Uddrag fra Authers:

“The push to higher real yields looks in play globally. It’s likely that a structural shift away from the GFC-era levels is under way, and a spread of 2% or greater above inflation expectations makes sense for the 10-year Treasury yield,” said Yung-Yu Ma, chief investment officer at BMO Wealth Management. “Yield movements can occasionally take a violent nature as traders and investors reposition. We are surprised by the timing of the recent move, but not the direction.” His own forecast for equilibrium is around 4.5% — but he didn’t expect to reach that level until next year.

A rise in real yields can portend a crisis, but it can also show a belief in a resilient economy in which minimal post-GFC interest rates will no longer be appropriate.

Investors Are Positioned for Lower Yields, Not Higher

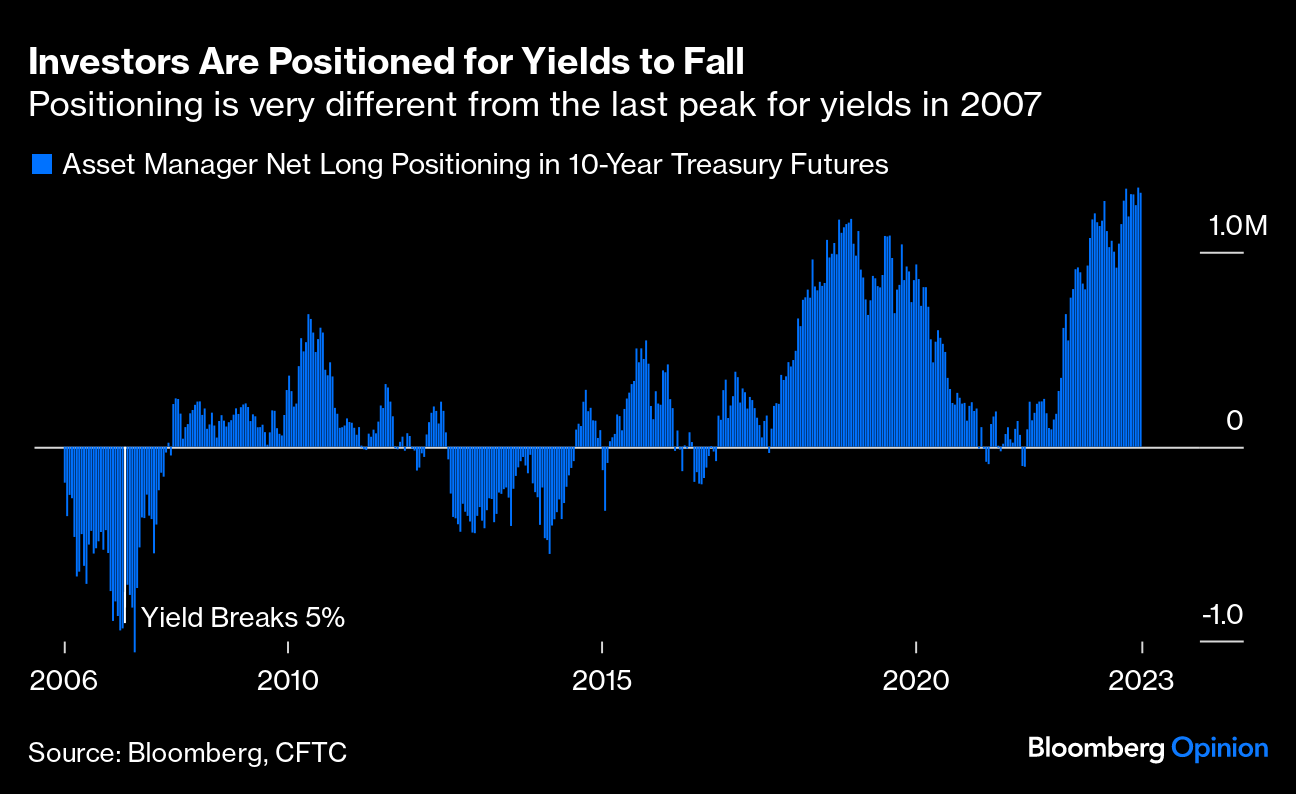

The move has not been driven by any great shifts by long-term investors, who are increasingly inclined to view Treasury bonds as a “buy” now that the Fed appears to have finished with rate hikes. In the US, the shift higher has startled investors, who entered 2023 quite confident that the peak for the yield had been reached last October. Asset managers, as tracked in commitment of traders data, are currently long 10-year Treasury futures to the greatest extent since the GFC, meaning that they are positioned for bond prices to rise and yields to fall. This is exactly the opposite of the last big bond breakout in the summer of 2007, when the crisis was taking shape and managers were strongly positioned for yields to keep rising. (They did the exact opposite.)

If yields keep heading upward, it could create as much pain for investors as the big fall in 2007 and 2008.

Not Much Higher, But for Longer

So why exactly is this happening now? To Tom Garretson, senior portfolio strategist with RBC Wealth Management, what changed was the markets’ shift in rate-cut expectations for 2024. While there is confidence that the peak for rates is in, there’s also a growing belief that rates will take a while to fall again. When the Fed does start cutting, it may ultimately only be down to a level around 3.5%, he said, a key factor that is perhaps at the core of rising yields. He said the rise:

largely reflects a surprisingly strong domestic economy and fading inflation concerns, while looming Treasury supply, fading global demand for Treasuries along with outright selling, amid typically low August liquidity, may be ancillary factors that are also helping to drive yields higher. In the short term, real rates are a headwind as valuations adjust, but as long as real rates are rising for the right reasons, risk assets can still work over longer horizons.

