Uddrag fra finanshuse, blandt andet JPM, Rabobank og Goldman

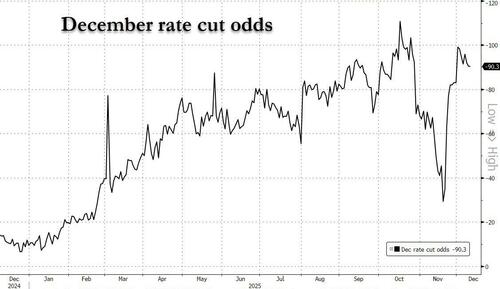

The Fed is widely expected to cut rates by 25bps to 3.50-3.75%, with Fed money markets currently pricing in a 90% chance of such an outcome, and this comes despite widening divisions among policymakers, with many dissents expected Wednesday by both hawks and doves (see below).

The latest cut would follow Octoberʼs reduction, bringing a total of 175bps in rate cuts since the easing cycle started in Sept 2024, although Chair Powell cautioned then that a December cut was far from assured and gave an analogy that “driving in the fog, you could slow down”.

As Newsquawk writes, given the Government shutdown, key data has been delayed, and little has been seen since the prior meeting, but in the following week, we will see the October and November NFP, the November Unemployment rate, and the November CPI (they follow a Sept/Oct JOLTS reported which came in far stronger than expected). Although markets are heavily pricing in a cut, it is a close call as shown by expected votes (more below), and given this, there is a widely held view that it will be a “hawkish cut”.

But what is a hawkish cut? It means that the market is pricing under 8bp of cuts in Jan and less than a full 25bp in the first three meetings of 2026 (after which Powell’s term as Chair ends). BofA’s interpretation is that investors have anchored to the notion that a mid-cycle adjustment usually entails three cuts.

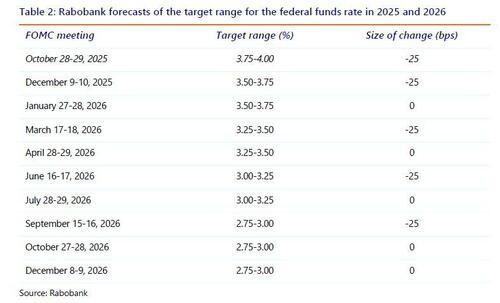

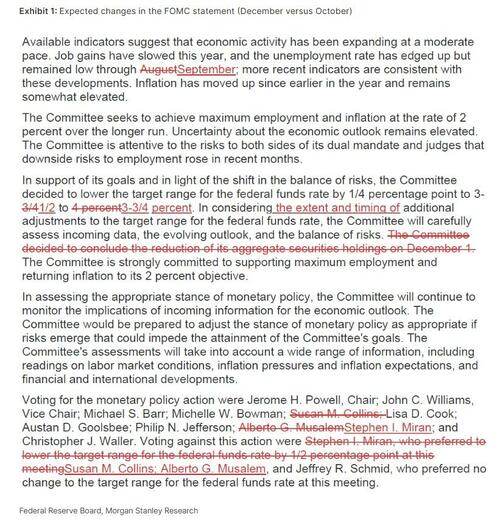

JPM adds that one way this could be conveyed would be for the statement to mimic last yearʼs forward guidance. Last Novemberʼs statement referenced “In considering additional adjustments…” which was followed by a cut in December, and then the Dec. statement was adjusted to say “In considering the extent and timing of additional adjustments…” which was followed by a pause in rates until September 2025. By reverting to the extent and timing guidance, the Committee could hint at a pause in the coming January meeting. Incidentally, chief JPM economist Michael Feroli expects the statement or the post-meeting presser to be hawkish. However, he expects that weakening labor data will lead to a January cut (markets are pricing less than 30% of a January cut). Looking ahead, Rabobank expects the Fed to continue its cutting cycle at least until its estimate of the neutral rate is reached.

HAWKS VS. DOVES: In the October FOMC press conference, Chair Powell noted there are strongly differing views on how to proceed, and that another cut in December is far from assured given inflation risks. Powell added that Octoberʼs cut was another risk management move, but going forward, it will be different. When speaking on the lack of data [at the time], he said he could imagine that the lack of data affects the December decision and gave an analogy that “driving in the fog, you could slow down”. Despite the clear ambiguity from the Chair, it isnʼt widely felt across the Committee, and economists’ calls for further reductions have been underpinned by backing from several Fed officials, including key remarks from NY Fed President Williams, who said a near-term cut could be appropriate.

