Den kraftige forværring af pandemien har sat sine spor på europæernes forbrug. Forbrugertilliden er faldet i november, mere end forventet, til minus 6,8 point. Det største fald i år. Der har især været et kraftigt fald i indkøb af større forbrugsgoder, herunder biler, i det seneste halve år. Også den stigende inflation kan have dæmpet købslysten. ABN Amro venter dog en stigning i forbruget i det nye år, hvor banken venter en lavere inflation.

Delta leaves its mark on EZ consumer sentiment

Eurozone consumer confidence dropped lower in November on the back of the spreading of the Delta variant and high (energy price) inflation

Eurozone consumer confidence fell to -6.8 in November, down from -4.8 in October, staging its largest drop in a year. The outcome was below the consensus forecast. The details of the sentiment index have not yet been published, but it seems very likely that the fast spreading of the Delta variant in a number of member states is an important factor behind the drop in confidence.

Indeed, a number of countries has already re-introduced containment measures aimed at limiting the spread of the virus, while further measures seem to be in the pipeline and other countries might follow. The resulting uncertainties will probably have depressed consumer confidence.

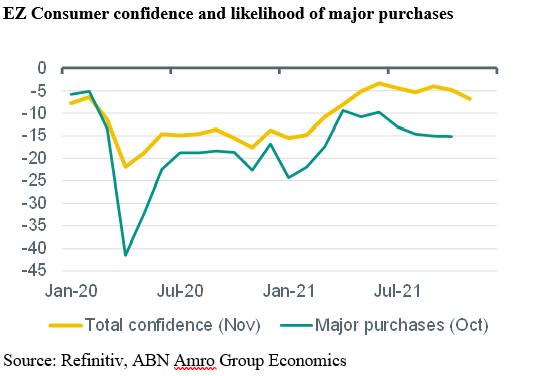

Moreover, the ongoing rise in (energy price) inflation probably added to the decline in consumer sentiment, particularly the propensity to carry out major purchases. This component of consumer sentiment has already been falling persistently in every month since June (see graph) and it probably moved down further in November.

Meanwhile, monthly data for retail sales, new car registrations as well as high frequency data (such as Google mobility data for visits to retail and recreation) have suggested that private consumption growth in the eurozone slowed down noticeably in Q4 after it probably grew robustly in Q3. Although the components of Q3 GDP have not yet been published, we think that private consumption expanded by around 4% qoq, following 3.4% in Q2.

A rise in consumption in line with our expectations would keep consumer spending still some 3% below the pre-pandemic level in Q3 (versus -0.5% for total GDP), implying that there still is quite some pent-up demand.

Looking forward, we think that the current weakness in private consumption will dissipate during the course of next year, when inflation should decline noticeably, while the labour market recovery should continue. Indeed, we expect private consumption growth to outpace total GDP growth in 2022 as a whole.