Uddrag fra John Authers:

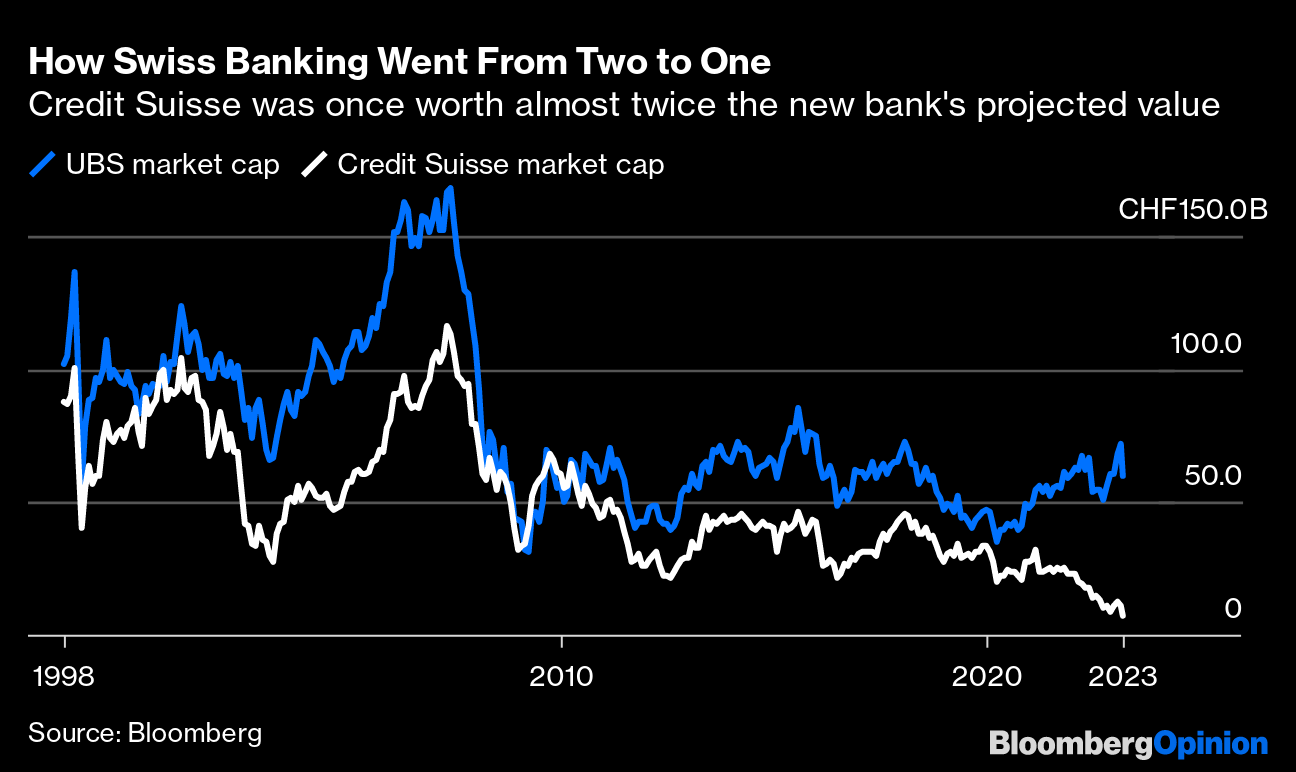

Credit Suisse will cost its long-time rival only 3 billion Swiss francs ($3.3 billion). It’s a brutal fate for a proud franchise. This is how its market cap has compared to UBS since the latter completed its founding merger in 1998:

At the time of writing, the deal appears to have been well received in Asian markets, but there is no guarantee that this will continue. Credit Suisse is by far the biggest global financial institution to surrender its independence since the Global Financial Crisis 15 years ago. Here are some answers to key questions.

What Just Happened? |

- UBS agreed to buy Credit Suisse in a historic, government-brokered, all-share deal. The price per share marked a 99% decline from Credit Suisse’s peak in 2007. Shareholders don’t get to vote on this.

