Uddrag fra John Authers, FT:

Of course, this hasn’t been such an uneventful time. Only days ago, the banking turmoil led traders to question whether the Fed should hike at all. As Points of Return noted yesterday: Hike 50 basis points and markets would panic; hike 25 and add further pressure to an already stressed banking system; or hit pause and signal to the world that the Fed lacks faith in the financial infrastructure and its own crisis management.

Once seen as the base case to cope with increasingly entrenched inflation, a 50-basis-point hike came to seem extreme. Some, like Nomura Securities, were even predicting a rate cut. They changed their predictions because of the problems that have suddenly afflicted banks. The question is how to gauge and respond to those problems. Estimates for the effect of the banking crisis have ranged from a hit to the economy equivalent to a rate increase of 1 percentage point (Yardeni Research) to half-a-percentage point (Bloomberg Economics). Powell acknowledged that banking problems tighten credit conditions and help the Fed fight inflation — but it’s still not clear how big or durable the effect will be.

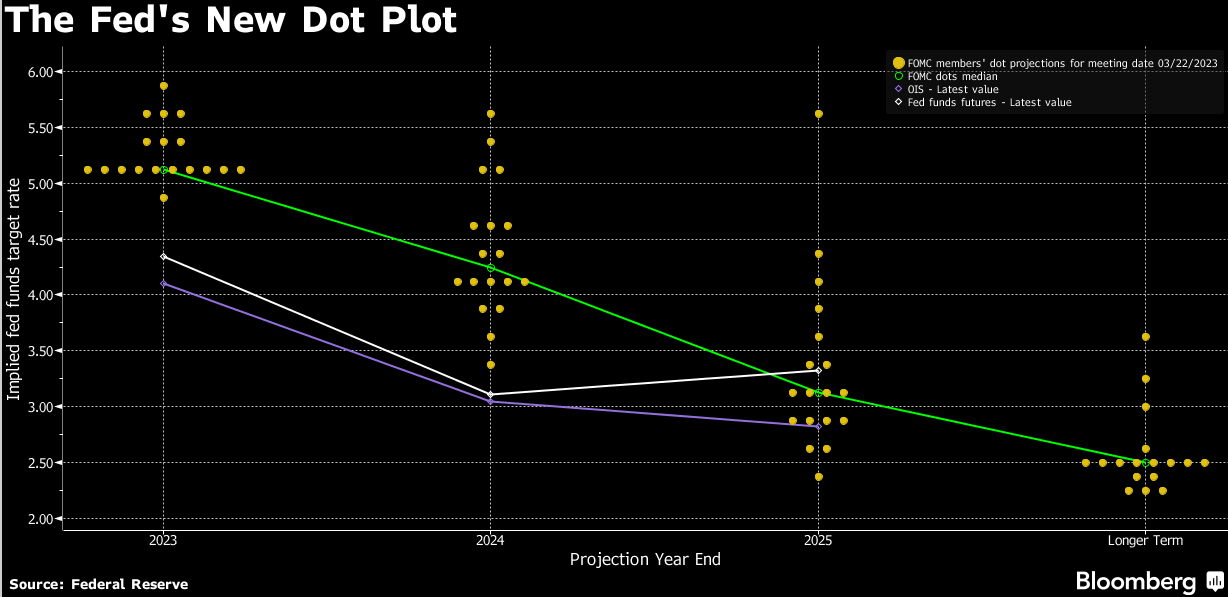

As it stands, the Fed has found middle ground by coupling its rate hike with language that doesn’t pre-commit to more hikes in future — or a “dovish hike,” in the jargon. Critical to this was the summary of economic projections, or “dot plot,” in which the prediction of each committee member for future fed funds rates is shown as a dot. The FOMC now thinks that rates will end 2023 at about 5.1%, unchanged from their median estimate when the dot plot was last published in December:

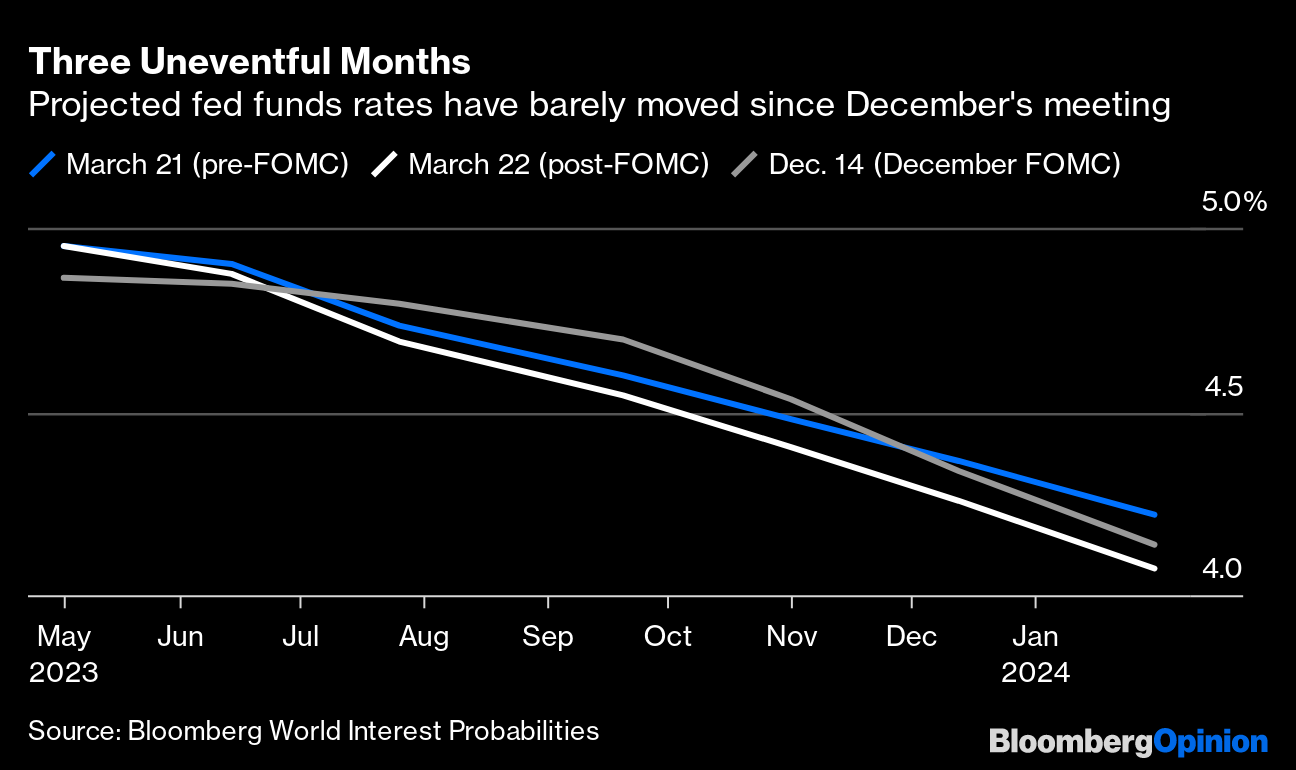

There are two more important points to be made about the dot plot. Powell and his colleagues “just don’t” see rate cuts this year. “Rate cuts are not in our base case,” he said. They are, however, the base case of the market. While the Fed is saying that rates will be above 5% in December, so the market is still betting against this, with its implied rate for December now only 4.22%, almost a full percentage point lower. Neither side has shifted in three months.