Uddrag fra FT skribent John Authers blog:

Crisis? What Crisis? |

Markets are behaving as though this is already a crisis — or at least some of them are. Bond markets have been turned upside down across the world, with the two-year yield in the US now some 120 basis points lower than a week ago. That betokens a seismic shift in the financial system. In economics, markets have the ability to create their own reality. Within days, they’ve forced the Federal Reserve and the Swiss National Bank to intervene to aid banks. But is it a crisis?

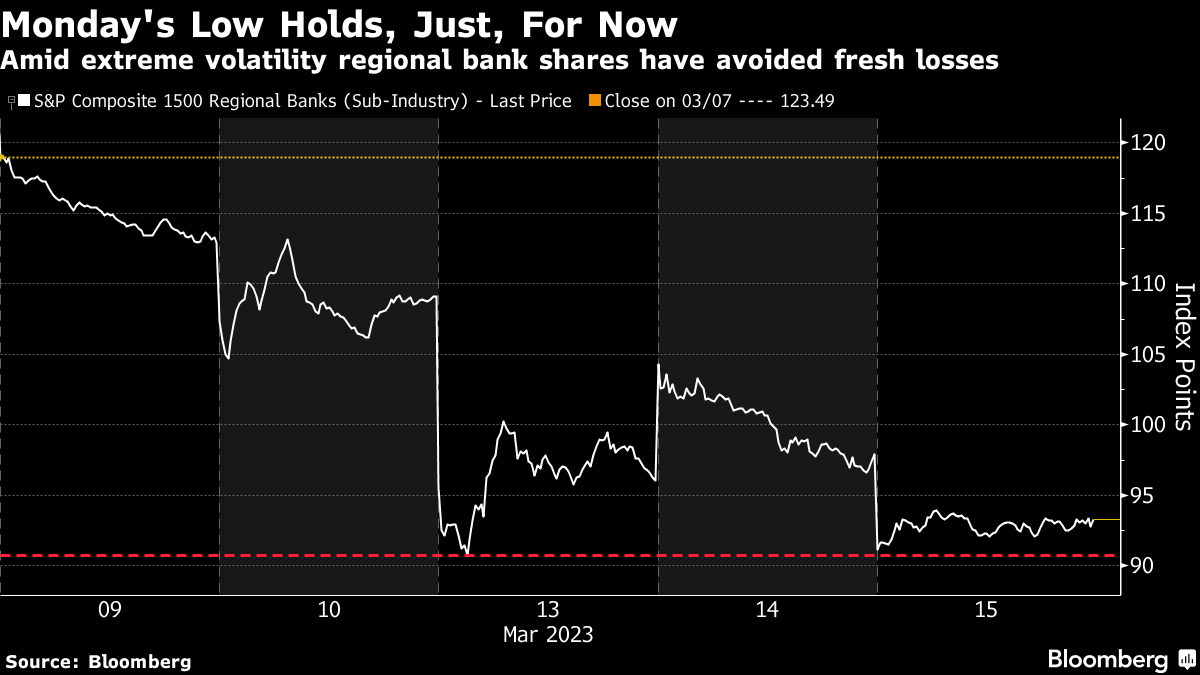

US regional banks, after the multiple failures of last week, are the area of a greatest concern. Amid volatility, the market’s attitude to their problems remains in suspended animation. Since a terrifying fall at Monday’s opening, the S&P 1500 regional banks index has failed to mount a sustained rally, but it has also failed to take out the low it set. There’s no way this is encouraging, but at least the sector is not in free fall:

