Uddrag fra Authers

America is disinflating, but it’s doing so disappointingly slowly. Thursday’s update from the Bureau of Labor Statistics showed that both the headline and core measures of the consumer price index had shown less disinflation than hoped.

The headline number is prone to the vagaries of changing base effects and volatile food and fuel prices, but it’s still usually the figure that is most discussed and has greatest political salience. So it seems worth pointing out, pace Ben Hunt of Epsilon Theory, that this most watched measure of inflation hit a low last June and has been rising ever since. Even then, it was higher than had been seen in the years before the pandemic:

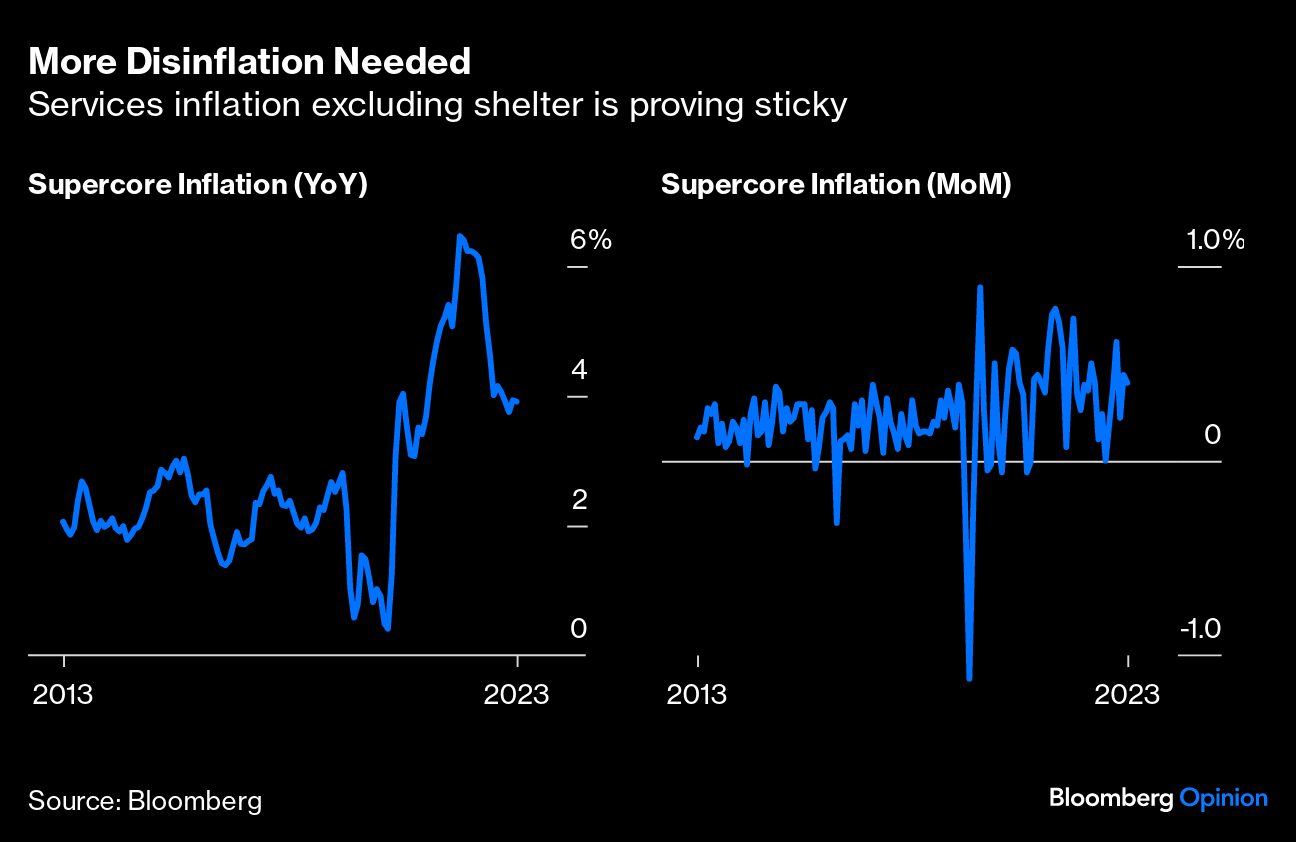

Headline CPI isn’t, and shouldn’t be, a measure that drives what the Federal Reserve does next. For that, we need to look at what’s now known as “supercore inflation,” covering the services sector excluding shelter. These businesses are particularly sensitive to wages. This measure also suggests that disinflation has stalled. It’s not just about base effects, but also high on a month-on-month basis:

