Få fri adgang til alle lukkede artikler på ugebrev.dk hele sommerferien til udgangen af august:

Tilmeld dig tre udgaver gratis af aktieanalysepublikationen ØU Formue, der udkommer igen første gang 9 august

Uddrag fra finanshuse

The US is expected to add 104K nonfarm payrolls in July, a drop from the prior 147k print, but above the 80-

100k breakeven estimated by Fedʼs Barkin. The Unemployment Rate is seen at 4.2%, up from 4.1% previously, but still below the Fed year-end median projection of 4.5%, according to Newsquawk.

At his post-meeting press conference, Fed Chair Powell said that the unemployment rate is the figure to watch when looking at the labor market. Powell also noted that most Fed officials believe that the labor market is at or near maximum employment, but downside risks remain; however, he did appear more focused on the inflation side of the mandate. In the month, labor market proxies saw Jobless Claims ease from the prior reference period, while the S&P Global Employment report noted employment rose for a fifth straight month. ADP and June JOLTS were soft, while layoffs rose. The Fed’s Beige Book saw employment increase very slightly overall, hiring remained cautious, but layoffs were limited, although more prevalent in manufacturing. Fed Chair Powell was quizzed about a possible rate cut at the September 18th FOMC confab, and he said the Fed has not made its decision yet, noting that there is a lot of data due before the meeting, with two more labor market reports (and one more PCE, two more CPI reports), this is one piece of the puzzle that will help shape expectations on a Fed rate cut in September.

Expectations:

- The consensus looks for the US economy to add 104k nonfarm payrolls in July (prev. 147k; 3mth avg of 150k, 6mth avg of 130k, 12mth avg of 151k); expectations range between 0 (Santander) and 170k (ABN Amro).

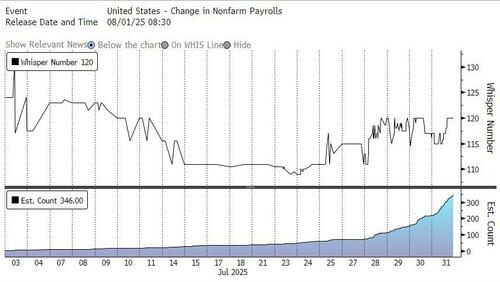

- The whisper number started off the month of July at 125K before sliding to 110K by mid-month before reversing and was most recently back around 120K

- The unemployment rate is expected to rise by one tenth, taking it to 4.2%, but forecasts range between 4.0-4.3% (note: the Fed forecasts the jobless rate will rise to 4.5% this year).

- Average hourly earnings are expected to rise +0.3% M/M, picking up from the +0.2% rate in June, while average workweek hours are seen remaining at 34.2hrs.

Labor Market Proxies

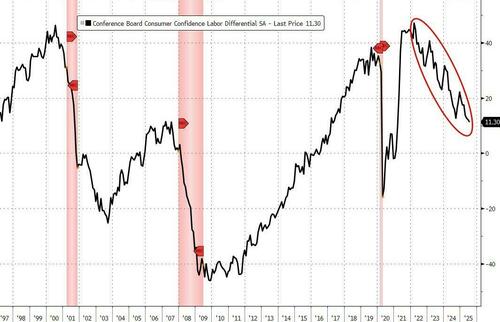

Jobless Claims for the week that coincides with the NFP survey window saw Initial Claims at 221k, a notable decline from the prior month’s reference period of 246k. Continued Claims meanwhile fell to 1.946mln from 1.964mln. The drop in continued claims may show that those who had previously been struggling to return to work have managed to secure a job. The ISM PMI reports will be released post-NFP, but the S&P Global Flash PMI report saw employment rise for a fifth straight month as companies took on additional staff in response to rising backlogs of work. The ADP National Employment Print disappointed, while the June JOLTS report was also soft. Challenger Layoffs rose by 62k in July, accelerating from the 48k in June. Meanwhile, the Conference Board’s labor-market differential (the share of respondents who say jobs are plentiful less those who say they’re hard to get) declined again in July to a new cycle low (and a level last seen in early 2017).

Arguing for a stronger-than-expected report:

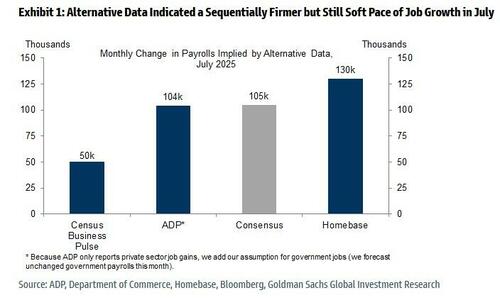

- Big data. Alternative measures of employment growth indicated a rebound in private sector job growth, though to a still soft pace. The indicators that we track averaged 95k in July vs. 39k in June.