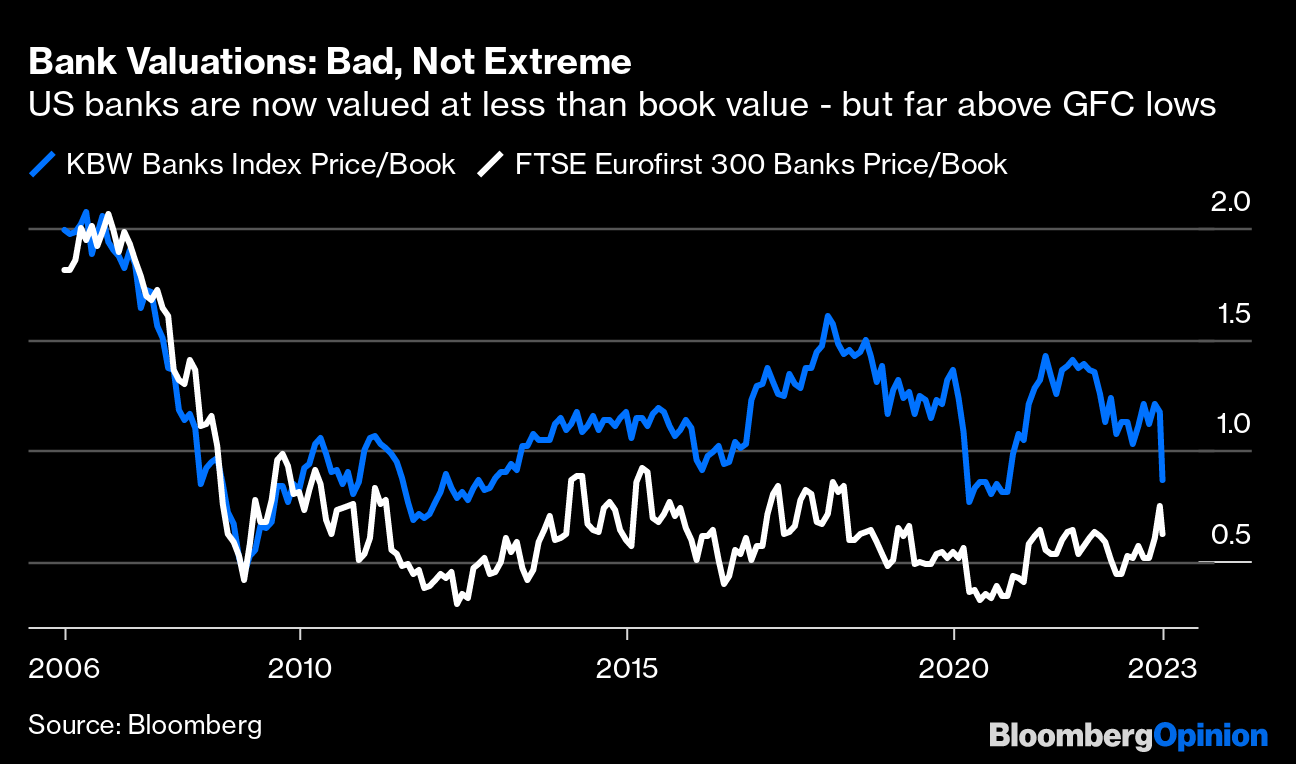

Looking at bank valuations, the picture is surprisingly subtle. Investors generally price bank shares as a multiple of their book value — the equity left on their balance sheet once liabilities are subtracted from assets. On this metric, the big US institutions in the KBW banks index have fallen, and are now trading just below their book value, but they remain far above the depths they plumbed during the Global Financial Crisis of 2008. European banks, which were further hobbled by the implosion in eurozone sovereign debt that started in 2010, also remain comfortably above their lows of that era. The situation is bad, for sure; it’s not clear it can be called a “crisis”:

