Uddrag fra Zerohedge

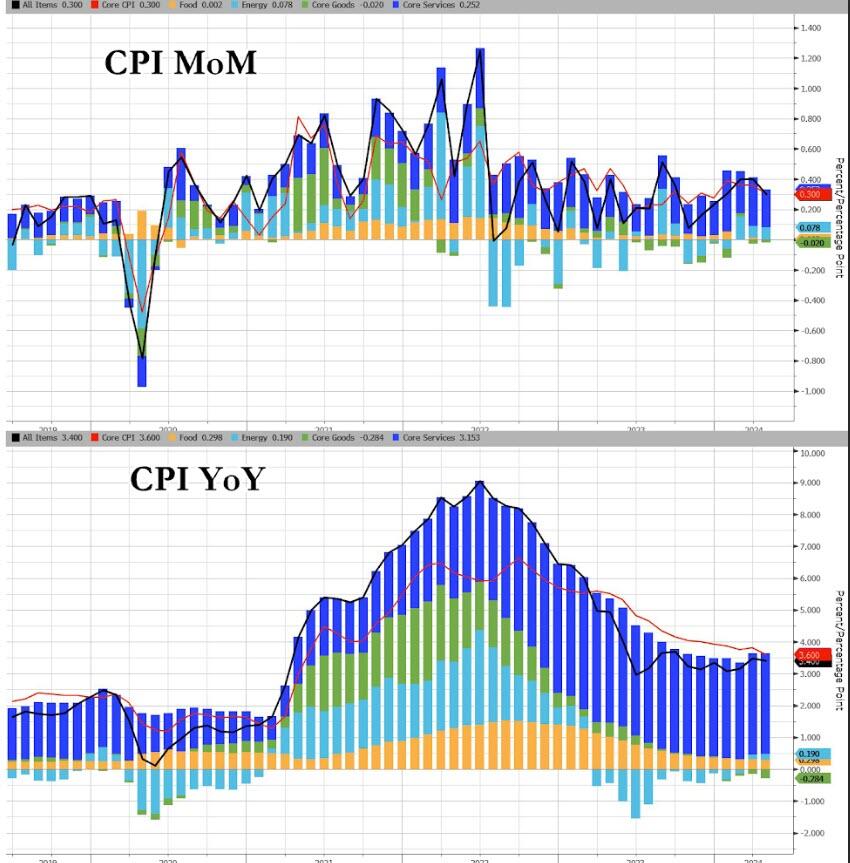

After a fourth straight month of hotter than expected PPI, analysts’ expectations for CPI were tightly ranged around 0.3-0.4% MoM and printed +0.3% MoM (slightly below the 0.4% expected). The YoY headline CPI fell to +3.4% as expected from +3.5% prior

