Det er svært at få en klar tendens i den økonomiske udvikling, men investorerne vil på Jackson Hole-mødet i USA sidst på ugen få en mere sikker fornemmelse af markedets retning. Det bliver centralbankchefen Powell, der får en chance til at styre investorernes forventninger, skriver Nordea i en omfattende analyse. De høje renter har markant påvirket boligmarkedet, mens det nylige fald i benzinpriserne påvirker forbrugerstemningen. Udenlandske investorer har solgt ud af ameriknske T-bonds.

Uddrag fra Nordea:

Macro & Markets: Managing expectations

There was little new in the Fed Minutes, but Powell gets another chance at Jackson Hole next week. Higher rates are working in the housing sector, but gasoline prices are more important for the consumer. Investors are shunning long-end Treasuries.

In a week without much hard US data, the Minutes of the July 27 FOMC meeting were supposed to be the highlight. However, neither we nor the market (it looked like) were much wiser after reading the account of the central bank meeting. Given that the market interpreted Jerome Powell’s press conference performance as dovish, sending rates down 10bps, and that we have had a raft of Fed officials seeming trying to repair that impression by sounding hawkish in the weeks since, we had expected a more direct tone in the Minutes. It really should not come as a surprise to anyone that the Fed will be more data dependent going forward, but the central bank could have used this occasion to address the market pricing of rate cuts next year, which is starkly at odds with their own forecast. Powell gets another chance at managing investors expectation at his at the Jackson Hole Economic Symposium next Friday.

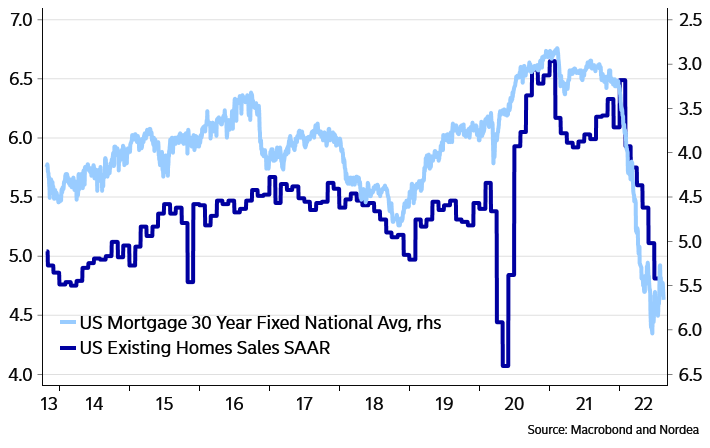

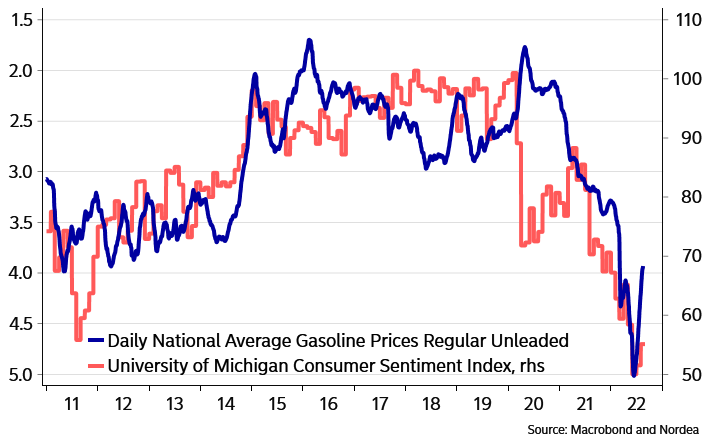

In terms of economic data, we saw another batch of weak housing data, with housing starts down almost 10% in July. With the rapid increase in mortgage rates, this is really the only sector we can see having been clearly impacted by tighter Fed policy thus far. Consumer confidence, on the other hand, improved. It seems that lower gasoline prices are working. In fact, we can probably attribute much of the weakness in consumer sentiment and goods spending this year to the high pump prices. The recent 1$/gallon reversal will leave more money to be spent elsewhere, and this will probably be visible in better macro data over the next couple of months.

Chart 1: US Housing activity is clearly impacted by the level of mortgage rates.

Chart 2: Consumer sentiment is heavily impacted by gasoline prices. The recent decline in pump prices bodes well for US households.

Besides data and central banks, we have had two interesting Treasury auctions the last two weeks. Both the 30- and 20-year auctions came in very weak, sending long-end rates markedly higher. This is a reminder that investors demand a premium to move out the curve. Keeping the interest curve inverted for longer periods of time is therefore difficult unless rate cuts are just around the corner (which the Fed is telling us is far from the case now). As short end rates continue to march higher, we expect to see more weak bond auctions.