- Holders of “Additional-Tier 1 (AT-1)” bonds have been wiped out. Credit Suisse’s roughly 16 billion Swiss francs ($17.3 billion) worth of risky notes are now worthless. The deal will trigger a complete writedown of these bonds to increase the new bank’s core capital — meaning that these creditors have had a worse deal than shareholders, who at least now have some stock in UBS.

- Switzerland’s government is putting a lot of taxpayer money at risk to ensure that UBS went through with the deal. If UBS’s attempts to sell off hard-to-value assets on Credit Suisse’s books result in losses, it will take the first 5 billion Swiss francs, and the next 9 billion will be borne by the government. This could be taken to imply that there is a problem of solvency, and not just liquidity.

- The Swiss National Bank’s extension of $54 billion in liquidity to Credit Suisse has, within two trading days, been found insufficient, suggesting the pressure on its deposits must have been extreme.

What Lessons Learned? |

Unfortunately, there is now quite a range of examples of big banks that needed help. They provided a number of lessons that have plainly been taken into account here. Past rescues show that the result can be disastrous for the rescuer (Lloyds TSB’s purchase of HBOS, or Bank of America Corp.’s deal to buy Merrill Lynch) and this explains why UBS has driven a hard bargain. But they can also work out well.

JPMorgan Chase & Co. acquired Bear Stearns and the Washington Mutual branch network during 2008, while Wells Fargo & Co. bulked up to great size by buying Wachovia. The same is true for big deals that weren’t forced by regulators.

The 1998 merger of Citicorp and Travelers to form Citigroup Inc. was only the most notorious of a series of big mergers in that era that proved excruciatingly difficult to implement. But the basic logic of monopolies and economies of scale also applies — bigger banks tend to have greater pricing power and can reduce their costs as a proportion of the total.

They also tend to create really serious problems for everyone when something goes wrong. Mike O’Rourke of JonesTrading argued that the deal would “likely magnify Credit Suisse’s problems by moving them to UBS, making a $500 billion problem a $1.8 trillion problem.”

Regulators grasped that “bailout” was a dirty word after the many perceived injustices of 2008, and that it was impossible ever to give that name to any rescue operation. But this was a bailout as most of us would understand it. “Yeah, it was a bailout,” said Mohamed El-Erian, the Bloomberg Opinion columnist who is currently president of Queens College, Cambridge, on Bloomberg TV. He added:

“They’re going out of their way to say that it’s not a bailout, but then they can’t explain why money’s being put to work. Look, this was not the best solution, but it dominated the other two, which was either nationalization, or trying to wind down the bank.”

The critical point here is to avoid what is known as “moral hazard” — the propensity to encourage even more risk-taking by making it clear that there will be a bailout from its consequences. It’s hard to rescue a big bank without amping up moral hazard.

Probably the greatest argument ever made against worrying about this, at least in the public consciousness, was made by the CNBC commentator Jim Cramer during the summer of 2007, when he argued that the Federal Reserve of the day “knew nothing” and complained that then-Chair Ben Bernanke was thinking like an academic: “He has no idea how bad it is out there!” Other Fed chiefs would have been faster to capitulate. Jay Hatfield of Infrastructure Capital commented that Alan Greenspan “would have cut rates two weeks ago.”

The arguments for the harm done by bank rescues were put very nicely by Jason Zweig of the Wall Street Journal. And it’s plain that the Swiss regulators have taken these ideas on board. “Additional Tier 1” capital was a category introduced under the Basel III banking accords that followed the GFC, with the intention of providing banks with more security. Holders of the bonds were to be behind other creditors in the event of problems. In the first big test of just how far behind they are, we now know that AT1 bondholders come behind even shareholders.

This follows the logic of the post-crisis approach, and it limits moral hazard. The question is whether anyone will want to hold AT1 bonds after this. The market response will be fascinating, and it remains possible that the regulators have avoided repeating one mistake only to make a new one.