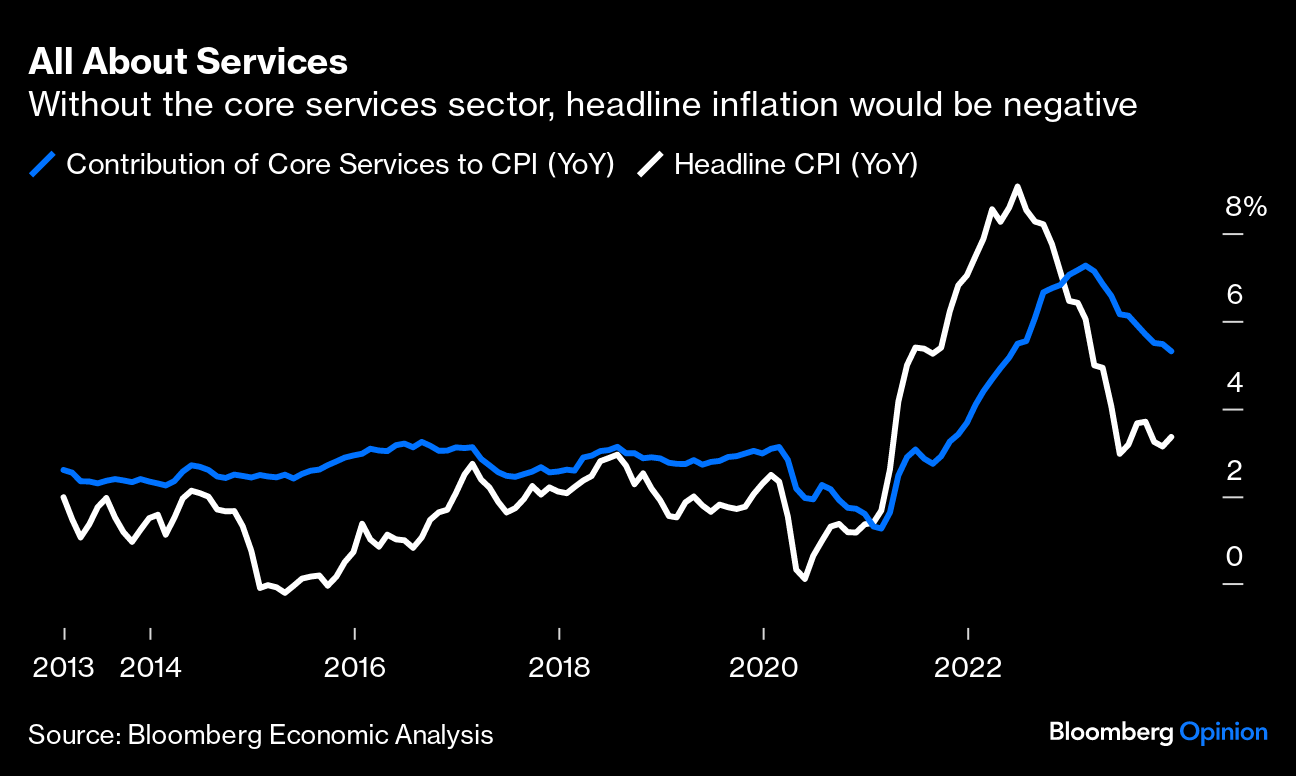

The focus on core services seems justified as it now effectively accounts for all inflation. As this chart from the Bloomberg economic analysis (ECAN <GO> on the terminal) shows, it’s higher than the headline, meaning that all the other components net out to less than zero:

