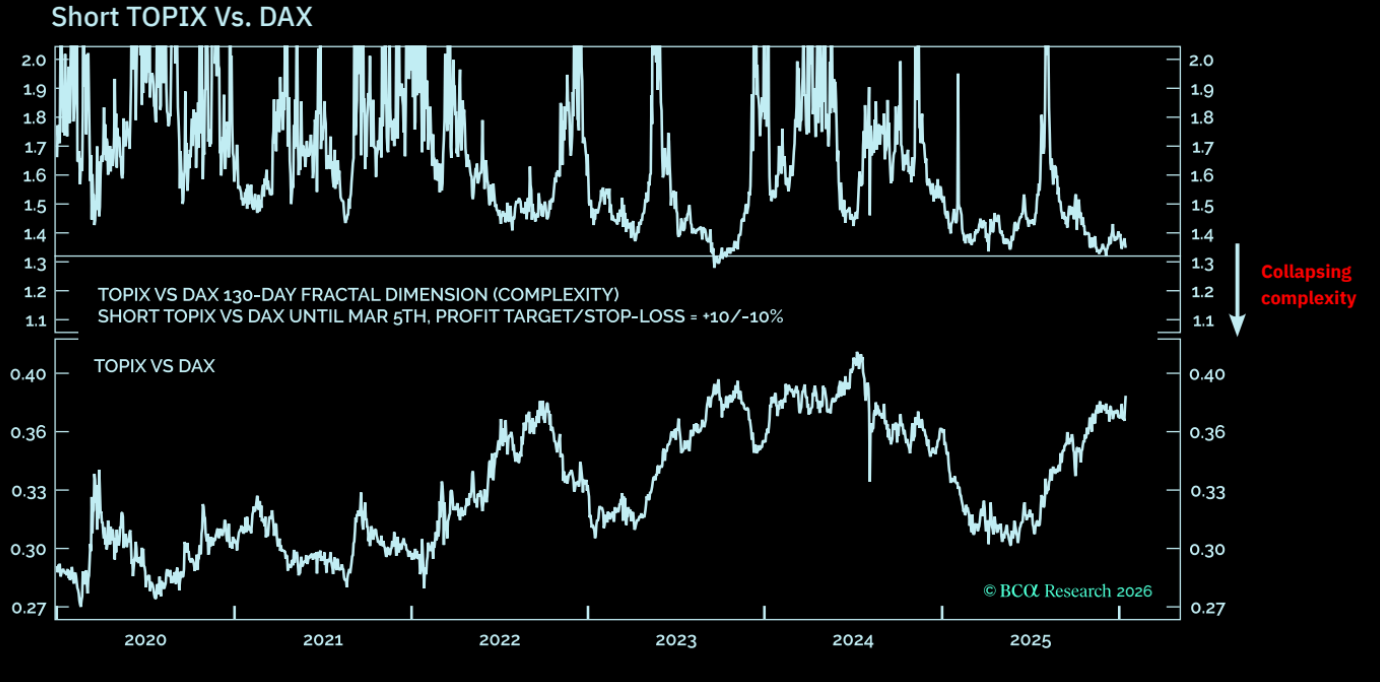

Short TOPIX / Long DAX

Perhaps not our cup of tea as we do not like pair trades like these, but anyhow worth flagging this BCA trade.

“…with TOPIX/DAX near the top of its post-pandemic trading range and the complexity of the 130-day outperformance at its collapsed lower bound, the trade is short TOPIX versus DAX until March 5th and setting the profit target/stop-loss at +10/-10 percent.”