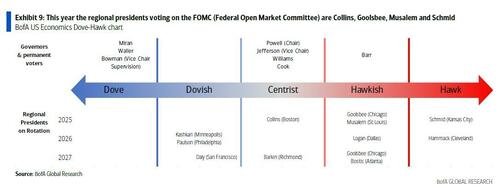

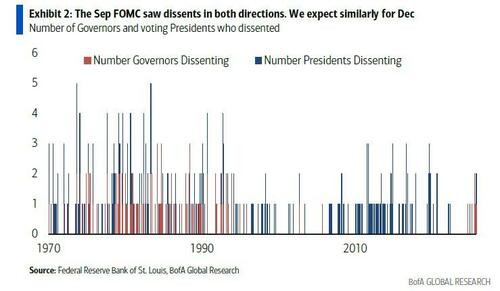

Newsquawk analysis indicates that among voting members, four have explicitly supported cuts (Bowman, Waller, Miran, Williams), one is seen leaning towards a cut (Cook), two have been unclear (Powell, Jefferson), while five are leaning towards a hold (Barr, Schmid, Collins, Musalem, Goolsbee). The divisions mean the meeting could produce the highest number of dissents since the early 1990s, with four or more opposing any reduction (polymarket odds of 4 dissenting votes at 22%) , and could even end in a three-way split (dissent to opposite decision, the decision, and a 50bps cut from Miran).

To get a sense of the wide extent of opinions held by various Fed officials, here is a summary of key quotes from Fed speakers – both hawks and doves – in recent weeks.

DATA: Due to the prolonged Government Shutdown, there has been a notable lack of key US economic data, which has added uncertainty to the path ahead and has made for a very split Committee, which was further illustrated by the October minutes. In terms of what we have seen as data starts to resume, initial jobless claims have been edging lower, with the last print seeing just 191k, the lowest since Sept. 2022 – albeit there are concerns this was seasonally affected by Thanksgiving. Meanwhile, October JOLTS soared to 7.670mln from Augustʼs 7.227mln, and also above Septemberʼs 7.658mln, which was released alongside the October print. Note, the November and October NFP print will be released on the 16th of December, but there will be no October unemployment rate. Meanwhile, the November CPI will be released on December 18th. FED CHAIR: If there arenʼt enough conflicting arguments heading into the December meeting, the 2026 rate outlook is further clouded by President Trumpʼs imminent choice for new Fed chair, which is likely to come in early January. A strongly dovish pick, such as NEC Director Kevin Hassett, who is a hot favourite and closely aligned with Trumpʼs policy stance, would increase the likelihood of additional cuts in 2026.

POWELL PRESSER: At the press conference, Rabobank thinks Powell will probably downplay any dissent as something that follows from a challenging situation with upside inflation risk and downside employment risk. Regarding the January meeting, the Chair is likely to stress that the Fed is data-dependent and makes decisions meeting-by-meeting, but any clear signal Powell provides would be key. When he spoke about December not being a foregone conclusion in October, a strong hawkish reaction was seen at the time.

Bank of America is more skeptical and says that Powell is facing the most divided committee in recent memory. Therefore, he will attempt to balance the expected rate cut with a hawkish stance at the press conference, just as he did in October. But the bank is skeptical he can get away from an interpretation of data dependence. Powell’s hawkish remarks in July and October jolted markets, but they don’t seem to have changed the policy path. Investors might be wary of getting head-faked for a third time, especially because we will be getting so much data before the Jan meeting. The week after the Dec meeting, we’ll get Oct and Nov payrolls, the u-rate for Nov, Oct retail sales and the Nov CPI. We should get one more iteration of all these indicators in Jan (possibly two for retail sales), before the FOMC meeting. And then there is the fact that Powell is a lame duck and his replacement is coming in just 5 months (if not sooner).

So, how can Powell credibly signal a pause in Jan? He’ll probably get a question in this vein. One option would be to indicate that it would take significant further weakening in the labor data for the Fed to cut again. Investors will be looking for any indication of thresholds for the Jan policy decision. Powell won’t commit to quantitative thresholds but he might provide qualitative guidelines. Another option for Powell would be to argue that a policy rate of 3.5-3.75% isn’t restrictive in real terms, with inflation (even ex of tariffs) still a few tenths above target. While BofA is very sympathetic to this argument, they doubt Powell will want to take such a strong stand given his general dovish leaning.

