Deutsche Bank skriver i en omfattende analyse af den tyske bilindustri, at Tyskland på grund af høje omkostninger risikerer at miste sine bilfabrikker, der kan blive nødt til at flytte ud til sine store markeder. Det gælder især til Kina, der ligger tættere på det store asiatiske marked. Klima-bestræbelserne kan blive en stor belastning for bilproduktionen – ikke for selve selskaberne, men for produktionslandene. Fabrikkerne skal nok klare sig, men de flytter blot til andre lande.

German carmakers better prepared for the future than Germany as

a carmaking location

Structural challenges more serious than corona crisis

The COVID-19 pandemic is the most important factor behind downturn in the German auto industry. In 2020, the production index for the sector probably declined by about 25% in real terms.

Nevertheless, structural challenges will play a considerably more important role in the coming years. They may even endanger Germany’s status as a carmaking location. Some of these challenges stem from regulatory economic policy framework conditions, others from market developments. Demographic developments are a major factor, too. This article gives an overview of the

situation.

What does this structural change mean for the sector? First, it will lead to more expenses, above all for investments in the new technology, and declining average returns per car; after all, the car industry often subsidises electric vehicle purchases, too. Producers that do not comply with their CO2 targets in 2020 or 2021 will have to pay fines – another element which may drive

expenses up.

In addition, the sector is likely to shift production to cheaper locations. This process usually takes several years; its impact is not felt all at once. Moreover, the shift from combustion to electric engines will lead to changes along the automotive value chain. While Germany is likely to establish a sizeable battery cell production, a significant number of batteries will be imported. As the market

share of electric cars increases, demand for traditional engine parts and components, such as engines, gearboxes, exhaust systems, etc., will decline.

Many of these parts and components are still produced in Germany. In fact, some companies from the sector have recently announced that they may shift traditional engine production abroad. Hardly anybody expects the structural changes to be ultimately beneficial for value added and employment in the auto sector in Germany. And neither do we, at least not from today’s vantage point.

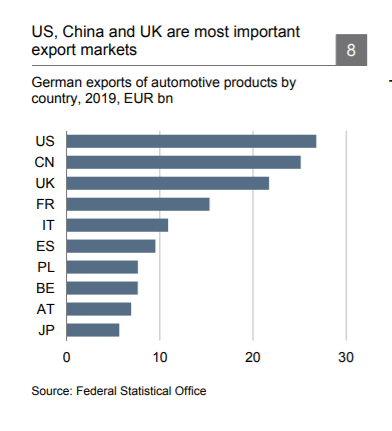

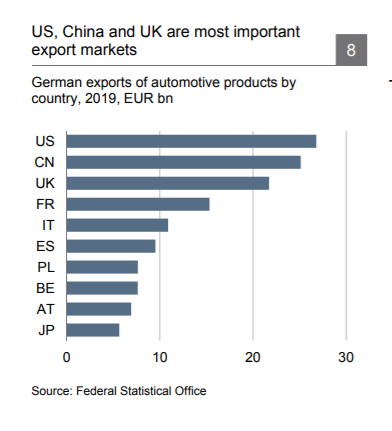

About three quarters of the total German car output are exported. The sector also exports engines, gearboxes and other parts and components.

That is why Germany, as an industrial location, is heavily dependent on open markets and liberal trade policies. The trade conflict between the US and China, the Trump administration’s threats of levying higher taxes on car imports from the EU and the uncertainties surrounding Brexit were and are not supportive for the sector; instead, they have dampened investment activity. At the moment, quick progress in international trade policy is not in sight.

If the EU does not succeed in lowering trade barriers versus large growth markets such as China, India, the ASEAN countries or the US, these markets will be probably supplied from factories run by German carmakers in the relevant countries. For example, German producers’ facilities in China

may become an export hub for the Asia-Pacific region after 15 countries from that region signed the Regional Comprehensive Economic Partnership

Will output ever return to its former highs?

Overall, we believe that the German automotive industry is better prepared for the electric mobility future and other structural challenges than Germany as a car-producing location. Companies are free to decide where they want to produce and can change locations over time if the framework conditions

deteriorate. From today’s vantage point, the outlook for Germany as a car production location appears comparatively bleak.

It is disconcerting if numerous policymakers simply shrug off the deterioration of the framework conditions, be it for the auto industry or for other sectors. Once an industrial location has lost its lustre, it may be difficult to lure companies back.