Udsigterne i eurozonen er hurtigt blevet forværret, og økonomien synes på vej mod recession. ECB bliver nødt til at styrke sin stilling som inflationsbekæmper og må fortsat hæve renterne. Afhængigheden af russisk energi bliver i særdeleshed mærkbar til vinter. Hvis energieksporten til Europa helt standses, vil den tyske økonomi falder med hele 7 procentpoint, ifølge et scenarie fra Bundesbank. I en recession kan det blive svært for ECB at hæve renten, men det er nødvendigt.

Macro & Markets: Running out of energy

The outlook for the Euro-area economy has darkened quickly and the economy appears to be heading towards a recession. Despite the weakening outlook, the ECB will have to strengthen its credentials as an inflation fighter and continue to raise rates.

Inflation is putting a strain on people. Many are worried that it is here to stay. We keep an eye on these so-called inflation expectations. That’s why we have raised interest rates: to send the message that we will not allow inflation to stay above 2%. That will help keep inflation expectations in check. – ECB website on why they have raised interest rates.

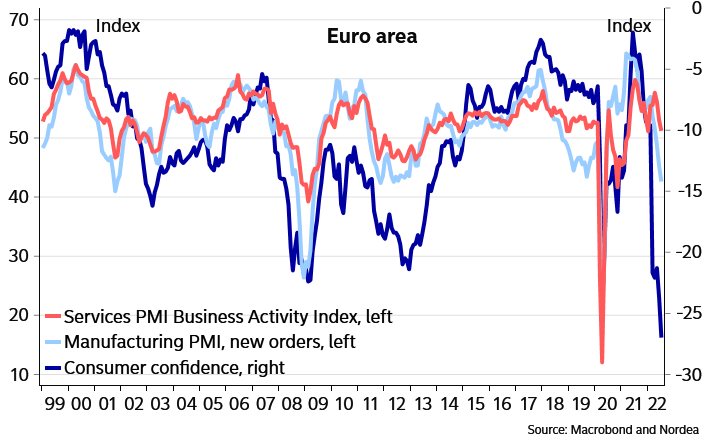

We wrote last week why we think the US economy is much stronger than many seem to think. Unfortunately, we cannot say the same for the Euro area. While Euro-area Q2 GDP numbers were still surprisingly strong, much worse lies ahead. Confidence has tanked both among consumers and companies, high inflation and energy prices are causing increasing pain, financial conditions have tightened, shortages of energy threaten over the winter and Italian political risks have increased again. According to the PMIs, the weakness has already spread also to the service sector, which was supposed to balance weakness in the manufacturing sector. In short, the Euro-area economy is increasingly likely to enter a recession later this year.

Euro-area economic confidence has tanked across the board

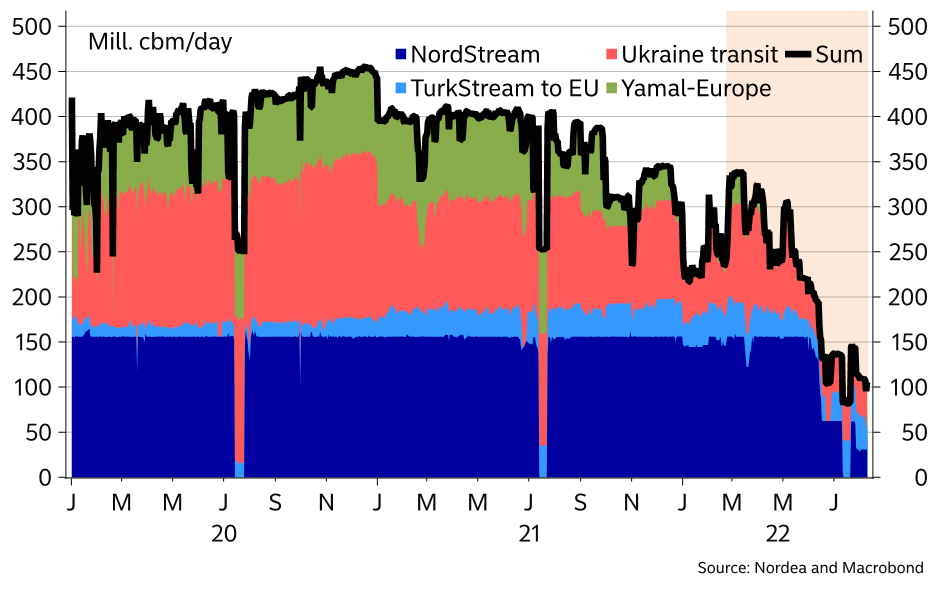

The downside risks have been apparent for many months already. The consequences of being too reliant on Russian energy will increasingly be felt over the winter, even if their exact magnitude still looks uncertain and depends on the extent of future gas flows and the severity of the upcoming winter, among other things.

