Uddrag fra Goldman/ Zerohedge:

After the dead cat bounce peaked in late May, it’s been going from bad to worse for Chinese stocks. In addition to a never-ending housing crisis and a lack of any credible policy to bolster market confidence, the looming US election could also become a major threat to investors. In a note published on Monday, Goldman estimates that China’s stocks could fall sharply if Donald Trump returns to the White House and imposes steep tariffs on the nation’s exports (see “China Strategy: Trading “Trump Trade” in China “, available to pro subs).

As Bloomberg notes, the sharp selloff of US stocks Wednesday has made Chinese shares appear less miserable in comparison (let’s not fool ourselves, Chinese stocks are unchanged for the past decade and anyone hoping for a bounce has been punked over and over). But if investors are turning more bearish on major economies, it cannot be good news for the Chinese market. After all, exports have been one of its economy’s few bright spots these days.

Chinese investors also have to be worried about geopolitics. Trump, the betting market’s favorite to win the Nov. 5 election, has floated the idea of imposing 60% (at least) tariffs on all Chinese imports.

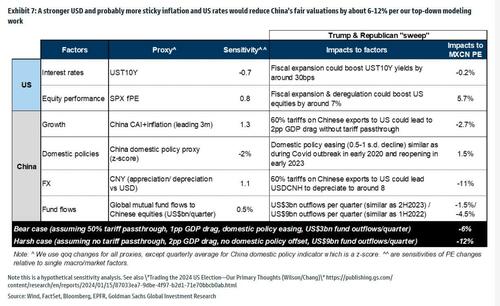

If Trump follows through on the threat and there’s no policy offset by Beijing, the “fair value” of the MSCI China Index would drop to 50 from 70, according to Goldman strategist Kinger Lau. The index is trading at 58 currently.

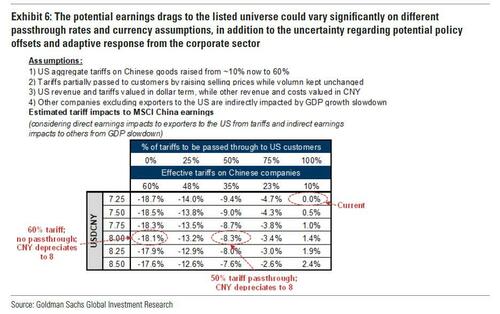

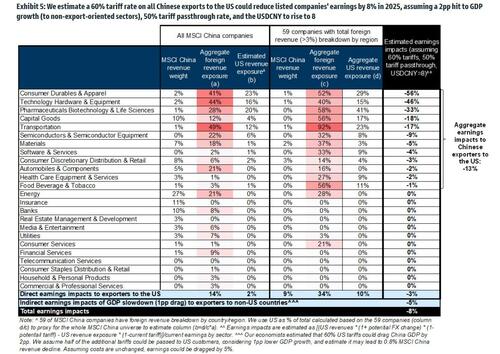

The estimate is based on the assumption that the tariffs would reduce the earnings of the MSCI benchmark by 8 percentage points next year, cut China’s GDP by 2 percentage points and send the yuan to 8 per dollar, from around 7.3 currently.

It would also crush companies earnings by at least 8% in 2025.

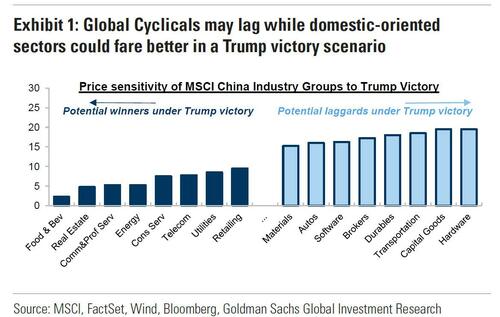

Sector-wise, companies in tech hardware, capital goods and transportation are likely to be hit the most, while consumer tech, consumer services, and energy firms may be least vulnerable, according to the strategists.

Of course, Beijing won’t just sit there and take it, and the country’s policy makers will most likely respond by finally delivering a wave of stimulus, which in turn will send commodity prices soaring and send inflation sharply higher .

To be sure, there are also many uncertainties around the US election. And if, or rather when Trump does win, it remains questionable whether he will do what he says on campaign trails.

While odds of Trump winning the election have slipped modestly to levels before his debate with Joe Biden last month, largely as a result of the full-bore media campaign to make Kamala appear as if she has monetary and voter support (she does not as we reported here and here). So while one cannot pin the recent decline of Chinese stocks on Trump, by the same token, since the Trump victory risk hasn’t been fully priced in, one could envision much more volatility ahead as the election draws near.