Uddrag fra Zerohedge/ Deuteche Bank, Bank of America og Goldman Sachs

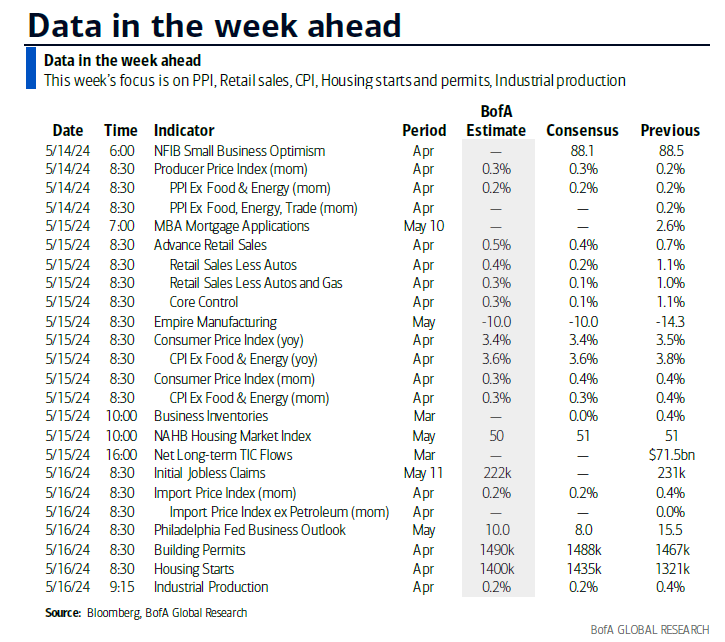

After a very slow week, the key event for markets this week will be US inflation data with April’s PPI (Tuesday) and CPI (Wednesday) the highlights. We’ll see if the higher-than-expected US inflation seen in Q1 extends into Q2 or not. Markets will also hear from Powell (tomorrow) and Vice Chair Jefferson (today) as the highlights of a busy Fedspeak calendar that are included in the day-by-day list at the end. The next most important US data release is Retail Sales on Wednesday.

Elsewhere China’s monthly activity numbers (Friday) are important, and staying in Asia, we also have Japanese PPI (tomorrow) and Q1 GDP (Thursday). In Europe tomorrow’s ZEW survey in Germany and UK labor market stats are highlights. Swedish CPI (Wednesday) may get a little extra attention after last week’s Riksbank cut, only the second G10 currency to ease this cycle after Switzerland earlier in the year. Earnings season quietens with only 7 S&P 500 companies and 69 Stoxx 600 companies reporting.

Previewing the main events now and let’s start chronologically with regards to US inflation. For PPI tomorrow, the headline (+0.3% consensus, vs. +0.2% previously) and core (+0.2% consensus vs. +0.2% last month) are always less important than the key components that feed into the core PCE deflator – namely, health care services, portfolio management and domestic airfares. As DB economists point out, whilst the March health care services print was relatively soft (+0.1%), the six-month annualized growth rate of 3.5% was still higher than at any point in the decade prior to the pandemic. They also highlight that with respect to portfolio management, the strength in asset market performance leading up to March should result in a strong print for April, given the typical lags.

With regards to CPI, DB economists think that given the 3% rise in seasonally adjusted gas prices, headline CPI (+0.37% forecast vs. +0.38% previously) should grow faster than core (+0.29% vs. +0.36%). This would lead to core YoY CPI falling two-tenths to 3.6%, and headline falling a tenth to 3.4%, both in-line with consensus. The three-month annualized rate under this scenario would fall by four-tenths to 4.1%, but the six-month annualized rate would tick up a tenth to 4.0%. As ever all eyes will be on whether rents finally respond more in keeping to the numerous models that have suggested they should already be well below where they currently are.

For Wednesday’s US Retail Sales, DB’s headline (+0.5% vs. +0.7% previously), ex-autos (+0.4% vs. +1.1%) and retail control (+0.3% vs. +1.1%) forecasts suggest some payback from a strong March release. There will be a few extra eyes on initial jobless claims this week given the spike to +231k last week after months of relative stability around the +210k level. DB economists think the spike could have been mostly due to NY school holiday dates having been shifted and would therefore expect much of the spike to reverse. We also have US housing starts and permits on Thursday which include a 2019-2024 seasonal revision which could be of note. Various regional factory surveys are out which will help fine tune PMI forecasts.

Courtesy of DB, here is a day-by-day calendar of events

Monday May 13

- Data: US April NY Fed 1-yr inflation expectations, Japan April M2, M3, Germany March current account balance, Canada March building permits

- Central banks: Fed’s Mester and Jefferson speak

- Earnings: SoftBank, Tencent Music, Petrobras

Tuesday May 14

- Data: US April PPI, NFIB small business optimism, UK Q1 output per hour, March weekly earnings, employment change, April jobless claims change, Japan April PPI, machine tool orders, Germany and Eurozone May Zew survey

- Central banks: Fed’s Powell speaks, ECB’s Knot speaks, BoE’s Pill speaks

- Earnings: Alibaba, Tencent, Rheinmetall, Home Depot, Vodafone, Sony, Bayer

Wednesday May 15

- Data: US April CPI, retail sales, May NAHB housing market index, Empire manufacturing index, March total net TIC flows, business inventories, Italy March general government debt, Eurozone Q1 GDP, employment, March industrial production, Canada March manufacturing sales, April housing starts, existing home sales, Sweden April CPI

- Central banks: Fed’s Kashkari speaks, ECB’s Villeroy speaks, China 1-yr MLF rate

- Earnings: Cisco, Allianz, Burberry, RWE

Thursday May 16

- Data: US April industrial production, import and export price indices, housing starts, capacity utilization, building permits, May Philadelphia Fed business outlook, New York Fed services business activity, initial jobless claims, Japan Q1 GDP, March capacity utilization, Italy March trade balance, Norway Q1 GDP

- Central banks: Fed’s Harker, Bostic and Mester speak, ECB’s financial stability review, Panetta, De Cos, Nagel and Villeroy speak, BoE’s Greene speaks

- Earnings: Walmart, Baidu, JD.com, Applied Materials, Deere, Siemens, Take-Two, Deutsche Telekom, BT

Friday May 17

- Data: US April leading index, China April retail sales, industrial production, new home prices, property investment, France Q1 ilo unemployment rate, Canada March international securities transactions

- Central banks: ECB’s Vasle, Guindos, Vujcic, Holzmann and Kazaks speak, BoE’s Mann speaks

* * *

Focusing on just the US, Goldman writes that the key economic data releases this week are the CPI and retail sales reports on Wednesday and the Philadelphia Fed Manufacturing Index on Thursday. There are several speaking engagements from Fed officials this week, including an event with Vice Chair Jefferson and Cleveland Fed President Mester on Monday and an event with Chair Powell on Tuesday.

Monday, May 13

- No major economic data releases scheduled.

- 09:00 AM Fed Vice Chair Jefferson and Cleveland Fed President Mester (FOMC voter) speak: Fed Vice Chair Phillip Jefferson and Cleveland Fed President Loretta Mester will take part in a discussion on central bank communications at an event hosted by the Cleveland Fed. Q&A is expected. On April 16th, Vice Chair Jefferson noted that his baseline “continues to be that inflation will decline further with the policy rate held steady at its current level, and that the labor market will remain strong, with labor demand and supply continuing to rebalance.” Vice Chair Jefferson also said that “if incoming data suggest that inflation is more persistent than I currently expect it to be, it will be appropriate to hold in place the current restrictive stance of policy for longer.” On April 17th, President Mester noted that she was still “expecting inflation to come down,” but that she thought the FOMC needed “to be watching and gathering more information before we take action.” President Mester will retire from the FOMC in June.

Tuesday, May 14

- 06:00 AM NFIB Small business optimism, April (consensus 88.1, last 88.5)

- 08:30 AM PPI final demand, April (GS +0.3%, consensus +0.3%, last +0.2%); PPI ex-food and energy, April (GS +0.2%, consensus +0.2%, last +0.2%); PPI ex-food, energy, and trade, April (GS +0.2%, last +0.2%)

- 09:10 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will deliver a speech at an event hosted by the New York Fed. Text is expected. On March 25th, Governor Cook noted that while disinflation “has been bumpy and uneven,” “a careful approach to further policy adjustments can ensure that inflation will return sustainably to 2% while striving to maintain the strong labor market.”

- 10:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will take part in an event with European Central Bank Governing Council member Klaas Knot hosted by Netherlands’ Foreign Bankers’ Association. Q&A is expected. At the press conference following the FOMC’s May meeting, Chair Powell pushed back strongly against the possibility of rate hikes, saying that he thinks “it’s unlikely that the next policy rate move will be a hike.” He added that the FOMC would need to see evidence that policy is not sufficiently restrictive in order to hike but is not seeing that. Chair Powell also suggested that he did not take much signal from the inflation uptick in Q1, emphasized the “lag structures built into the inflation process,” and noted that he expected sequential inflation to slow this year.

Wednesday, May 15

- 08:30 AM Empire State manufacturing survey, April (consensus -10.3, last -14.3)

- 08:30 AM CPI (mom), April (GS +0.37%, consensus +0.4%, last +0.4%); Core CPI (mom), April (GS +0.28%, consensus +0.3%, last +0.4%); CPI (yoy), April (GS +3.42%, consensus +3.4%, last +3.5%); Core CPI (yoy), April (GS +3.61%, consensus +3.6%, last +3.8%): We estimate a 0.28% increase in April core CPI (mom sa), which would lower the year-on-year rate by two tenths to 3.6%. Our forecast reflects a 2.5% pullback in airfares and net declines in auto prices (used -0.8%, new unchanged) based on rising inventories, mixed auction prices, and a pullback in incentives. We also assume another decline in communication prices (-0.25%) now that post-holiday price normalization has run its course; Adobe data also indicates falling prices for consumer electronics. We estimate a further slowdown in the primary rent measure (+0.37% vs. +0.41% in March) reflecting the continued softness in apartment inflation, but we assume continued strength in OER (+0.45% vs. +0.44% in March) given the resilience of the single-family segment. On the positive side, we forecast another large gain in car insurance rates (+1.6% vs. +2.6% in March) based on online price data, and we assume a 2bp boost to core CPI from this year’s tax preparation price hikes (within financial services CPI). We estimate a 0.37% rise in headline CPI, reflecting higher energy (+1.7%) and food (+0.3%) prices. Our forecast is consistent with a 22bp increase in core PCE in April.

- 08:30 AM Retail sales, April (GS flat, consensus +0.4%, last +0.7%); Retail sales ex-auto, April (GS -0.2%, consensus +0.2%, last +1.1%); Retail sales ex-auto & gas, April (GS -0.4%, consensus +0.1%, last +1.0%); Core retail sales, April (GS -0.4%, consensus +0.1%, last +1.1%)… We estimate core retail sales fell 0.4% in April (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects payback from strong Easter spending in March, as well as sequential softness in credit card spending across retailers and restaurants. We estimate unchanged headline retail sales, reflecting higher auto sales and gasoline prices. 10:00 AM Business inventories, March (consensus flat, last +0.4%) 10:00 AM NAHB housing market index, May (consensus 51, last 51)

- 12:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a fireside chat at the 2024 Williston Basin Petroleum Conference. Q&A is expected. On May 7th, President Kashkari said that he thought “the most likely scenario is we sit here [at the current fed funds rate] for an extended period of time.” President Kashkari noted that the FOMC could cut rates “if inflation starts to tick back down or we saw more marked weakening in the labor market,” but that “if we get convinced eventually that inflation is embedded or entrenched now at 3% and that we need to go higher, we would do that.”:

- 03:20 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak at the DC Blockchain Summit 2024 in Washington D.C. Q&A is expected. On May 10th, Governor Bowman said that she had “not written in any cuts” for 2024 in the FOMC’s latest Summary of Economic Projections. Governor Bowman noted that her “expectation would be a number of months of progress, … and a number of probably meetings as well before I might be comfortable with” interest rate cuts.

Thursday, May 16

- 08:30 AM Philadelphia Fed manufacturing index, May (GS 9.0, consensus 7.5, last 15.5); We estimate that the Philadelphia Fed mane the economy and eventually get us to 2%,” but that he was not “in a mad-dash hurry to get there if all these other good things are happening.” President Bostic also emphasized that if “inflation starts moving in the opposite direction away from our target, I don’t think we’ll have any other option but to respond to that,” noting that he would “have to be open to increasing rates.”

Friday, May 17

- There are no major economic data releases scheduled.

- 10:15 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will deliver a speech on the payments system at the International Organization for Standardization Technical Committee. Text is expected. On March 27th, Governor Waller noted that he continued to “believe that further progress will make it appropriate for the FOMC to begin reducing the target range for the fed funds rate this year. But until that progress materializes, I am not ready to take that step.” Governor Waller also emphasized that “the strength of the US economy and resilience of the labor market mean the risk of waiting a little longer to ease policy is small and significantly lower than acting too soon and possibly squandering our progress on inflation.”

- 12:15 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will deliver a commencement address at the University of San Francisco School of Management. Text is expected. On May 9th, President Daly noted that the policy rate was “restrictive, but it might take more time to just bring inflation down.” She also emphasized that “it’s far too early to declare that the labor market is fragile or faltering.”

- 05:45 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will deliver a commencement address at the Frank Batten School of Leadership and Public Policy at the University of Virginia. Text is expected. On April 3rd, Governor Kugler noted that her “baseline expectation is that further disinflation can be accomplished without a significant rise in unemployment,” and that “if disinflation and labor market conditions proceed as I am currently expecting, then some lowering of the policy rate this year would be appropriate.”

Data Sourced from DB, Meta and GS