Dansk bearbejdet resume af analyser af den accelererende likviditetskrise:

Resumé: Finansielt stormvejr udløst af swap spread-kollaps og basis trade-opløsning

Baggrund og tidligere advarsel

Tilbage i oktober 2024 advarede Goldman Sachs om en potentiel finansiel krise forårsaget af udviklingen i swap spreads – et teknisk, men afgørende element i finansmarkedets infrastruktur. Dengang blev et kollaps afværget i sidste øjeblik, muligvis via skjult statsstøtte op til valget, hvor Kamala Harris var favorit.

Nuværende situation – et decideret sammenbrud

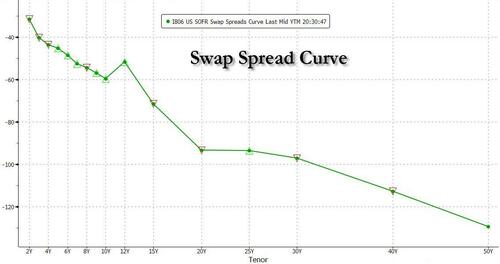

I marts/april 2025 er lignende advarsler blevet virkelighed. Swap spreads – særligt 3-årige SOFR-spreads – er faldet dramatisk. Dette afspejler en kaotisk opløsning af den såkaldte “basis trade”, hvor hedgefonde går lange i statsobligationer og korte i swaps. Paniksalg for at afvikle disse positioner fører nu til, at swaps klarer sig markant bedre end statsobligationer, hvilket skaber ekstremt negative spreads.

Årsager og konsekvenser

Flere faktorer tilskrives krisen:

Stagflationsfrygt og handelskrig (Trump-administrationen).

Kinesisk salg af amerikanske statsobligationer.

Overmodenhed i markedet for basis trades.

Resultatet er, at både hedgefonde og traditionelle kapitalforvaltere sælger obligationer og andre aktiver for at skaffe kontanter, hvilket udhuler likviditeten i markedet. Det har ført til:

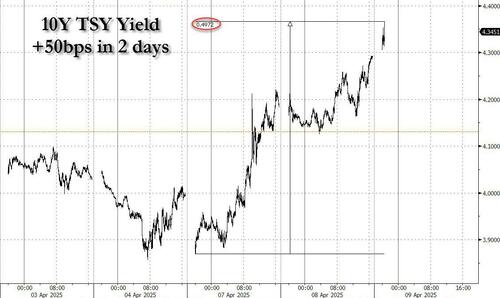

En 50 basispoints stigning i 10-årige renter på bare to dage.

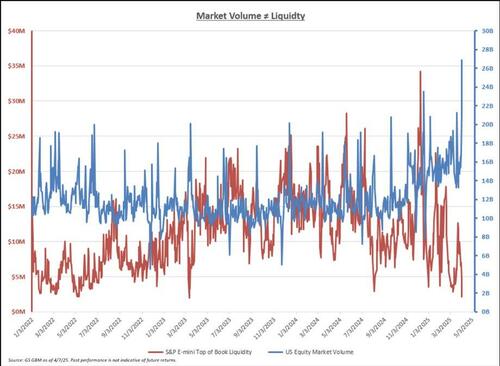

Drastisk fald i aktiemarkedslikviditet.

Tømning af markedet for amerikanske statsobligationer, virksomhedsobligationer og realkreditpapirer.

Alarmklokker ringer hos eksperterne

En trader fra Nomura kalder situationen “et vakuum af likviditet” – muligvis det værste, han har oplevet i sin karriere. Markedet venter nu spændt på, om den amerikanske centralbank (Fed) vil gribe ind med nødløsninger som:

Operation Twist.

Likviditetsinjektioner via SRF (Standing Repo Facility).

Afslutning på kvantitativ stramning (QT).