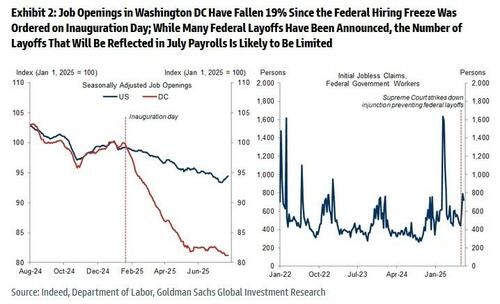

- Government hiring. Goldman expects unchanged government payrolls (vs. +23k per month on average so far this year), reflecting a 15k decline in federal government payrolls that offsets a 15k increase in state and local government payrolls. The bank also expects the ongoing federal government hiring freeze, which was extended from July 15th to October 15th, to continue to weigh on federal government payrolls. While far more federal layoffs have been announced than appear to have been reflected in the official statistics so far, a portion of the shortfall likely reflected the impact of an injunction that paused some layoffs. That injunction was struck down by the Supreme Court earlier this month, though likely too late in the survey period to impact tomorrow’s report.

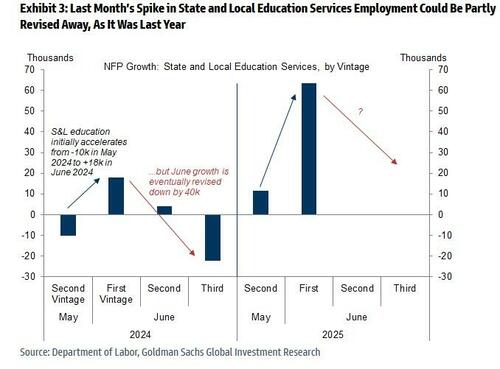

- Goldman has penciled in partial payback for last month’s spike in state and local education services hiring — which may have reflected seasonal adjustment difficulties — and a downward revision to the outsized June increase. The chart below shows that state and local education services employment similarly spiked last year in the first June vintage but was subsequently revised down by 40k.

Mixed/neutral factors:

- Layoffs. Initial jobless claims decreased to 230k on average in the July payroll month from 246k in June. The JOLTS layoff rate remained at 1.0% in June. Announced layoffs reported by Challenger, Gray & Christmas increased by 14k in June to 62k (NSA), compared to 63k on average in 2024.

- Employer surveys. Both the GS manufacturing survey employment component tracker (+0.5pt to 49.1) and the services survey employment component tracker (+1.0pt to 49.1) increased but remained in contractionary territory in July. However, the signal from survey data has been less useful—and at times misleading—during the post-pandemic period and thus has little bearing on our payrolls forecast.

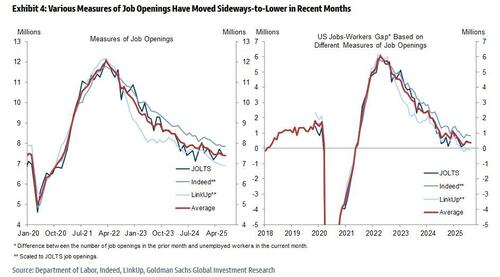

- Job availability. While JOLTS job openings decreased by 0.3mn to 7.4mn in June, averaging across a few measures of job openings suggests that openings were roughly unchanged month-over-month. The Conference Board labor differential—the difference between the percentage of respondents saying jobs are plentiful and those saying jobs are hard to get—decreased by 0.9pt to +11.3 in July, the lowest level since March 2021 and meaningfully below the 2019 average of +33.2.

Tariff impact

The July employment reports will provide timely evidence on the possible labor market effects of several government policies.

- First, tariffs could weigh on manufacturing payrolls in upcoming reports. Manufacturing employment declined by 5k per month on average in Q2 vs. -9k in 2024.

- Second, the reduction in force efforts led by the Department of Government Efficiency will directly lead to declines in federal government employment, and federal spending cuts might have spillover effects on state & local government, healthcare, and education. So far, we have seen a moderate impact from this channel: federal government employment has declined by 14k per month on average since February while state & local government, healthcare, and education hiring has remained elevated.

- Third, the slowdown in immigration could weigh on hiring in industries that disproportionately rely on immigrant labor. Job growth in the industries most exposed to immigration policy changes declined to 7k on a three-month average basis through May (vs. 27k on average in 2024), the latest month for which payroll employment data is available at the detailed industry level. Tighter immigration policy could also keep some immigrants away from work, which would be visible in the household survey micro data. Data through June indicate that labor market outcomes for recent immigrants have remained healthy this year, though the response rate of recent immigrants to the household survey has declined.

Fed Implications

The Fed is largely focused on inflation over employment at the moment (it continues to see labor market performance as “solid”), albeit if there was a sudden deterioration, it would be willing to cut rates, though that is not their base case. Given the uncertainty in the economy from Trump’s trade policies, indicators suggest that companies are holding off on hiring plans until there is more clarity, but there are fears that higher costs in the face of tariffs will see companies pass on these costs to the consumer. This uncertainty keeps the Fed at bay for now, with the majority looking for a wait-and-see approach, albeit Governor Waller and Bowman voted for a 25bps rate cut at the July meeting. Fed Chair Powell also noted how most on the Committee agree that the labour market is at or near maximum employment, but inflation is further away from its goals. However, Powell did warn that there are downside risks to the labour market given the uncertainties. It is also worth noting that the Fed chair suggested that the unemployment rate is the main metric to watch when looking at the labour market, noting how the breakeven number for job creation has come down. Fedʼs Barkin suggested late June the job market breakeven is now back to around 80-100k per month.

Labor Market Commentary

Recently, most Fed officials have viewed the labor market as in ‘a good placeʼ (Williams), but note that job growth and labour supply are both slowing. But officials like the dovish Governor Waller have warned that there is mounting evidence that the labour market is becoming weaker, even though he sees conditions as “solid” for now; Waller made the case that the Fed should not wait to cut rates until the labour market hits any trouble. The latest Fed’s Beige Book saw employment increase very slightly overall, with one District noting modest increases, six reporting slight increases, three no change, and two noting slight declines. Hiring remained generally cautious, while labour availability improved. It also noted that although reports of layoffs were limited in all industries, they were somewhat more common among manufacturers. Looking ahead, many contacts expected to postpone major hiring and layoff decisions until the uncertainty diminished.

Market Reaction

As usual we start with JPMorgan’s Market Intel team which provides the following matrix, with odds in [brackets]:

- [5%] Above 140k. SPX gains 1% – 1.5%

- [25%] Between 120k – 140k. SPX gains 50bp – 1.25%

- [40%] Between 100 – 120k. SPX gains 25bp – 75bp

- [25%] Between 80k – 100k. SPX loses 50bp – 1%

- [5%] Below 80k. SPX loses 1.5% – 2.5%

JPM’s Andrew Tyler thinks think that “the outcomes are skewed positively and that the market will react positively to any number above 100k.” As shown above, the whisper numbers are now above Bloomberg consensus, e.g., 115k vs. 110k, suggesting rising optimism. PMI / ISM releases earlier this year reflected a view that businesses have cash to spend on both capex and hiring but that uncertainty around trade and taxes created too much uncertainty. Now, we are closer to certainty on both metrics. The Market Intel head concludes that “while that may only be partially witnessed in this print, this gives confidence that we do not see hiring number experience a significant down-move. Longer-term, there are issues there are economic headwinds from the trade war but the magnitude and timing remain tricky, but we do not think we see the brunt of that headwind in the July data that prints in August.”

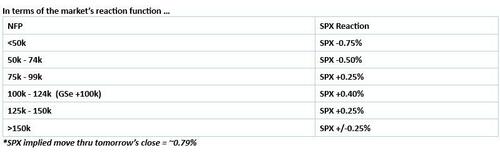

Next, we turn to Goldman trade Cullen Morgan who has shared a similar market matrix, only this one is more subdued than JPMorgan’s.

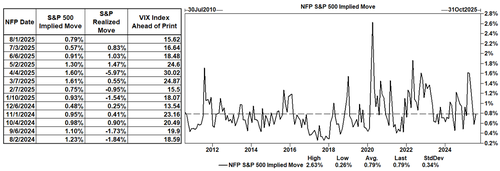

Morgan next shows that the implied move tomorrow is slightly above July’s, yet below much of 2025.

Finally, some thoughts from around the Goldman trading desk:

Vickie Chang (Global Macro Research)

Our growth pricing estimates suggest that the market is pricing 1y-ahead growth at around 2%. That’s clearly above our near-term forecasts of 1.4% and a bit above our 2026 q4/q4 growth forecasts of 1.8%. So although growth pricing doesn’t look wildly optimistic versus the medium-term view, it is now more generously priced and is less likely to be the main source of macro tailwinds from here. We think our baseline forecast is still fairly friendly for risk assets and have generally been positive on the equity outlook in the last couple of months. But given the pricing and the rally, the market is more vulnerable to data that’s weak enough to catalyze a slowdown narrative. Arguably the quickest way to open up deeper downside tails is a sharp enough rise in the unemployment rate that makes the market worry that it’s misjudged that growth weakness will be limited. Our baseline forecast for a tick higher in the unemployment rate to 4.2% and +100k on NFP is not that kind of print. But the jobs report is the kind of event that could in principle open up that debate if there is a big enough disappointment. We think that for investors with long risk positions it makes sense to look at adding protection for that reason, particularly if it helps them maintain long exposures that they would otherwise think about reducing. There is still a premium in implied vol to realized, but implied volatility has fallen enough that short-dated protection, through some mix of front-end rate receivers or equity puts/VIX calls (or jointly positioning for lower rates and lower equities), looks reasonably priced.

Ryan Hammond (US Portfolio Strategy)

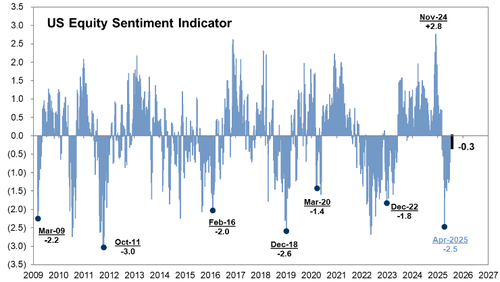

The jobs report on Friday represents an important test for the US equity market, which has continued its notch new all-time highs in the past few weeks. With Cyclicals having sharply outperformed Defensives and equity valuations near all-time highs, the equity market appears to be pricing a favorable combination of strong forward growth expectations and a dovish Fed. If the jobs report is broadly in line with consensus, we expect equities would continue to move higher as it would validate current market pricing that the worst growth outcomes will be avoided but the Fed will be able to resume its cutting cycle in September. Equity investor positioning remains in neutral territory (our Sentiment Indicator stands at -0.3), suggesting further room to add exposure to equities. However, if the jobs report is too strong, it could constrain the performance of equities as investors walk back expected Fed easing. On the other hand, if the jobs report is extremely weak, it would test investors’ ability to look through near-term growth weakness and reopen left tail risks to the equity market.

Shawn Tuteja (ETF/Basket Vol Trading)

Heading into the FOMC yesterday, it felt the equity market was hopeful the Fed would explicitly set up a September cut as base case. Now that the interpretation of the meeting was slightly more hawkish than market expectations (even though Powell did talk about the slowing economy many times), I think we’re entering a unique set up tomorrow. If the data is really bad (sub 50k, URate 4.4-4.5%), the market will likely trade the same theme it did last year post the July meeting – a policy mistake into a growth slowdown. If the data is extremely strong or mixed (weak NFP number but 4.1% URate), I don’t believe the market can interpret that number too bullishly either. The most bullish outcome seems to be a slightly soft number with a 4.2% URate, as a gradual slowing to lead to a Fed easing cycle is what the market wants. Into this week, we’ve seen a renewed boldness from our client base to fade the non-profitable tech names / lower quality parts of the market, as the view is the quant community has de-grossed and the pain is over on the short side of this trade. Colleague Lee Coppersmith put out a good note on SMH – it’s trading over 60 days without touching its 20d MA to the downside, something it’s only done once since its 2012 inception. With all vols having re-rated lower, any positioning-driven sell offs are likely driven by the semis complex trading weaker, and we think downside makes sense as portfolio hedges.

Joe Clyne (Index Vol Trading)

Heading into Friday’s NFP, we’ve been trading in quite consistent SPX range with low realized for about a month now. As realized has fallen, we’ve seen front end vols compress as well and after NFP, we are mostly catalyst free through August expiry. While the straddle for Friday’s close still costs 50 dollars, the desk thinks that includes premia for both month-end rebalance flows as well as AMZN/AAPL earnings. In other words, there shouldn’t be a large vol premium for the jobs report itself. We think the traded range should be somewhat tight coming out of the jobs report as weaker numbers could lead to more dovish interpretations of the path of rates and a stronger jobs number could be faded as cuts get priced out. We think that 3 month SPX upside looks cheap as it trades close to the bottom end of its 5 year range and would prefer to own the topside to the downside.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her