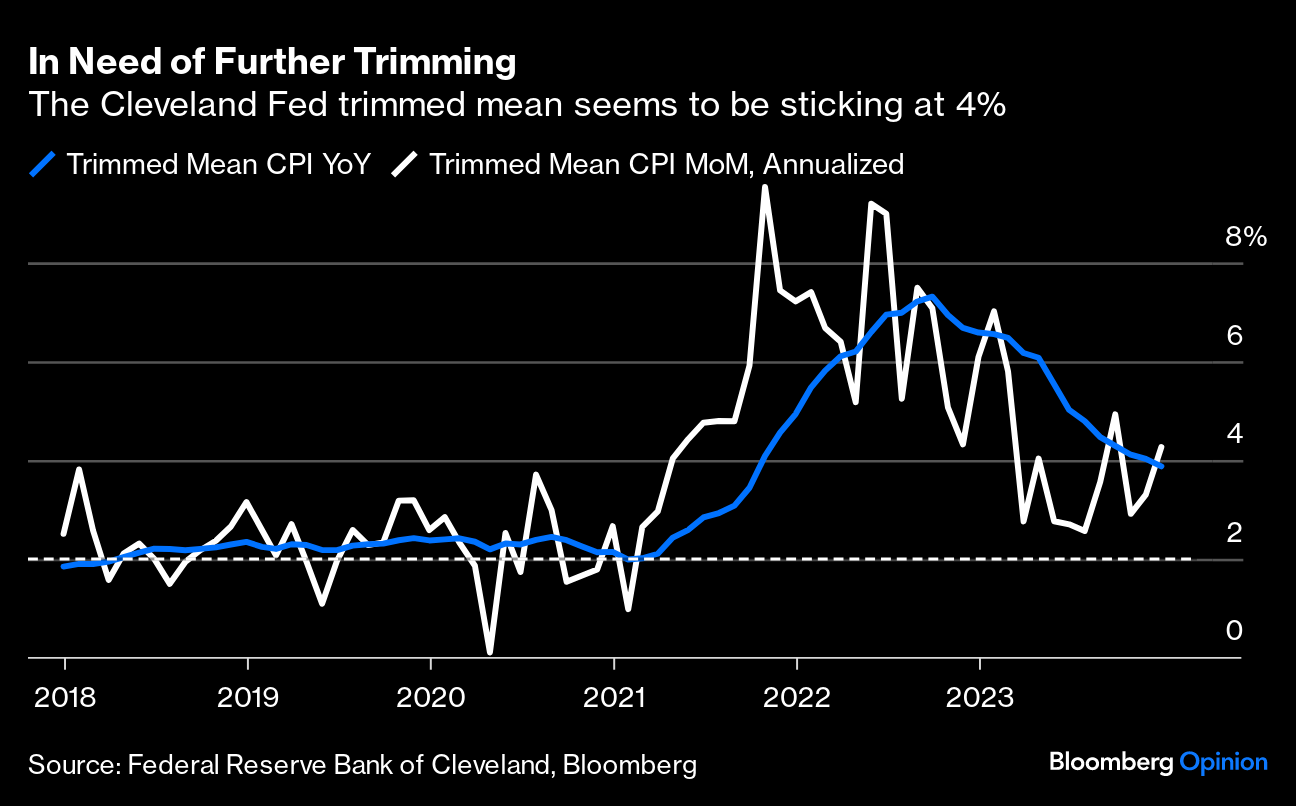

The trimmed mean measure published by the Cleveland Fed is beloved by statisticians. It excludes the biggest outliers in either direction and takes the average of the rest for a good measure of core underlying inflation. On a year-on-year basis, disinflation continues but has become painfully slow. The month-on-month version has risen for the last two months, having hit a low last summer. This seems to confirm a picture of a disinflation which if not totally stalled or reversed is disappointingly slow:

The clearest reason for hope is that the BLS’s methodology for shelter inflation tends to be seriously lagged, meaning that it might well be overstating rental inflation. That’s important because CPI excluding shelter is back below 2% — and shelter inflation is falling, though slowly:

In the context of expectations of a faster fall, and the dominant narrative that inflation has now been licked, this was a disappointing report. Not disastrous, but certainly not strengthening the case for imminent rate cuts. Rather, it appeared to confirm fears that the “last mile” of disinflation to get back to the Fed’s 2% inflation target was going to be difficult, with the easiest gains now in the past. Tiffany Wilding, economist at Pimco, summed it up as follows:

The deflationary impulse from normalizing supply chains is a tailwind that will eventually fade. Shelter inflation continues to slowly cool, and services ex-shelter inflation remains sticky — supported by still-elevated wage growth. We think this backdrop is likely to mean that disinflation, which was incredibly fast by historical standards in 2023, could be slower and more complicated in 2024.