The German Bundesbank, for example, has estimated that the level of German GDP could end up 7% below the baseline in 2023 (GDP would fall by just over 3% in 2023) in an adverse scenario, where there is a complete and permanent stoppage of Russian energy exports to the EU, energy and commodity prices rise further, energy usage needs to be rationed and macroeconomic uncertainty and financial market volatility will increase.

The Bundesbank risk scenario is among the more drastic ones and the impact varies by country, with e.g. France and Spain likely to perform much better than Germany and Italy. Nevertheless, it will take time for many countries to find alternative sources of energy. In the meantime, the negative economic consequences can be sizable, if and when Russia decides to completely turn off the taps. And based on recent events, it appears only a matter of time, before gas completely stops flowing from Russia to the EU.

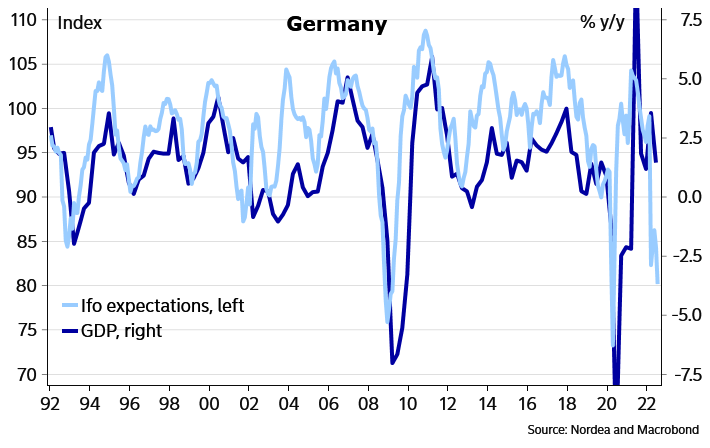

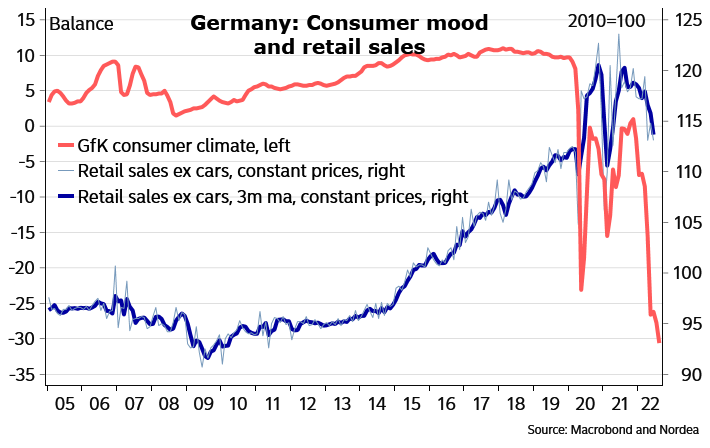

Growth in the largest Euro-area economy (Germany, accounting for almost 30% of Euro-area GDP) was already halted in Q2, and leading indicators such as the Ifo business confidence index have fallen deep into recession territory. The almost total absence of confidence among consumers is already apparent in private consumption, as illustrated by big drops in retail sales, though changes in consumption patterns from goods to services may explain some of the weakness.

Ifo expectations suggest weak times ahead for the German economy

Extremely weak consumer confidence already reflected in retail sales

Gas flows from Russia to the EU have already collapsed

ECB cannot possibly hike rates in a recession, or can it?

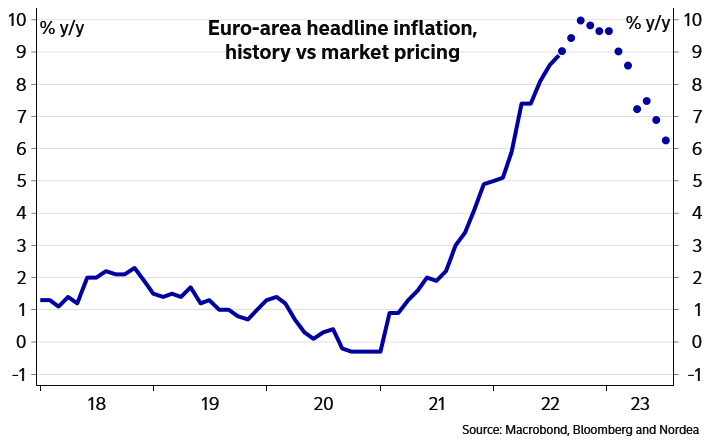

Where does this leave the ECB? In other circumstances, the central bank would focus on the weakening growth outlook and could start to ponder easing policy. But not this time. The ECB played the inflation-is-transitory-and-we-should-just-look-through-it card last year and failed miserably. Inflation pressures have continued to mount and broaden and even if the economy hits recession, it will take time for inflation to recede. In fact, if the economic weakness results from high energy prices, inflation could remain at close to current levels or even higher well into next year.

