Fra Seekingalpha:

Summary

Bitcoin explained by a former bitcoin miner.

Parallels to the famous tulip mania.

When to invest and what return to expect.

I was a Bitcoin miner

Several years ago, when distributed computing started to take off, I became interested in Bitcoin as a curiosity. I joined a mining guild and made the computing capacity of my computer available for mining. I mined for several months, before I decided to put my spare computing capacity to more altruistic use with the World Community Grid. Instead of pursuing riches, I am helping to cure cancer now.

Back then it was a curiosity concept that got coverage in computer magazines, but never any attention in mainstream media, let alone in the business press. With the current craze about Bitcoin, let’s see what history can teach us.

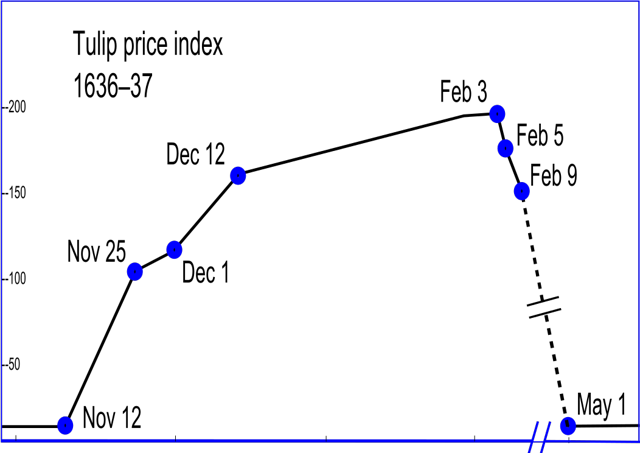

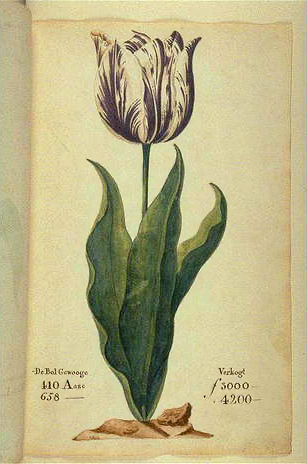

The Tulip Mania

The tulip mania of 1636 in the Netherlands is generally considered the first recorded speculative bubble. Formal future markets were introduced first in the 17 th century in the Netherlands and the object of speculation became rare tulip bulbs that at the height of the bubble sold for more than 10 times the annual income of a skilled crafts worker. The mania ended with a spectacular crash: “Tulip mania reached its peak during the winter of 1636–37, when some bulbs were reportedly changing hands ten times in a day. No deliveries were ever made to fulfil any of these contracts, because in February 1637, tulip bulb contract prices collapsed abruptly and the trade of tulips ground to a halt”

Tulip prices to this date haven’t reached their former heights again.

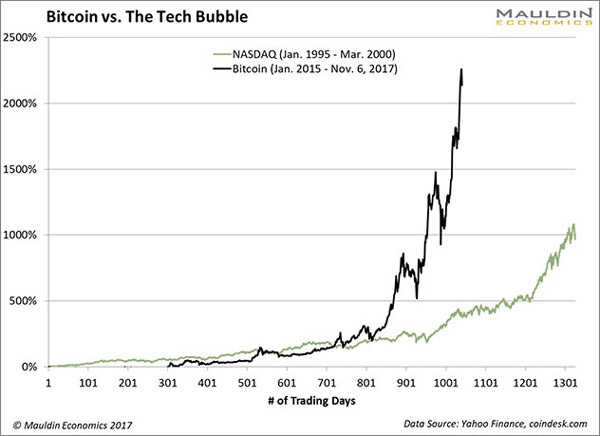

The first bubble I participated in was the famous Tech Bubble. See how Bitcoin compares. Bitcoin is on a tear, and everyone wants a piece of it.

The Bitcoin Mania – Even Grandma wants in on the action

An article with this headline published in Wall Street Journal on November 29th, detailing how Grandma Rita Scott was convinced by her grandson to put a few hundred dollars into Bitcoin.

