Uddrag fra Zerohedge:

(dansk oversættelse)

“Der er aktuelt store sårbarheder i systemet for markedsbaseret finansiering (MBF), i lyset af den nuværende rentevolatilitet, og det udgør risici for den finansielle stabilitet.”

De dystre ord kommer fra en ny rapport fra Bank of England, som fremhæver en aktuel sårbarhed i det globale finansielle system: spekulativ handel i et rentefald fra amerikanske hedgefonde, hvor noget tilsvarende var ved at ødelægge obligationsmarkedet i 2020.

Rapporten kommer to måneder efter, at vi påpegede, at det velkendte spøgelse af systemiske risici er dukket op igen: Spekulativ handlen, der førte til repo-krisen i september 2019 og også forværrede krisen i marts 2020, hvor obligationsmarkedet i flere dage var helt uden likviditet, er tilbage og kan ødelægge en hel ny generation af uerfarne rentehandlere.

Det er korrekt: handlen mellem kontanter og futures på obligationer (Treasury cash-futures basis trade), som vi detaljeret beskrev i marts 2020, førte til rekordtab blandt hedgefondene, der handlede parvis, og fik Federal Reserve (Fed) til at indskyde milliarder USD i likviditet på markedet for at undgå et katastrofalt sammenbrud (hvor covid-pandemien og krisen bekvemt fungerede som den perfekte “lige i tide” afledning, der tillod Powell at gøre netop det). Denne handel er nu vendt tilbage ifølge BBG’s Garfield Reynolds, som bemærker, at “den nylige stigning i belånte positioner, der satser på, at obligationsfutures vil falde, ligner såkaldt basis-handel”.

————————————————–

“…there remain vulnerabilities in the system of MBF [market-based finance], which could crystallise in the context of the current interest rate volatility…and pose risks to financial stability.“

Those are the somewhat ominous words from a recent Bank of England report, that highlighted one of the bigger vulnerabilities of the global financial system being a US hedge fund trade that is staging a comeback after nearly blowing up the Treasuries market in 2020.

The report comes two months after we highlighted the fact that the familiar systemic crisis ghost has made a surprise re-appearance: the trade that led to the repo crisis in Sept 2019 and also brutally exacerbated the crisis of March 2020 when for several days the Treasury market had zero liquidity, is back and is looking to blow up a whole new generation of clueless rates traders.

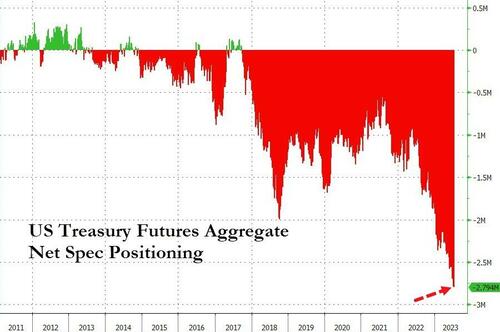

That’s right: the Treasury cash-futures basis trade, which as we profiled in detail in March 2020, led to record losses among the pair-trading hedge fund community, and prompted the Fed to inject trillions in liquidity into the market to avoid a catastrophic collapse (and where the covid pandemic and crash conveniently served as a perfect “just in time” decoy to allow Powell to do just that), has returned according to BBG’s Garfield Reynolds who notes that “the recent surge in leveraged positions betting that Treasury futures will fall … smacks of so-called basis trading.”

- The trade, a variant of which first claimed LTCM and its roster of Nobel-prize winning idiots back in 1997, earns tiny nominal returns (when all goes according to plan) so funds use cash borrowed from the repurchase agreement market to leverage up positions and juice their wagers.

- The problem is that when not everything goes according to plan, the blows up are absolutely epic since this is the same strategy that led to career-ending losses on investors in March 2020, drying up liquidity not just in Treasuries but also in other money markets key to the smooth functioning of the financial system.Similar to mid-2019 and early 2020, the current environment favors buying the cash bonds and selling futures against them, thanks to strong asset-manager demand for the derivatives and an increased public supply of Treasury securities as the Federal Reserve sheds its holdings.

The problem is that such basis trading distorts how speculators respond to economic data, making it harder for other investors to read signals from the bond market as a guide to the US outlook.

And this week, the BoE added its voice to the growing concerns over the potential exposure to this trade, saying the risks associated with these trades have mostly not been tackled by regulators.

“Vulnerabilities remain in the system of MBF. For instance, over recent months, leveraged hedge funds have built up large positions in US Treasury futures, which market intelligence suggests are relative to bonds or swaps. If these markets were to move sharply, deleveraging these positions could further amplify stress.

These risks, and other underlying vulnerabilities in the system of MBF identified by the FPC and financial stability authorities globally, remain largely unaddressed and could resurface rapidly.“

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her