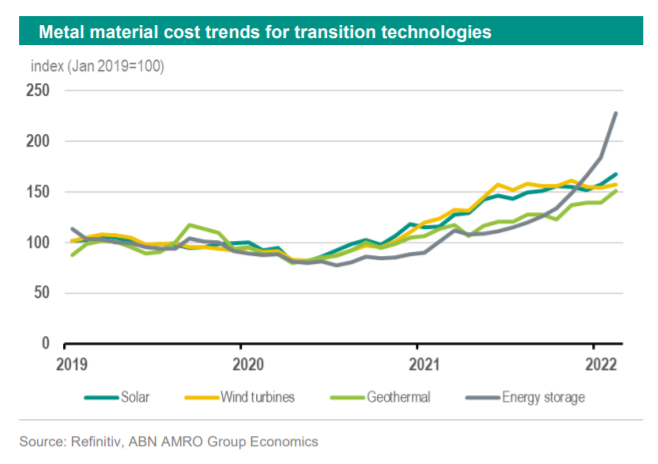

Voldsomme prisstigninger på materialer til oplagring af energi kan blive en hæmsko for den grønne udvikling – for en hurtig overgang til Net Zero – skriver ABN Amro i sit nye ugebrev om grøn energi og ESG, Sustainaweekly. Priserne på disse produkter er steget med 185 pct. i løbet af pandemien. Alle produkter til f.eks. sol- og vindenergi er steget under pandemien, men ikke nær så meget.

Sustainaweekly – Transition commodities an obstacle to Net Zero

We have been struck by the soaring prices of transition commodities and how this might impact the economics of the energy transition. It can be an obstacle to Net Zero.

Most notably, the material costs for energy storage have seen a 185% increase since May 2020!

We also explore the greeniums of ESG bonds in the primary and secondary markets, early steps to regulate ESG scores providers and the policies of the largest Dutch pension funds towards the fossil fuel sector.

Economics Theme

Transition commodities – the key raw materials used to produce green technologies at scale – could become a bottleneck to Net Zero. Our proprietary transition commodity price indexes are soaring, especially the index for commodities necessary for energy storage. The secular demand shift could also over time lead to problems in supply.

Strategy Theme

We explore greeniums in the credit space. We find that they exist with regards ESG bank bonds, in the both primary and secondary markets although they are becoming smaller. For corporates, we find little evidence of a greenium in the primary market, but we do see clear evidence for one in the secondary market.

ESG Bonds

New issues this week – DZ Hyp and Deutsche Bank – saw strong demand with new issue premiums below this year’s average.

Policy and Regulation

ESMA has recently published a Call for Evidence on ESG ratings, with the goal to gather information on the market structure for ESG rating providers in the EU. This is an early step towards increased regulation of the sector.

Company and Sector news

We review the investment policies of the three biggest Dutch pension funds towards the fossil fuel sector, following the announcement of PFZW. There are similarities in approach but also some variation in the ‘divesting to engaging’ spectrum.

ESG in figures

In a regular section of our weekly, we present a chart book on some of the key indicators for ESG financing and the energy transition.