Resume af teksten:

Japans inflation er faldet markant, primært på grund af ændringer i energitilskudsprogrammer, selvom kernepriser forbliver stabile. Bank of Japan forventes at være forsigtig med rentestigninger midt i lavere inflation og øget økonomisk usikkerhed. På 30. oktober forventes en rentestigning på 25 basispoint. Forbrugerprisindeksets inflation faldt til 2,1% i december fra 2,9% i november, mens kerneinflationen, eksklusive friske fødevarer, faldt til 2,4%. Energitilskud har bidraget til inflationsfaldet, men kernekerneinflationen, som også ekskluderer energi, forblev næsten stabil på 2,9% i december. Dette skyldes stærk lønvækst og en svag yen. Regeringens socialvelfærdsprogrammer kan støtte prisfald, og yderligere rentestigninger vurderes forsigtigt af banken. Data for Tokyos inflation forventes at vise et yderligere fald, hvilket kan påvirke Bank of Japans beslutninger om renten i fremtiden.

Fra ING:

Japanese Inflation has fallen sharply, mainly due to fluctuations in energy subsidy programs, but core prices remain firm. The Bank of Japan is likely to take a cautious approach to rate hikes amid slowing inflation and increased economic uncertainty

We expect the Bank of Japan to opt for a 25bp rate hike on 30 October

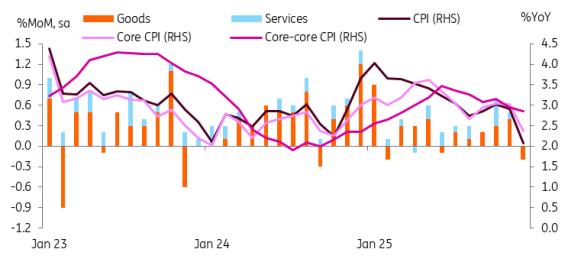

Consumer price inflation

Core inflation, excluding fresh food, rose 2.4%

Inflation slowed mostly due to energy subsidies

Japan’s headline consumer price index inflation slowed to a 2.1% year-on-year pace in December (vs 2.9% in November, 2.2% market consensus). Core inflation excluding fresh food also eased to 2.4% (vs 3.0% in November, 2.4% market consensus).

The sharp decline stemmed from changes to the energy subsidy programmes over the past two years. Not only were new subsidies introduced last month, but the expiry of energy subsidies in November 2024 set a high base for December’s figures.

Headline and core inflation are likely to decline in the first half of the year, supported by energy subsidies, lower rice prices, and expanded social welfare programs such as free tuition. Rice prices spiked 100% in mid-2025 but have since dropped to a 34% rate in December and are expected to continue cooling. Global energy price gains are also projected to slow down. Prime Minister Takaichi’s fiscal policy will also provide a wide range of social welfare programmes, which are likely to reduce some public service prices.

Meanwhile, we will see quite sticky movements in core-core inflation, which excludes fresh food and energy. It only edged down to 2.9% in December (vs 3.0% in November and 2.8% market consensus), suggesting that, aside from monthly fluctuations caused by energy subsidy programmes, underlying price pressures remain persistent. This is mainly due to strong wage growth and a weak yen.

We expect the BoJ to communicate a cautious tone about the economy’s inflationary path. Persistent core-core inflation could support further policy normalisation, but slowing headline and core inflation may lead to a wait-and-see approach in coming months.

Tokyo inflation data is scheduled for release next week. We expect it to decelerate to 1.7% YoY from 2.0% in December. This would likely reinforce our view that the Bank of Japan will maintain a cautious approach regarding additional rate hikes.

Energy and food prices pulled down headline, but core-core prices remained at an elevated level

Source: CEIC

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.