It will also be interesting to see how Powell will represent the hawks’ perspective. Up to eight regional Fed Presidents (Schmid, Hammack, Logan, Kashkari, Collins, Musalem, Goolsbee and Bostic) and possibly Governor Barr, might prefer to stay on hold (even if they don’t explicitly dissent). But why? Are they unconvinced that labor demand is weakening materially? Are they concerned about second-round inflationary effects from tariffs? Or do they see upside risks to demand-driven inflation next year from additional rate cuts? This information could also give markets clues on the thresholds for additional cuts next year.

It remains to be seen whether Powell will seal the deal on this interpretation of the forward path for policy. He is more likely to leave the door open for Jan. Bank of America wouldn’t be surprised if markets start pushing more aggressively for a Jan cut in the near term. And the anticipation of this outcome might raise the probability of more dissents in Dec, since hawks might be inclined to dig their heels in instead of compromising.

According to Morgan Stanley, Powell will signal that the recalibration phase of monetary policy is now complete. His message will likely emphasize that the current stance is better positioned to respond to potential risks on both sides of the mandate. From this point forward, any additional adjustments will be considered on a meeting-by-meeting basis and guided by incoming data. In tone, Powell will sound closer to Governor Waller’s recent remarks: the December rate cut was appropriate given the circumstances, but the outlook for January remains uncertain. Echoing other banks, MS believes that Powell will frame the January meeting explicitly as data dependent, avoiding any commitment to a preset path and underscoring that decisions will hinge on the evolving economic picture. When explaining the December decision, Powell will likely point to the absence of clear signs of a healthier labor market and the persistence of cooling trends. He may highlight the recent uptick in the unemployment rate in the latest jobs report as evidence that risks to the employment side of the mandate remain. In other words, December will likely be framed as a prudent adjustment to support continued progress toward the Fed’s dual mandate. Additionally, he might underscore that the median projection in the September Summary of Economic Projections was fully consistent with rate cuts in both October and December, reinforcing that the decision aligns with prior guidance rather than signaling a policy shift. Overall, MS expects a message that blends caution with flexibility: recalibration is over, policy is well aligned with current conditions, and the future will depend on the data.

According to Goldman, the overwhelming consensus view is that Powell will sound very similar to October (“nothing is pre-set” and “we’re already closer to neutral“) as he needs to reflect the hawkishness of the rest of the committee. However, Tuteja thinks that given this hawkish expectation, the market can take comfort any time he says the committee hasn’t had a chance to see the data and are attentive and will respond to labor market risks.

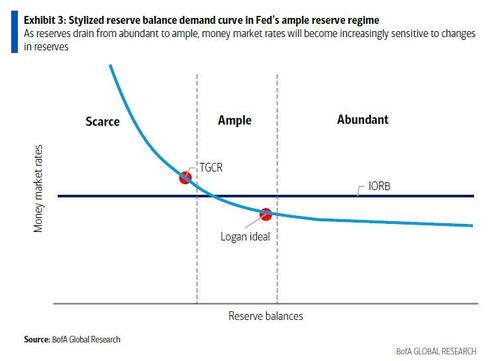

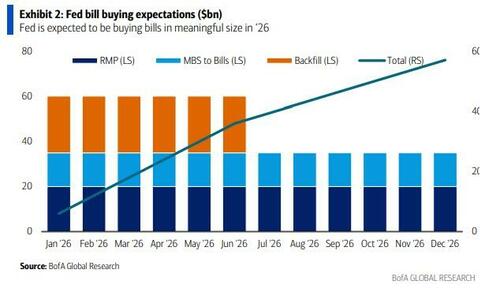

BALANCE SHEET: There has been some focus on the balance sheet since the prior meeting, whereby the Committee announced they decided to conclude the reduction of its aggregate securities holdings on December 1st. Since then, Waller has said not to perceive the balance sheet staying where it is, noting natural reserve demand will push it up, and it could be as short as a month or a couple of months before it grows again. Meanwhile, NY Fedʼs Perli noted ‘at some pointʼ Fed will need to expand its balance sheet again, and said a technical Fed balance sheet expansion is likely to take place soon.

As such, Bank of America predicts an extra announcement of Reserve Management Purchases – besides cutting rates – translating into ~$45bln in monthly short-term Treasury bill purchases to maintain bank reserves and prevent liquidity issues.

Combined with MBS reinvestments, total bill purchases could reach $60bln/month. BofA adds, these “Reserve Management Purchases” arenʼt QE, and aim to keep money markets functioning, not stimulate lending. While many will see it as money printing regardless (as it does inject liquidity into the system), the move could reassure markets amid rising Treasury issuance and concerns about tightening liquidity. It will also send non-fiat assets sharply higher.