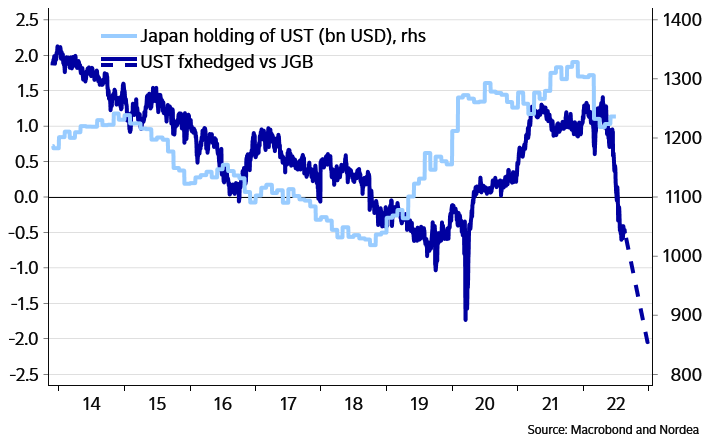

Foreign interest was particularly weak this week, not surprising given the negative pickup when buying US bond on an fx hedged basis. This metric will only deteriorate. In fact, international investors look to pick up an extra 2% buying 10Y JGBs over TSYs at year end if long end rates keeps to their forwards. Japanese investors have been net sellers of US Treasuries since March, and we expect them to trim their holdings further. In addition to the bad relative value metrics, the Fed’s QT program will also start firing on all cylinders come September. Another large buyer turned seller will not help bonds perform…

Chart 3: The pickup in US Treasuries for foreign investors is vanishing rapidly. The Japanese have been net sellers this year, with more to come

Outside of the US, Norges Bank hiked rates by 50bps as expected and signaled there is more to come. We expect core inflation to continue to climb until year-end paving the way for another 50bps of hikes next month. Read more here.

Next week will not bring a whole lot of hard US data either. PMIs will probably continue to show a weaker picture for manufacturing, but still ongoing strength in services as households are still in the process of switching back to a more normal consumptions pattern from the extremely goods-oriented preference during the pandemic.

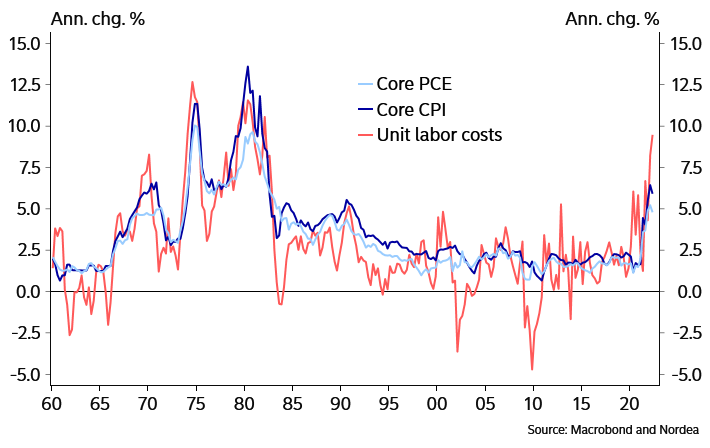

With little hard data to lean on, and with no clear new messages from the Fed (until next weekend), we will take the opportunity to take a closer look at US inflation. This is where the battle on rates will be fought eventually. The one thing the Fed has been very clear about, is that they will not ease policy until it’s very clear inflation is closing in on 2%. We believe this will take much longer than currently envisaged by market pricing. The above 10% YoY print for UK inflation this week is a reminder that prices can grind higher even though commodity prices are on their way down from extreme heights.

For the Fed, it’s still all about inflation

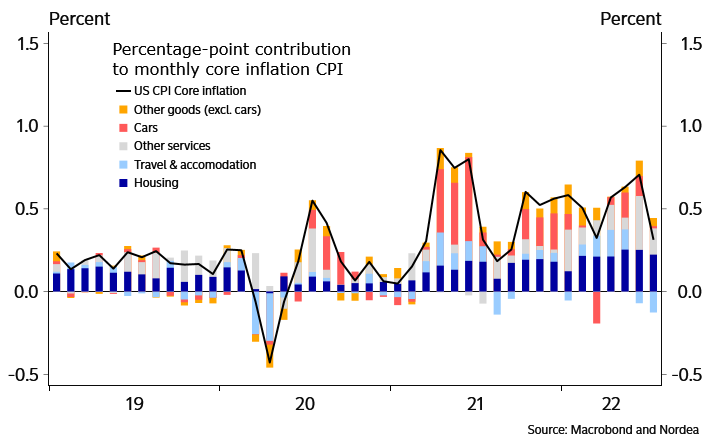

The soft July CPI is not enough for a dovish Fed pivot. The drop in commodity prices and easing supply chain disruptions will alleviate price pressures on categories that have jumped throughout the pandemic. These categories – goods, cars, travel and accommodation – will likely deflate and eventually return to their usual (disinflationary) price trend. In our view the July CPI report served as an appetizer of what is to come in the coming months: Jumpy categories starting to drag, but no real change in the underlying inflation, which is still elevated and broad-based.

Chart 4: Sticky inflation remains

Importantly, these categories – particularly gasoline – pressed the Fed and warranted a frontloading of interest rate hikes as they risked unanchoring inflation expectations. Looking ahead, this means incentives for the Fed to frontload interest rate hikes have diminished, but there are still significant reasons to keep rising interest rates and keeping them elevated for a longer period.

Deciding how high the Federal Funds Rate has to go and when to pivot the Fed will focus on the economies underlying inflation trend and disregard noisy signals. Here, the fact is that core CPI remains elevated and broad-based. The Atlanta Fed Sticky Core CPI printed at 5.2% annualised in July and the Cleveland Fed’s Median CPI came in at 6.5% annualised. To top that 56% of the core CPI items rose by more than 4% annualised in July.

Measuring quarterly trends across various inflation baskets there is little evidence of a lower core inflation trend. In fact, year-on-year core inflation is unlikely to have peaked. In a broader context we continue to see price pressure with wages increasing and productivity clearly falling. Unless output materially declines – which is not our base case – this is unlikely to result in inflation getting on a trajectory that will allow the Fed to pivot or stop hiking interest rates just yet.