Resume på dansk fra analyse af Authers, originaltekst nedenfor

AI-FESTEN VAKLER: Er tech-giganterne ved at brænde milliarder af?

Reality check eller rene hallucinationer?

Det er spørgsmålet, der i 2026 har sendt chokbølger gennem de amerikanske aktiemarkeder.

Siden ChatGPT gik i luften i november 2022, har kunstig intelligens været børsens guldkalv. Investorerne har kastet penge efter alt med bare den mindste AI-vinkel. Men nu melder tvivlen sig: Hvem vinder egentlig? Og hvem står tilbage med regningen?

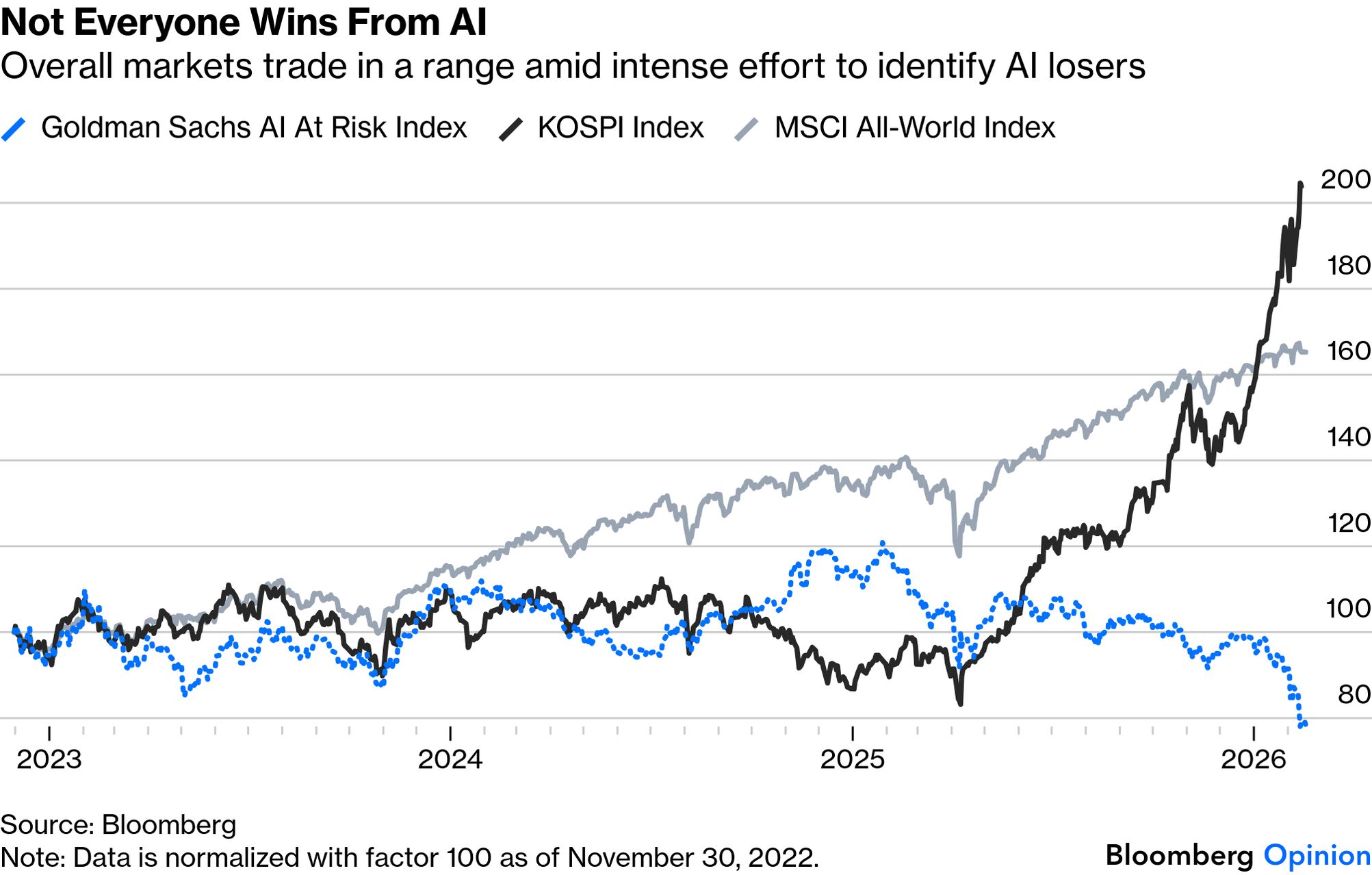

En ny opgørelse viser, at ikke alle får del i festen. Goldman Sachs’ såkaldte “AI At Risk”-indeks – selskaber, der risikerer at tabe på AI – halter markant efter markedet som helhed. Jagten på taberne er for alvor gået ind.

Samtidig er selv de såkaldte “Magnificent Seven” – Microsoft, Amazon, Alphabet, Meta og de øvrige tech-giganter – ikke længere urørlige. Ifølge Barclays-analytiker Alex Altmann er deres aktier blevet barberet ned til samme værdiansættelse som resten af markedet. Årsagen? Investorerne frygter, at milliardregningen for AI aldrig bliver tjent hjem.