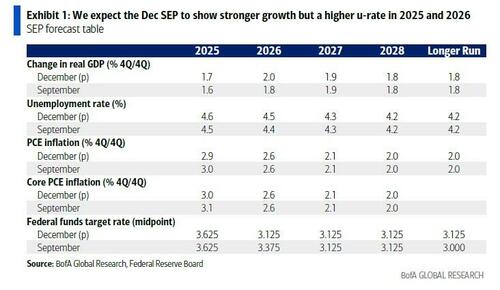

SEPs: Updated Summary of Economic Projections are due; the Reuters poll points to a lack of consensus in the 2026 dot plot, with medians showing two further cuts but significant disagreement driven by fiscal risks, tariff effects, and concerns over Fed independence. Conflicting policymaker signals have also heightened uncertainty. Analysts highlight that there is a wide gap between consumer and market inflation expectations, complicating the Fedʼs task, and PCE inflation is expected to stay above 2% through 2027.

The US economy likely grew 3.0% in Q3, slowing to 0.8% this quarter, and is forecast to average 2.0% in 2026, the Reuters poll found. Wells Fargo expects only minor adjustments to the 2026 outlook, with slightly higher GDP and unemployment and marginally lower inflation. It sees the 2026 median dot staying at 3.375%, although one lower dot could pull it down, with risks tilted slightly to the downside. JPM thinks, as was the case in September, the median participant will pencil in one more cut in each of the next two years. Likewise, JPM doesnʼt see reason to look for large changes to the economic forecasts and looks for the forward guidance in the statement to reference “the extent and timing” of additional adjustments, a subtle shift to indicate a cut is less likely at subsequent meetings. The bank sees no change to GDP/Unemployment; some chance inflation is marked down a tick or two. According to Goldman, client consensus is that the dots for 2026 will out-hawk what’s currently priced in the market. In aggregate, the trading community thinks there will be 1 dot / projected cut for next year – as many non-voters (whose projections are included in the dot plot) likely submit 0 for their 2026 projections which balances out the more dovish members of the committee.

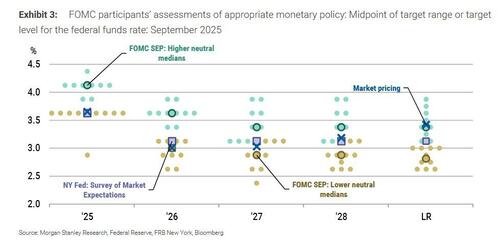

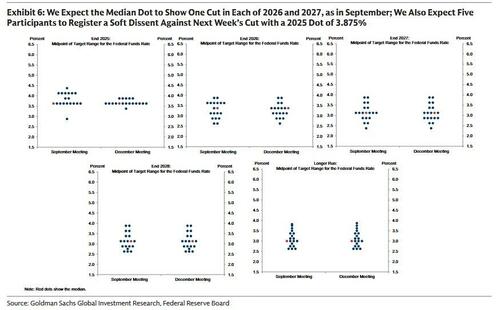

DOT PLOT: In the dot plot, Goldman expects the median projection to show one rate cut in 2026 to 3.375% and one more in 2027 to 3.125%, as it did in September, though it is a close call that comes down to a single participant in our attribution. In general, we expect fairly little movement in the dots relative to September because there has not been much economic data or other news relevant to the outlook.

In its chart of the proposed dot plot, Morgan Stanley shows how the market prices a very similar path expected by market participants and primary dealers through 2028. With market prices aligning closely with market participant expectations, the pricing of policy trades with very little term premium.This alignment between market pricing and investor expectations provides context for the low realized volatility environment in which the rates market remained

range bound. It also suggests that, if investor expectations move in one direction or another, risk premium could exacerbate the move in markets – leading to a higher realized volatility environment.