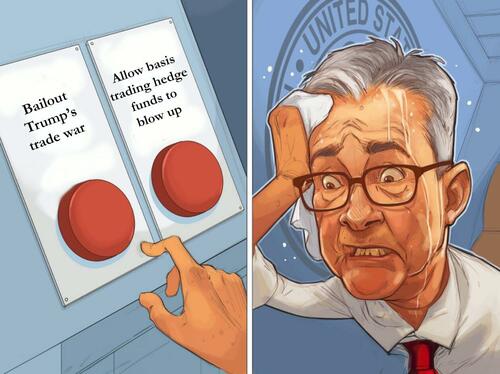

Politisk spændingsfelt: Powell fanget mellem Trump og demokraterne

Powell og Fed er i et dilemma: Enhver redningsaktion kan blive tolket som politisk støtte til Trump, hvilket demokraterne vil opfatte som utilgiveligt. Omvendt kan passivitet føre til en systemisk kollaps. Denne konflikt gør det svært for Fed at handle – trods åbenlyse markedsforstyrrelser.

Konklusion: Kritisk 48-timers vindue

De kommende statsobligationsauktioner (10- og 30-årige) vil fungere som lakmusprøve. Et mislykket resultat kan udløse en fuldgyldig krise. Parallelt er der store pengestrømme knyttet til skattemæssige deadlines, som yderligere kan presse likviditeten.

Sammenfatning i punktform:

Swap spreads kollapser på tværs af løbetider – et tegn på systemisk stress.

Basis trades afvikles i panik, hvilket presser renterne op og likviditeten ned.

Både fonde og institutionelle investorer går i cash.

Fed er under massivt pres for at gribe ind, men er politisk lammet.

De næste 48 timer bliver afgørende for hele det amerikanske finansielle system.

Uddrag fra finanshuse

But first, we urge readers to reread our article from October 2024 when for the first time we looked at a rather opaque and otherwise boring corner of the financial plumbing universe, Treasury swap spreads. The article was the aptly named “What Is Going On With Swap Spreads?”: Goldman Warns All Hell About To Break Loose In Repo.”

Luckily, all hell did not break loose back in October, as swap spreads eventually halted their sharp move, thanks to a still unexplained source of liquidity emerging in the last minute (although with said calamity expected to occur just days before the election which Kamala Harris was supposed to win, we can kind of imagine where the stealth funding came from).

This time, however, we are not so lucky.

Presenting Exhibit A: 3 Year SOFR Swap Spreads…. which are currently in unprecedented freefall, and about to recreate the catastrophic scenario that Goldman warned about back in October.

What’s going on here? Well, the simple explanation is that the most popular trade among the hedge fund community, the abovementioned basis pair trade of long Treasuries, short swaps is in the process of terminal, catastrophic unwind (here some blame Trump for unleashing the stagflation genie with his trade war, others accuse China of dumping Treasuries in response, yet others say it’s just long overdue that the basis trade finally blew up), and as a result of the panicked scramble to unwind, swaps are now massively outperforming Treasuries, which are getting dumped, and pushing swap rates far below Treasury yields, resulting in record negative swap spread rates!

The bottom line is that funds and banks are panic selling Treasuries to raise cash, while adding swaps to maintain exposure to interest rates, leading to the record low spread between swap rates and Treasury yields across the curve: yes, we have shown the 3Y SOFR swap spread chart above, but one can look at every tenor across the curve and get the same message.

Translation: basis trade implosion translating in swap spread stop-out devastation!

The Financial Times, which picked up on the topic of the collapsing basis trade topic about 10 days after us, quoted a hedge fund manager who said that “hedge funds have been liquidating US Treasury basis trades furiously.”

The “furious” panic to unwind the basis trade means the “paper” leg of the trade has pushed yields soaring, something which can be seen by observing the unprecedented 50bps move higher in the 10Y yields in just the past 2 days (a move which may easily have gotten some additional kick from Chinese selling of US paper too)!

The moves were not limited to hedge funds. Investors across the board have sold Treasuries to raise cash, with one fixed-income trader pointing specifically to traditional asset managers: “I think investors are moving to cash and cash-adjacent assets to weather this market volatility,” said Ed Al-Hussainy, senior rates analyst at Columbia Threadneedle Investments.