Source: Bloomberg

Under the hood, Services slowed modestly MoM…

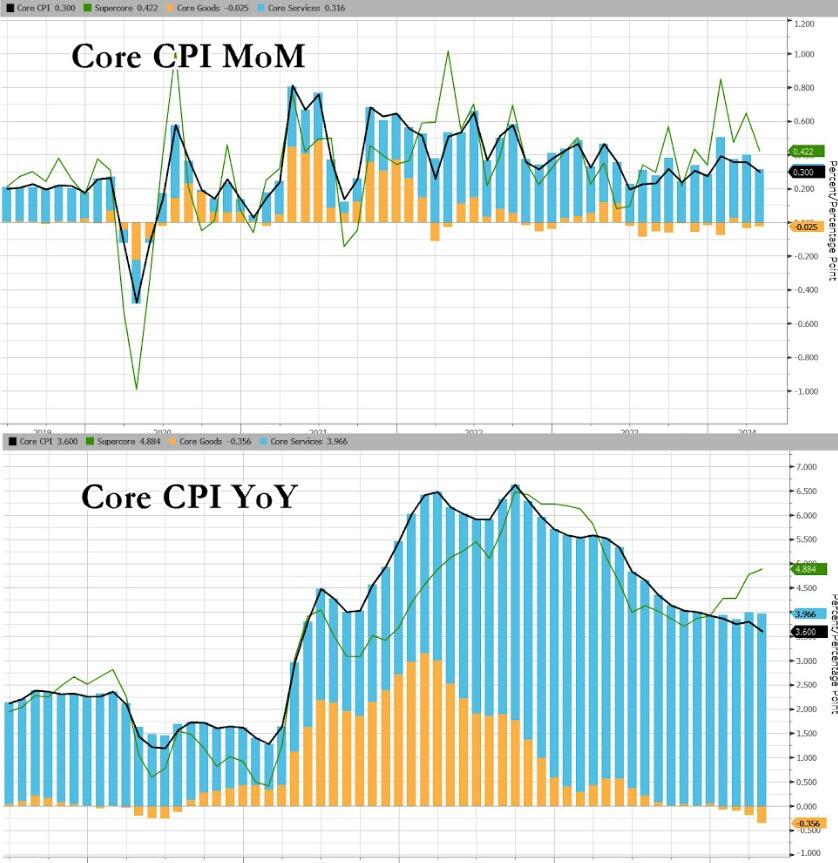

Core CPI rose 0.3% MoM (as expected) with YoY slowing to +3.6%, also as expected…

Source: Bloomberg

Core goods deflation continues while Core Services continue to rise…

Source: Bloomberg

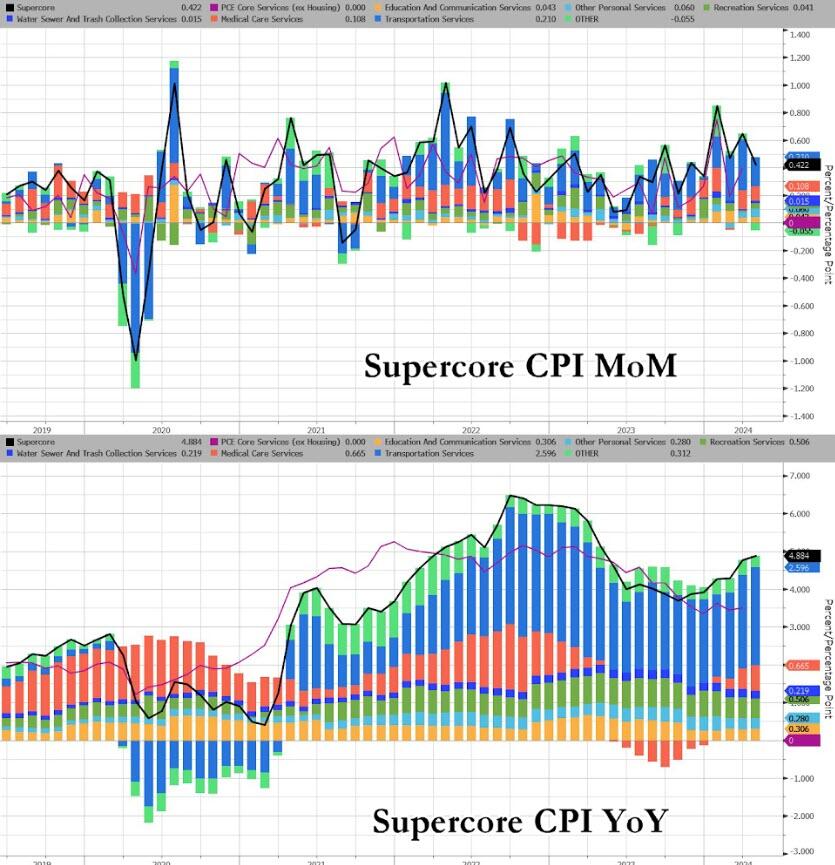

And one step deeper – the so-called SuperCore: Core CPI Services Ex-Shelter index – rose 0.5% MoM up to 5.05% YoY – the hottest since April 2023…

Source: Bloomberg

Under the hood of SuperCore CPI, Education costs rose (to pay for cleaning up all those protests?) and Transportation Services dominated on a YoY basis…

Source: Bloomberg

Finally, we note that consumer prices have not fallen in a single month since President Biden’s term began (July 2022 was the closest with ‘unchanged’), which leaves overall prices up over 19.5% since Bidenomics was unleashed (compares with +8% during Trump’s term). And prices have never been more expensive…

Source: Bloomberg