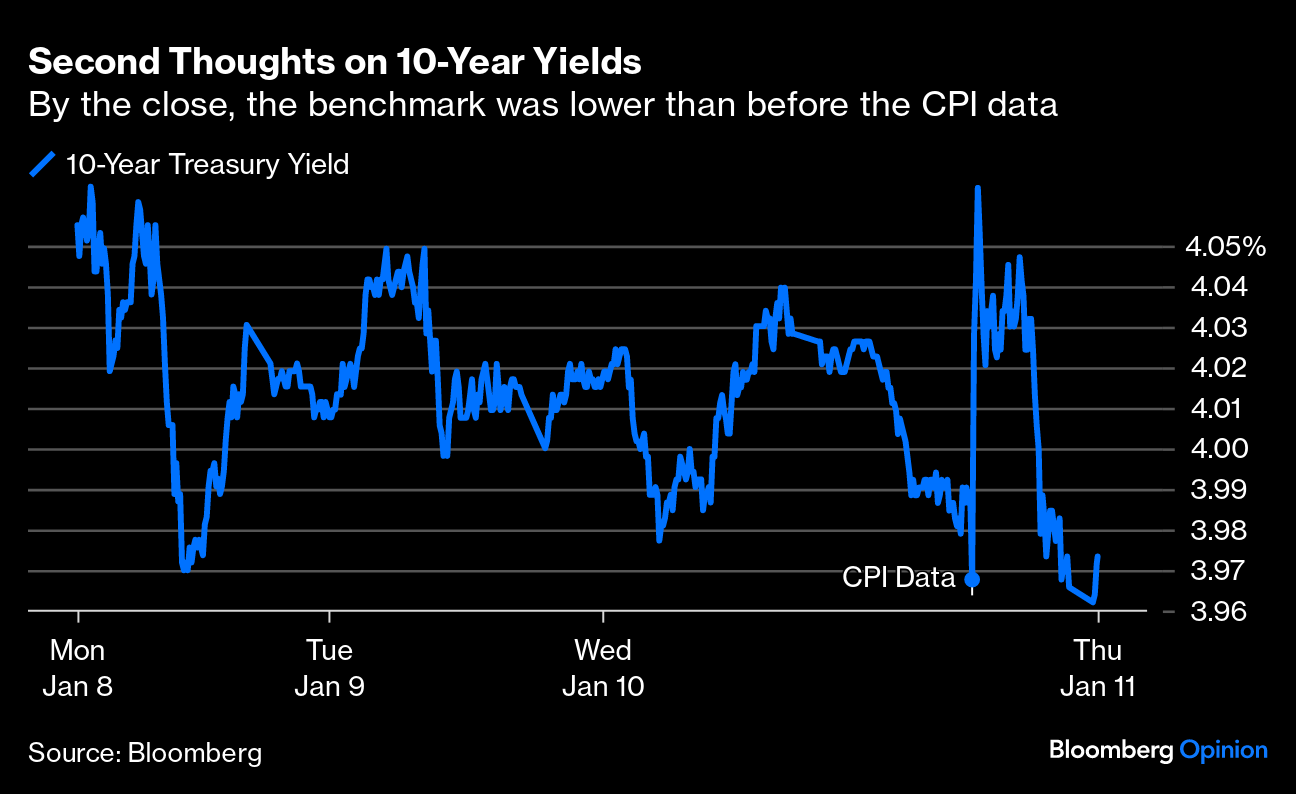

Jeff Schulze of ClearBridge averred that the print “confirms that the process of disinflation will not be a straight line down, requiring further patience from the Fed before officially transitioning towards an easing cycle.” He added that core goods inflation ticked into slightly positive territory for the month, breaking a streak of six consecutive declines. Taken together, he concluded, “This print should put some modest upward pressure on long-term Treasury yields as near-term expectations for rate cuts are pushed out slightly.”

Of course, 10-year yields fell for the day (and had done so before news of strikes against the Houthis in the Red Sea gave reason to be nervous about oil prices again). The immediate reaction to the inflation news was taken as a great buying opportunity, and brought the yield back below 4%:

It’s hard to see how the Fed can start cuts as early as March, with disinflation stalled and inflation still above target. Yet federal funds futures barely moved. They still discount five cuts this year, while the chance of a 25 basis-point cut in March is still put as high as 63%. The market odds on a cut briefly exceeded 90% in the aftermath of Jerome Powell’s dovish performance at the last Federal Open Market Committee meeting; but this now seems an overly high belief in rate cuts:

What can explain it, other than complacency? The numbers are a tad disappointing but not terrifying, while shelter should help bring overall prices down a bit further. They weren’t a game changer, particularly given the widespread belief that the last stage of disinflation would be the hardest.