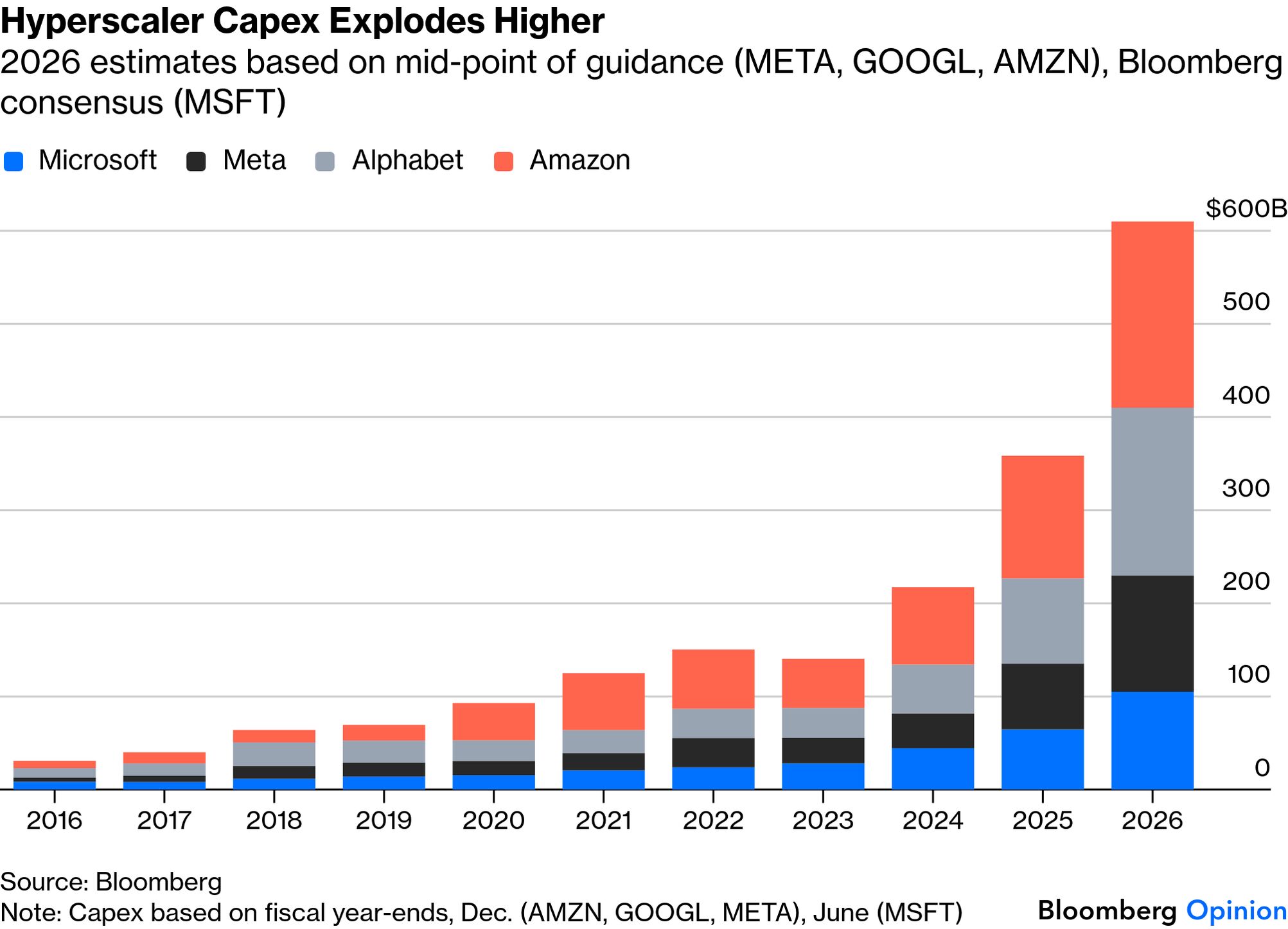

For regningen er voldsom.

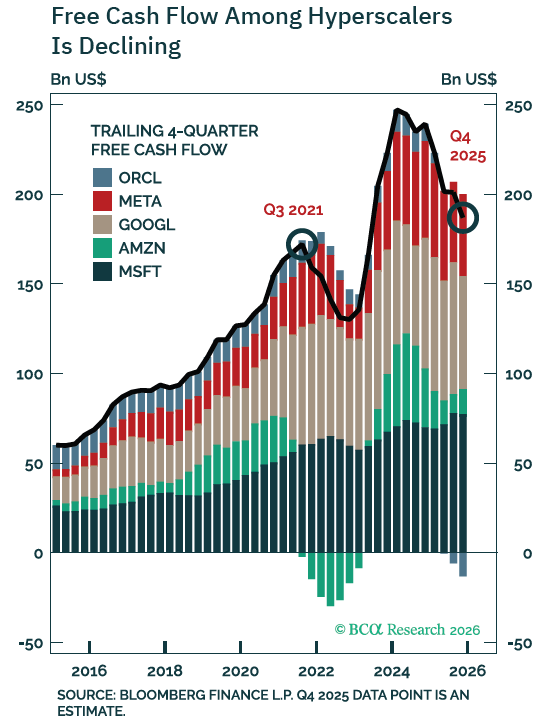

Tech-giganternes investeringer i datacentre, chips og infrastruktur eksploderer. En opgørelse viser, at deres samlede kapitaludgifter i 2026 nærmer sig svimlende 600 milliarder dollar. Samtidig falder deres frie cash flow. De er ikke længere de “kapitallette” maskiner, der bare spyttede penge ud.

Det skræmmer investorerne.

Men måske overser kritikerne et afgørende punkt: Den nuværende infrastruktur er simpelthen ikke gearet til AI-revolutionen. Kun 35 procent af verdens cloud-kapacitet er i dag optimeret til AI-arbejdsopgaver. Hvis giganterne ikke investerer massivt nu, risikerer de at stå uden kapacitet – og uden indtjening – senere.

