Uddrag fra Zerohedge/Bank of America

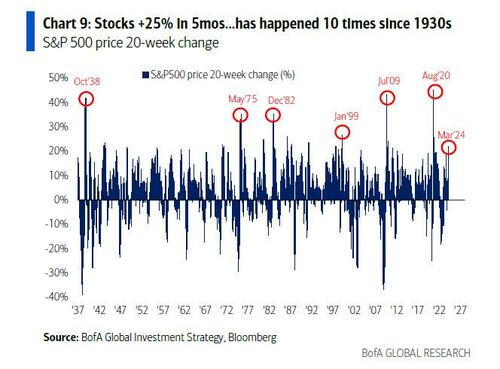

The key theme of Michael Hartnett’s Flow Show last week was his observation that market moves such as this one – a 25% surge in 5 months – have only happened at extreme events: either during recession lows (as in 1938, 1975, 1982, 2009, 2020) or at the start of bubbles…

… and since the politicized NBER would never admit that the US is in a recession just months before the election, the only conclusion we can reach is that this is, in fact, a bubble (not like one would need much convincing after seeing the price action in tech stocks in recent months).

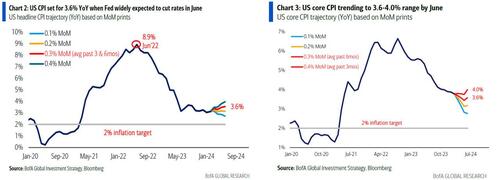

Of course, every bubble has an Achilles heel, and this one is no different… and can be summarized in one word: “inflation.” Indeed, rising prices are always the pin that pops an asset price bubble, and yet there is something odd about this cycle. You see, as Hartnett writes in his latest weekly Flow Show (full pdf available here to pro subs), after troughing back in June 2023, US headline/core CPI is again trending higher, and as the base effect fades, CPI will rise to 3.6-4.0% by June which – curiously – is when the Fed is expected to cut rates.

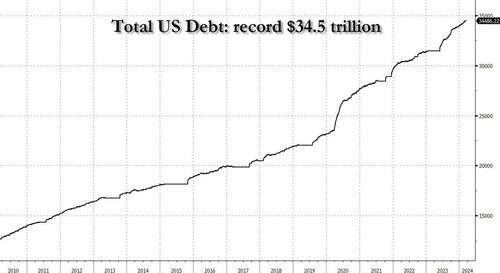

It is this expectation of Fed starting the next easing cycle just as inflation is set to hit a one year ago, which to Hartnett suggests that the Fed is tolerating higher inflation (which also eases the record US debt burden at $34.5 trillion) and has tacitly accepted a higher inflation target than the historical 2%, just as we said it would two years ago…

… and since the Fed is now telegraphing weaker policy credibility, that means a weaker currency is just a matter of time, and explains “why crypto & gold at all-time highs.”

And speaking of the US debt, it’s not like frequent readers don’t know what is going on, but that $34.5 trillion in debt won’t grow itself..

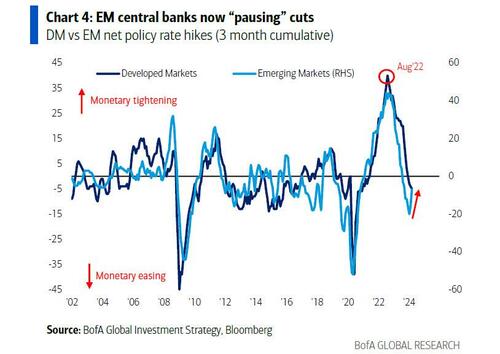

Turning to the economics of it all, Hartnett cautions that it this creeping rise in yields means the macro picture is gradually shifting from a benign “Goldilocks” in Q4 ’23/Q1 ’24 to a malignant Stagflation in Q1/Q2: inflation is up in DM & EM (EM central banks now “pausing” cuts)…

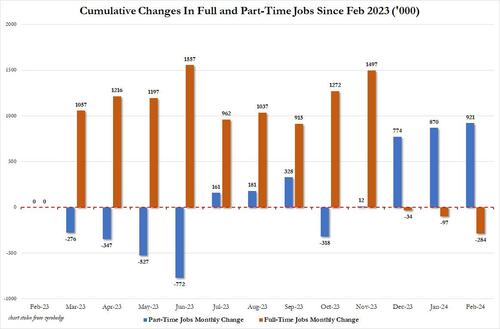

… while the US labor market is finally cracking, with full-time payrolls down 3 million jobs in 3 months…

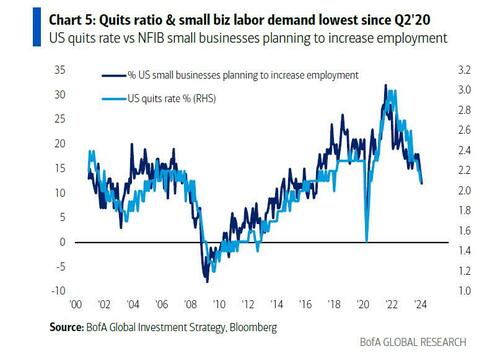

… quits ratio and small business labor demand down to lowest since Q2’20 lockdown.

So while the US economy in Q4 was a “Goldilocks” 3% growth and 2% inflation, in Q1 we are seeing sub-2% growth & 3-4% inflation, which of course means Stagflation… and it’s why oil is now handily outperforming Nasdaq YTD!

Of course, one can come up with a more creative name than just stagflation, and Hartnett has done just that, hence…

Goldishocks, which Hartnett frames as follows:

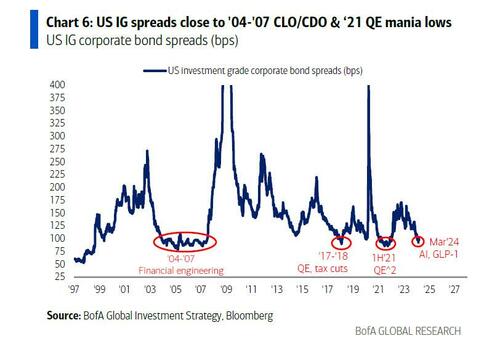

- US stocks & crypto joined by Japan & corporate bonds buzzing with euphoria on prospect of “Fed cuts = Goldilocks”;

- US IG credit spreads (95bps) close to ’04-’07 CLO/CDO (79bps) & ‘21 QE mania lows (86bps);

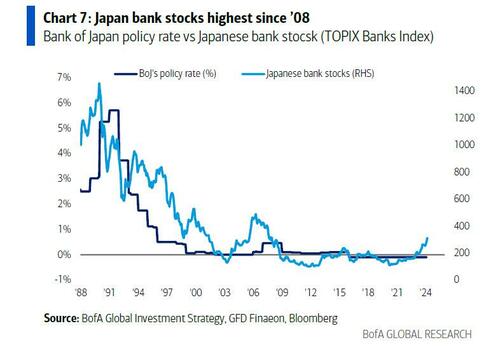

- Japan bank stocks highest since 2008 on end of Japan deflation (albeit still 80% below 1990 levels);

But, as noted above, in market bubbles (Japan/internet/China, etc) the macro, policy, rates were irrelevant until central banks or real rates cause pop; but if we do get the first Bank of Japan rate hike since Feb’07 next week, while a weaker US labor market and ebbing US monetary and fiscal credibility cause stronger yen, wider credit spreads & higher bond yields, then the macro will once again start dominating the bubble, and a new bout of stagflation means outperformance of gold, commodities, crypto, cash, a big steepening of the yield curve, and a very contrarian equity barbell of resources & defensives.