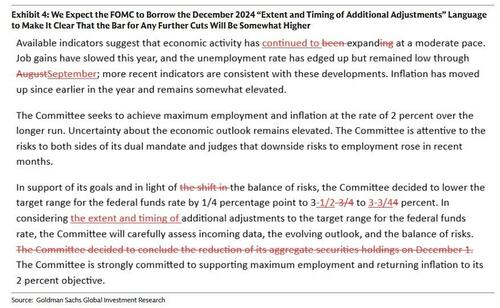

STATEMENT: As BofA warns, “watch the forward guidance language.” The bank looks for two or three substantive changes in the FOMC statement. The description of labor market conditions is likely to omit the language that the u-rate “remained low”, to reflect the 32bp uptick over the last three months. The forward guidance language might also be tweaked to indicate that the bar for additional cuts has risen. This would be a nod to the hawks. One option would be to add the word “any” as follows: “In considering any additional adjustments to the target range for the federal funds rate…”. Another, slightly more dovish option would be to use “the extent and timing of” instead of “any”. That would be a return to the language from earlier this year, when the committee was on hold, but was anticipating more cuts. Goldman trader Shawn Tuteja notes that consensus is that the statement will change to signal a pause in further cuts (after this meeting) unless there is deterioration in the labor market data – which is consistent with how the statement changed in October 2019 and December 2024 (both of which also were the 3rd consecutive meetings of cuts like this one likely will be). Below is a proposed redline comparison by Morgan Stanley for what the FOMC statement will look like.

And here is Goldman’s proposed statement redline:

BANK EXPECTATIONS: For this section, we summarize what two of the most important banks expect will happen. We start with Goldman Sachs:

- 25bps cut tomorrow, in line with market expectation.

- 2 dissents in favor to keep rates on hold

- No dissent in favor of a 50bps cut

- Adjust language back to 2024 language to reflect somewhat higher bar

- Focus will be on how Chair Powell positions bar for future cuts (watching language closely). They will likely say they say wants to see how data unfolds over Q1 to softly indicate they want to take stock over longer time frame

- On the dot plot, focus is on the UER forecast for 2026, expect the median dots for the Fed Funds rate to be unchanged (1 further cut in 2026). One way to display a hawkish cut is to show higher UER and still holding 1 cut indicating the expectation for labor market weakness

- Powell won’t give up optionality fully and will say looking at they are looking at things meeting by meeting. Showing a higher UER with same number of cuts indicates there needs to be more progress made on inflation

And here is JPMorgan:

- 25bp cut tomorrow, in line with market expectation.

- At least 2 dissents in favor of keeping rates on hold

- Expects statement or the post-meeting presser to be hawkish. However, weakening labor data will lead to a January cut (markets are pricing less than 30% of a January cut).

- Median dots will indicate only one more cur in each of the next two years.

- No change to GDP/Unemployment; some chance inflation is marked down a tick or two.

MARKET REACTION: According to Goldman FICC trader Shawn Tuteja, the bank’s client consensus into the meeting is clear: the FOMC statement, dots, and press conference are likely to be hawkish. “This is extremely well understood in the trading community, as we have gotten numerous inbounds on worries around the FOMC de-railing a year-end rally.” Tuteja next writes that broad-based index (SPX) is likely fine even in a hawkish FOMC. The more hawkish that Powell sounds (e.g. the more he emphasizes being close to neutral, labor market data being ok, etc), the more likely the market will probably try to trade NDX > RTY and other similar rotations under the surface. However, even if SPX is unlikely to sell off meaningfully after the event, an extremely hawkish FOMC will place a lot of importance on the payrolls that will come after.

The setup into this FOMC meeting is very different than into December 2024 or this past October. A few notable differences stand out:

- there has been a sizable correction in some of the frothier equities since mid October (GSXUMSAL (rolling most short basket) has underperformed SPX by almost 18%)

- December 2024 and October 2025 were “hawkish surprises” – this is clearly not going to be a “surprise” given the entire trading community expects hawkishness. I’d actually argue the risk is that there could be a low quality rally into what is perceived as “less hawkish than feared” rhetoric and

- any extra hawkishness can likely be quelled in the coming weeks by an announcement – or the anticipation of an announcement – of the new Fed chair. The market seems to continue to “positively decay” into the new committee in May.

Tuteja concludes that many clients believe that the front-end of the rates curve offers convexity. With a little more than 2 cuts priced for 2026 and the fact that we’ll get 5 months worth of payrolls data by the March FOMC, there’s growing belief that the Jan / March tenors are ones where people think there is value to being long / receiving.

VARIANT PERCEPTION: while the prevailing tail-risk scenario according to consensus is one of an extremely hawkish sounding statement/Powell presser, always the contrarian BofA’s Michael Hartnett takes the other side, and writes in his latest Flow Shows that “only thing that can stop Santa Claus rally is “dovish” Fed cut causing a sell-off in long-end.” In other words, Hartnett believes that an overly dovish FOMC will send long-end yields surging similar to what happened after the jumbo Sept 24 rate cut, and spark a selloff in equities as the next inflation wave is priced in.

In summary, the Goldman head trader thinks it’s hard to get an extreme broad-market reaction to the anticipated hawkish FOMC. As such, he thinks that owning optionality into next week’s payrolls is more valuable (preview to follow next week).