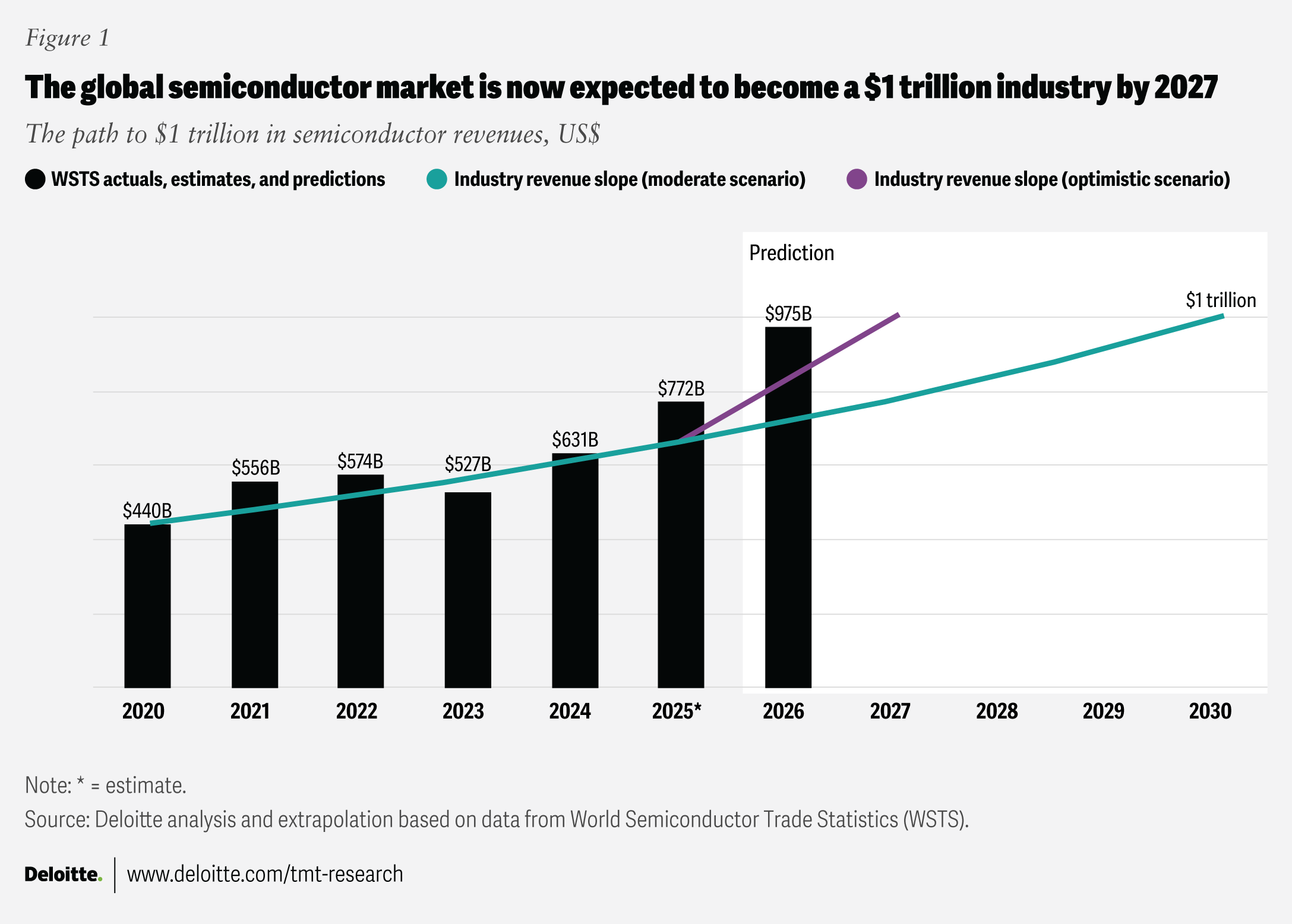

Markedet for avancerede AI-chips forventes ifølge analyser at vokse fra 116 milliarder dollar i 2024 til op mod 600 milliarder dollar i 2033. Andre vurderer, at det kan nå over 1.000 milliarder dollar allerede i 2030.

Det er dén fremtid, tech-selskaberne jagter.

Men tålmodigheden er kort. Meta viste i sit seneste regnskab, at investorerne kun accepterer de enorme udgifter, hvis de kan se konkrete resultater. Microsoft afslørede, at over 40 procent af deres cloud-forretning går til OpenAI – noget markedet reagerede negativt på af frygt for afhængighed. Amazon må omvendt afvise kunder, fordi de mangler kapacitet.

Budskabet fra flere analytikere er klart: Hvis hyperscalerne bremser investeringerne nu for at tilfredsstille nervøse aktionærer, kan det blive en historisk fejl.

“Denne industrielle revolution udspiller sig på fem år i stedet for 50,” lyder det fra en kapitalforvalter. “Og vi forsøger at værdiansætte den på kvartalsregnskaber.”

Wall Street er begyndt at fokusere på både omkostninger og gevinster ved AI – ikke kun drømmen. Det er sundt. Men risikoen er, at man stirrer sig blind på kortsigtet nervøsitet og misser en teknologisk revolution, der kun lige er begyndt.