In other words, if the markets are right in their current assessment that the economy is stronger than previously thought, and won’t hit a recession, then the rise in real yields is appropriate. Any problems for risk assets will be mitigated by that economic strength.

Bank of Japan

If any one event appeared to trigger this latest breakout, it was the decision by the Bank of Japan to loosen its yield curve control policy, the pillar of efforts to limit borrowing costs, according to Steve Chiavarone, head of multi-asset solutions at Federated Hermes. The BOJ’s move to raise the 10-year JGB yield it would tolerate from 0.5% to 1.0%, which became known on July 27, was followed by sharp rises across the world. This doesn’t prove causation, of course. But it certainly looks like the news, which meant less cash flowing into world markets from the BOJ, also gave Japanese investors an incentive to bring their money back home.

Fitch

Finally, there is the issue of the federal deficit, which continues to rise. The decision by the Fitch rating agency earlier this month to downgrade US debt plainly had an effect on sentiment and would, all else equal, prompt investors to exit, forcing up yields in the process. Another congressional battle over a government shutdown later this year would not help sentiment on this front.

That said, it’s hard to find true “bond vigilantes” who truly think that the US will have problems paying its debts. The arithmetic set out by Jay Hatfield, CEO at Infrastructure Capital Advisors, is reassuring:

The current US external debt is approximately $25 trillion versus gross debt of $31.5 trillion. Nominal GDP as of the end of the second quarter of 2023 was $26.8 trillion, so total external debt is 95% of GDP. The Federal budget deficit is projected to be $1.4 trillion for the fiscal year ended September 2023. This represents 5.2% of nominal GDP. US nominal GDP growth has averaged just over 6% since WWII.

Even if average GDP growth slows to just over 5%, the ratio of external debt to GDP will be stable at approximately 1x GDP. This level of debt and deficits is suboptimal for economic growth as government deficit spending crowds out private investment and, therefore, slows US economic growth. However, given the strength and diversity of the US economy, including being the dominant source of most cutting-edge technology, this level of debt is manageable.

Hatfield suggests that yields will head back to around 3.5% in due course. While a ratings downgrade is bound to cause concern, most investors for now seem to agree with his assessment that the US fiscal situation is unhealthy but not disastrous.