USA mister terræn i det globale kapløb om at være den førende industrination, skriver Merrill Lynch i en analyse. Det er Kina, der presser US af banen på flere områder, f.eks. elektriske produkter, kemikalier og computere, mens USA stadig holder skansen inden for papirprodukter og medicinalprodukter. Kina er blevet førende på område efter område og har en markedsandel på mindst 20 pct. på stort set alle områder. Men vil Kina så udkonkurrere USA? Ikke nødvendigvis, mener Merrill Lynch. Det afhænger især af de nuværende bestræbelser – politisk – på at styrke den amerikanske produktion. Men Merrill hæfter sig også ved den overvældende arbejdskraft og stærke infrastruktur, som Kina besidder. Kapløbet er ikke endelig afgjort.

In The Race For Global Manufacturing Supremacy, America Is Slipping

Behind

First the good news: America remains a manufacturing powerhouse, holding commanding positions in a number of industries ranging from paper products to pharmaceuticals. The bad news: China’s manufacturing might continue to expand and exceed America’s in a number of

key industries like electrical equipment, chemicals and computers.

As outlined below, the contest for global manufacturing supremacy boils down to the U.S. versus China. It’s a race of great strategic importance since the country that prevails will gain first-mover advantage in a number of key industries, attain pole position in setting global industrial standards, and secure a competitive leg up in critical third markets like India, the Middle East and Africa.

America: Good not great

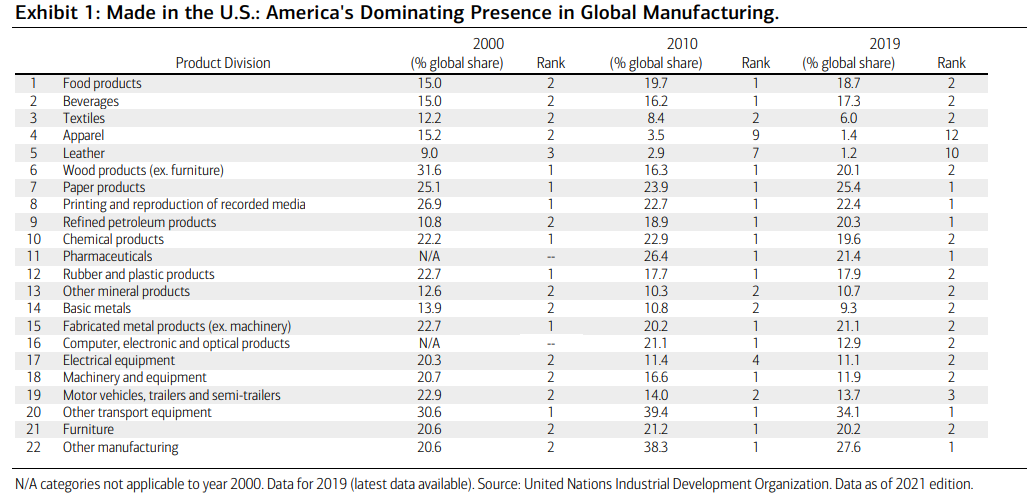

While many investors are under the impression that the U.S. is not in the business of making “stuff” and that America’s manufacturing capacity has either been allowed to atrophy or be shipped to low-cost locales like China and Mexico, nothing could be further from the truth. America is a manufacturing superpower as Exhibit 1 makes clear. The table highlights America’s global share and rankings based on 22 different manufacturing categories, ranging from food and beverages to basic metals to motor vehicles. The numbers come from the United Nations (UN) and are based on 2019 data, the last year of available data.2

Note that of 22 categories outlined, the U.S. ranked first in six categories and second in 13 others, underscoring the manufacturing breadth and competitiveness of American manufacturing. In only two sectors—apparel and leather—did the U.S. significantly lag the rest of the world.

Note also that between 2000 and 2019, America’s global manufacturing share actually edged higher in a number of sectors, including beverages, paper products, refined petroleum products and other transport equipment. In general, then, the overall health of U.S. manufacturing is good.

Yes, but….

More impressive still are the manufacturing strides taken by China over the past two decades. In 2000, for instance, China ranked first in only three categories—tobacco, textiles and leather. But fast forward to 2019, and the picture shifts dramatically, with China ranked first in 16 categories while second in six others. According to data from the UN, China accounts for 28.7% of global

manufacturing output versus America’s share of 16.8%; Japan, ranked number three, has a 7.5% share, while Germany comes in fourth (5.3%). State-directed industrial policies married with China’s cheap labor and foreign direct investment inflows, notably from Hong Kong and

Taiwanese firms, have transformed a one-time backward, agrarian economy into one of the preeminent manufacturers in the world.

Think of it this way: if global manufacturing was akin to the Olympics, then China would take gold or silver in every contest of the games. Impressive. Virtually every nation in the world has been touched in some shape or form by the economic rise of China, the U.S. included. But the country bearing the brunt of China’s manufacturing rise has been Japan, which, in 2000, ranked either first or second in 18 different categories. In 2019, however, Japan was not ranked first or second in any category, subsumed largely by the rising manufacturing output of the mainland.

Speaking of which, Exhibit 2 highlights the massive manufacturing gains of China this century. Note the outsized lead China has in such light industries like apparel and textiles, or general sectors like basic metals and electrical equipment, and higher-end activities like computers and motor vehicles. There’s hardly a sector in which China does not have at least a 20% global market share, while commanding a 50%+ share in textiles, apparel and leather, and 40%+ shares in electrical equipment, basic metals and computers.

And even in the post-pandemic world, where global supply chains are becoming more dispersed and less (on the surface) China-centric, China’s manufacturing dominance, in our opinion, remains largely unchanged. Relative to the rest of the world, no other economy has as large a skilled labor force and as efficient an infrastructure system, and doles out as much in terms of state subsidies and incentives, than China. Hence China’s command of global manufacturing activities.

The race isn’t over

China’s manufacturing lead is not insurmountable—after all, China’s labor force has peaked, wages are rising, and more state-control of industry could ultimately choke off future innovation/ manufacturing growth. This is a marathon, not a sprint. The good news is that the U.S. has awakened to the challenge of China and is focused on reinvigorating U.S. domestic manufacturing activities. The recently passed CHIPS Act bill and pending Inflation Reduction Act are two public sector programs that speak to and address America’s slipping global manufacturing position.

What this all means for U.S. investors is this: The renewed focus on bolstering U.S. manufacturing activities/capabilities couldn’t come at a more critical time given the widening manufacturing gap between the U.S. and China. The production of physical goods remains essential to the future health of the economy—notably at a time when the physical supplies of food, medical equipment, armaments and semiconductors, to name a few key products, are in short supply and increasingly subject to nationalist whims. Long term, we remain constructive on U.S. Equities given the dynamic and resilient nature of the U.S. economy. We continue to monitor the U.S.-China manufacturing gap but take solace in the fact that America has awakened to the challenge and starts from a position of strength. Stay tuned.