Spørgsmålet er ikke længere, om AI forandrer verden.

Spørgsmålet er, hvem der tør betale prisen – og hvem der mister modet undervejs.

Originaltekst fra FTs Authers:

If there’s one question that has put US stocks through a bizarre start to 2026, it’s this: “Who wins and who loses from AI?” The possibilities of artificial intelligence have driven markets since ChatGPT launched on the scene in November 2022, but careful consideration of whether the immense sums being spent will ever pay off, and who will lose out if they do, has only come recently.

This chart shows the performance of Goldman Sachs’ “AI At Risk” index of companies it fears stands to lose, and that of the Korean KOSPI, starting on ChatGPT’s launch date:

Not all those committing billions to AI infrastructure will reap returns. That holds true even for the Magnificent Seven, until now treated as inevitable AI winners. Now, as Barclays’ Alex Altmann points out, they have derated back to much the same multiple as the rest of the market, thanks to concerns about their huge expenditures and the continuing opacity of their hopes to make a return on the investment. The needle may have moved too far:

The near-term path of the hyperscalers and the AI narrative attached to them is the most-debated topic by investors at present given they are still delivering best-in-class earnings growth and now the least crowded versus the market in over 15 years.

Spending such large sums carries risks, evidently. The hyperscalers have long been “capital-light,” an advantage over old-line industrial companies; that is no longer the case. Also, as this chart from BCA Research shows, a direct consequence is to leave them with less free cash flow.

BCA Research’s Peter Berezin points out that free cash flow still exceeds capex for most of the hyperscalers, so they don’t have to rely on external financing. But it understandably stirs a a perception of overinvestment, as noted by the majority of money managers in the most recent Bank of America fund managers survey.

These concerns may miss a crucial point — that this capex is necessary because current infrastructure is inadequate to carry all the hoped-for advances. A recent Bloomberg Intelligence report found that only 35% of global cloud computing infrastructure is optimized for AI workloads. That suggests hyperscalers’ increasing capex is justified if they want to be able to turn a profit:

BI projects that the shift from central processing units (CPUs) to graphics processing units (GPUs) could help expand the market for advanced chips to about $600 billion by 2033, from $116 billion in 2024. Other estimates suggest this is conservative. Deloitte projects that AI chip sales will top $1 trillion by 2030:

Predictions like this explain why hyperscalers don’t want to take their foot off the gas. But still, Meta Platforms’ recent earnings underscore a key reality — investors are more willing to tolerate costly buildouts when companies can prove that earlier spending is already feeding through to profits.

How do companies that still need to make substantial investment avoid investors’ wrath? Berezin argues they may ultimately scale back their spending to appease shareholders. That would bring the AI capex narrative close to breaking point — but such a pragmatic response wouldn’t deal with the fundamental problem that the current computing infrastructure is inherently constrained.

Alpine Macro’s Noah Ramos cites recent earnings from Microsoft and Amazon to show that tech groups should stay the course. Both demonstrated that they badly needed the extra capacity the capex would buy for them. Microsoft said that over 40% of its cloud business was going to OpenAI, which the market hated due to concentration risk, while Amazon’s cloud business has a backlog, forcing it to turn away business:

For a hyperscaler to not build out the infrastructure, they’re deferring revenue further and won’t be able to capture it. The risk of not building out in the short term due to having a market pullback does not outweigh the long run.

In other words, short-term concerns might drive a long-term mistake. To quote Shaia Hosseinzadeh of OnyxPoint Global Management, “This industrial revolution is unfolding in five years instead of 50. And we are trying to value it on a quarterly earnings model. No one alive has firsthand experience investing through a shift of this speed or magnitude.”

Hosseinzadeh notes further that Wall Street’s habit of applying linear models to non-linear change is fault-prone and risks systematic over- or underestimates. After all, nobody predicted Amazon’s hyperbolic growth after the dot-com bust.

Wall Street’s new emphasis on both the costs and benefits of AI, rather than just the benefits, is a healthy development. But it shouldn’t be taken too far.