Uddrag fra Zerohedge:

Tl;dr: The FOMC Minutes are considerably more hawkish than expected in terms of both the timing of the liftoff of rates and the pace of normalization of the balance sheet.

* * *

Since December 15th’s FOMC statement, bonds have been battered, the dollar is down modestly while stocks and gold are up strongly….

Source: Bloomberg

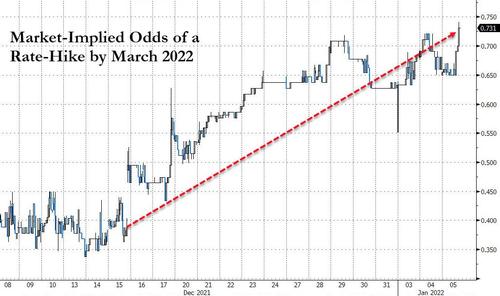

The short-end of the yield curve has risen dramatically, pricing in the new hawkish dot-plot offered by The Fed (for 2022) with a 73% chance of Fed hikes by March 2022 now ((from 40% pre-FOMC)…

Source: Bloomberg

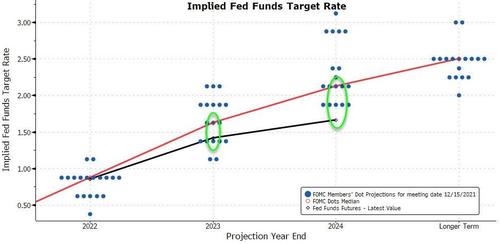

Interestingly though, the market has rejected The Fed’s longer-term dots, presumably pricing in a policy-error/reversal…

Source: Bloomberg

All of which leaves the market desperately seeking clues today on the accelerated taper and timing of lift-off and trajectory of rate-hikes among the Minutes.

On the liftoff timing and pace of rate-hikes:

“Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate. Some participants judged that a less accommodative future stance of policy would likely be warranted and that the Committee should convey a strong commitment to address elevated inflation pressures.”

Policymakers thought changes in Fed Funds Rate should be primary means for adjusting stance of policy.

Some participants also remarked that there could be circumstances in which it would be appropriate for the Committee to raise the target range for the federal funds rate before maximum employment had been fully achieved – for example, if the Committee judged that its employment and price-stability goals were not complementary in light of economic developments and that inflation pressures and inflation expectations were moving materially and persistently higher in a way that could impede the attainment of the Committee’s longer-run goals.

On Omicron’s impact:

“In particular, the possibility that COVID-19 cases could continue to rise steeply, especially if the Omicron variant proves to be vaccine resistant, was seen as an important source of downside risk to activity,while the possibility of more severe and persistent supply issues was viewed as an additional downside risk to activity and as an upside risk to inflation.”

“Members also agreed that, with the emergence of the Omicron variant, it was appropriate to note the risk of new variants of the virus in their assessment of risks to the economic outlook.”

On normalization:

“Participants also judged the Federal Reserve to be better positioned for normalization than in the past.”

“Participants judged that the appropriate timing of balance sheet runoff would likely be closer to that of policy rate liftoff than in the Committee’s previous experience.”

On Inflation:

In their comments on inflation expectations, some participants discussed the risk that recent elevated levels of inflation could increase the public’s longer-term expectations for inflation to a level above that consistent with the Committee’s longer-run inflation objective.

A few participants, however, noted that long-term inflation expectations remained well anchored, citing stable readings of market-based inflation compensation measures or the generally low level of longer-term bond yields.

“Participants noted that supply chain bottlenecks and labor shortages continued to limit businesses’ ability to meet strong demand. They judged that these challenges would likely last longer and be more widespread than previously thought.”

On social unrest:

“Participants noted their continuing attention to the public’s concern about the sizable increase in the cost of living that had taken place this year and the associated burden on U.S. households, particularly those who had limited scope to pay higher prices for essential goods and services.”

On labor market:

Committee’s assessments of maximum employment, a condition most participants judged could be met relatively soon if the recent pace of labor market improvements continued.

Several participants remarked that they viewed labor market conditions as already largely consistent with maximum employment.

Additionally, a key thing to understand from the Minutes is that there was a wide variety of views on when to start shrinking the balance sheet.

“almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate.”

On the format of balance sheet normalization:

“Many participants judged that the appropriate pace of balance sheet runoff would likely be faster than it was during the previous normalization episode.”

“Some” policy makers even favored reinvesting money from maturing mortgage-backed securities into Treasuries to start shifting the composition even ahead of balance-sheet contraction.

“Depending on the size of any caps put on the pace of runoff, the balance sheet could potentially shrink faster than last time.”

* * *

Read the full Minutes below: