Uddrag fra Zerohedge:

As the countdown to the reopening of futures trading gets louder by the second amid episodic observations of bank runs around the US, news flow is starting to accelerate fast so this will be a placeholder post with updates until we get major news.

3:00pm ET Update: In a reversal of what Janet Yellen said just hours ago, WaPo reports that federal authorities are “seriously considering safeguarding all uninsured deposits at Silicon Valley Bank” – and by extension any other bank on the verge of failure – and are weighing an extraordinary intervention to prevent what they fear would be a panic in the U.S. financial system. Translation: bailout of all depositors, not just those guaranteed by the the FDIC (<$250K).

Officials at the Treasury Department, Federal Reserve, and Federal Deposit Insurance Corporation discussed the idea this weekend, the people said, with only hours to go before financial markets opened in Asia. White House officials have also studied the idea, per two separate people familiar with those discussions. The plan would be among the potential policy responses if the government is unable to find a buyer for the failed bank.

While selling SVB to a healthy institution remains the preferred solution – as most bank failures are resolved that way and enable depositors to avoid losing any money – there have been several reports that no big bank has stepped up as of yet, leaving the government/Fed as the only option.

As reported earlier, the FDIC began an auction process for SVB on Saturday and hoped to identify a winning bidder Sunday afternoon, with final bids due at 2 p.m. ET.

Some more from the WaPo report:

Although the FDIC insures bank deposits up to $250,000, a provision in federal banking law may give them the authority to protect the uninsured deposits as well if they conclude that failing to do so would pose a systemic risk to the broader financial system, the people said. In that event, uninsured deposits could be backstopped by an insurance fund, paid into regularly by U.S. banks.

Before that happens, the systemic risk verdict must be endorsed by a two-thirds vote of the Fed’s Board of Governors and the FDIC board along with Treasury Secretary Janet Yellen. No final decision has been made, but the deliberations reflect concern over the collateral damage from SVB’s collapse and authorities’ struggle to respond amid limits on their powers implemented following the 2008 financial bailouts.

“We’ve been hearing from those depositors and other concerned people this weekend. So let me say that I’ve been working all weekend with our banking regulators to design appropriate policies to address this situation,” Yellen said on the CBS program “Face the Nation.”

But more importantly, the WaPo report contradicts what Yellen said just a few hours earlier, namely that “during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again,”

This suggests that in just a few short hours, officials and regulators peaked behind the scenes and realized just how bad a potential bad crisis could be and have made a 1800 degree U turn.

The result: any erroneous higherer for longerer narrative spewed by some self-appointed experts has just blown up, and what is about to be unleashed is another vast liquidity wave, something that bitcoin clearly is starting to anticipate.

* * *

1:15pm ET Update: In a throwback to the legendary “Lehman Sunday”, when dozens of credit traders did an ad hoc CDS trading and novation session on the Sunday ahead of the bank’s Chapter 11 filing to minimize the chaos and fallout from the coming bankruptcy, Bloomberg reports that the FDIC kicked off an auction process late Saturday for Silicon Valley Bank, with final bids due by Sunday afternoon.

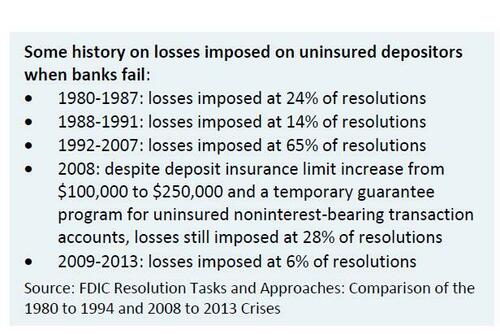

The FDIC is reportedly aiming for “a swift deal” but a winner may not be known until late Sunday. Bloomberg also reported that the regulator is racing to sell assets and make a portion of clients’ uninsured deposits available as soon as Monday; the open questions are i) whether there will be a haircut and ii) how big it will be. A table from JPM’s Michael Cemablest below shows historical haircuts on uninsured depositors in previous bank crises.

We get a slightly more positive vibe from a Reuters report according to which “authorities are preparing “material action” on Sunday to shore up deposits in Silicon Valley Bank and stem any broader financial fallout from its sudden collapse.”

Details of the announcement expected on Sunday were not immediately available. One source said the Federal Reserve had acted to keep banks operating during the COVID-19 pandemic, and could take similar action now.

“This will be a material action, not just words,” one source said. Earlier, U.S. Treasury Secretary Janet Yellen said that she was working with banking regulators to respond after SVB became the largest bank to fail since the 2008 financial crisis.

As fears deepened of a broader fallout across the U.S. regional banking sector and beyond, Yellen said she was working to protect depositors but ruled out a bailout.

“We want to make sure that the troubles that exist at one bank don’t create contagion to others that are sound,” Yellen told the CBS News Sunday Morning show. “During the financial crisis, there were investors and owners of systemic large banks that were bailed out … and the reforms that have been put in place means we are not going to do that again,” Yellen added.

Meanwhile, more than 3,500 CEOs and founders representing some 220,000 workers signed a petition started by Y Combinator appealing directly to Yellen and others to backstop depositors, warning that more than 100,000 jobs could be at risk.

Reuters also reports that the FDIC was trying to find another bank willing to merge with SVB:

“Some industry executives said such a deal would be sizeable for any bank and would likely require regulators to give special guarantees and make other allowances.”

That said, the longer we wait without some resolution the more likely it is that SVB’s unsecured depositors will get pennies on the dollar, according to the following (unconfirmed) reporting from Chalie Gasparino: “Bankers increasingly pessimistic a single buyer will emerge for SVB, laying out options for clients w money in there: 1-ride it out. 2-sell deposits for around 70-80 cents on dollar to other financial players; borrow against deposits jpmorgan at 50 cents on dollar.”

The FDIC previously said the agency has said it will make 100% of protected deposits available on Monday, when Silicon Valley Bank branches reopen.

There was also news for those whose money remains frozen at SIVB. BBG notes that tech lender Liquidity Group is planning to offer about $3 billion in emergency loans to start-up clients hit by the collapse of Silicon Valley Bank.

Liquidity has about $1.2 billion ready in cash to make available in the coming weeks, Chief Executive Officer and co-founder Ron Daniel said in an interview on Sunday. The group is also in discussions with its funding partners, including Japan’s Mitsubishi UFJ Financial Group Inc. and Apollo Global Management Inc., to offer an additional $2 billion in loans, he said.

“By helping the companies to survive now, I’m hoping some of them would succeed and come back to us in the future,” Daniel said. “We’re nurturing our future clients.” A typical loan will be a one-year facility of $1 million to $10 million, or as much as 30% of the balances held with SVB, Daniel said. The priority is to help companies meet payroll expenses.

The fate of other SVB-linked entities appears to be somewhat rosier. Bloomberg reports that Royal Group, an investment firm controlled by a top Abu Dhabi royal, is considering a possible takeover of the UK arm of Silicon Valley Bank following its collapse last week, according to people familiar with the matter. The conglomerate, chaired by United Arab Emirates National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan, is discussing a potential buy-out through one of its subsidiaries.