Den hollandske vækst steg i andet kvartal overraskende med 2,6 pct., men den tendens kan ikke fortsætte, vurderer ABN Amro, som venter en lavere vækst i andet halvår, selv om der er nogle positive tegn i økonomien.

Dutch GDP strength unlikely to last

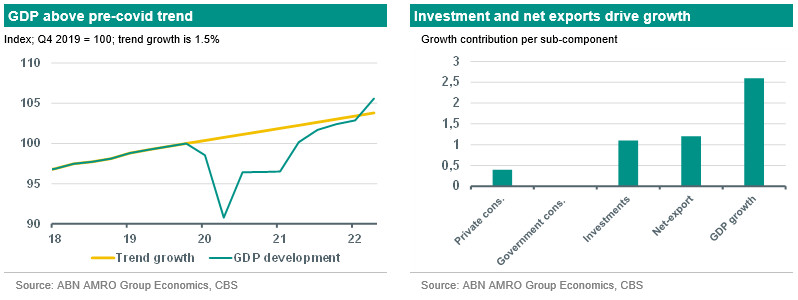

NL Macro: Q2 GDP data surprise dramatically to the upside . Figures show that Dutch GDP grew by a whopping 2.6% quarter-on-quarter (q-o-q). This was much higher than anticipated and illustrates the resilience of the Dutch economy coming out of the pandemic and in the face of high inflation and gas shortages. Indeed, GDP in level terms is now above the pre-pandemic trend. In terms of contributions, all subcomponents surprised to the upside, but investment and exports stood out in particular.

Investment increased by 5.2% q-o-q regaining some lost ground. Due to supply bottlenecks and labour shortages investment had been lagging the GDP trend since mid 2021. Net exports contributed 1.2 pp to growth. This was driven by favourable developments in global trade and by a post-covid catch-up of services exports. Domestic demand also contributed positively. Despite high inflation pushing consumer confidence to record lows, private consumption increased by 0.9% qoq. This expansion was in part driven by a further rebound in services consumption.

Since the pandemic, backward adjustments to GDP data have been significant – for Q1 these were almost 0.5pp. Today’s upward surprise therefore raises the possibility of being adjusted downwards.

Looking forward: Growth in the second half of 2022 is set to slow down

For the second half of 2022 we expect economic momentum to slow as catch-up growth is likely behind us, and possible energy shortages and (energy) inflation are increasingly hurting demand. Our current thinking is that this is likely to drive a small downturn starting in Q4 of 2022 (see also our note on the eurozone here). Uncertainty regarding this outlook stems from the many bright spots that remain in place. We still see a lot of unfilled demand in the economy which has yet to show signs of relief, pandemic savings are not yet spent, and the labour market is still very strong.