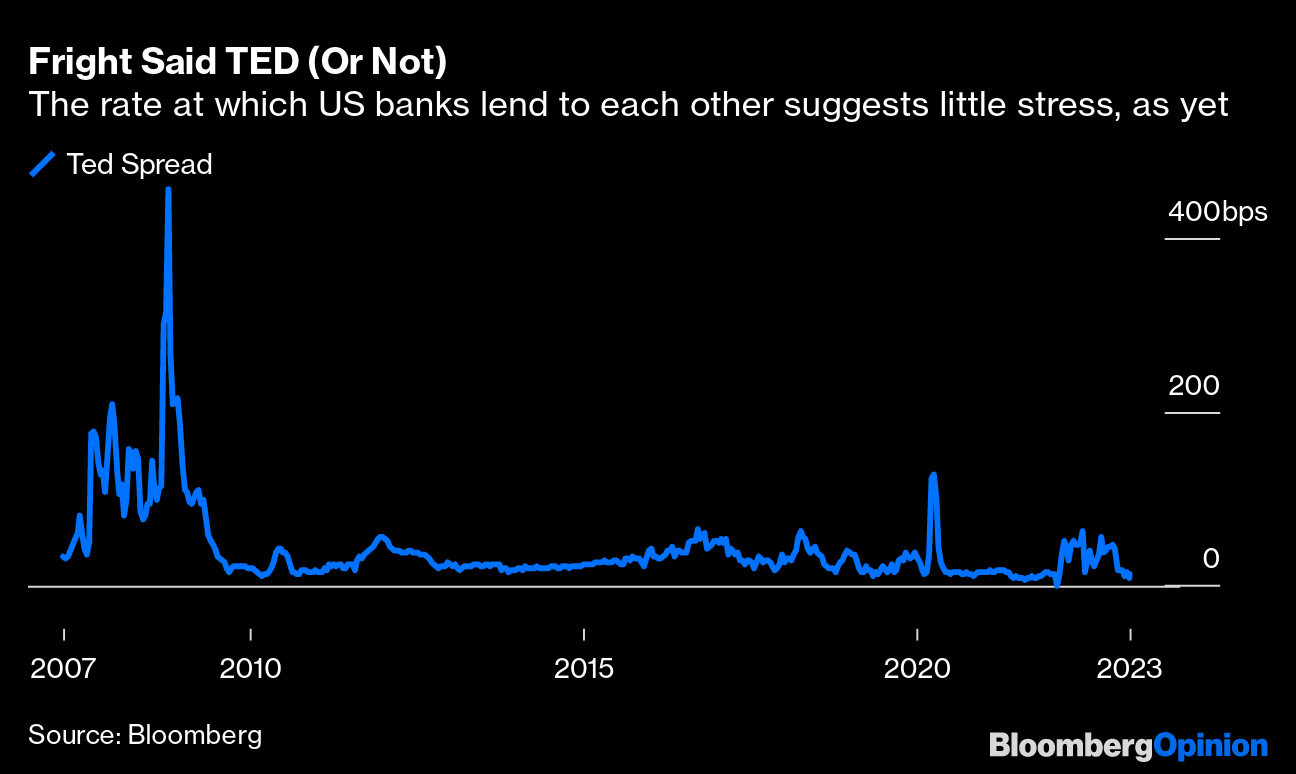

Another classic measure of banking strength is also suggesting little reason for concern, at least for now. The “TED Spread” — the gap between the rate at which banks lend to each other, traditionally captured by Libor (the London Interbank Offer Rate) and the equivalent Treasury bill yield. The higher the spread, the greater the distrust between banks. There is no particular evidence that confidence has broken down at present, and certainly nothing remotely comparable to the GFC:

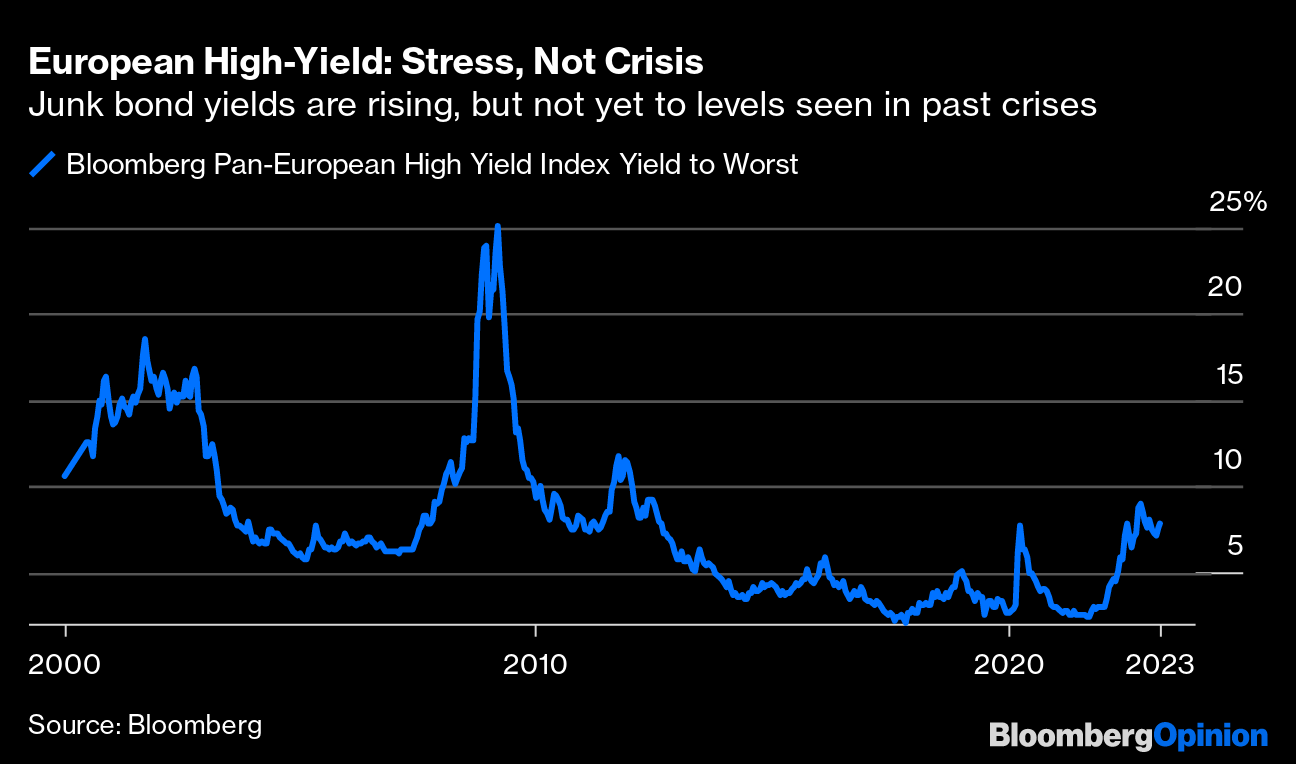

Credit more broadly also suggests that things are getting worse, but have not yet delivered us into crisis. This is how the yield on European high-yield bonds has moved, as measured by Bloomberg (US junk bonds tell a similar story). Again the picture is of worsening conditions, but not a disaster, and certainly not one on the scale of 2008:

Threading the needle, this can be explained if the crisis of confidence is still only one of liquidity — about whether banks have enough cash on hand to meet demands from customers and counterparties — rather than solvency, in which the value of the loans on their books is called into question. In 2008, solvency was compromised as it grew clear that many of the mortgage-related securities on their books were not going to be repaid. Now, even the run on Credit Suisse AG (of which more below) is hard to define as a problem of