“The simplest explanation (for the move in yields) is investors selling what they can and hunkering down. Selling equities now will lock in losses so the lowest-hanging fruit is to raise cash by selling Treasuries,” said Al-Hussainy.

The hedge fund manager who attributed the moves in yields to the basis trade said the scale of the broader hedge fund selling was “destroying” liquidity, or the ability to easily buy and sell assets, across Treasuries, high-grade corporate bonds and mortgage-backed securities.

And certainly stocks: as we noted earlier, according to Goldman head trader John Flood, the Emini top of book has just dropped to a record low $1.39 million, even as stock trading volumes hit all time highs resulting in insane rollercoaster days like today and yesterday.

“There’s massive deleveraging going on, any source of liquidity is being tapped,” the person told the FT.

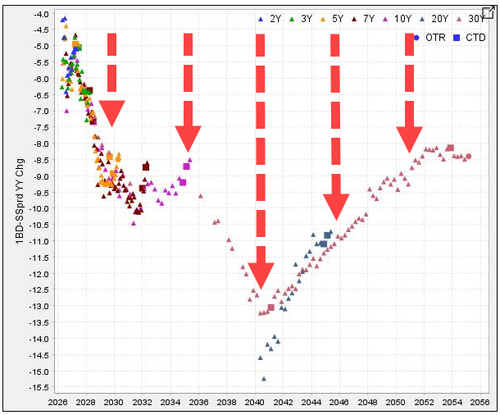

That was actually one of the more cheerful takes; for a far more dire perspective on what is happening, we bring your attention to an absolutely must read note published this evening by Nomura rates trader Ryan Plantz (available here to pro subscribers), which our friend Charlie McElligott summarizes as follows: “OUR PETS HEADS ARE FALLING OFF” in Treasuries -space, where it’s just unwind city into this Bear-Steepening shock, with Swap Spreads and Basis trades melting…look at the 1d ASW chg (Cash Bond calamity and cheaping violently to the Swap), something that Ryan calls “…one of the largest if not the largest that I remember in my career…it’s simply a vacuum of liquidity at this point.“

We excerpt more from the must read note below which, we are delighted to note, comes the same conclusion as what we said earlier in the day: the Fed now has to step in, and even though Powell may hate to appear like he is bailing out Trump’s trade war, he simply has no choice!

The Trump administration meant it when they said “quiet mode” – they are letting the pain really flow. The fear induced from a true buyers strike driven by the administrations aggressive stance on our trade partners has left a void in the UST market. Absolutely, spectacular meltdown into the end of the session which has many (myself included) continuing to question their sanity as the curve aggressively bear steepens and spreads, basis, etc. fall out of bed. The ASW change on day is truly remarkable – this is a 1d change mind you which is one of the largest if not the largest that I remember in my career. It’s simply a vacuum of liquidity at this point:

The dialogue has quickly become “when will the Fed come to the rescue?” question deluge. We flagged earlier this morning until we see material liquidity change, funding stress via higher repo, massive funding raise from banks via FHLB like we saw during the bank crisis a few years ago, etc. then this is really all about sentiment and comfort – then and only then is an “emergency cut” on the table. Well…we are certainly feeling like this could be the next shoe to drop. Recall, 2020 QE was about liquidity and market function and surely another gap move like we saw today could leave us in a place where tapping the SRF, ending QT, etc. is quickly on the table. I even uttered the words “operation twist” today…that’s where we are. That said, we still aren’t there yet in funding markets.

Frank Nugent, Head of Repo Sales to comment on this below:

“The world is awash in uncertainty amidst the melt down in asset classes across the globe. The price action in the yield curve and the unwinding of popular RV trades (basis / swap spreads etc.) has many wondering if the next shoe to drop will be funding rates. Throw in potential reserve manager selling adding to already bloated dealer sheets, and it’s not hard to see why some are wondering if we’re looking at another march 2020 type event.