After constantly underestimating inflation developments since early last year, the ECB is now seeking to strengthen its credentials as a credible guarantor of price stability – even if it means hiking rates in a recession. One should also remember that the ECB has a history of making policy mistakes towards tighter policy, as it hiked rates in 2008 on the eve of the global financial crisis and twice in 2011 ahead of an escalation of the Euro-area debt crisis.

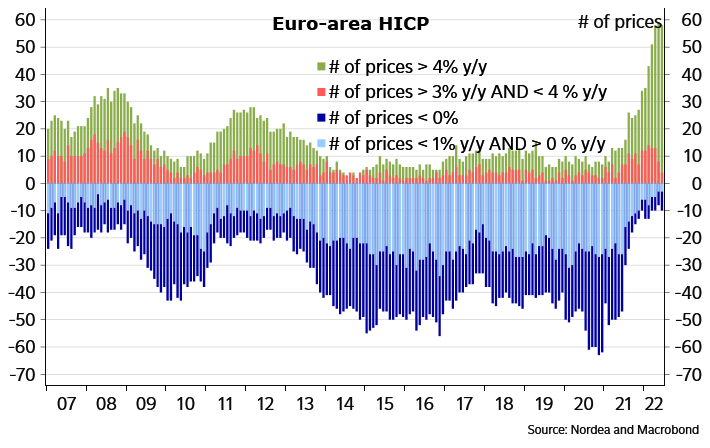

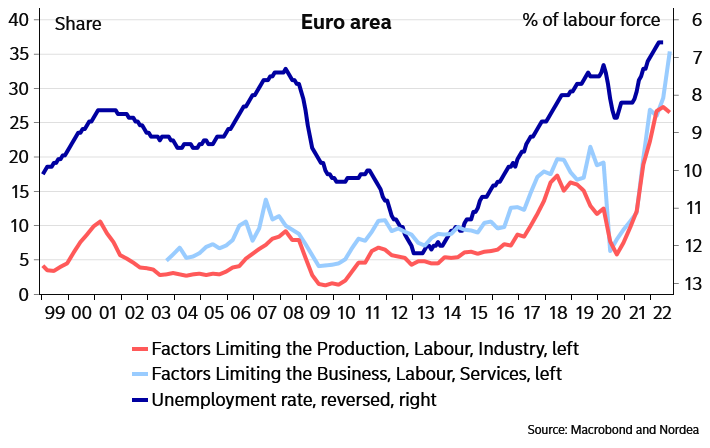

The ECB does have some genuine reasons for concern. Euro-area labour markets are showing signs of elevated tightness, as illustrated by the record-low unemployment rate, even if wage growth has yet to pick up considerably. An increasing share of prices is rising rapidly, and it is not a given that weaker economic developments would quickly bring inflation down to the ECB’s 2% target. As the ECB has emphasised, it needs to send a clear message that it will not allow inflation to stay above 2%. And it will certainly take more than one rate hike and a deposit rate at zero to send such a message. We expect 50bp rate hikes at the upcoming two monetary policy meetings and the depo rate to reach 1.5% next year.

Euro-area inflation set to rise further in the coming months

The price increases broadened considerably

Euro-area labour markets look tight

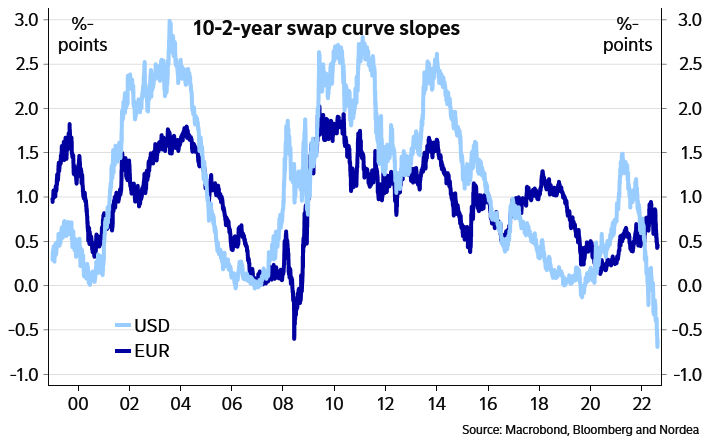

For financial markets, we think the EUR curve could flatten further towards the end of the year, as the ECB hikes lift the short end, while growth worries limit the upside for the long end. If the economy rebounds after the winter and the ECB pauses its rate hikes in the first half of next year, the curve could steepen again. As the US economy is set to outperform the Euro-area economy, we also see further downside for the EUR/USD towards the end of the year.