Andet kvartal i USA har skabt energi uden lige i energiselskaberne, der næsten har tre-doblet indtjeningen. Men i de fleste store selskaber og sektorer har resultaterne været bedre end frygtet, nemlig i 450 af de 500 i S&P 500. Men uden fremgangen i energisektoren, ville virksomhederne dog have haft en nedgang i resultaterne i forhold til året før. Merrill venter, at resultaterne i 2023 bliver 8 pct. lavere end i år. Derfor anbefaler Merrill investorerne at sprede risiciene endnu mere end normalt.

Uddrag fra Merrill Lynch:

An Energized Q2 Earnings Season

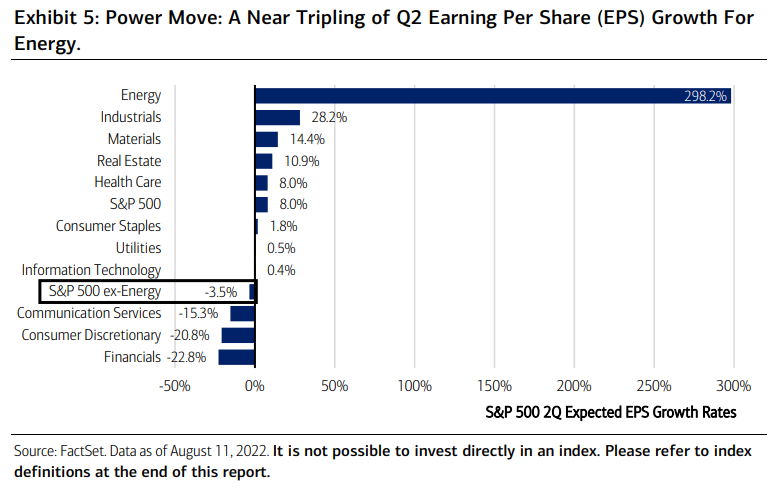

Through more than 450 of the S&P 500 company results, the tag line has been “better than feared” for Q2 earnings. Cushioned by the elevated nominal growth environment, results are charting earnings growth of around 8% for Q2 compared to the year prior, thanks in large part to one sector: Energy.

In fact, excluding the Energy sector, earnings would not only decline, but shrink by almost 4%. Of the eleven sectors, and by a large margin, Energy’s estimated 298% earnings growth leads the pack, with profits expected to have increased almost $50 billion, tripling profits from a year ago. By contrast, three sectors have recorded a negative earnings growth rate, with the Financials sector the laggard, as banks faced tough loan loss reserve comps of the year prior.

Also to note is that of the five largest individual stock contributors, two of the top five are within the Energy sector, (up from one in Q1 2022).9 The Global Wealth & Investment Management Investment Strategy Committee double upgraded the Energy sector from underweight to overweight last March 2021 when Energy was 2.8% of the index. A glacial progression, Energy stocks now make up 4.2% of the overall index sixteen months later.

Courtesy of the ascent in oil and natural gas prices, as well as the lingering (albeit fading) effect from the broader reopening of the economy and improving capital investment in exploration and production by energy companies, earnings have risen from 3% of total S&P 500 earnings to 13% this earnings season.

While analysts have begun to trim their estimates for the second half of the year, they’ve been slower to trim 2023 estimates, likely an admission of the uncertain outlook and uncertain magnitude of recession on the way. Current positioning in Equities and bearish

sentiment have set the stage, in our opinion, for Equities to see bear market rallies (especially around a peak in inflation), already having seen two 10% rallies since the January 3 peak on the S&P 500.

And although we are encouraged by the resiliency of corporate earnings results so far this year, given the deteriorating outlook into year end,

we expect an earnings decline in 2023 of 8% on economic weakness and margin pressures. For that reason, we remain disciplined and “on guard” and would consider using market volatility to become even more balanced at the sector level in Equities and diversified at the asset allocation level according to an investor’s risk profile.