Note well I do not think we are there. This is not the same. Funding markets remain remarkably functional. Levels are likely to remain at or near upper bound in the near term, but that’s not far off from where my base case was before the past two days price action. Cash available and the growth in sponsored repo mean we are in a much better spot now than then.

That said many are concerned and any disruption (or even the perception of it) in funding rates would be gasoline to this fire, and there is significant event risk in the coming week with mid month coupon settlements and tax day flows. Tax day sees large amounts of cash moving thru the system (MMF outflow, TGA up, Reserves down) and while balance sheet will not be a binding constraint here there can be large frictions associated with these cash movements, especially with the RRP low. When I look at the auction results in the 3y today – and the large dealer take- I see additional potential sources of stress (let’s see how the rest of the coupon supply shakes out). Fortunately the fed has tools in place to address any potential liquidity concerns over the tax day period.

A lot can change in a week, but why not position the SRF for additional morning operations similar to this past quarter end. These can be announced immediately and remain through the long weekend and would not have the balance sheet constraints we would see in a typical month/quarter end. While i don’t think we’re at risk of it meaningfully being used, why not make it available in an effort to calm the broader markets and perhaps stabilize spreads. In spite of it not being used, we’ve seen the availability of the morning operations, which satisfy overdraft concerns, have stabilizing effects in the very recent past. No reason to expect different now. Good luck everyone. Frank”

There is much more in Plantz note (available here to pro subscribers), but we will go straight to the conclusion which is rather terrifying (or perhaps tariffying):

“So in all, does the Fed bend the knee or do they look at funding so far and say “this is fine”? We are going to be watching how repo trades in the morning very closely and, surely, the 10yr auction tomorrow might be once of the most watched events we can recall in some time from a supply perspective. Until then, as we flagged this morning, we still think waiting until ~3.5% level in greens is where it is sensible to start scaling into duration longs if we get a flush overnight. As for spreads, if I liked them this morning…I don’t even know what you call it now.

For those who are lost, we are now at that moment:

To summarize:

- Multi-trillion basis trade is blowing up and countless funds and banks are unwinding positions, but…

- There is not nearly enough liquidity in the system

- The lack of liquidity shockwave is rampaging across all markets, sending stocks plunging (liquidation panic), bonds crashing (yields up 50bps in 2 days), and a flight to safety in FX (yen soaring… but at some point the inflection point will get hit and there will be an acute shortage of dollars as the global synthetic dollar short at around $6 trillion is even bigger than the basis trade).

- We have critical liquidity drainage events as soon as tomorrow (the 10Y auction followed by the 30Y auction on Thursday), and if there is not enough liquidity in the system, we may have an unofficially failed auction – yes Dealers would in theory take down the whole thing, but if we get a 40 or 50% dealer award, it’s the same as a failed auction.

Meanwhile, if this were happening at any other time, the Fed would be rushing to bail out the system. After all Powell cut a jumbo 50bps in Septemebr 2024 when there was zero stress in the market plumbing… But he can’t do anything now because he would be seen as aiding Trump, especially since the narrative now is that yields are surging because of stagflation fears. Only, that’s not the case at all – indeed, yields were tumbling until Friday, when the basis trade started to get unwound, at which point they shot straight up.

And the biggest paradox is that the more liquidity is drained, the higher yields will rise, the more the Fed will misinterpret the signal sent from yields as one of stagflation (“let Trump fix that, he just needs to undo tariffs”) instead of what it really is: imploding liquidity and an imminent market crisis.

Oh and lest we forget, if Powell were to cut tomorrow, or launch QE, the Democrats would never forgive him as they would see such an action as bailing out Trump.

Only Powell no longer has a choice, because if he lets Trump crash and burn, the Fed Chair will also be allowing the entire financial system collapse!

In retrospect little did we know how prescient this tweet from more than a year ago would prove to be…

And now we wait to see what the Fed will do because the next 48 hours may well be the most important in the recent history of the US.

* * *

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her