As Bitcoin value approached 10.000 USD they sold for a net profit of 45%. Grandma Scott didn’t even know what she was buying into:

“I thought it was a big coin,” the 70-year-old said. “I didn’t even know what it was, a piece of coin? Why would I invest in a piece of coin?”

But she liked the result, stating that she hadn’t had this much fun with her T. Rowe Price investment funds.

She might still harbor some regrets, now that the Bitcoin value has soared past $17.000. The agony of missing out on gains can easily wipe out the joy of winning.

The crypto currency that evolved from obscurity

Bitcoin was conceived in the doldrums of the 2008 market meltdown, when the regular banking system came near a global collapse. It is accredited to a person using the pseudonym of Satoshi Nakamoto who published in November 2008 a paper under the title: Bitcoin: A Peer-to-Peer Electronic Cash System. The bitcoin software was released under open source code in January 2009. To this date the identity of Nakamoto remains unknown.

The BitCoin Miners

The software released essentially entails an organized search for difficult to find numbers, called nonce. You can envision it as a form of massive hacking attempt to find the access key to a cryptographically secured password. If you crack it, you obtain a block, which gets exchanged for Bitcoins. Early on the keys you had to crack were short, so it was easy, but the network continuedly adjusts the difficulty requiring more processing power and time to find the next one. Imagine a password that has only 2 digits, who can be either 0 or 1.

4 attempts of combinations will open it:

11,01,10 or 00

When you extend to 3 digits it will take 8 attempts:

111,110,101,011,100,010,001 or 000

The longer the key, the longer it takes.

In the Bitcoin world, this isn’t called “cracking” but rather “mining”, conjuring the image of digging for gold.

Early on, computers could find a nonce fast, but as the difficulty got elevated, it required more and more processing power. As it turns out parallel processing capability is preferable to the serial processing of computer processors. Modern graphics cards excel at this. In the race to mine Bitcoins the fastest graphics cards gave you an edge. This led to an un-expected demand for Nvidia (NVDA) graphics cards in the early days, as they were ideal for mining. These days specialized computer chips designed for the sole purpose of mining bitcoins are deployed. Nvidia graphic cards are still in use for other digital currencies.

There is a cost associated with mining, and that is the electricity to run the computer. The usage could spike high enough that the police raided bitcoin miners in the search of illegal weed growing operations.

As finding a bitcoin block got more and more demanding, mining corporations sprung up. Essentially a mining corporation or guild used the distributed computing power of its members to search for bitcoins and then shared the bounty with all, minus an administrative commission. An individual miner didn’t have to go for the all or nothing option anymore, he obtained fractions of a bitcoin.

The race was always to find the next block first, as the one after it gets subsequently harder and if you weren’t first, all the computing time invested was lost. That explains why Nvidia was constantly sold out on the newest most bitcoin-worthy graphics cards.

The total number of bitcoins is limited to 21 million. The last bitcoin to be mined is expected for 2140. So there will be a limited supply.

The bitcoin banks

You have found “virtual gold” – what to do with it? Bitcoins are stored publicly in something called a blockchain, which is the equivalent of a security box that resides on multiple networked computers. Your ownership is secured with an almost un-crackable private key. Just yesterday the CEO of NiceHash announced some $75M worth of bitcoins stolen in a successful hacking attempt, so “almost” is the correct description.

As an individual if you lose the key you lose the bitcoin in your deposit box. There is no central key to get it back.

Paying with BitCoin

A virtual wallet stores the information necessary to access and transact with bitcoins. With your private key you can re-assign bitcoins to someone else. These transactions can happen without any proof of your identity, which made it attractive for all sort of illicit activity on the dark net.

Bitcoins are the equivalent of digital cash, not a check or a wire transfer, where you can easily identify the sender.

Bitcoins have three useful qualities in a currency, according to The Economist in January 2015: they are “hard to earn, limited in supply and easy to verify”

It is still debated though whether bitcoins are indeed a currency, as they do not have backing of any government. Where it becomes real is at the bitcoin exchanges that trade bitcoins for any other global currency.

