ABN Amro har analyseret de seneste tal for inflationen i eurozonen. Det viser, at det udelukkende er de meget høje energipriser – gas og elektricitet – som giver den høje inflation, der blev på 5,1 pct. i januar. Krisen over Ukraine har presset gaspriserne i vejret, men der er flere faktorer, der ligger bag udviklingen, især begrundet i pandemien og flaskehalsproblemer. Fødevarerne stiger kun meget lidt, og kerneinflationen faldt i januar. ABN Amro venter et kraftigt fald i inflationen senere i år.

Energy keeps eurozone inflation elevated

The flash estimate for January inflation in the eurozone came in higher than expected. Although the rise in inflation was (again) driven by energy prices, the core inflation rate also fell less than expected.

The flash estimate for January inflation in the eurozone came in higher than expected. Headline inflation rose to 5.1%, up from 5.0% in December 2021.

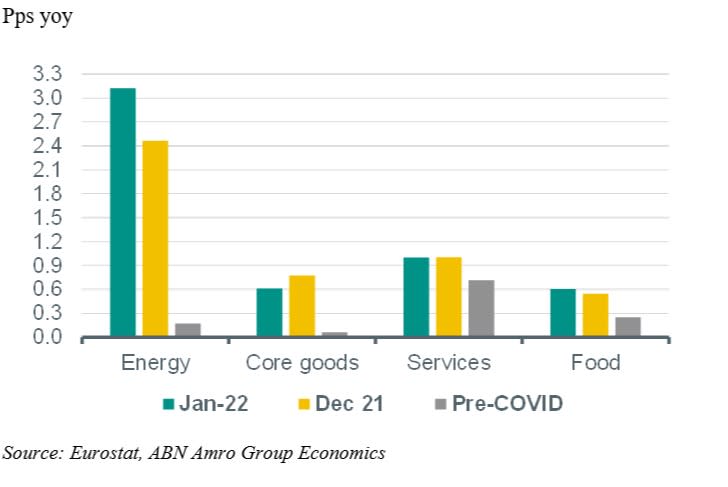

The rise in inflation was (again) driven by energy prices. The contribution of energy prices to total HICP inflation rose by 0.7 percentage points, to 3.1 pp between December and January. Most of the rise in this contribution of energy (i.e. 0.4pp) was due to the fact that the weight of energy in the HICP index increased.

Eurostat recalculates the weights of the components in the HICP every year in January, to better reflect the changes in the spending patterns of consumers. This year, this resulted in a rise in the weight of energy by 1.4%.

Contribution of main components to eurozone inflation

Besides energy, food prices also had an upward impact on inflation in January, albeit modestly (0.1 pp). Working in the opposite direction, the core inflation rate, which excludes food, energy, alcohol and tobacco declined to 2.3% in January, down from 2.6% in December.

Within core inflation, non-energy industrial goods price inflation fell to 2.3% from 2.9%, whereas services price inflation stabilised at 2.4%. A further breakdown into components of services inflation is not yet available at the eurozone level, but detailed national data of some of the big individual member states have indicated that services price inflation still is lifted by base effects in holiday-related services.

Looking forward, we expect inflation to remain elevated for a while, as the upward impact of global supply chain bottlenecks on good prices as well as the normalisation of services prices probably will take at least until the middle of the year.

On top of that, we have recently raised our forecasts for oil prices, which are now expected to remain somewhat higher throughout this year. Nevertheless, inflation should fall noticeably in the course of the year, ending up below the ECB target around the end of the year.