The “real world” value of bitcoin

So far bitcoins look like the Gedankenexperiment of some unknown mathematician setting out to build an alternate currency to save the world from financial Armageddon in case the traditional banking system breaks down. How does this currency compare to the greenback?

Ever since the US abandoned the tie of the US dollar to gold as a physical commodity in 1944 with the Bretton Woods agreement, the US has had a fiat currency.

Merriam Webster defines fiat as follows

Fiat: a command or act of will that creates something without or as if without further effort:

Example: Fiat lux = Let there be light!

For a fiat currency to work and replace bartering (the exchange of physical goods) it must have the trust of the population. The currency is typically backed by a government. The value of fiat currency is determined by the relationship between supply and demand. If the central bank fires up their printing presses, they can churn out a lot more notes, but they would be subsequently be valued lower as the supply increases. Money is being used as an intermediary for physical goods and services. If the relative value of those goods and services stays constant, doubling the amount of currency ends up doubling the price. You have double the money with half the purchasing power, getting you exactly the same amount of goods as before.

How much is a bitcoin really worth?

Let’s start with an easier question: What is the cost of a bitcoin?

Miners pay real world dollars to invest into computers commonly called bit mining rigs (capital) and then electricity to operate them (running cost).

If bitcoins cost more to generate than their trade in value in USD, the mining economy would collapse. First the capital would dry up, as it isn’t worth to spend thousands of dollars on new mining rigs and then bit by bit the existing rigs would be shut down as the cost of electricity exceeds the value of the bitcoin generated. No different than the fracking drilling rigs really….

As of Nov. 30 th this year according to one calculation published on Quora you need 13,684 kWHrs to generate one bitcoin. In comparison a typical US home uses about 11,000 kWhrs per year. At the average rate of electricity of 12 cts/kWhr in the US, that equates to 1642 USD just for the operating costs. The Antminer S9 rig that was used for this calculation is available for purchase on Amazon for about $5,500. For $7,200 you too could get into bitcoin mining. But I wouldn’t recommend it. By the time one Antminer finds a bitcoin block, the goal post will have moved. If someone else finds it first, your work gets discarded and the clock restarts. You are competing with data center size installations, some of them located in Iceland where energy is cheap.

This has grown into a veritable industry. As a former bitcoin prospector, I couldn’t compete anymore.

Let’s assume that the Antminer has to pay back in a year as it will obsolete quickly. The cost of generating a new bitcoin in the US equals about $7,200 today. In a country with lower energy cost, it could go as low as $6,400.

This is the current price to continue increasing the supply of Bitcoins.

Assuming a 20% profit that calculates to around $7,800-$8,640 for a brand-new bitcoin. The lower floor is the variable cost of electricity: $400 – $1600/bitcoin

Unlike the oil industry which is solely dependent on the selling price of oil, in bitcoin mining, the difficulty of finding a bitcoin block is dependent on the aggregate computing capacity assigned. The time to find a new blockchain is kept nearly constant. If the computing capacity doubles, the task will get doubly difficult, taking the same time. If everyone else would stop mining completely, your own desktop computer would be sufficient again to do some mining. The cost of mining is variable and drops with less market participants. Of course, that would have to be precipitated by a massive price drop of Bitcoins, causing everyone else to fall below variable cost.

What is a bitcoin worth?

As a fiat currency, it’s worth is defined by what people agree on. That’s it.

There is no intrinsic or residual value. Gold has one as it is used for industrial purposes. The value of bitcoin can range from zero to any number in the universe.

If you have lived with the dollar all your life, just look at Europe. They have gone from lira, francs, Deutsche marks and other local currencies to the euro. All previous currencies are worth exactly zero, as agreed to by the European governments. Venezuela is in the process of driving its currency value close to zero, due to the actions of its government.

With bitcoin, there is no central bank or authority. It is up to all the holders of bitcoin to determine the value. The same is true for trading baseball cards. The same was true for tulips during the Golden Age speculation in the Netherlands.

But the banks are getting into bitcoin, so it is gaining legitimacy?

Banks are not getting into bitcoin. They are getting in the business of making money off bitcoin. With a current bitcoin market value of about $280B, which is the equivalent of the market cap of Walmart (WMT), and a lot of giddy trading going on, they want a piece of the trading fees. Just remember, they will make money every time you trade. The don’t care whether the value of bitcoin goes up or down. Banks offer the same service on pork bellies. They don’t usually ever own pork bellies. It also means you shouldn’t invest into pork bellies just because the banks are “in it”. I would contend, that the concept of a pork belly is easier to understand than that of a crypto currency using blockchains stored on the computers of the world. And pork bellies have some residual nutritional value. Maybe not such a bad idea in comparison after all. If the pork belly market implodes, you would still have left plenty to throw a BBQ.

Why is bitcoin going up so much in value?

What you are looking at is a massive momentum trade. The expectation that price will continue to go up, attracts more speculators, which keep driving the price up, thus confirming the expectation. Most of the investors are still private, owning fractions of a coin like Grandma Scott. Bitcoin is going up in price, not in value.

As Warren Buffet worded it:

Jamie Dimon CEO of JPMorgan Chase doesn’t mince any words when it comes to bitcoin. He thinks that people who buy bitcoin are stupid.

What we are experiencing is a live manifestation of the “greater fool theory”. The theory states that buying something with the sole expectation that there will be another someone in the future, that will pay you a higher price is viewed as rational behavior for justifying the current price. Of course you eventually run out of fools.

It reminds me of a 2007 Money Magazine story I read, that featured a 23-year-old on its title espousing how he made millions flipping condos. Reading the article, he had 200k USD to his name and 3million USD worth of mortgages on several condos. He claimed it was so easy to make money this way and that he couldn’t loose, as house prices would always go up. I am still wondering what happened to him. It wouldn’t surprise me if he is invested in bitcoins now.

Unlike housing, bitcoin doesn’t even have a clear agreed upon narrative. The only argument for why it should be going up, is… well. It’s going up!

When you should invest in bitcoin

I’ll highly encourage you to invest money into bitcoin if you meet any of the following criteria:

– You are young and you “know” bitcoin will change the world

– You want to get rich in a hurry

– You don’t mind being called “stupid” by one of the most successful banking CEOs

– You can’t stand to be the odd man out in your peer group

– You like bragging about your smarts in investing. You will gain invaluable insights:

– You’ll get a full emotional investor profile of yourself

– You’ll get a chance to experience the emotions of greed, hubris, fear and despair on a highly condensed time line (and likely in that order)

– You will make lots of new friends, that share the bond of a once in a century experience, unless you were the one recommending they invest

– You will come out of this experience as a better investor, unless you succeed in making money. Then I am afraid you will be on a lifelong quest to find the next bitcoin for another “kick.”

When you should not invest in bitcoin

I discourage you to invest money if you meet any of the following criteria:

– You can’t afford a total loss of the money invested or even a partial loss

– You don’t have a computer, don’t trust credit cards or online banking

– You like stashing your money away under your mattress

– You think bitcoin is a piece of a coin

– Your underage grandson thinks this is the coolest way to make money.

By all means however encourage your grandson to invest some of his own allowance. I’d recommend a sizable chunk of his savings. Enough to hurt when being lost, but not so much that it will impact his life or life style. You will provide him with one of the cheapest lessons for his investing life. What he’ll loose in money, he’ll gain in wisdom. Also have him contact me via the comment section. I have it on good authority from a Dutch friend that the tulip market is finally going to make a comeback and can provide him with a bargain priced access to some rare tulip bulbs.

If bitcoin sounds too impersonal for you, there is an alternative called Cryptokitties, where you can sell cute virtual kittens for up to $100k.

I am long bitcoin

If memory serves me well, I ended up mining about 0.1 bitcoins, before I called it quits. That fraction of a Bitcoin is worth about $1700 today.

Now if I could just remember where I placed my digital purse….

Disclosure: I am/we are long NVDA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.